Mercado Libre: a winner in Latin America

Mercado Libre, the largest online eCommerce ecosystem in Latin America, has disrupted the retail industry. Its innovative business model has positioned the company as a winner in Latin America, which has been reflected in its impressive growth.

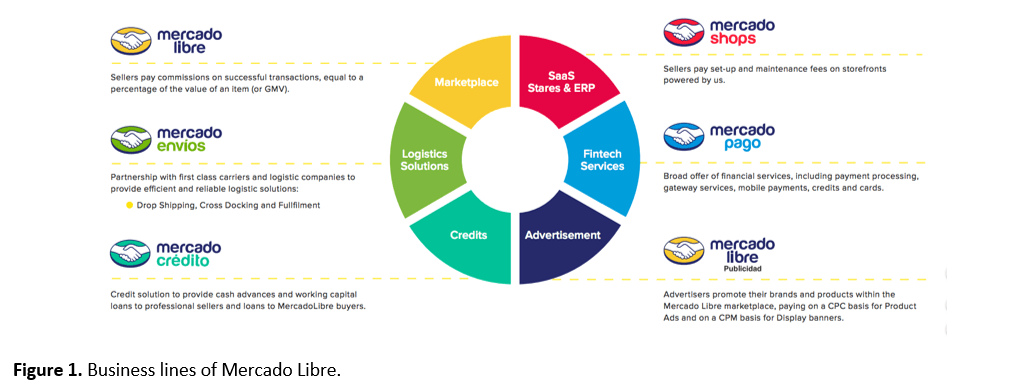

Mercado Libre Inc (MELI) is the largest online ecommerce ecosystem In Latin America with presence in 18 countries [1]. The company, founded in 1999, offers a variety of services including a marketplace (mercado libre), a logistics service (mercado envios), a credit solution (mercado credito), an online store solution (mercado shops), a fin tech platform (mercado pago), and an advertising service (mercado publicidad). I believe that Mercado Libre is a winner due to its disruptive business model in the marketplace and fin tech platforms, which has led to an impressive growth of the company.

Business model and impact on competitors

Mercado Libre Marketplace is an online platform in which businesses and individuals buy and sell products. The marketplace, founded in 1999, has been a disruptor of the traditional retail companies in Latin America. When Mercado Libre was founded, the traditional retailers saw the e-commerce only as an opportunity, but not as a threat. This effect delayed the response of the traditional players, facilitating the penetration of Mercado Libre. To illustrate, although Falabella, one of the largest retail companies in the region, created its online website in 1999, it was not until the 2010s that the company focused on expanding its online capabilities [2]. Due to this time advantage, Mercado Libre has been able to grow the online business faster than traditional retailers, becoming a winner in the marketplace space.

Mercado Pago is a fintech platform that allows users to send and receive payments online in a secure and timely manner [1]. In 2004, after the impressive growth of the Marketplace, the founders decided to create Mercado Pago to facilitate transactions in the marketplace. In the last years, this service has been extended to support other businesses to process payments. In addition, since in Latin America there were few payment providers and a high percentage of cash transactions, the company started offering in-store physical payment by selling QR payment codes, pre-paid cards for users to spend money from their Mercado Pago wallet, and a market fund to invest the balances of Mercado Pago accounts. This fintech platform is a winner since it has disrupted the payment card industry in Latin America. To illustrate, Transbank, the Chilean credit card administrator, was a monopoly [3] and charged rental fees for the equipment and a significant merchant discount. The entry of Mercado Pago has created a more competitive market, reducing the fees for users as well as increasing the financial inclusion of segments of the population that normally have been underserved by the financial institutions [1].

