This article originally appeared on Medium.

Today, only 5% of the US population participates in clinical research. With the rise of new software tools that make research faster, cheaper, and more accessible and with a forward-looking FDA digital health team, the time is ripe for a clinical trial paradigm shift.

Healthcare companies that support clinical trials have been famously slow to adopt technological innovations. Many research sites still use physical protocol binders, paper diaries and decade-old software.

That tide is starting to turn as more companies across the clinical trial value-chain incorporate software into their product offering. A recent study found that 64% of researchers have used digital health tools in their clinical trials, and 97% plan to use these tools in the next 5 years.

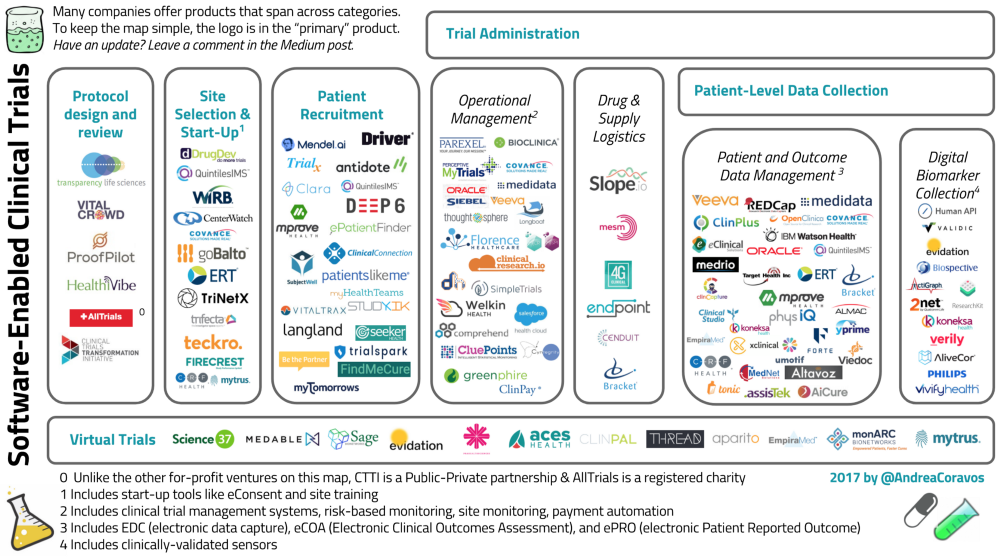

The goal of this post is (1) to highlight new software tools that support clinical research across the value chain, and (2) provide perspective for two emerging innovations: virtual trials and the rise of digital biomarkers.

Virtual or “siteless” trials are conducted outside of the site or clinic — and in the participant’s home. Digital biomarkers, as described by Rock Health, are consumer-generated digital tools that collect behavioral and physiological data (e.g., clinically-validated wearables and sensors).

Sponsors conducting virtual trials often reference four benefits:

(1) Cost. Virtual trials can cost half as much per participant compared to a site-based trial.

(2) Recruitment. They can increase recruitment rates and diversity by making it more convenient to participate in trials.

(3) Data. Using digital tools (e.g., digital surveys and sensors), a Sponsor has many more touch-points with the participant during the trial. For example, if a participant comes into a site a few times a month, the Sponsor can collect ~50 hours of data on the participant. However, if data can be collected passively at home, nearly 4000 hours of data can be collected — a 75x increase. Furthermore, the data collected from a participant’s natural environment are more “real-world” than site-collected data.

(4) Clinical-applicability. As we all know, more data doesn’t always mean better data — or improved outcomes. Nevertheless, in the past few years new algorithms and approaches are assisting researchers to make sense of and use this data and apply the results clinically. For instance, AliveCor and Cardiogram take thousands of heart-rate measurements at home and can predict abnormal heart conditions like atrial fibrillation with 97% accuracy.

Of course, with any new technology there are solvable challenges (e.g., data quality, ownership, security). With the rise of computing power, and the FDA’s revised stance on digital tools, this software-enabled tide is rising. We are poised for a paradigm shift in clinical research.

Methodology

The clinical trial value chain is filled with alphabet soup — CTMS, EDC, ePRO,eCOA, 21 CFR Part 11. Even seemingly benign phrases like “patient engagement” have strong — but varied — associations within segments of the industry (e.g., “patient engagement” may mean “user experiences during trial administration” or could describe a “best practice when designing the study protocol”).

