Macy’s: America’s Omnichannel Store

How a 158-year-old retailer is staying relevant in the digital age

The advent of digital technology has completely disrupted the retail industry. Traditional brick and mortar retailers are struggling to remain relevant in the digital age, facing fierce competition from new brands and more efficient ecommerce players. Macy’s, a 158-year-old department store, offers an example of a retailer that has made strides in evolving its business model through digital technology while also showcasing the additional work to be done.

Macy’s was one of the first retailers to develop an ecommerce sales platform, as it launched Macys.com in 1998 as a Silicon Valley subsidiary (its main operations remained in New York City). However, as many retailers have found, simply having an online presence isn’t enough to counteract competitive threats and changing consumer behavior. Macy’s needed to fundamentally change its business model from that of a traditional physical retailer to a truly hybrid brick and mortar/digital retailer. It wasn’t until 2010 that Macy’s digital transformation truly started to gain traction when it announced a holistic omnichannel strategy focused on creating an integrated customer experience across physical and digital channels.

Ship from Store

The chief way in which Macy’s has executed its omnichannel strategy is through leveraging its expansive store network – 868 total stores at the beginning of 2016 – to serve as online order distribution centers [1]. By building out “ship from store” capabilities, Macy’s is simultaneously maximizing both its inventory management and its customer experience. Rather than housing additional inventory exclusively for ecommerce orders in warehouses, the retailer can ship an online order from a store anticipated to have excess inventory of the items requested, thus minimizing its total inventory costs and reducing potential markdowns. Additionally, the customer benefits from the quicker delivery of items from local stores rather than national distribution centers.

Buy Online, Pick Up In-Store

Macy’s “buy online, pick up in-store” program also utilizes its store network to bridge the physical and digital divide. The customer benefits from ease and convenience, while Macy’s benefits from the incremental sales driven by these customers – those who came in to pick up their online order, but discovered additional items while in the store. The program also allows Macy’s to compete more effectively with the ecommerce behemoth that is Amazon and its free two-day delivery Prime membership program.

RFID (Radio Frequency Identification)

Adopting RFID technology is another way in which Macy’s executes on its mission to become “America’s Omnichannel Store.” RFID allows the company to precisely track the location of a product within a store or within its supply chain, which is critical to the fulfillment of its “ship from store” and “buy online, pick up in-store” programs. It serves as an example of a digital technology that has changed both the business and operating models of Macy’s. According to the company’s Chief Omnichannel Officer, RB Harrison, “There’s an omnichannel component to RFID. We’ve always said RFID would help us maintain more accurate inventory, and with more accurate inventory we would buy the right stuff, have it in the store and in turn take care of the customer more efficiently” [2]. RFID allows Macy’s to improve product assortment and service (its core business model) while leveraging its existing inventory to fulfill customer demand (its core operating model). The inventory management changes produced by RFID enabled Macy’s to reduce $1 billion of inventory from its stores [3].

Success

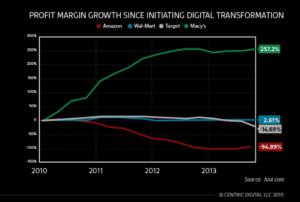

Since launching their digital transformation strategy, Macy’s profit margin grew by 257% in 2014 (versus 3% for Walmart and -14% for Target) [4].

The company has achieved this success by recognizing that its core customer (women ages 25-54) “shops online, offline and everywhere, so Macy’s has adapted its inventory, marketing and internal team structure to let her research, buy and collect her purchases where and when she wants” [5].

While Macy’s has proven itself to be a retailer that is ahead of the curve in embracing digital technology, it needs to continue to innovate in order to stay competitive in the industry. Macy’s has begun testing same-day delivery of online orders and image search, but this continues to prioritize the online shopper. The company needs to make similar investments in elevating the in-store experience using digital technology. As stores face increasing staffing cuts, the service levels in-store may diminish, and Macy’s must be proactive in addressing this, as its core customer still values in-store service. While it is testing “smart” fitting rooms and beacons to send personalized offers via mobile, it should also invest in educating store associates on how to best leverage these technologies to improve both the quality and efficiency of their customer service.

Although store closures and reduced physical footprints are inevitable in the current retail environment, the lion’s share of shopping still happens in physical stores, and Macy’s must be careful not to disregard this in-store experience in favor of its online presence.

(800 words)

[1] Macy’s, Inc, “2016 Store Count and Square Footage,” https://www.macysinc.com/for-investors/store-information/store-count/2016/default.aspx, accessed November 2016.

[2] Phil Wahba, “Macy’s aims to become retail tech powerhouse with latest moves,” Fortune, September 24, 2014, http://fortune.com/2014/09/24/macys-tech/, accessed November 2016.

[3] “Macy’s Leverages the Power of RFID to Fuel Successful Omni-Channel Fulfillment Strategy,” Tyco Retail Solutions press release (Neuhausen, Switzerland, January 16, 2016), http://www.tycoretailsolutions.com/Pages/ArticleDetail.aspx?ItemId=697.

[4] Centric Digital, “How Macy’s Implemented a Successful Omnichannel Approach,” March 30, 2016, https://centricdigital.com/blog/digital-trends/how-macys-implemented-a-successful-omnichannel-approach/, accessed November 2016.

[5] Think With Google, “Macy’s Goes Omnichannel,” October 2014, https://www.thinkwithgoogle.com/interviews/macys-goes-omni-channel.html, accessed November 2016.

