Beauty in the Age of Individualism: Sephora’s Data-Driven Approach

Sephora harnesses user data to offer pinpointed product recommendations, offers, and loyalty incentives

Sephora is the world’s leading specialty beauty retailer, and a pioneer in the field of predictive analytics, topping the Retail Personalization Index two years in a row.[1] The brand’s experience, famed for its playful and customer-centered approach, spans online and offline channels, with 2.3 million visits monthly to its site[2], a top-ranked Shopping app in the App Store, over 1 million downloads in the Google Play store[3], and 2,300 physical stores worldwide.[4] But as a an offline-born brand under LVMH’s traditional management, its position as machine learning leader was not always guaranteed.

Founded in 1998, Sephora began to embrace artificial intelligence in its digital product development in the early 2000’s. From personalized email offers, to “you might also like” product carousels on its product display pages, the company committed early on to an experience interwoven with machine learning, giving it an edge over department stores and vertical competitors like Ulta. Beauty, the second-most penetrated category in online shopping after fashion & apparel[5], was well-suited to the online channel, given consumers’ propensity to test a variety of brands, and rely on peer reviews. Sephora’s clientele, largely female, also reacts well to high-service shopping experiences, which a personalized website emulates.[6] The challenge in beauty – a category with fast replenishment – is to predict what consumers want before they buy it from a competitor.