To keep the landscape open to newcomers, we limited jargon and focused on product functionality. This approach was useful for other reasons, too: many companies are developing products and services that expand beyond an industry-standard acronym.

To keep the graphic simple, we put a company’s logo in it’s “primary” product, recognizing that many companies (e.g., Medidata and others) offer products that span across categories.

The focus of this piece is software-led companies supporting clinical research with human participants. Therefore, we excluded multiple contract research organizations (CROs) because many provide services rather than software tools. With the focus on human trials, we also excluded cloud-based laboratories like Transcriptic.

The data was collected using publicly available sources — company websites, Crunchbase, TheConferenceForum.org, and through interviews.

Of course, this landscape is a snapshot in time, and with the rapid innovations in technology, this map will constantly change.

Have an update? Leave your notes in the comments.

Software-Enabled Company Overview

Protocol Design and Review

Protocol design and review is one of the most important stages of the clinical trial. Improved protocol design means less changes throughout the trial, lowering costs and helping good therapies come to market faster.

When a good drug or device fails its trial because of bad design, it is not only a huge economic loss, but also a social one: good trial design is important to maximize patient engagement and minimize drop-out rates.

Biopharma and device manufacturers are facing additional pressure to make trials more patient-centered and ensure that results that are produced during the trial can hold up after the therapy comes to market. Yale professor Dr. Joseph Ross and his colleagues reported that 1 in 3 FDA drug approvals have safety issues after coming to market. Good design can minimize these issues while getting more therapies to market faster.

While there are many great companies and contract research organizations (CROs) that specialize in protocol design and review — most are consulting services and without software/data products. However, there are a few that are actively using new technology advancements. Transparency Life Sciences and VitalCrowd are building platforms that crowdsource protocols for clinical trials.

Verified Clinical Trials (VCT) has an online database to detect protocol violations and minimize duplicate enrollments in clinical trials. TriNetX also has a real-time tool to analyze protocols.

ProofPilot has launched digital health study templates for clinical research. HealthiVibe has survey and feedback tools to collect data from participants to inform the study design process.

There are a few non-profits and consortiums supporting this category, too. The Clinical Trials Transformation Initiative (CTTI) is a Public-Private Partnership that published guidelines earlier this year for the use of mobile technology in clinical trials — with a focus on novel endpoint design.

AllTrial.Net calls for “all past and present clinical trials to be registered and their full methods and summary results reported” — a beneficial registry to counterbalance the bias of only reporting positive results. Negative results, while not as “interesting” to publish, are results — and can greatly affect future research so we don’t repeat past failures.

Site Selection and Start-Up

The two most popular online tools for site selection are DrugDev’s Site Feasibility Tool owned by QuintilesIMS and CenterWatch’s Research Center Profiles owned by WIRB. TriNext also has a tool to analyze protocols and find the right sites and patient populations.

Regarding site launch and training, goBalto is building anend-to-end study startup platform that speeds clinical trials through site selection, feasibility, and activation. The team is shifting the time to set up a site from months to weeks or days. Teckro is also building training and connection tools to speed up site launch.

Trifecta Clinical specializes in online investigator training which can “deliver your training in as little as 5-business days. Less than a week to get training up and running.” Covance’s Xcellerate Trial Design product uses two proprietary data assets — (a) investigator performance data derived from “Covance’s central laboratory operations that spans >45% of all clinical trials globally” and (b) “de-identified longitudinal diagnostic data from LabCorp which spans some 100M lives.”

For site start up, there are also a number of eConsent companies which assist sites by digitizing the informed consent process. Mytrus, one of the leading eConsent companies, was purchased by Medidata earlier this year. A number of other companies have eConsent products, including DrugDev’s SecureConsent, FIRECREST, and CRF Health.

Patient Recruitment

Patient recruitment could be a separate deep-dive with all the new software-led approaches. There are many different approaches to finding better ways to recruit patients; technology advances (e.g., natural language processing, AI, online training) is part of the solution, but not the silver bullet.

Mendel.ai raised $2M earlier this year to match cancer patients to clinical trials using an algorithm to understand unstructured natural language within ClinicalTrials.gov and matching it with a patient’s medical record.

