Trader Joe’s

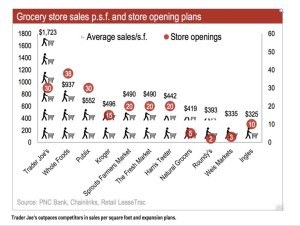

How one grocery store is beating the competition at sales per square foot by selling fewer items and focusing on supplier and distributor savings

Trader Joe’s has effectively aligned their business model of providing high quality, low cost groceries with their operating model of minimizing SKUs and optimizing distribution. Trader Joe’s is a privately held grocery store chain in the US that was started in 1958 by Joe Coulombe. In 1978 he sold the business to the Albrecht family of Germany, owners of Aldi, a leading global discount supermarket chain. [2] Since 1978 Trader Joe’s has expanded beyond California, and currently has over 450 locations nationally. [4]

Selling more by selling less

To achieve these sales, Trader Joe’s has focused on keeping supplier and distributor costs down. Never aspiring to be a one-size-fits-all grocery store like its peers, Trader Joe’s stores stock around 4,000 SKUs, a fraction of the 50,000 SKUs in a typical grocery store. [3] Rather than offering multiple brands and versions of a product, such as peanut butter, Trader Joe’s intensive R+D process identifies the ‘best’ peanut butter and partners with one supplier to sell their product under TJ’s proprietary label. This strategy enables TJ’s to negotiate lower prices than their competitors and decrease their supplier costs through economies of scale. Suppliers are sworn to secrecy and are not allowed to disclose their partnership with Trader Joe’s. [3]

To achieve these sales, Trader Joe’s has focused on keeping supplier and distributor costs down. Never aspiring to be a one-size-fits-all grocery store like its peers, Trader Joe’s stores stock around 4,000 SKUs, a fraction of the 50,000 SKUs in a typical grocery store. [3] Rather than offering multiple brands and versions of a product, such as peanut butter, Trader Joe’s intensive R+D process identifies the ‘best’ peanut butter and partners with one supplier to sell their product under TJ’s proprietary label. This strategy enables TJ’s to negotiate lower prices than their competitors and decrease their supplier costs through economies of scale. Suppliers are sworn to secrecy and are not allowed to disclose their partnership with Trader Joe’s. [3]

Cutting out the middle man

Cutting out the middle man

Trader Joe’s distribution model is another example of how they link their business strategy to their operations. Trader Joe’s distribution model is focused on minimizing the number of people who touch each product. Trader Joe’s buys directly from suppliers, cutting out the costly distributors that their peers rely on. [4] Instead they operate their own distribution centers, and trucks leave daily from the distribution center to each store. This setup allows for smaller footprint stores because instead of each store having its own stockroom, the distribution center functions as a centralized stockroom for many stores. [3] In fact, Trader Joe’s distribution model is such a crucial part of their overall strategy that distribution dictates where the company will open new stores, not the other way around. [3]

Low prices + friendly customer service = lasting value

Their limited-selection, high-turnover model allows for a competitive advantage over their peers since they source and stock fewer SKUs, and keep most of their inventory on their shelves or in their distribution centers, strategies that decrease their costs and allow them to offer lower prices. However, Trader Joe’s other competitive advantage is in-store where they have streamlined checkouts by selling perishables by unit, not weight and focused on providing friendly customer service. [3] Trader Joe’s consistently earns the top stop in terms of customer satisfaction, a key contributor to their customer loyalty. [1] While other grocery stores like Whole Foods are starting to face major competition as big box stores move into the organics market [5], Trader Joe’s unique operations model is a key competitive advantage that will likely lead to more growth in the coming years.

Sources:

[1] Anderson, George. “Why are Trader Joe’s Customers the Most Satisfied in America?” Forbes, July 30, 2013. http://www.forbes.com/sites/retailwire/2013/07/30/why-are-trader-joes-customers-the-most-satisfied-in-america/

[2] Lewis, Len. The Trader Joe’s Adventure: Turning a Unique Business into a Retail and Cultural Phenomenon. Chicago: Dearborn Trade Pub., 2005.

[3] Kowitt, Beth “Inside the Secret World of Trader Joe’s,” Fortune, Aug 23, 2010. http://archive.fortune.com/2010/08/20/news/companies/inside_trader_joes_full_version.fortune/index.htm

[4] http://www.traderjoes.com/our-story

[5] Lutz, Ashley “How Trader Joe’s Sells Twice As Much As Whole Foods,” Business Insider, Oct 7, 2014 http://www.businessinsider.com/trader-joes-sales-strategy-2014-10

Intersting model, I did not realize Trader Joe’s was owned by ALDI. How does their operational model compare? Are there synergies in the procurement channels? The procurement model reminded me of Picard’s model in France which focuses on frozen goods and also sources high quality products from producer directly.

To Laurent’s point, I wonder how Aldi factors into the bigger picture for Trader Joe’s operating model and organisation. It seems like the model is successful, so I’m curious as to why Aldi hasn’t sought to replicate it in some of their other chains. Aldi is incredibly successful as a grocery store franchise, so I have no doubt that they outperform your average supermarket – but it seems like they could benefit from using this or trying to incorporate some of its elements into their broader operating model. Could it be moving some of its ‘best’ identified ‘Trader Joe’s’ products into Aldi chains? Could it eliminate scales and go to per unit pricing elsewhere? Do they use a centralized stockroom for their existing stores?