Results

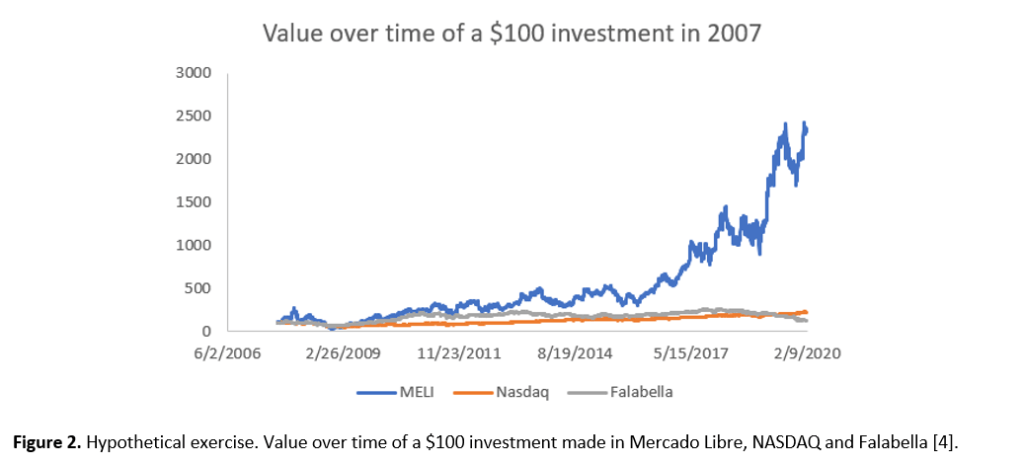

The stock price of Mercado Libre has grown significantly since it was listed on the NASDAQ in 2007. The stock price grew from $28.5 in October of 2007 to $663 in January of 2020. Figure 2 shows what would be the value of a $100 investment made in 2007. In January of 2020 the investment worth $2,326, while the same investment in NASDAQ and Falabella worth $360 and $128 respectively.

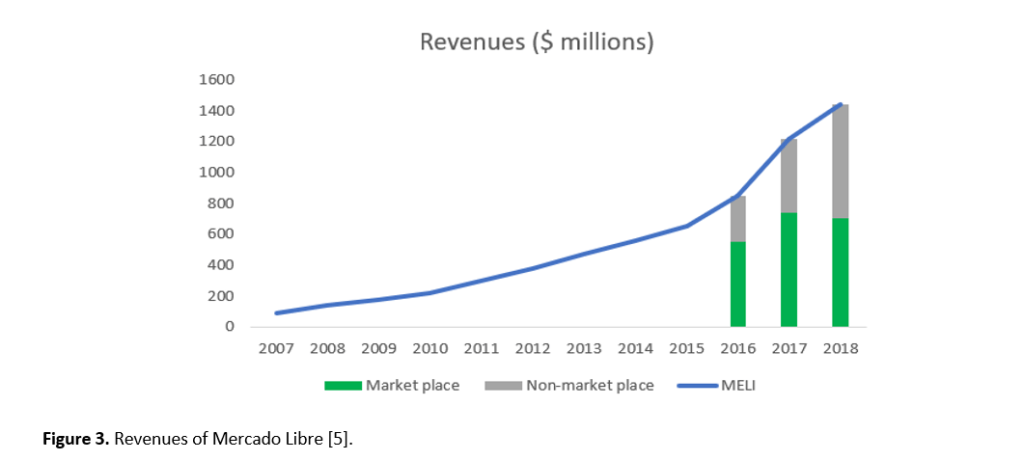

Furthermore, the revenues of Mercado Libre increased from $85 million in 2007 to $1,440 million in 2018. In addition, Figure 3 shows that the revenue growth in the last year has been driven by non-marketplace revenue streams. This confirms that the fintech platform of Mercado Libre will be critical to continue positioning the company as a winner in Latin America.

Finally, Mercado Libre shows a significant improvement in the key performance indicators of the business. The number of registered users increased from 53 million in 2010 to 212 million in 2017, while the number of sold items increased from 39 million to 81 million in the same period. Along the same line, in 2018 the fintech platform had 389 million of transactions, 68% over the 2017.

Going forward

The fact that Mercado Libre has become a winner in the last decade does not mean that it will continue being a winner in the next years. The potential entry of Amazon to more countries in Latin America and the growth of competitors such as Linio in the marketplace industry and Mach in the fintech industry, are challenges that Mercado Libre will have to face. Investment in new technologies, the growth of new areas such as the fintech platform, the penetration of new regions, and the improvement of the customer experience are some of the initiatives that Mercado Libre should develop to continue being a leader in Latin America.

Word count: 735 words

Thanks for sharing the article Andres. I agree Mercado Libre has been disrupting the retail industry for a long time now, I think the company has succeeded in creating a platform that is at the same time simple, informal and reliable. It creates a community of buyers and sellers that gives them a competitive advantage. I also agree they will have to watch as Amazon grows in the region and they need to anticipate further innovations in the industry, but they have some competitive edge that will give them some space.