Deep6 is also applying artificial intelligence and natural language processing to medical records to find patients.

Clara Health has developed a software platform to streamline the process of participating in clinical trials.

Driver.xyz is a stealth-mode technology company that’s building a treatment access platform for cancer patients.

PatientsLikeMe is a patient network that also operates a real-time research platform. Other technology-led patient recruitment platforms include QuintilesIMS, TrialSpark, TriNetX, TrialX, SubjectWell, StudyKIK, Seeker Health, mProve Health, Langland, Clinical Connection, Comprehend Clinical, and FindMeCure.

Some ventures are working on connecting with participants after the clinical trial wraps up. BeThePartner is building a patient community beyond the clinical trial.

Trial Administration

Once the site is set up and patients have been recruited and onboarded, the trial begins. This section was the most challenging one to group into categories because many pieces of software can span across functions.

Operational Data Management

This category handles the site-level and operational information (e.g., clinical trial management systems, site monitoring, risk-based monitoring, and payment automation). Many companies offer products that have multiple features. We’ll share a few highlights.

Clinical trial management systems (CTMS) have been in the industry for a long time. A few of the classics are Oracle’s Siebel CTMS Cloud Service, Parexel’s Perceptive MyTrials, Bioclinica’s OnPoint CTMS, and Medidata CTMS.

Some start-ups are taking a new approach to operations management. Founded in 2014, Florence Healthcare recently raised $1.7M to move clinical research off paper and into the cloud. Also founded in 2014, Longboat is building a clinical trial management platform that focuses on investigator site engagement and protocol compliance. Launched in 2015, ClinicalResearch.io is building a similar software system to replace paper-based data collection. Released in 2016, Trial by Fire Solution’s SimpleTrials platform is an “on-demand” Clinical Trial Management System (CTMS).

There are also a number of start-ups that are assisting in the operations around clinical research. Welkin Health is building a modular patient relationship management platform focused on people living with chronic diseases. CluePoints is a risk-based monitoring (RBM) systems for clinical trial monitoring. Bioclinica’s ClinPay and Greenphire are automating clinical trial payments and budget forecasting.

Drug and Supply Logistics

Most companies that provide drugs and supplies to clinical trial sites don’t use a lot of technology; however, there are a few exceptions.

Slope.io is a start-up that integrates with electronic data capture systems and uses clinical trial data to inform automated logistics workflows. They also supply kits that can be customized by site, patient, or study timepoint.

If a Sponsor is collecting information using mobile or connected technologies — how do those devices get to the participant? MESM supplies sites with a number of connected devices including Apple iPad/iPhone products. Multiple eCOA and ePRO vendors, like CRF Health, will also supply sites with smart devices. Some of the digital biomarker companies, like Actigraph, will also handle their own sensor logistics. This category is still in early days, but it will grow as virtual trials and digital endpoints take off.

Continuing with the clinical trials alphabet soup , there are a number of companies that support clinical trial randomization and the associated drug supply management process. As an excellent post from Medidata lays out, many acronyms are often associated with these processes: Randomization and Trial Supply Management (RTSM), Interactive Voice Response (IVR), Interactive Web Response (IWR), Interactive Mobile Response (IMR), Interactive x Response (IxR), or even Interactive Response Technology (IRT).

Acronyms aside, there are a few companies doing some interesting work with software to modernize these activities. Launched in 2015, 4G Clinical built a platform using natural language processing (NLP) among other tools to reduce the time it takes to get a drug to a participant. Launched in 2010, Endpoint Clinical features a system that has real-time reports and is configurable to a study’s supply chain. Launched in 2007, Cenduit has a platform that works across multiple smart devices and integrates with multiple third parties (e.g., other data capture systems and outcome platforms). ICON, Almac, Bracket, and Medidata also have solutions for randomization and trial supply management.

Patient-Level Integration

This category was also a challenge — there aren’t clean lines around patient engagement and collecting/storing/analyzing patient information. We split it out into two categories to better highlight the rise in digital biomarkers.

Patient and Outcome Data Management

This category includes electronic data capture (EDC) systems and other platforms that will store patient-level data. It also includes digital tools that collect eCOAs (Electronic Clinical Outcomes Assessment) and ePROs (electronic Patient Reported Outcome)/PROM (Patient Reported Outcome Measures) data. Many companies have created products that span across the patient and outcomes data layer.

