StockX: the price of trust

Stomping out fakes on the path to profits.

While digital marketplaces allow consumers to buy anything anytime, one prominent remaining barrier in e-commerce has been trust surrounding item authenticity, especially in the realm of peer-to-peer transactions involving brand-name items, such as the collectible sneaker resale industry. StockX sought to tackle this problem in 2015, and in the subsequent 8 years, have built a lucrative platform that generated $1.8B in gross sales and $400M revenue in 2021, reaching a $3.8B valuation1.

How it works:

StockX’s marketplace model operates similarly to Ebay, in that sellers have the option of offering their items either through a “Buy Now” option or an auction. Once a purchase is confirmed, the seller mails the sneakers to StockX’s verification center. If the item is successfully verified by StockX, StockX ships the item to the purchaser, and takes a percentage of sales as fees. If the item is rejected during verification, then the seller forfeits the shipping cost, and further actions may be taken, such as turning it over to police. Generally, sellers with more successful sales are rewarded with lower fees and faster payment mechanisms.

Value to buyer:

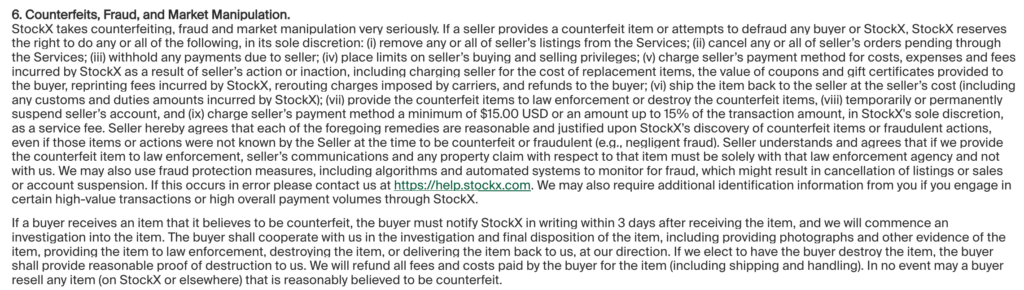

1. Trust: The immediate benefit is the peace of mind that the purchased item has been verified by StockX, who recently modified their authentication process to include more security criteria2—the purchase even comes with a refund guarantee in case of counterfeit goods3. This increase in trust is invaluable since this market is widely known for its prevalence of knockoffs.

Source: StockX Terms

2. Selection: The buyer also benefits from having wider access for a niche product, since StockX can aggregate offerings to provide more comprehensive inventory (for example, offering a particular shoe in many sizes by aggregating sellers).

Value to seller:

1. Trust: Because sellers are selling a premium good, the trust mechanisms built into StockX allows sellers to command the correct, premium price for their products. In absence of that trust, buyers usually just don’t buy, or assume the product is fake, and pay accordingly.

2. Fees & operations: StockX also charges less fees than competing platforms, and their handling of logistics makes it easier for many unsophisticated sellers to grow operations.

The flywheel:

By investing in their ability to efficiently verify large volumes of designer goods, StockX attracts more buyers who are seeking a peace of mind, which then attracts more sellers who are seeking to sell at fair market values. The increase in both buyers and sellers creates cross-side network effects, and contributes to greater transaction volume and size, which increases StockX’s taxable revenue base. This then allows StockX to invest further in verification processes and logistics, continuing the virtuous cycle.