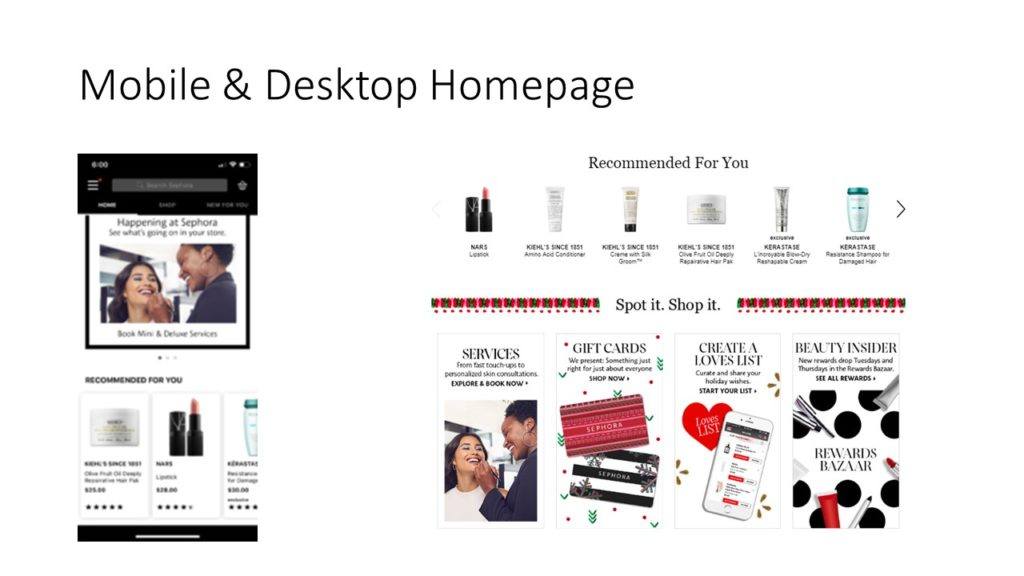

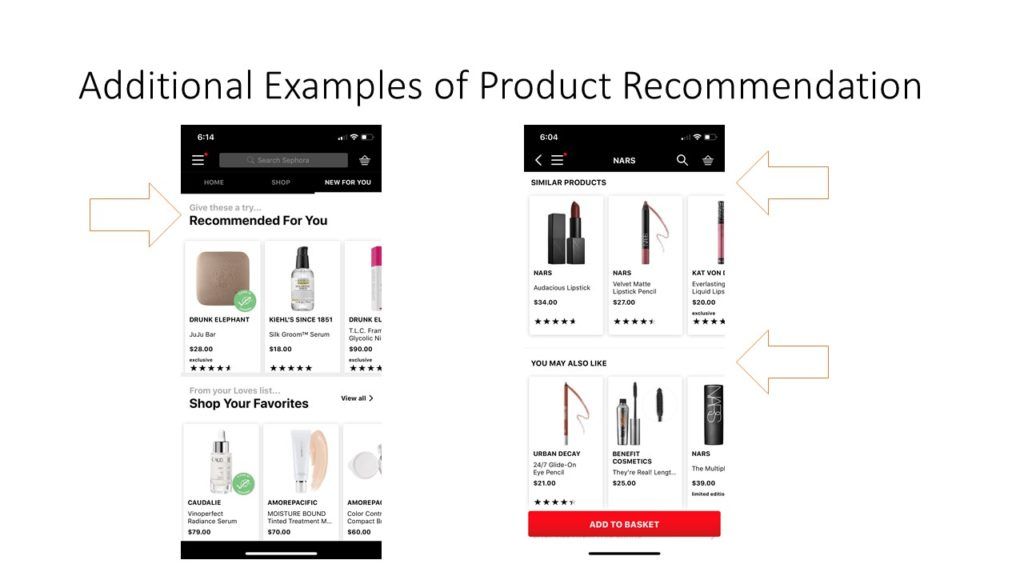

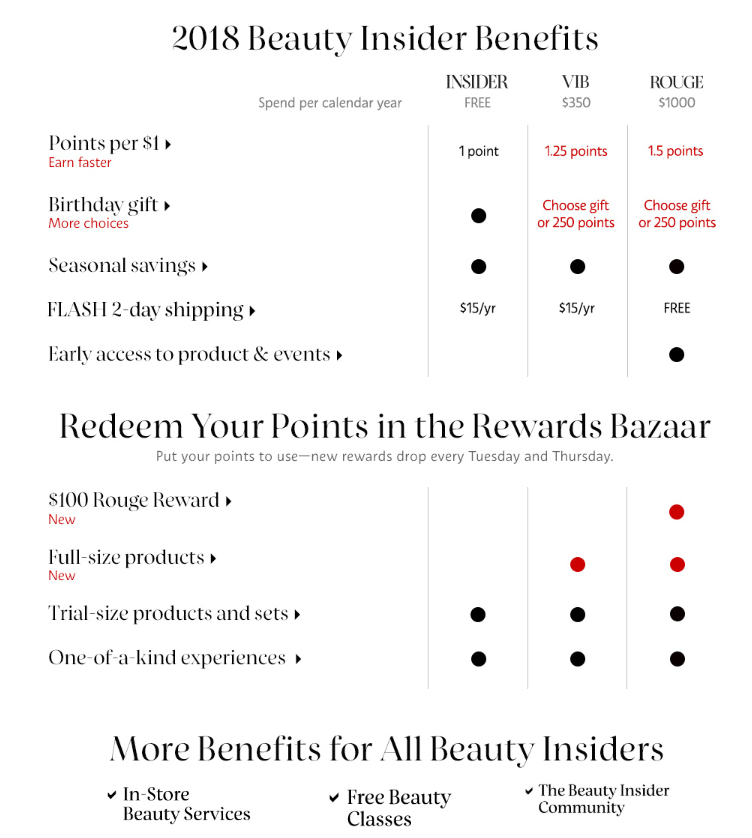

Today, Sephora’s digital experience is highly individualized, with product-discovery tools and loyalty rewards that are customized 1:1. The site homepage showcases products “recommended for you”, a selection chosen based on a mix of past purchase and browsing activity [Exhibit 1]. Another tab of the homepage curates newly-released products in a “new for you” feed of recommendations. On an individual product page, the inquisitive user can choose between“similar products,” “you may also like” suggestions, and “recently viewed” SKUs, of which the former two are predictive guesses at what she might be seeking [Exhibit 2]. Sephora also recognizes various loyalty tiers based on how much consumers spend per year, and sends customized streams of email with product recommendations based on purchase patterns from this “inner circle” [Exhibit 3]. These efforts have garnered success, with 80% of surveyed Beauty Insiders professing complete loyalty to Sephora [1].

