Allbirds of Prey – From Zero to $1.4B DTC Darling in Five Years

Allbirds' execution of the eCommerce playbook let the DTC brand soar.

Allbirds are easy to overlook: They are understated, relatively neutral in their color choices, and one would not be surprised if they get mistaken for a generic store-brand shoe from Target. Yet somehow the company’s first shoe, the Wool Runner, has become part of Silicon Valley’s uniform. In just five years since its founding in 2015, the company has managed to generate $100M in annual revenue, garnered a $1.4B private valuation, and – unlike many other unicorns – is allegedly profitable since 2016. Let’s dive into what let Allbirds soar.

Industry Context

Back in 2015, when Tim Brown and Joey Zwillinger, the Allbirds co-founders, first developed their runners, the environment for athletic shoe startups was all but friendly: Adidas and Nike operated a near duopoly in athletic footwear manufacturing. Shoe sales were predominantly done in retail-stores like Footlocker, who prefer big name brands to garner rebates at the end of the season. Penetrating brick and mortar as an unproven brand and a non-luxury segment was virtually impossible. And while eCommerce has since grown 15% YoY and is now taking over the world, back in 2015 the idea of selling a shoe online was inconceivable for most. It was industry gospel that consumers cared about large selection of styles, price, and the ability to try on their shoes before buying.

Product Launch and Go-to-Market

Brown and Zwillinger developed the first iteration of their Wool Runner in 2015 financed by a research grant from New Zealand. They were able to tap into the declining local wool industry and produce a shoe that was light, breathable, and eco friendly, and relatively cheap to manufacture. As a starting point the team opened a kickstarter campaign, found tracktion with early adopters by advertising the unique materials, and sold over $120K worth of shoes in just five days.

Instead of attempting to sell through retailers, the Allbirds team decided to use the momentum from their Kickstarter launch of go direct-to-consumer. Even if traditional retail had been an option, the the eco-friendly story from New Zealand wool was simply too complicated to make its way to consumers via store-shelves. What came next was an exemplary execution of eCommerce tactics to date:

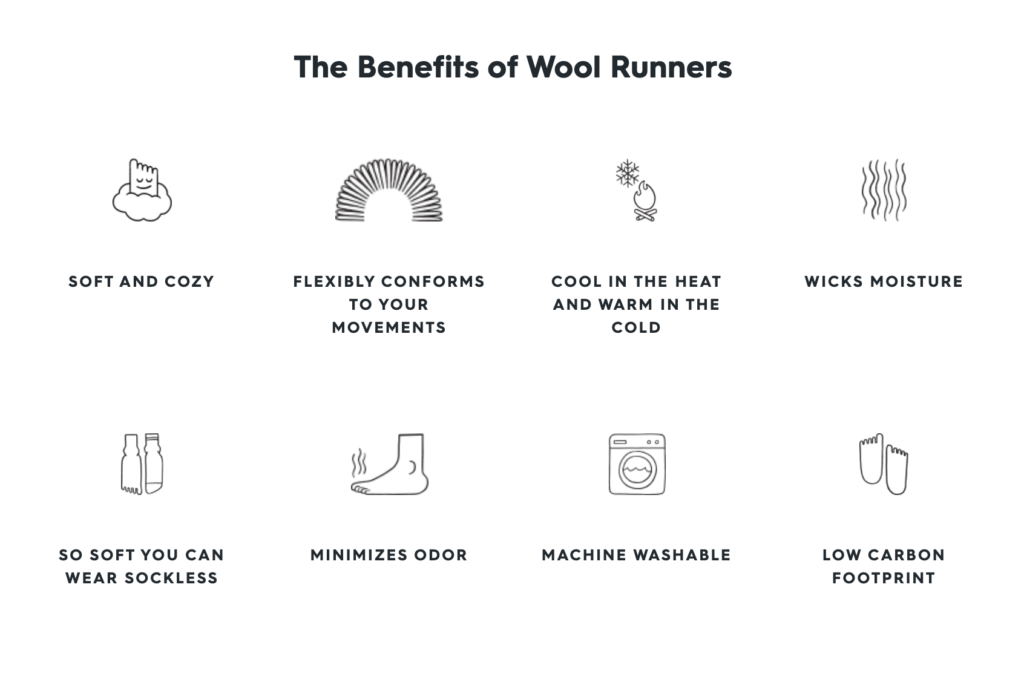

- Stellar Landing Page Design: First and foremost, Allbirds elevated their natural materials and benefits whenever the customer visits their page.

- Easing customers into shopping online: From the get-go the company offered free shipping and returns, 30-day trial period, and plenty of social proof to make the buying decision as easy as possible.

- Nurturing customer email campaigns that continue to tell the story: Branded emails with animations and friendly copy are sent to customers and prospects on a regular basis. From the abandoned cart email over ‘welcome to the flock’ to re-engagement campaigns post purchase all reinforce the brand message and remind buyers of the story. Customers are encourage to feel good about the environmentally friendly choice they have made and are being given a sense of community

