Hungry? Lazy? DoorDash is the one-stop solution to your problems.

From personal deliveries to a $68.9 billion impact on the U.S. GDP. Discover how DoorDash’s data-driven approach and revenue model have shaped the food-delivery giant’s success.

Every person who at times does not feel like cooking or going out understands the need for a platform that delivers pizza in thirty minutes. In the competitive world of on-demand food delivery services, DoorDash’s remarkable success lies in its focused approach to efficient food delivery and growth within the United States market, where it has maintained a commanding lead. Established in San Francisco in 2013, the Doordash app connects drivers with local restaurants to bring meals directly to users, a venture that co-founder Tony Xu initially embarked upon by making deliveries personally.

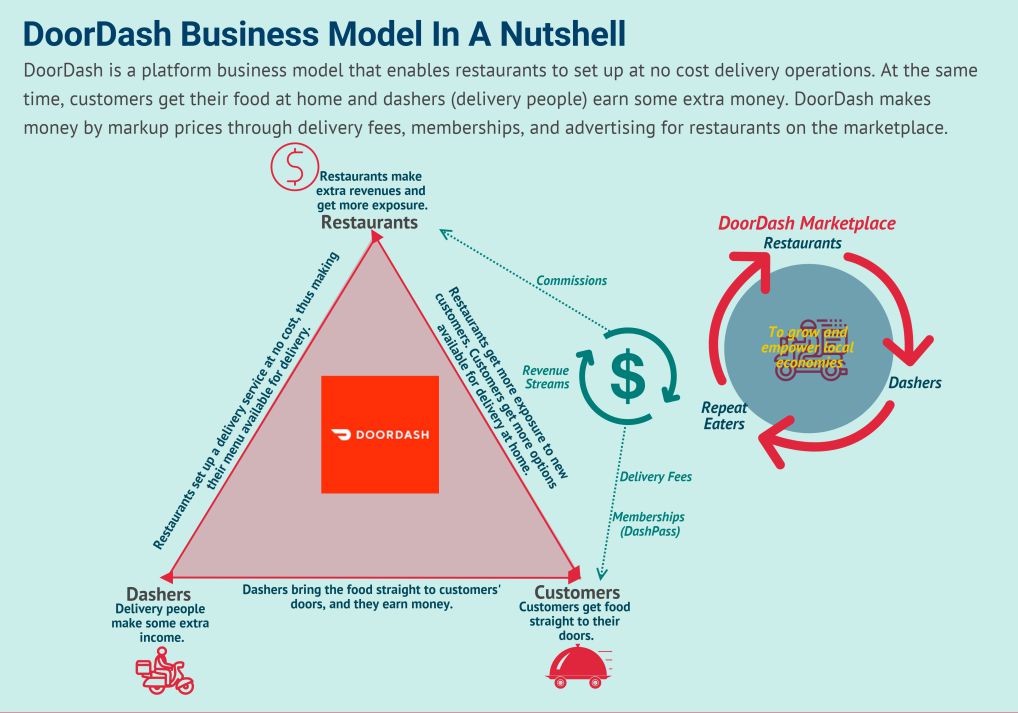

With a value proposition of providing customers with convenient access to a wide variety of local restaurant options, Doordash generates revenue by implementing markups on prices, facilitated through delivery fees, memberships, and restaurant advertising on the platform. In 2021, DoorDash supported an estimated $68.9 billion in U.S. GDP with over 500,000 merchants active on the DoorDash platform in the U.S. that same year. DoorDash also facilitated over $25 billion in sales in the U.S. for its Marketplace merchants in 2021.

Image source: https://shorturl.at/dmyS1

DoorDash’s revenue model combines commission-based earnings, delivery and pickup fees, and its subscription service, DashPass. Through commission fees, DoorDash charges restaurants a percentage for each order, creating a sustainable income stream linked to transaction volume. Delivery fees provide an extra revenue source, helping offset costs and contributing to DoorDash’s profitability. Additionally, the DashPass subscription service further bolsters revenue with its monthly fees, while also fostering customer loyalty through reduced delivery fees and exclusive discounts.

Notably, Doordash leverages data to improve efficiency in both operations and growth. For instance, it analyzes traffic patterns, delivery distances, and order volumes to optimize delivery routes. Moreover, DoorDash’s integration with partner restaurants’ point-of-sale (POS) systems streamlines the order process, ensuring accurate delivery and customer satisfaction. Valuable data on consumer preferences, order histories, and delivery patterns is used to further refine the platform and provide personalized experiences. Their fusion of revenue strategies and data-driven optimization underscores DoorDash’s commitment to providing a seamless and rewarding experience for all stakeholders involved.

The recent DoorDash Economic Impact Report conducted by Oxford Economics highlights the firm’s focus on three segments: users, merchants, and Dashers(drivers). As per the report, consumers benefit from a wider array of choices and time-saving convenience. DoorDash acts as a catalyst for broader customer outreach for merchants enhanced profit margins, and heightened brand visibility through menu features on the platform. This improves Dashers’ earnings which stimulates spending in the broader economy and the firm’s influence extends beyond value creation to factors like workforce size and supply chain engagement.

