Toast Inc, The Restaurant POS and Management Platform

Providing a fully integrated tech platform for restaurants to cover all aspects of their business and drive retention

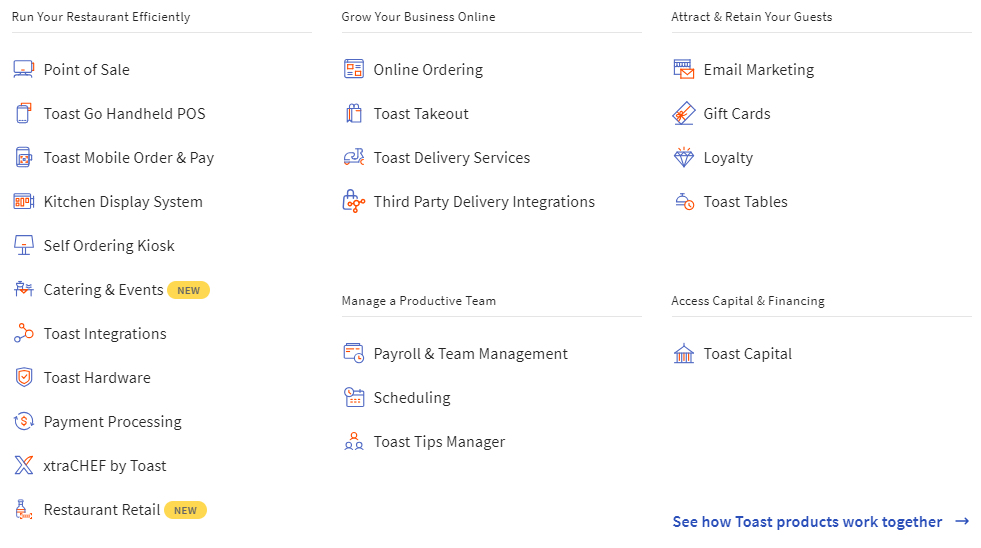

Restaurant operations, and the systems/processes to run them, have become immensely complex. The image below highlights a few of these challenges that span POS, inventory management, payroll & HR, and payment processing.

National chains utilize tailor-made solutions to cover these processes. McDonalds developed their own in-house solution with NewPOS NP6 System, while Burger King leveraged Oracle Micros as an off the shelf solution with a layer of customization. In contrast, smaller restaurants tend to be behind on technology adoption. Many rely on pen and paper for tracking business critical processes or piece together solutions integrating multiple products from different suppliers. Enter Toast, the restaurant first platform that offers a full front-to-back solution. See how it works in the video below.

Toast adds value to the restaurant by improving their operational efficiency. Their POS systems transmit data between the server and the kitchen display system allowing for customization of orders and offering real time feedback from the kitchen. This increases revenue and check size by reducing comps and voids for mistakes that eat into margins. By speeding up the ordering process, Toast helps combat labor shortages, allowing each server to support more tables.

By handling payment processing and invoicing, Toast can perform detailed inventory management and cost tracking, allowing chefs to see cost breakdowns and margins by plate, informing sourcing strategies for ingredients. They also help restaurants generate additional revenue streams by diversifying their offerings including retail with SKU tracking and catering.

Restaurants have unique requirements for back-office tasks. Since a large portion of staff compensation is based on tips, Toast’s payroll tools are designed to easily manage tip pooling by allowing managers to set rules across teams. Another time-consuming process is scheduling and managing shift swaps. Normally, this would require multiple rounds of emails, calls, and texts; however, Toast built all of this into a seamless interface.

One platform extension is Toast Capital, which provides restaurants with financing. Nearly 70% of small businesses that apply for funding are rejected for some or all of the money they apply for. Since Toast handles payment and invoicing, they’re better able to assess credit risk without a credit score or personal guarantee. Restaurants can get approved for $5-300K in loans, which are then collected as a percentage of daily sales. This works in the restaurant’s favor because their repayments scale with business rather than being a fixed amount each period.

Toast is an extremely sticky platform because they cover so many use cases. If you wanted to transition to another product, you’d need to integrate multiple other companies to cover the same offering. Toast uses this to their advantage while onboarding. They start clients on an initial contract of 1-3 years, selling them hardware and locking them in with payment processing. This allows Toast to recoup their costs with a 1.5-2 year payback window as they collect a cut of every transaction and subscription revenue. By the time the contract expires, the customer switching costs have accumulated and they’re unlikely to shift to a competitor.

Several competitors exist in this space; however, Toast’s platform provides a competitive advantage through their all-in-one cloud-based solution and comprehensive capabilities. Square is a simplified offering that is general purpose, not restaurant specific, so it doesn’t boast as many tailored features as Toast. Some restaurants start by using Square, but eventually transition to Toast when they require those industry specific functions such as tip pooling. Lightspeed, TouchBistro, and Upserve all charge add-on fees for certain functionality while Toast includes those in their “all-in-one” package. Some, like TouchBistro, are also locally installed as opposed to cloud-based, so they aren’t as scalable. Clover more closely matches Toast; however, they require a third-party app to sync information between the front and back of the house.

Toast faces several challenges operating in this space. The restaurant industry has inherently high failure rates with 30% not surviving their first year. This leads to significant customer churn, which has been exacerbated by COVID-19 lockdowns and social distancing causing many restaurants to close their doors. The market is also highly fragmented, especially since they’re targeting SMBs so overall customer acquisition is a concern. That said, I believe they have a sustainable and scalable business model due to the inherent stickiness of the platform once a customer is acquired and the defensive moat they’ve built by being a full front-to-back solution that’s hard to replicate.

Really interesting post! One question I have for you is whether the TAM is limited by sophistication of the restaurant and maturity of the business. You mentioned the 30% failure rate but I wonder if that actually becomes higher if you account for restaurants on a global scale and you consider mom & pop shops that might well have too little working capital to sustain this sort of investment. Should Toast eye a particular segment to ensure long-term sustainability?

This was super interesting, Ben (as always!). I had heard of Toast before, but I never really actually considered what they do. I think you mentioned a big value add from scale is the data aggregation and insights that Toast is able to capture from working with such a variety of users, but I wonder if there’s additional value that Toast could provide at the market/industry/regional level. Like, do you know if they plug into research or analyst organizations to provide overall forecasts? If not, we should suggest it!

Toast has been a rocketship in the Boston tech scene, and I’m glad to seem them featured here! You did a great job breaking down all the functionalities that Toast supports for small restaurants, but noting how that comes with a price as businesses inherently face steeper switching costs as they utilize more of the Toast ecosystem.

Do you have a sense of what their NPS is? Anecdotally, I’ve talked to a few restaurants who use Toast, and their reactions were…lukewarm. It seems that Toast was a first mover in a space that deeply craved “good enough” technology, but I’d be curious if their product is genuinely meeting restaurants needs, or if it’s just clearing the low bar of paper/ pencil solutions. Finally, I didn’t know that they were making loans part of their business model, but it is very smart. At the very least, I wonder if they would be willing to share some of this data with third party lenders (like banks), to help scale up their lending volumes.

Good stuff! This semester, I’m actually working on an IP that explores SMB financing, and I’ve talked to several proprietors of restaurants who are always cash-strapped. It seems like a lot of them establish relationships with local banks for financing, and prefer the long-term relationships they have with bankers. I wonder how Toast Capital will disrupt this because while the capital deployment is faster (it seems), the capital is much more expensive.