Great post, ARS. Through a hybrid click and mortar strategy, it seems like Macy’s has done a great job of improving its value proposition to customers that use digital technology, while at the same time not alienating an older, less tech savvy segment of its consumer base. I wonder though if Macy’s was to enter new markets, say China and its rising middle class consumers, if the company would be best served by adopting a much more online-centric approach since there are no already established brick-and-mortar customers to serve.

I’m also curious about the future of omnichannel retailing and its impact on the in-store experience and the structure of the retail workforce. As someone who values interacting with a knowledgeable retail salesperson to make my shopping experience better, I’m worried about how the omnichannel model will change customer service. An article in the June 2015 issue of the Journal of Retailing, Adam Rapp et all define “showrooming” as when consumers use the physical store to browse products which they go on to purchase online (sometimes from a different retailer, such as Amazon, at a lower price). Rapp’s study finds that “Showrooming has negative effects on both salesperson self-efficacy and performance.” Further study and experimentation with sales training will be needed to redefine the role of the retail salesperson in the physical store. This problem is also concerning in light of the discussion we had last week about the hollowing out of middle-skill jobs in our economy.

(Source: http://www.sciencedirect.com/science/article/pii/S0022435914000955)

Great post and really cool to see all the cool digital things Macy’s is doing. This might be more of a marketing concern, but I still worry that no one has appropriately figured out how to manage investments in all stages of the customer journey across channels. Online-to-offline conversion is a really difficult marketing analytics challenge for which I didn’t see a ton of great solutions when I was working in digital marketing. Another concern I have about a giant like Macy’s is that while they have a ton of resources to throw at developing technological capabilities, they may not have the nimbleness to iterate on and improve their technology in the way that a small e-commerce company might.

This post does a great job exploring the opportunities and challenges that digital technology pose for traditional retailers. A major concern that I have about the omnichannel strategy being adopted by Macy’s and other traditional retailers is that ecommerce threatens to commoditize the business. Simply offering convenient purchasing does little to differentiate Macy’s from other ecommerce platforms. Ryan Matthews of Black Monk Consulting raises an interesting point about Macy’s strategy: “With all due respect, Macy’s is missing the point here. The real ‘power’ of Amazon is the continuing stickiness it manages to create with customers. It keeps inventing more and more ways to connect. Attacking one of these platforms simply isn’t going to prove effective over the long haul.”

Macy’s will need to identify new ways to build brand loyalty with its traditional consumer. Importantly, the company needs to figure out how to make its bricks-and-mortar stores relevant by coming up with creative ways to drive foot traffic besides in-store pickup. I worry that Macy’s will lose relevance if it becomes just another online retailer.

Source: http://www.forbes.com/sites/retailwire/2015/08/09/will-omnichannel-keep-macys-ahead-of-amazon/2/#b5acf153143b

This was an interesting read – thanks for posting, ARS. I understood that one could order from Macys.com and pickup in a selected store, but I didn’t realize that Macy’s might also ship from a local store to cut down on shipping costs and times, and to better manage store-level inventories. That is a novel approach, and I wonder how many other traditionally brick-and-mortar retailers are already adopting that same approach, and what cost benefits have been realized (is the cost of holding inventory at a distribution center for online orders actually any higher than the cost of shipping to a store, than using store inventory to ship to the customer?).

Interesting post! I enjoyed reading about how Macy’s is currently working to better manage the gap between the physical and digital world. Two additional thoughts that I had while reading were:

1) To what extent does Macy’s want consumers opting in to “shop online, pick-up in store”? While this definitely does provide a convenience for shoppers, and is likely something Macy’s needed to test as it’s a good entryway into a omnichannel shopping experience, I’m concerned about the “treasure hunt” nature of shopping and whether this impacts overall store performance. I imagine CostCo has avoided pick-up in store for a similar reason. I’d be curious to know if average basket size goes down as shopper navigate to shop online, pick-up in store.

2) The second was a question on whether Macy’s is considering investing in improving the experience of shopping in-store, adding features that can only be experienced live. I think this might be the future role for physical stores in a digital world so would be curious if Macy’s was also investing in this space.

I had no idea Macy’s has been so successful with its digital applications! Especially in light of trends hitting the department store industry overall. I like the idea of digitizing the in-store experience, since there are many aspects of the online clothes shopping experience that cannot be matched in a store. Linking people’s online searches with the RFID technology in stores, the Macy’s website could show customers where exactly in the closest store the products in the customer’s shopping basket are located and recommend they try it on before buying. It can also potentially pair the customer with a customer service representative at the store to provide in-person advice once the customer arrives at the store. This would help to maintain higher utilization of the workforce if customer visits are anticipated and also streamline the customer process by guiding them with a map directly to their purchase of interest. Along the way, Macy’s could continue to reap the benefits of incremental sales.

Very thorough post ARS. I have spent the last five years working in the consumer products and retail industry, but I had no idea that Macys.com launched so long ago. As is the case for all brick-and-mortar retailers in my opinion, e-commerce will have to become a greater focus for the distribution strategy at Macy’s going forward to ensure its on-going success. Although I recognize the ability for improved profitability from e-commerce channels, I am concerned that their continued profitability gains will be somewhat constrained since the business is primarily selling third-party brands and not receiving the benefit of circumventing a wholesaler mark-up. Additionally, I think profit margins will be challenged as Macy’s will have to improve shipping speeds and product availability in order to compete with other online retailers such as Amazon.