There are a number of big EDCs that have been in the industry for a long time: Medidata, Oracle, RedCap, and eClinicalSolutions. Some companies, like Veeva Systems, have been modernizing the tools for SaaS in global life sciences, expanding out its cloud-based platform.

Aside from the big players, there has been a rise in software tools to capture patient outcomes. CRF Health is one of the leaders in eCOA and ePRO assessments. Bracket is one of the leading providers of eCOA, rater training, and trial supply management solutions for biopharma sponsors — with a focus on CNS therapies. Altavoz is also building an eCOA platforms. uMotif is building a “next-generation” patient data capture platform with many tools designed for clinical research. The International Consortium for Health Outcomes Measurement (ICHOM) has published a number of companies that have web and mobile-based reporting systems for outcome measurements on the ICHOM TechHub.

Outcomes are also influenced by med adherence technologies, and there are a number of new tools that are designed to improve adherence. AiCure is an advanced medication adherence solution powered by artificial intelligence, which visually confirms medication ingestion on any smartphone. Dan Gebremedhin and Kara Werner from Flare Capital recently conducted a deep-dive in medical adherence tools on the market. These types of technologies are in many ways more similar to digital biomarkers than to the big patient data capture databases.

Digital Biomarker Collection

As described by Rock Health, digital biomarkers are consumer-generated digital tools that collect behavioral and physiological data. These tools can be used to diagnose and/or treat patients remotely.

This list is far from exhaustive, and there is a lot of innovation that is happening in digital biomarkers that we’ll share in future posts. For now, a simple way to think about this category is (a) the sensors and tools that collect the data and (b) the systems that integrate that data.

There are hundreds of teams working on developing digital biomarkers. A few of the most prominent are:

Google’s Verily has recently launched Project Baseline, a collaboration of Duke University and Stanford University that will enroll 10,000 healthy people for the study. The study will likely use survey data along with sensor data from the Study Watch, a sensor-packed smartwatch Verily launched in April.

Actigraph is one of the oldest companies in the digital biomarker industry. Founded 15 years ago, Actigraph provides medical-grade wearable activity and sleep monitoring solutions for the global research community. Another company developing digital biomarkers is AliveCor, which has developed a FDA-cleared single-lead EKG for $99. Vivify Health is a remote care service provider that has created customized “kits” that include 4g tablets with wireless vitals monitors.

There are companies that are developing platforms to integrate the sensor data. Validic is a technology platform that provides “access to a world of mobile health and in-home devices, fitness equipment, clinical sensors, activity wearables, smart bands and wellness applications.” HumanAPI is similarly building a “real-time health data network, powering more than 10,000 applications in 40 countries.” Apple has been heavily investing in ReasearchKit over the past two years, developing customized apps and products for a range of conditions. Qualcomm Life’s 2Net is a “non-exclusive, open, and interoperable” platform that has partnered with over “400 collaborators including medical device manufacturers, health service providers, app developers, and more.”

On the evaluation front, Evidation Health is building a solution to help companies quantify their digital outcomes, focusing on research with connected devices.

The FDA has recently made a number of forward-thinking changes that will speed up the development of digital biomarkers. The FDA’s Center for Devices and Radiological Health has spun out a software group headed by Bakul Patelto look at more at these digital tools. Last summer, the FDA released new guidelines for Software as Medical Device (SaMD) and this past summer, it has released a “PreCert” program which will certify companies rather than products, allowing developers to continue to iterate on the software after FDA clearance.

CTTI, recognizing the advances — as mentioned earlier — released a set of guidelines for how to use these mobile technologies to develop novel endpoints. These advances, along with the increased R&D in the sensors, are priming the industry for many new tools — a paradigm shift for research.

Remote-Virtual Trials

One of the biggest shifts that’s happening in clinical research is the rise of virtual or “siteless” trials. These trials hold the promise of being cheaper, accessing a wider population and more opportunities to capture real-world data from participants.

Biopharma and device Sponsors are under pressure to reduce costs, improve patient engagement, and simplify the trial administration process. With this shift, many Sponsors have reduced their partnerships with contract research organizations (CROs) — cutting down on the number of CROs used in a trial, taking the CRO responsibilities in-house, and/or work with virtual trial providers.

