Put down that cookie, you’re contributing to climate change

What Unilever talks about when it talks about palm oil

Let’s talk about palm oil. Palm oil is a cheap-to-produce, relatively healthy, highly prevalent but rarely discussed ingredient found in anything from lipsticks and lotions to cookies. With global palm oil consumption exceeding 64 million metric tons per year, palm oil deforestation is one of the leading contributors to greenhouse gas emissions. In fact, tropical deforestation is one of the driving factors in rapidly progressing climate change, accounting for ~10% of total global warming. [1]

Where does it come from and why do we care? Over 80% of the world’s Palm Oil supply is produced in Indonesia and Malaysia, home to rich biodiversity and rainforests that are classified as high carbon stock (HCS) forests. [2]

Deforestation for palm oil production most frequently occurs through a process of burning peat (thick layers of decayed vegetation coating the forest floor), which releases extremely high levels of carbon dioxide – one hectare of burned peatland can release up to 6,000 metric tons of C02. These emissions are damaging to the ozone and result in notoriously high air pollution in neighboring cities, not to mention the rampant destruction and displacement of native wildlife and biodiversity. [2]

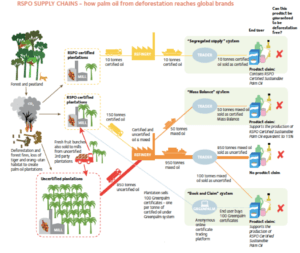

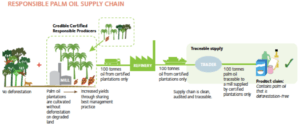

Why does Unilever care about climate change? Unilever purchases ~3% of global palm oil production (~1.5 million tons annually), making it the world’s top consumer of palm oil. Accordingly, they have been at the forefront of corporate responsibility and commitment to sustainability. In 2004, Unilever helped found the Roundtable on Sustainable Palm Oil (RSPO), a not-for-profit initiative that is taking an active role in shaping global standards for the production of sustainable palm oil. Beginning in 2009 Unilever publicly committed to sustainably sourcing their palm oil. They set a target to be totally RSPO certified by 2015 and achieved that 3 years ahead of schedule. [3] However, A RSPO-certified processor of palm oil can source materials from multiple plantations without confirming the sustainability of the supply [for more info on RSPO supply chains, read here]. [4]

How palm oil makes its way from a plantation in Indonesia to your cookie:

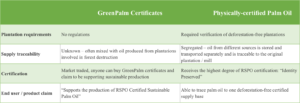

What’s left to be done? Unilever’s progress is admirable, but like many large corporations the majority of their RSPO-certified palm oil is backed by something called GreenPalm Certificates. Referring back to the supply chain of palm oil, the issue of deforestation stems from the original farmer, but is traded upstream through manufacturers, processors, and distributors before hitting the shelf in the form of a Unilever product. While Unilever is admirably able to vouch for the sustainability of 19% of their oil, this means that the remaining 81% covered by GreenPalm certificates is untraceable and is likely a product of deforestation. [3]

Given that consumer awareness of the issue is relatively low, and upstream partners in the supply chain have little stake in the traceability of their palm oil, the burden falls on the consumer goods companies to help stoke sufficient demand to warrant a change in the supply chain.

In its efforts to achieve 100% identity-preserved palm oil by 2020, Unilever’s approach has been to go directly to the supply countries and build their own facilities.

In 2015 Unilever invested 130 million Euros to build and staff an independent production facility in North Sumatra. By partnering with local smallholders (small, independent plantations) to improve yields in a sustainable manner, Unilever is simultaneously taking control of their own supply chain process and helping mitigate impacts of global warming. [3]

Risks ahead:

- Consumers don’t care enough about the sustainability of their products to tolerate price increases. In this case, either Unilever will need to absorb the extra costs or forego their efforts to stem deforestation.

Do more!

- While the recent 130 million euro investment in supply chain traceability seems admirable, compared to Unilever’s consolidated net profit of ~$5.3 billion they probably have some room to increase investment.

- Enforce more stringent certification standards for RSPO members

- Consider eliminating the GreenPalm program – it was a good way to start off, but is it really effective in the long term? (read more here)

word count: 790

Sources:

[1] Statista 2016: Consumption of vegetable oils worldwide from 2012/13 to 2016/2017, by oil type (in million metric tons).

<https://www.statista.com/statistics/263937/vegetable-oils-global-consumption/>

[2] Kodas, Michael. (2014, November 16). Palm Oil Production Poses Problems for the Climate.