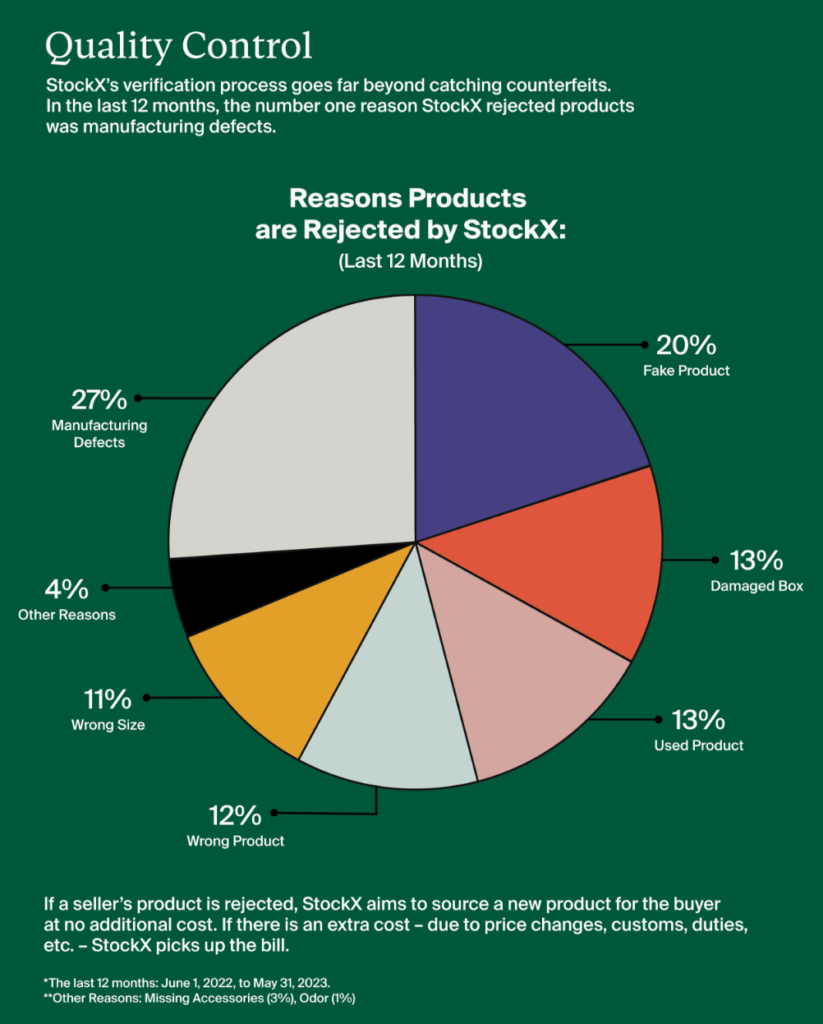

There is also a same-side network effect for sellers since sellers want to list where other reputable sellers are. By not refunding the shipping fee and potentially destroying/ giving counterfeit items to police, StockX is fundamentally dissuading insidious actors from attempting to sell on StockX, while not over-punishing sellers who inadvertently sell fake goods- reducing the percentage of product rejections due to counterfeiting down to 20% in 20234.

Source: StockX

Finally, since people are often both buyers and sellers in the sneaker community, StockX is raising the overall profile and viability of the community, which enables the market to gain more mainstream appeal.

Sustainability and growth:

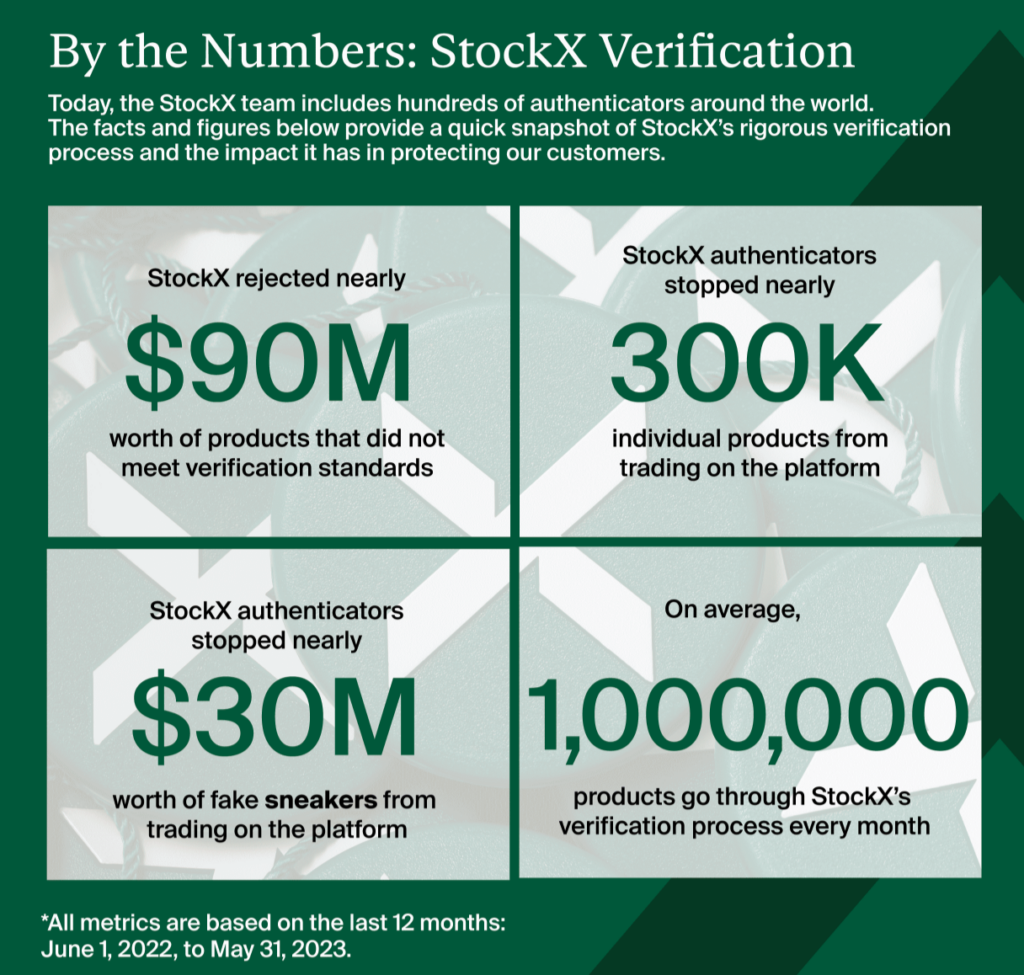

StockX’s key competitive differentiator has been their verification operations, which currently boasts 12 authentication centers in 9 countries5, verifying 1M products every month6.