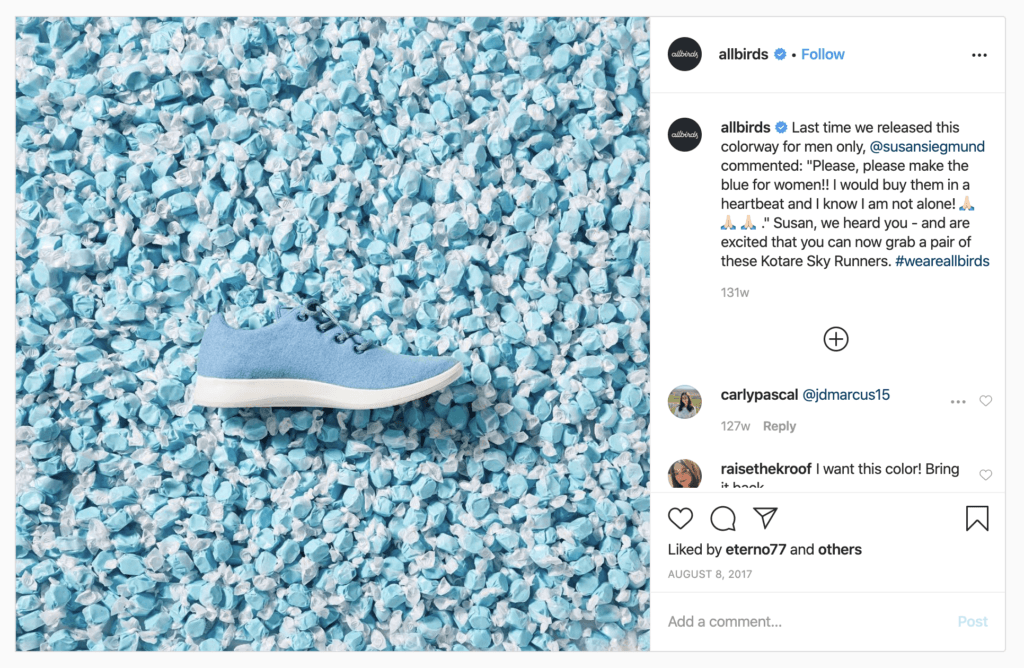

- Feedback through social media: Instead of treating Instagram and Facebook as one-way acquisition channels, the Allbirds team actively solicited feedback and incorporated it into product decisions. Based on user feedback the first Woolf Runner received 27 iterations before being relaunched in 2016. Mary Meekers highlighted the shoe brand for their customer responsiveness in her “Internet Trends 2017” Report. As a second example, the company reacted to the comments by predominantly females and adjusted the production of available sizing accordingly.

Conclusion

Riding the wave of eCommerce and building out a strong brand story with their customers has elevated Allbirds to the top of DTC brands. Their 40% share of direct traffic (vs organic and paid search) puts them among the top performers in the business. And while their perfect execution of eCommerce tactics may seem obvious in 2020, it should be considered pioneering work when the brand first left the nest.

Sources

https://www.wired.co.uk/article/allbirds-shoes-on-trainers

https://digiday.com/marketing/allbirds-uses-instagram-focus-group/

https://jilt.com/blog/ecommerce-marketing-tear-down-allbirds/

https://www.axios.com/sources-allbirds-profits-56a5fb6a-f67e-4210-8b0f-0353300fb6cd.html

https://gallantway.com.au/blog/allbirds-growth-marketing-case-study/

I love my Allbirds 🙂 They have a great store on Newbury Street!

Great article about Allbirds and the brilliant strategic decisions that fueled their meteoric rise in popularity.

I was admittedly a bit late to the Allbirds game, but I recently got my first pair and I absolutely love them.

A few months ago news started swirling about Amazon’s “Allbird knockoffs” (e.g. https://www.geekwire.com/2019/weve-wearing-amazons-allbirds-lookalikes-compare-real-thing/). Do you think the initial strategic choices Allbirds made that you highlighted above will allow them to cement their position of wild popularity, or will they become yet another victim of the Amazon steamroller squashing smaller players with copycat products?

I believe that there’ll always be a space for a high-end consumer brand that provides superior quality. Given that everything across the digital initiatives is strongly branded, I think that users will see value actually purchasing the “real deal” and not rely on amazon.

I see Amazon’s basics programs rather problematic for horizontal, low-cost fashion companies i.e. H&M, Uniqlo and others, that provide non-branded basics to consumers.

Thanks for sharing, Leo! It is especially interesting to see your point on Allbirds’ use of Facebook and Instagram as a way to not only advertise, but also to collect direct feedback from customers. I am particularly impressed that Allbirds is agile enough to incorporate customer feedback into their production cycle, which I imagine is fairly complex. I would be interested to see if other shoe brands are able to imitate Allbirds to change their product development and production based on customer feedback. I would actually be surprised if others are able to do so, given most shoe companies’ long product development processes that are not as agile as Allbirds.

I’m with you. I don’t believe that many other companies will follow Allbirds’ footsteps (haha) and iterate on their product design based on customer feedback. It seems too expensive to be a leader and experiment, when you can simply be a fast follower and copy whatever worked. As Matt points out above, there are currently a ton of copy cats in the market that Allbirds is litigating against.

Any insight into how Allbirds has approached new product development (i.e., has it been heavily creative-driven, or more market-/data-driven)?

very well written! I wonder if this is a truly “winning” business model though… it seems to me that their value proposition is not that differentiated and could be easily disrupted by other competitors. How can they ensure a sustainable competitive advantage?

Thanks for an interesting read Leo. Even though I’m an Allbirds fan and own 2 pairs myself, I do agree with Petra on this. How defensible is Allbirds value proposition in an era where D2C is already the new thing? Agree they have a superior quality product and first mover advantage, but I don’t see why other competitors couldn’t enter the space and become the “new hot sneaker brand” with some sort of differentiating attribute such as Allbirds’ wool component. With the entry of more and more D2C retail brands, Allbirds might end up losing share to new, more “in” brands that consistently enter the space.