SageBionetworks is one of the most unique companies in this category. First off, they are a non-profit research organization, which “seeks to develop predictors of disease and accelerate health research through the creation of open systems, incentives, and standards.” Sage is the mastermind behind Apple’s ResearchKit, and they’ve put out a number of virtual trial apps including mPower, for Parkinson’s disease.

Going “fully-virtual” can be an operational challenge for biopharma. For example, if the protocol requires a participant to get regular chemo, having the infusions at home could be a risk (e.g., patient has anaphylactic shock and no medical support to treat it). As a result, many biopharma companies are taking a “direct-to-patient” approach when possible and may have some parts of the trial remain in a clinic while shifting more touch points to the home (e.g., more virtual).

There are a few business models that are starting to emerge. First are companies that are building a “Platform-as-a-Service.” Medable, launched in 2013, is building a leading cloud-platform product that is designed for siteless trials and has a number of tools ready to deploy direct to patient. This model is a technology play, building products that are highly configurable and deployed across iOS, Android, and the web. Parallel6, which was recently acquired by PRA Health, is also building a software-based platform that Sponsors then license for their trials. ClinPal is building a cloud-based digital patient recruitment and engagement platform, currently focusing on “siteless” trials.

Aces Health, launched last year, is one of the more recent players in the end-to-end remote clinical trials management systems, featuring a platform “automatically collecting data on demand from over 15,000 eHealth sources.” THREAD Research, a startup still in stealth mode, started as a dev shop with extensive clinical trial experience. Public information on this venture is limited, but on their site they claim to build customized apps that enable biopharma, CROs, and researchers to conduct remote patient research. Perhaps this may lead to a platform one day, too. monArc Bionetworks is the newest venture, launched in October last year. The team is building a “Digital Research Platform” for remote patient trials.

Science 37, perhaps the best known virtual trial venture, has raised $67M in the past two years to support siteless trials. In contrast to the pure-platform technologies plays, Science 37 is more similar to a “digital CRO”, although the company does not use the term “CRO” in public materials — emphasizing its technology roots.

Science 37 is taking a more full-service model than the “Platform as a Service” companies and hiring over a hundred employees (133 employee listed on LinkedIn), many of whom are supporting the remote trial operations. Science 37 offers recruitment and other full value-chain services. In contrast, the pure tech “Platform as a Service” plays have smaller teams (Medable is ~20 people) and don’t hire coordinators or nurses.

QuintilesIMS launched a Real-World & Late Phase Strategy group that is doing many interesting things at the intersection of software and digital tools. For instance, the team launched a “pragmatic trial” which collected remote data from patients. This ADAPTABLE study cost $14M as compared to a classical RCT of a similar size, which would have cost ~$420M. Nice savings, while collecting more real-world data.

EmpiraMed, which serves Merck, Biogen, Janssen, Sanofi Genzyme, UT, and TEVA, has completed three virtual studies where they’ve directly recruited patients into their portal and followed the participants for one year in a completely autonomous and automated manner. Their electronic portal incorporates web, mobile, and wireless device applications.

Evidation Health, backed by GE Ventures, was first listed in a digital biomarker section because it has a different approach. Gleamed from publicly available documents, rather than focusing on “traditional” clinical trials like Science 37, Evidation Health seeks to partner with start-ups and digital device companies to design and execute research to validate digital products. The company’s vision is to “quantify outcomes in the digital era, using real life data from connected patients.”

Last but not least, we also included e-consent platform Mytrus, which was purchased by Medidata earlier this year. Myrus is one of the old-guard in this category, assisting Pfizer launch the “first-ever virtual trial” in 2011.

With the rise of improved software tools and sensors, it is becoming easier for Sponsors to launch remote, virtual research. Clinical trials are poised for a paradigm shift as software scales research faster than ever.

What’s next?

There are hundreds of teams working on algorithms and sensors to collect clinically-useful digital biomarkers. We’re working on a separate post to highlight these. Stay tuned.

Source Data

Want to dig into more detail? Check out our AirTable for more information at a company-level.

Thanks to Sofia Warner, Franklin Yang, Nancy Yu, Samantha Pearlman, Richard D, and many others for contributing to this piece.