Digitizing Grandpa: how a Chilean bank is re-imagining customer journeys

Banks are no strangers to change in the era of digital revolution, but have been slow to adapt in the past. This post provides a brief description of how a mid-sized Chilean bank is positioning itself for success in the next decade.

Bci is a Chilean retail bank with 360+ branches[1], originally targeting mid-high value customer segments. It was founded in 1937, and steadily grew to become the 5th largest domestic bank[2]. Like many traditional banks in Latin America, its digital offering was developed gradually, at a slower pace than American and European banks. However, higher penetration of internet-enabled devices and threat of disruptive fintechs led bank leadership to embark on a step change of its business model in 2015 to position Bci as the digital leader in Chile.[3]

The goal: a new business model in a new age

The change started by adopting a customer-centric approach to capture new clients and increase cross-selling by fully redesigning the customer journeys using a design-thinking approach[4]. The transformation was done on a product-level basis, starting with the “plan” (checking account and credit card bundle) since it is the product through which the bank usually acquires customers. Enabling fast, remote, digitally-enabled account opening significantly improves the experience of joining the bank, and at the same time reduces costs. The improved economics allow the bank to profitably expand into lower value segments. In addition, the development of a cross-product omnichannel platform, coupled with advanced analytical capabilities, allow to significantly expand sales of additional products.

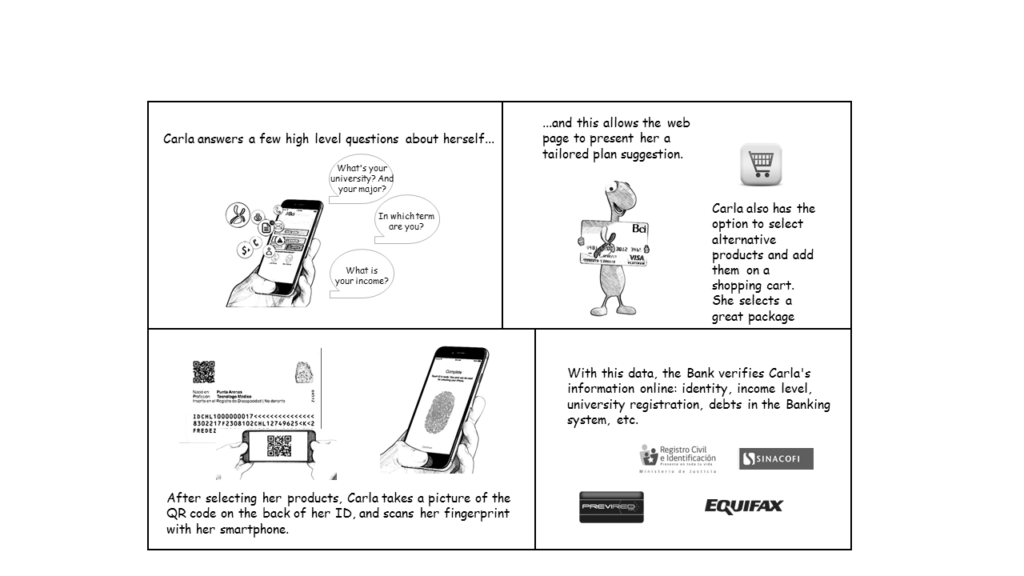

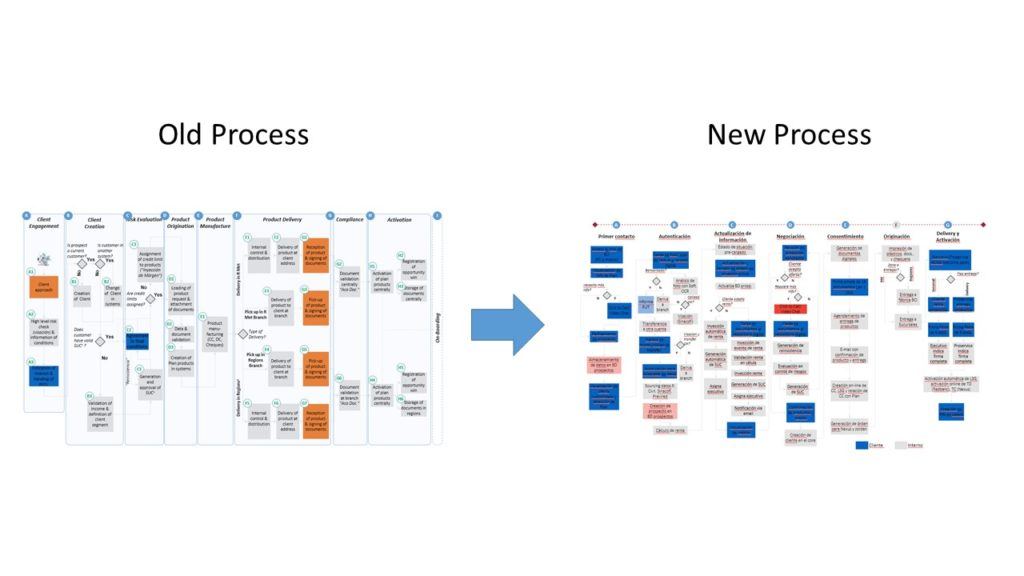

The change is best understood by following two clients, Old Arnold and New Newton. If Arnold wanted a personal loan to buy a car, he would have to first visit a branch. He would formally become a client 9 days, 3 visits and 21 signatures later. Then he would initiate a loan request, which took an extra 5 days and required submission of significant paperwork and a telephone recording to agree to terms. In contrast, Newton can become a client from the comfort of his living room in 30 minutes using his mobile or notebook[5]. After he logs in to the account for the first time, the system automatically offers loans suited to his needs. If he accepts the offer, he can have the money deposited in a matter of minutes.

