Zara: Fast Growth through Fast Fashion

How Zara has leveraged its operational structure to drive a competitive advantage in fashion retail

The Importance of Newness

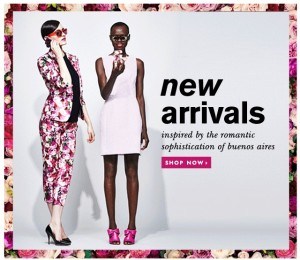

It doesn’t take much time in any shopping center or mall to realize the importance of ‘newness’ in today’s retail fashion environment. The word ‘NEW!’ is displayed across virtually all retailer-to-customer touchpoints, from store signage to communication emails to sales associate training guides. In today’s highly competitive fashion economy, the ability to frequently introduce new products to consumers can be an extremely beneficial point of differentiation, driving customer traffic across the lease line into the store or onto a retailer’s website. While speed-to-market is something most vertically-integrated fashion retailers strive for, perhaps no one rivals Spain-based group Inditex, and specifically, its specialty apparel retailer Zara, on this dimension. Since its inception in 1975, Zara has done an incredible job aligning its internal operations to support its fast-fashion business model, which focuses on driving mass consumer sales via a merchandise portfolio of new on-trend, designer-inspired pieces at affordable prices.

This model has ultimately allowed Zara to grow to be one of the world’s most successful retailers: in fiscal year 2014, Zara had sales of $19.7 billion (compared to Gap’s $16.4 billion or Abercrombie and Fitch’s $3.7 billion) [1]. While it takes apparel retailers approximately 9 months on average to bring a concept into stores, Zara is astonishingly able to do so within just 10-15 days [2]. Zara’s ability to produce newness allows the retailer to secure a global average of 17 store visits per customer versus the industry average of 3 visits per year [3].

Doing Things Differently

Apparel retailers have traditionally developed designs based on trend predictions and forecasts months in advance of bringing them to the physical or online store, causing them to possess a relatively static product assortment throughout the season. Zara, however, operates on a much more rapid, customer response-oriented production model to allow for the flexibility and speed to incorporate the newest trends into its designs.

To do so, Zara has instituted a number of operational enablers that help it secure shorter lead times:

- Production Decisions: Zara chooses to keep a significant amount of its production in-house, as this allows the firm to maintain flexibility in the quantity, frequency, and variety of new products to be produced. Design decisions are delayed as long as possible to allow for maximum incorporation of ongoing trends. In fact, Zara pre-commits only 50-60% of its line at the start of the season, with the remainder being designed and manufactured in the middle of the season [4]. Zara even has reserved mill capacity to ensure production facilities so that if a certain style gains popularity, Zara is able to design and get it into stores while the trend is still peaking. Most traditional clothing retailers commit 80-90% of their assortments to manufacturing prior to the season, so they have much less flexibility in product adjustments [5].

- Enhanced Technological Capabilities: Zara has invested in a number of in-house technological capabilities to support its short lead times. For instance, it has purchased high-tech equipment that allows its factories to adjust for sudden increases or changes in production. Moreover, store managers also use electronic ordering devices that help relay order information directly to Zara’s headquarters. This real-time information flow helps the business update and shift spare transportation abilities, warehousing, and production capacity as needed.

- Real-Time Communications: Zara puts the ‘customer in control’ by maintaining strong communication ties with its in-store sales force. Store managers are expected to constantly record customer feedback on current products, which is relayed back to Headquarters on a daily basis [6]. Such communication allows for real-time inputs to be conveyed to Zara’s designers, who can then respond quickly with new style adjustments to the assortment. Most traditional retailers do not possess the operational capacity and functionality to facilitate such frequent and productive information flows.

- Centralized Decision-Making: Zara centralizes its designers, buyers, and planners within the same location at its Headquarters. This allows for the product team to make quick changes in a coordinated manner: designers can make adjustments to store items, buyers can order more of them, and planners can decide how to distribute everything across stores [7].

- Distribution Investments: Unlike many retail competitors who choose to save on distribution costs (shipping via truck or boat), Zara invests in air transportation to ship their products to foreign markets, which – while more costly – allows them to secure their industry gold-standard 2 week concept-to-store turnaround time [8].

It is clear that Zara has taken major steps to align its operational model with its fast-fashion business model. In doing so, Zara has built a foundational structure to support rapid and flexible production of product newness – allowing the retailer to capitalize on and develop much more on-trend merchandise than its more traditional retail competitors. Based on recent sales performance, it is clear that such efforts have not only resonated strongly with the consumer – in many ways, these ‘fast-fashion’ methods have revolutionized the apparel industry overall.