In the words of DoorDash’s Head of Policy Research, Cheryl Young. “While we’re proud of the statistics in the report, there are also stories of impact that can’t be quantified and are inspiring. From a local business growing to meet the number of new orders to helping a college student earn on her own time to powering the delivery of a meal for a sick relative, DoorDash provides value.”

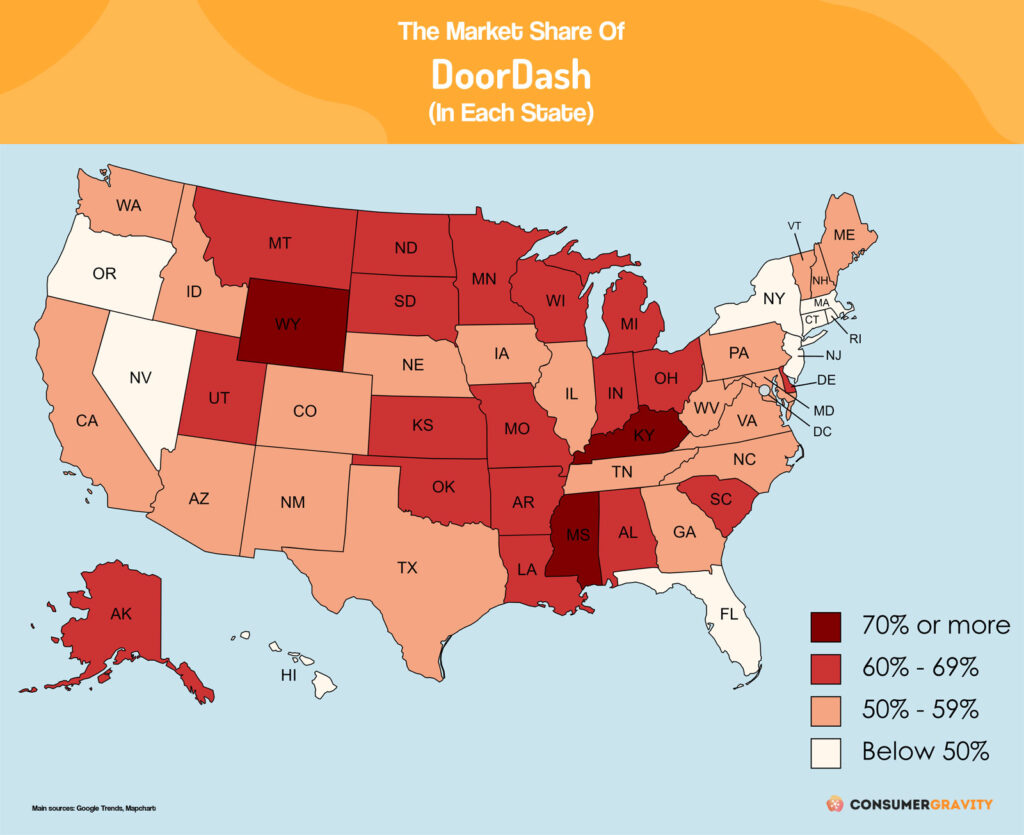

DoorDash has demonstrated impressive scalability, expanding its presence to serve millions of customers across various countries globally after capturing 65% of the US market share. The company’s ability to continuously onboard new restaurants and delivery drivers, coupled with its technological infrastructure, positions it for continued growth.

However, profitability and sustainability remain a critical consideration. While DoorDash grew revenue by over fivefold between 2019 and 2021, its losses remained high and actually increased 2020-2021. It grapples with low profitability primarily due to steep customer acquisition costs. The undifferentiated nature of their services, coupled with intense competition and labor costs, leads to frequent promotions that benefit consumers but strain the companies’ finances. Adapting to evolving consumer preferences and maintaining a positive reputation while maintaining profitability will be pivotal in ensuring long-term sustainability.

DoorDash has transformed the way we experience food delivery, creating a platform that benefits restaurants, delivery drivers, and customers alike. Through strong cross-side network effects, technology-driven optimization, and a flexible revenue model, it established a strong foundation for value creation. As DoorDash continues to scale and navigate challenges in the dynamic food delivery industry, its ability to adapt and innovate will be key to ensuring its sustainability and long-term success.

Thanks Asra! I also like DoorDash a lot for ordering dinner. For profitability, you points out that there are high customer acquisition costs. Facing intense competition to acquire and retain customers, does DoorDash seek to lower price, cut revenue from drivers and restaurants, add more promotions, or increase marketing effort to maintain its cash flow? Besides, with the rich customer data, how can DoorDash make best use of it beyond optimizing its restaurant recommendation algorithm?

This is great! I think one thing I’d like to learn more about is how Cheryl Young thinks about investing in things, like impact, that are not quantifiable. It’s pretty clear from this that the bigger a platform grows, the more impact the platform has. And I wonder, without quantification, how she thinks about choosing future investments.