The backbone: a new operation to deliver on customer promise

A transformation of such magnitude requires major changes, starting with a full process redesign. Things look smoother from the customer side, but the bank takes on significant complexity. The main challenges were the automation of manual tasks and digitization of information flow. Amongst the former, were automatic customer authentication, gathering of demographic and income data, and credit and background check. The latter required adjustments in legal and compliance requirements to allow the elimination of paper forms. One of the biggest changes was the acceptance of digital signatures in place of physical signatures in many key documents.

New processes are sustained on two pillars: technology and people. The most visible technological change was the design of a new mobile app and webpage. But invisible to the client were many new applications that incorporated and recalled client information from the bank’s systems, and connected the systems with third-party vendors (for example, for authentication and client data sourcing). In addition, the bank had to develop new services such as click-to-call or online chat for customers to receive remote assistance.

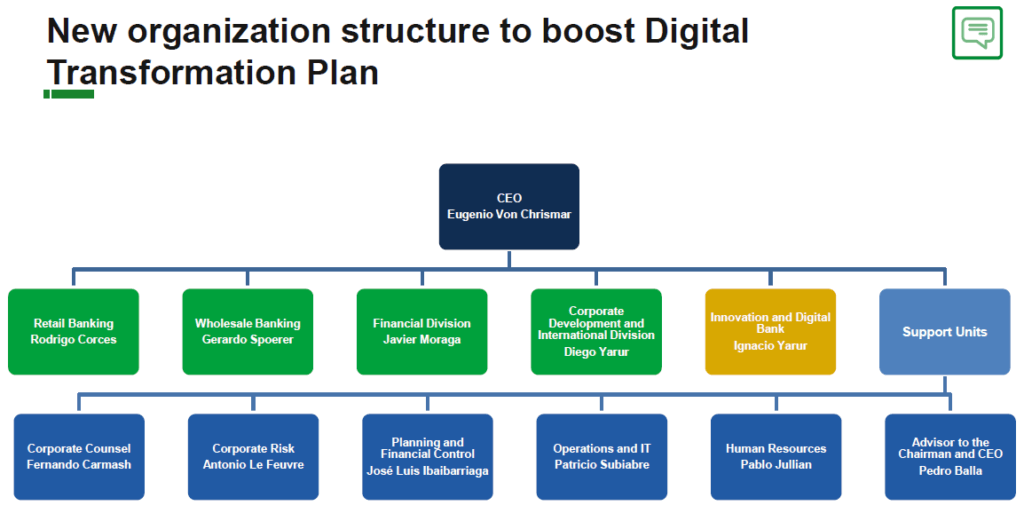

The largest change, however, was in the organization. To enable and sustain the new business model, the bank set up an innovation division reporting directly to the CEO[6]. The transformation was extremely hard for the company, particularly because it required many divisions to work together and break with decade-old preconceptions. Product development, Marketing, IT, Legal, Risk, Finance, and Operations all had to cooperate to deliver the transformation.

The future: a challenging, endless array of opportunities

Bci is on the right track, but it should aim to be a first mover in offering additional services in the rapidly changing financial ecosystem. In my opinion, the bank should be focused on two tasks. First, learning and/or partnering with fintechs[7]. Disruptive innovators have the potential to improve customer experience and revolutionize existing businesses. Take for example payment services. Players such as Venmo have dramatically changed the way people transfer small amounts of money. Such examples abound throughout the industry, and the bank that figures out how to partner with these players to its advantage will win.

Second, working to update the legal framework. In Chile, as in many other countries, the laws for banks are outdated and incomplete. This creates uncertainty, and prevents banks from fully driving change through digital technology. Bci should work with regulators to allow incorporation of more technology in banking services by relaxing unnecessary restrictions. This work should not be limited to theory, but also include investing in proofs of concept to identify necessary fixes and show the regulator that solutions are good in practice.

(784)

[1] Banco de Credito e Inversiones, 2015 Annual Report (Santiago, Chile: Bci, 2015) p. 86.

[2] Superintendencia de Bancos e Instituciones Financieras de Chile, Reporte Mensual de Informacion Financiera, October 1, 2016 [http://www.sbif.cl/sbifweb/servlet/InfoFinanciera?indice=4.1&idCategoria=2151&tipocont=0] Accessed Nov 16, 2016.