In the long-term, Sephora’s strategy is to make the entire online UX revolve around individual preferences. In a recent talk, e-Commerce Director Lorenzo Peracchione likened the company’s quest for better personal predictions to a hunt for “gold.” This year, the team re-organized its personnel and customer data architecture around an omni-channel customer strategy. Over the next decade, their aim is to use analytics to understand how users travel from offline to online and back in one continuous journey, and then engineer or stimulate that behavior to make existing customers more valuable to the brand [7]

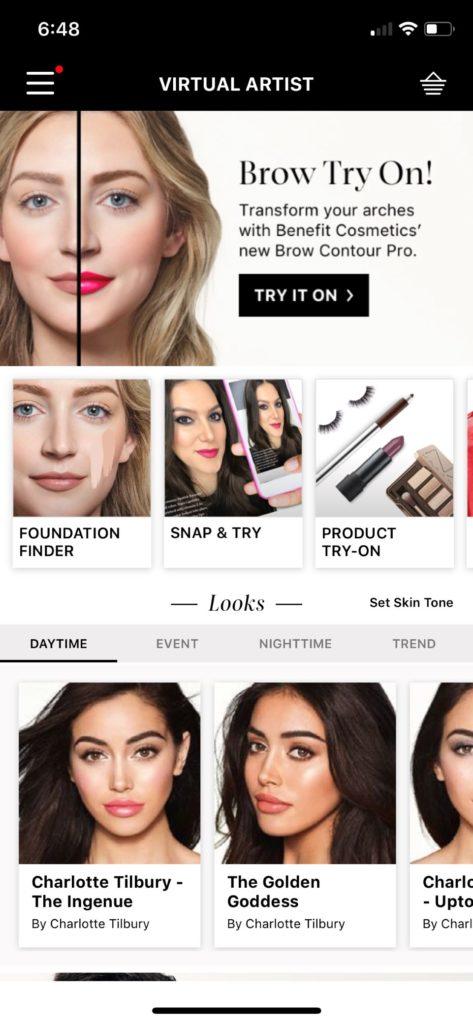

Numerous user experiences are ripe for the application of this new strategy. In-store, customers can opt for a Pantone ColorIQ test, in which a specialized camera device snaps a picture of their skin tone, matches the exact color from the Pantone library, and recommends products that suit their unique coloring. [8] In the long-term, one can imagine that mobile phones replace the special device, and Sephora analyzes ColorIQ inputs in concert with individual shopping behavior and omnichannel trends to determine product suggestions. Another innovative feature from the brand is Virtual Artist, which enables users to apply makeup in AR, and seamlessly shop products [Exhibit 4]. Today this tool is for individual experimentation, but long-term there are clear AI applications, in which the screen could pre-populate with looks that someone with similar hair color/skin tone/or style preference (natural vs. glam) has ordered in the past.

Of course, there is even more Sephora could do to take existing user data and project buying behavior. A recent bevvy of competitors have developed personalized beauty products with individually-formulated skincare and haircare offerings, based on user attributes. In a future state, Sephora could suggest a specialized formula made on-demand rather than recommending SKUs from a lineup of existing brands.[9]

Outstanding questions about the future of Sephora’s tech-enablement and forays into machine learning linger, particularly as it bridges emerging technology and in-store experience. Sephora recently rolled out a program with Google Home Hub enabling users to play Sephora YouTube beauty tutorials on demand.[10] How could Sephora integrate this new data stream into its UX personalization efforts? Does watching blogger content influence average order value, or brand loyalty/frequency? On the flip side, how can Sephora begin to individualize its brick & mortar experience? Is there a larger role for VR/AR to play in bringing the in-store experience and e-commerce experience together? Or could stores and offline marketing materials like their holiday gift guide benefit from an approach fueled by predictive analytics? (784 words)

Exhibit 1

Source: Sephora iOS app and desktop website in logged in user state, accessed 11/13/2018

Exhibit 2

Source: Sephora iOS app in logged in user state, accessed 11/13/2018

Exhibit 3

Source: Sephora.com. (2018). About Beauty Insider. [online] Available at: https://www.sephora.com/about-beauty-insider [Accessed 13 Nov. 2018].