Such an exciting winner story in LatAm! And also reminds me of Alibaba that initially started out as a Ecommerce platform and expanded into adjacent space gradually (vertical integration). You are spot on in terms of Fintech being the new growth area in order for Mercado Libre to continue to be a winner in the next decade. I do think they are uniquely positioned in the value chain to take on that challenge. A few low-hanging fruits are: 1) SME working capital financing: they already own all the merchants transactions so it will be easier for them to develop a proprietary risk assessment model to underwrite loan (like PayPal Working Capital); 2) Consumer PoS financing: for consumers who are not able to afford the purchace in one payment, especially the non-banked population / without credit card. they could offer installments to entice more consumer purchases (like Affirm in US); 3) Insurance: as consumers already have a Mercado Pago wallet, and invest the balances, Mercado Libre could take it further to offer insurance products. Thoughts?

Thanks Rocio, for your interesting comments. I completely agree with your points. Regarding point 3, I think that insurance products should be offered in the medium-term, not in the short-term. In the short-term, the company is focused on improving the logistics (to be prepared for the potential entry of Amazon). The company is also focused on boosting its fintech platform. Offering insurance in the short-term would be a distraction for the management team since it requires additional work with regulators.

Interesting piece Andrea. Mercado Libre’s story is very exciting. Online retail in LatAm is very different from the US. Challenges like poor internet infrastructure, inadequate distribution and low credit penetration make it a tough market. However, Mercado Libre has been able to successfully navigate through these challenges. For example, they were able to transition from desktop to mobile, helping consumers circumvent unrelieved broadband service. The question you raise about competition is a valid one, lets see if their local knowledge gives them an edge over players like Amazon.

Very clear and articulate description of the digital offering from Mercado Libre! Understanding the different services, with high degree of complementarity, helps realize why Mercado Libre is so successful. The founders could ride the wave of e-Commerce, as they believed in the opportunity well ahead all of possible competitors (e.g. existing offline retailers).

One thing that could be interesting to understand – it looks like the competitive advantage of Mercado Libre connects only to timing (i.e. they were among the first companies to leverage the power of digital in the retail industry). It would be important to define what the long term competitive advantage is (e.g. any tech advantage?) and if/how Mercado Libre could resist vs. new players (e.g. Amazon) which may enter the space.

Great article! As an Argentine myself, it’s been incredibly interesting to watch the evolution of Mercado Libre, not just into more territories, but also as you mention into a much broader portfolio offering of products. I keep coming back to comparing it to Amazon, and wonder whether what it’s lacking in order to become truly ubiquitous in the LatAm market is to focus on it’s offline/logistics/delivery capabilities, instead of growing it’s digital footprint. As was mentioned, since the infrastructure in these markets has not been built to allow for capabilities that Americans would consider basic for the online retail market (ie. affordable 1-2 day shipping), Mercado Libre would have to build this itself (vs. partnering with UPS in the US for example), which might too far removed from its competitive advantage. Yet still key to reaching Amazon-level scale. Food for thought.

Great article! I agree with you, Mercado Libre is one of the biggest success stories in Latam and it is exciting to see how much they’ve diversified over the years.

However, I wonder how they’ll evolve as they have been investing a lot in their logistics arm as a way to fend off a potential entry from Amazon into the region, while also having to focus on their fintech products which is where most of the growth is going to come from in the future. I’m curious to see if they can succeed in two such operationally complex objectives at the same time.

Thanks for an interesting read Andres, it always makes me happy to read about international business successes and even more if they are from LATAM. Even though Mercado Libre has proven to be very nimble and successful in overcoming the great number of challenges in the region, I wonder how well positioned they would be to respond to the entry of a large incumbent such as Amazon. I guess it’s only a matter of time until they enter the region, so will their logistics capabilities be as advanced as to compete with Amazon’s state of the art warehousing and distribution centers? Only time will tell. Maybe they’ll end up focusing on their fintech products instead of going head to head with the global e-commerce giant.

Such an interesting post, Andrés!

I’ve been wondering about the big areas of opportunity for a fintech platform in Latam, that has such informality in its economy and hence such a big space for financial inclusion. With a big growing base of smartphones in the bottom of the pyramid sector, the opportunity to offer services for digital finance is immense. The credit culture is scarce and new generations, with more productive digital tools will be more sensitive to these services.