[3] Banco de Credito e Inversiones, Q3 2016 Conference Call Presentation (Santiago, Chile: Bci, 2016) p. 6

[4] Roman Regelman, et al., How digitized customer journeys can help banks win hearts, minds, and profits, BCG Perspectives 2016, p. 1-6

[5] Bci Company website, https://www.bci.cl/webPublico/planes.html#/contratoplanes/landing, accessed on November 18, 2016

[6] Ryan Sy, Chile’s Bci appoints heads for digital banking, international biz, SNL Financial Extra, August 16, 2016, via Factiva, accessed on November 17, 2016.

[7] Michael Grebe, et al., Global Retail Banking 2016: Banking on Digital Simplicity, BCG, p. 5

Josue, thank you for your article! It is really well written and addresses the main issues involved in the digital banking movement in a clear and illustrative way. As I mentioned in BAH’s post, I believe that digital banking has disrupted with the traditional banking model and will drive the innovations in the banking industry from now on. As McKinsey pointed out in their article (link below), banks who fail to follow the digitalization trend will probably lose a lot of market share. However, I think the process of digitalization must be something implemented slowly, in order to include all bank’s customers. In fact, my only concern with the digital banking model is inclusion. In order for someone to be able to use the app, he/she needs to have access to a smartphone, which in South America is not always true. So, in order for the business model to succeed, Bci will need to promote digital inclusion initiatives aiming at developing digital skills and increasing its customers’ base. For doing that, Bci can replicate some initiatives found in banks around the world. Lloyds Banking Group, for example, has created a position called “head of digital inclusion” which Bci could consider including in the current corporate structured. Below there is the link to an interview with Lloyd’s head of digital inclusion Leigh Smyth that highlights how a bank can profit from increasing its customers’ digital skills.

http://www.mckinsey.com/industries/financial-services/our-insights/strategic-choices-for-banks-in-the-digital-age

http://www.computerweekly.com/news/450295841/Interview-Leigh-Smyth-head-of-digital-inclusion-Lloyds-Banking-Group

Thanks for sharing the information! I agree, inclusion is a major issue, especially in South America. I’d be curious to see what such a role could bring to Bci. While it is true that in South America there is a relatively low penetration of mobile phones, there is great division too – and the people with good stable jobs and access to banking services tend to be well digitized, so the motivation for inclusion is low (those non-digitized, low income customers, usually get sent to the national bank). But as the bank grows its customer base and expands into lower segments, I agree that this could become a big thing to consider.

“Digital processes are no less complex, but complexity is masked from customer.” This holds true as long as the system works well. I have found myself in many situations where the system was poorly designed and the whole experience became terrible. As Student12 mentions above, if you do not have access to smartphone/Internet or if you are not tech savvy you may not be able to access major financial services. That represents a threat for many citizens. Yes, all banks need to embrace the digital transformation but they should not forget that face-to-face customer interactions remain a key part of their job. I believe that banks that are able to maintain amazing customer experience while offering new digital services will be the one surviving this transformation.

Agreed! And the important thing to note is that while you digitize the experience, you still keep the option open for customers to go through the traditional channel should they prefer to. You do not shut down one in favor of the other on a given day, but rather open the digital channel and push for migration. Only when the critical mass has shifted do you actually close the physical channel (if you do it at all – they can coexist forever and that’s fine too). Just so you know what this particular bank is doing, it has set up branches with tablets so that any walk in customer can undergo the digital process with the assistance of a bank executive. It is being piloted in a few branches, and if it works, will be spread to the whole system.

As for the digital process being masked from the customer – yes, it holds true as long as the system works. But in the end, that’s how it should be if you do it right. I think many pains come from the fact that not enough testing is done prior to roll out, especially under the new agile development philosophy in which you are constantly iterating the product. In our case, a lot of testing was done before roll-out, and the roll-out was done incrementally. It was first open to a specific set of customers, and only then expanded to the whole population.

Thanks for this post, Josue. Very insightful, especially regarding the behind-the-scenes reorganization of the company that needed to happen to drive innovation. I previously worked on a consulting project for a mobile banking platform so this space is familiar to me.

The biggest challenge I encountered in my previous project was how to change customers’ misperceptions about fraud around mobile banking. While I agree that New Newton seems much easier for the customer, there is still a perception that mobile banking is “risky”, especially in emerging markets. I wonder if the “behind the scenes” checks and systems that are done should actually be more transparent so that customers understand how the system works and can feel more confident in it. Here’s an example of one company’s fraud prevention strategy: https://techcrunch.com/2011/02/17/clairmail-brings-fraud-management-to-mobile-banking-technology/

Josue, Thank you for this great article about how BCI completely reimagined the customer experience. I was wondering if BCI could use the power of the geolocational capabilities of mobile phones to create a better banking experience in two specific ways[1]

1) Provide better security to the customer – especially in a time when digital banking fraud is on the rise

2) Understand patterns of where customers are travelling – and can use this data to better make decision around opening ATM’s and bank branches.

I do understand there will obviously be privacy concerns with any such use of geo-locational data but I am optimistic there could be balance that could be found.

[1]http://iotindiamag.com/2016/08/5-ways-iot-can-change-way-banking/