Sources:

- Zara Leads in Fast Fashion (2015) http://www.forbes.com/sites/walterloeb/2015/03/30/zara-leads-in-fast-fashion/

- Zara’s Unique Supply Chain Management (2015) https://smbp.uwaterloo.ca/2015/10/zaras-unique-supply-chain-management/

- Zara: The Speeding Bullet (2008) http://www.uniquebusinessstrategies.co.uk/pdfs/case%20studies/zarathespeedingbullet.pdf

- Principles of Supply Chain Management (2015) http://www.ftpress.com/articles/article.aspx?p=2359420&seqNum=12

- Zara’s Unique Supply Chain Management (2015) https://smbp.uwaterloo.ca/2015/10/zaras-unique-supply-chain-management/

- Outlook: Zara’s Fashion Supply Chain Edge (2014) http://www.bloomberg.com/bw/articles/2013-11-14/2014-outlook-zaras-fashion-supply-chain-edge

- Zara’s Unique Supply Chain Management (2015) https://smbp.uwaterloo.ca/2015/10/zaras-unique-supply-chain-management/

- Zara’s Unique Supply Chain Management (2015) https://smbp.uwaterloo.ca/2015/10/zaras-unique-supply-chain-management/

Zara has undoubtedly been able to deliver a high growth model (same store sales growth of 5% in 2014) in an industry (traditional department stores in the US) that has struggled to deliver even single digit same store sales growth over recent years. I had a few two questions regarding how they operate their business model:

• As you mentioned, the company can respond real-time to customer feedback. However, customer preferences must vary by store and even more, by country. How does Zara manage diverse demands across stores (localization)—does their centralized development team design market-specific products? How are product allocation decisions made and how is inventory managed in-season?

• Zara is known to only have two major sale periods a year. Given the demand for consistent newness, how does the company clear out of old stock/ product lines throughout the year that don’t resonate with customers?

More importantly, with the growth of online-only retailers who can more easily deliver this same value proposition without the overhead costs of running stores, how will Zara evolve its model to sustain its competitive advantage?

Lillian, I think you nailed it on Zara’s success. The flexibility that they have built into the design process has allowed them to remain on trend.

My first question on Zara’s future success is to Trang’s last point above. How will Zara maintain success in the presence of such rapid growth in online sales? However, I think this may be a strong opportunity for Zara. This online presence may align with their strategy of flexibility. We are starting to see brands have “online exclusive” inventory and if Zara adopts this approach they may be able to get a pulse early for which niche items will sell through in-store. The underlying data on purchase location that is fed from web and mobile shopping can also be used to inform decisions on inventory management in-season.

Secondly, with design based in-house, Zara can follow trends, but it still has a certain style guide season to season. This differentiates it from some of the larger department stores who buy from outside designers. We have seen J. Crew and American Apparel struggle as of late. Both of these companies were once praised for their in-house design team’s ability to connect with its customer. Will Zara be able to maintain its core customer and still stay on trend once the overall style trend moves further from its beginnings?

Lillian, thank you for your post!

I would like to know your opinion about another critical element of the operating model of Zara – its advertising.

Unlike most fashion brands, Zara does not invest in advertising (magazines, TV ads…). The way to attract customers is the beauty and location of its stores in high-traffic areas of major cities, and usually near luxury brands such as Dolce & Gabbana and Prada. Thinking in terms of Marketing Mix, its Place is also its Promotion.

Also, Zara does not put its logo on its clothing to promote the brand like companies such as Tommy Hilfiger or Gap. How could such a shy brand become so successful?

Thank you for the post, Lillian.

1. Most vendors have many brands so that the production lines are never dry. Since Zara owns the factory do they produce other brands at their factories to make sure capacity is always full?

2.For specialized products, do they outsource the production? If not, how do they accommodate for keeping up with changing trends in the same factories?

Thank you!

Thanks for a great read!

One element of Zara’s business model that I always found fascinating was their approach to sales and discount pricing. Instead of having a small subset of their inventory on sale at any given point in time with larger subsets discounted during special times in the year (as is the case with most retailers), Zara has virtually no discounted merchandise throughout the year except during their two annual sales, at which point ALL of the merchandise goes on sale. Why do you think they’ve taken on this approach, and drawing on your industry expertise, do you think this is a winning strategy? How (if at all) do you think this biannual “cleaning house” ties in with the “newness” factor you discussed and Zara’s strategy of always being very current and on-trend?