Source: StockX

While there are a robust number of marketplace competitors (i.e. Ebay, Facebook), none of them have built out such a sophisticated infrastructure for the sneaker niche—the large players cater to a more diverse user/product mix, and the smaller players lack capital. There is a threat that one of the large sneaker manufacturers (Nike- 27% market share, Adidas-15%)7 could enter this space and exert vertical control; however, StockX has earned a well-regarded reputation as a trusted 3rd party amongst the sneaker resale community, which still matter significantly for a nascent industry.

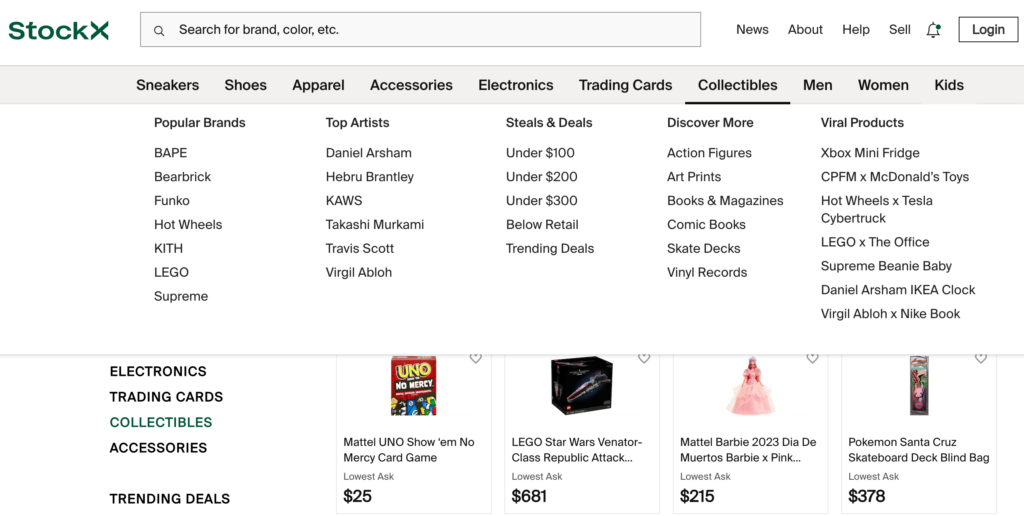

StockX’s most convincing path for future growth remains them leveraging their “trust and community building” playbook into other market niches, such as street fashion, trading cards, and other collectibles8.

By focusing on spaces where authenticity remains a market pain point, they have positioned themselves nicely as a market leader for people looking for non-commoditized goods in a fragmented and trust-challenged environment. There is a play for StockX to leverage their data to enter the DTC space but doing so would bring on a host of buying and inventory challenges that deviate from their core business model.

Sources:

- StockX, April 8, 2021. https://stockx.com/about/press-release-stockx-valuation-surges-to-3-8-billion-with-255-million-financing/

- James, Dani, “StockX removes ‘Verified Authentic’ tags”, RetailDive November 14, 2022. https://www.retaildive.com/news/stockx-removes-verified-authentic-sneaker-tags/636472/

- StockX, https://stockx.com/terms

- StockX, https://stockx.com/about/sx-market-insights/big-facts-the-verification-report/

- StockX, https://stockx.com/help/articles/where-is-StockX-located

- StockX, https://stockx.com/about/sx-market-insights/big-facts-the-verification-report/

- Glebova, Vera, “Nike vs. Adidas: An Undisputed Leader”, SeekingAlpha June 7, 2022. https://seekingalpha.com/article/4516865-nike-vs-adidas-an-undisputed-leader

- StockX, https://stockx.com/collectibles

This is a great post David! I have personally been using StockX since high school (during the hype-beast era). Though I often browse through their websites to just check prices of particular items, I rarely buy directly from them due to the high amount of fees I have to pay (I think at some point I had to pay over 20% of the total price as fees). Their process also used to be extremely slow, spanning couple weeks of wait time until the item is delivered to you. I do believe in their competitiveness with their brand image as the sort of “one and only” guy in the market and their extensive authentisity process that noone could match.