<http://www.climatecentral.org/news/palm-oil-production-climate-18338>

[3] Unilever Sustainable Palm Oil Sourcing Policy – 2016.

<https://www.unilever.com/Images/unilever-palm-oil-policy-2016_tcm244-479933_en.pdf>

[4] Roundtable on Sustainable Palm Oil (RSPO). 2016. RSPO Supply Chain Systems Overview.

<http://www.rspo.org/files/docs/rspo_fact_sheets_systems.pdf>

I do agree that Unilever has scope to do a lot more in the palm oil sustainability space. Having said that, Unilever was one of the first-movers to address the issue of palm oil deforestation in the South East Asia region and have made significant strides, encouraging a lot of consumer goods companies and the industry at large to follow suit but the uphill battle is a long, arduous one. A couple of comments I wanted to add on with are below.

I do agree that the GreenPalm certificates are probably the least efficient of the steps undertaken so far and do not do much to address the root issues. I found the above graphic on the palm oil supply chain system incredibly interesting, it showed me how very opaque, multi-faceted and complex the current landscape is. In fact, the foremost roadblock in trying to implement sustainable practices is this lack of traceability in the supply chain. Using technology to deliver traceability is one of Unilever’s main goals in addressing this issue and I think this is the key game-changer in this puzzle. Unilever has partnered with traceability systems experts FoodReg to develop the KnownSources tool, which allows for a consistent means of reporting traceability and origin of supply. This will allow companies like Unilever to trace back all its palm oil right back to the source farm and the mills, allowing them to then ensure that their entire supply chain is sustainable by 2020. Unilever started using the system in 2014 and 58% of their palm oil is now traceable to mills, but they need to continue this effort to ensure they have 100% visibility. Interestingly, KnownSources also incorporates a functionality that allows for the sharing of traceability information between inter-connected companies within a specific supply chain, enabling the creation of networks where traceability data is shared with the industry, reducing the duplication of individual companies each identifying their own supply chains, so the impact to the region and the companies operating within it will be huge. I would love to see Unilever invest more in this space and leverage more software technology in clearing the fog within their supply chain and achieve complete traceability of their palm oil.

Another area that I think Unilever needs to invest more in is its smallholder farms strategy. President Joko Widodo of Indonesia recently issued a moratorium on new land being used for plantations and instead asked the existing plantations to increase productivity and double yield, something they claim is possible with new types of seeds. While this is an impressive step forward, it does pose questions to what role governments and organizations can play to support plantation owners, especially smallholder farms, to make this transition through better financial support, training and technology so as to improve their productivity. Maybe Unilever’s own plantation can pioneer some of the scientific and technological innovations that enable a higher palm oil yield and embed the collective intelligence across the region?

Living in Singapore the last five years, this issue was very much front of mind for me (especially around Sep-Nov, during the burning season). The peat fires in Kalimantan and Sumatera especially would end up in smoke getting blown across the ocean and over our city. We’d wring our hands about it and point fingers at Indonesia, saying they needed to clamp down on these deplorable practices.

Indonesia would point back at Singapore; many of the companies syndicating the palm oil grown on the cleared land were headquarted or listed in–you guessed it–Singapore! If Singapore *really* cared about the smog, they had plenty of things they could do on the demand side. Everyone was just as conniving and complicit as the next person, with blame conveniently diffused by the complicated supply chain you diagrammed in your post

At the end of the day, as much of a nuisance as the smog was to Singapore, the people who were hurt the most by far were Indonesians themselves. A bloomberg article I read (http://www.bloomberg.com/news/articles/2016-09-19/study-estimates-100-000-premature-deaths-from-indonesia-haze) attributed as much as 100k premature Indonesian deaths to the haze.

One thing I really liked about your post is that you attributed the pollution problem to the method by which land is cleared vs. the palm oil itself. When reading about this crisis, I recall finding that palm is actually the most water and land efficient way to produce vegetable oil–if you were to ban palm, that basically shifts production to less efficient oil sources. Land will still be cleared, and tons of water will still be used. Those calling for ban on products containing palm oil are well-intentioned but misdirected.

How likely do you think it is that Jokowi’s ban on clearing more land will actually be enforced? I remember during the last dry season (a particularly bad one) the central government in Indonesia said they weren’t in a position to have much influence on this local problem. The government in Sumatera said they didn’t have the funding and firefighting resources, even as small fires turned into huge ones that lasted for weeks on end.

Both this post and Cami’s post on Levi’s make me think of the IKEA case–with such huge commodity needs, why don’t they give a shot at vertically integrating their supply chain and leasing their own palm plantations? Unlikely demand for CPG goods and the palm oil in them will go down any time soon…