Fascinating post, Sofia. I thought the idea of using distribution to dictate where new stores are opened is brilliant. Having high-turnover not only cuts out a middle man, it also allows the company to easily optimize SKU distribution to fit changing customer needs. In addition, incorporating the private label gives the company a ton of leverage — should relationships with a supplier not work out , Joes can simply move to another supplier without an impact on their customers.

Thanks so much for this post, Sofia. I love shopping at Trader Joe’s, so it’s interesting to see how their business and operating models have such big effect on making it an enjoyable and affordable place to shop. It would also be interesting to know more about their hiring strategy and corporate policies because I think one of the other differentiators of Trader Joe’s is its employees, who are generally very enthusiastic, helpful, and high energy. I wonder if recruiting and holding onto great talent is a significant factor in their strategy as well.

Great post, Sofia. I love the cheaper fresh produce, breads, and wines offered at Trader Joe’s. It is very interesting to learn that they are able to offer this benefit to customers by streamlining distribution and limiting SKUs. I do wonder a bit about their business model though? Everything that you have pointed out definitely would drive lower costs and inspire customer loyalty. However, I find that there are also many specialized expensive products that are offered at Trader Joe’s, which is an interesting dichotomy. In addition, there are some Trader Joe’s private label products that are cheap, but not necessarily good quality (cereal products as one example). I really enjoyed your post and understanding the operating model behind their offering. Just curious to understand exactly what it is they are shooting for in their business model?

Thanks for the interesting post Sofia! As a TJ’s customer, I’ve also been impressed by their culture and I think culture is a competitive advantage for the company. I see two manifestations of a “different” culture at TJ’s. First, their marketing and product branding is funny and offbeat and it makes customers (or at least me!) feel like shopping at TJ’s is a cool, slightly alternative choice. Second, they seem to look for an alternative “flair” in the type of employee they hire. They have created what seems to be a good employee culture – I’ve always thought that TJ’s employees seem to be happier with their jobs than employees of other grocery stores are with theirs. I wonder if TJ’s ability to employ the same recruiting processes and find similar talent pools impacts which geographies they are moving into?

Great post, Sofia! I have been a loyal TJ customer for years and I always thought the company was California-based, so I was surprised to learn that they are actually owned by a German company! To Sam’s point above, I do think the culture has a lot to with their success – the laid-back, California vibe in all of their stores definitely attracts a lot of customers who want to participate in the “lifestyle” that TJ’s offers. I also find their operating model, of providing mostly private-label goods, extremely interesting. I would be interested to see how much of their costs are associated with R&D as it seems like they are not only constantly churning out new product, but they are also testing new products all the time. I would guess that these new products actually probably contribute significantly to their revenues as they are able to create loyal fans out of their customers as customers are physically unable to purchase these products anywhere else. Because of this, I think it is important for Trader Joe’s to constantly innovate their product mix so that customers keep coming back for more.

Nice find, Sofia. I did not realize the extent to which they had streamlined their purchasing and distribution in order to keep customer costs down. I think the other key element of their business advantage is their diverse set of ready-made food available (not frozen meals, but pre-packaged fresh meals like sushi, lasagna, etc.). I wonder how they incorporate this into their low cost sourcing approach: do their have the suppliers create these too? Do they use the same suppliers that produce the raw food, or separate suppliers and/or aggregators? Or do they use their own labor to create some of these meals? If they outsource this, I could see that impacting their decision for choosing suppliers, and it may drive up costs as it would be more labor intensive (a slight misalignment with the rest of their operating model). However, these meals are currently available at low costs, so it seems that they have found a way to produce meals in cost-effective ways as well.

Great work Sofia – I’ve also been really impressed with Trader Joe’s, largely because there is no similar model in Canada. It makes me wonder how they can scale this business to new, international markets (assuming they believe there is a demand). With Trader Joe’s heavy emphasis on private label, I’m curious as to what the appropriate model is to expand internationally; would a slow approach of building a few test stores work, or do the private label orders require such volume that a large group of stores would need to be built at once in one city to make the logistics and economics feasible?

Hi everyone,

Thanks for your comments on my post. A few thoughts on some of your points and questions, and some more food for thought 🙂

Caroline/Sam: Yes, based on my reading Trader Joe’s does invest a lot in their employees and tries to keep employee turnover to a minimum. They pay their employees well compared to their competitors which helps them retain talent. I find their customer service to be friendly while not being creepy and often have pleasant and interesting conversations when I’m checking out (which I really can’t say I have at any other grocery store). Sam I don’t know how this impacts what markets they go into.

Jane: Aldi does sell some of TJs products in their stores.

Young/Meghan: I agree I’d love to know how much their R and D spend is. They are a private company, so it’s hard to get at some of this info. They are definitely innovating all the time in terms of what products they offer, and they take the losers off the shelves and replace them with winners. As with other grocery chains, they also have a fair amount of seasonal products that aren’t available year-round. Meghan, I think they view the high-end stuff (at better prices than other stores) as a way draw people in and keep them coming back for a good deal. For example, I think their nuts, cheese and alcohol are very well priced compared to competitors, but agree that these are more high-end products.

I forgot the food for thought, here it is: “Trader Joe’s Ex-President Launches Grocery Store That Sells Healthy Food at Fast-Food Prices” http://nextshark.com/daily-table/