Exhibit 4

Source: Sephora iOS app in logged in user state, accessed 11/13/2018

[1] Sailthru. (2018). Sephora Retail Personalization & Customer Experience Score. [online] Available at: https://www.sailthru.com/personalization-index/sephora/ [Accessed 13 Nov. 2018].

O’Brien, M. (2018). Sephora Retail Personalization Analysis. [online] Sailthru. Available at: https://www.sailthru.com/marketing-blog/sephora-personalization-index/ [Accessed 14 Nov. 2018].

[2] SimilarWeb. (2018). Sephora.com Traffic Statistics. [online] Available at: https://www.similarweb.com/website/sephora.com#overview [Accessed 13 Nov. 2018].

[3] iTunes App Store. (2018). Sephora: Beauty, Makeup & Hair. [online] Available at: https://itunes.apple.com/us/app/sephora-beauty-makeup-hair/id393328150?mt=8 [Accessed 13 Nov. 2018].

Google Play Store. (2018). Sephora – Makeup, Skin Care & Beauty Shopping 💄. [online] Available at: https://play.google.com/store/apps/details?id=com.sephora&hl=en_US [Accessed 13 Nov. 2018].

[4] Sephora.com. (2018). SEPHORA ≡ Maquillage ⋅ Parfum ⋅ Soin ⋅ Beauté. [online] Available at: https://www.sephora.com/about-us [Accessed 13 Nov. 2018].

[5] Nickalls, S. (2018). Infographic: How Women Want Tech to Shape the Shopping Experience. [online] Adweek.com. Available at: https://www.adweek.com/digital/infographic-how-women-use-tech-to-shop/ [Accessed 13 Nov. 2018].

[6] Brennan, B. (2018). How To Win With Women Consumers In 2017. [online] Forbes. Available at: https://www.forbes.com/sites/bridgetbrennan/2016/12/31/how-to-win-with-women-consumers-in-2017/#3d01c7c85122 [Accessed 13 Nov. 2018].

[7] Milnes, H. (2018). Why Sephora merged its digital and physical retail teams into one department – Digiday. [online] Digiday. Available at: https://digiday.com/marketing/sephora-merged-digital-physical-retail-teams-one-department/ [Accessed 13 Nov. 2018].

Tay, V. (2018). Sephora marketer on the 3 musts on mobile. [online] Marketing Interactive. Available at: https://www.marketing-interactive.com/sephora-marketer-on-the-3-musts-on-mobile/ [Accessed 14 Nov. 2018].

[8] Holson, L. (2018). How Sephora Is Thriving Amid a Retail Crisis. [online] Nytimes.com. Available at: https://www.nytimes.com/2017/05/11/fashion/sephora-beauty-retail-technology.html [Accessed 13 Nov. 2018].

[9] Pearl, D. (2018). Why Customizable Hair Care, the Latest Trend in Beauty, Is All Over Your Feed. [online] Adweek.com. Available at: https://www.adweek.com/brand-marketing/why-customizable-hair-care-the-latest-trend-in-beauty-is-all-over-your-feed/ [Accessed 13 Nov. 2018].

[10] Williams, R. (2018). Sephora, Google dive deeper into voice with Home Hub tutorials. [online] Mobile Marketer. Available at: https://www.mobilemarketer.com/news/sephora-google-dive-deeper-into-voice-with-home-hub-tutorials/541709/ [Accessed 13 Nov. 2018].

I think that the ability for consumers to try out different products virtually would be a huge value proposition, but only for products that are highly visually focused (e.g., make up tones, lip colors, hair colors) versus touch and feel focused (e.g., moisturizers, shampoos, toners) as VR/AR currently would struggle to mimic this for consumers. I feel that using VR/AR to narrow down the initial product offerings could help sales people be more effective in their advice and recommendations, while simultaneously helping to convince consumers that a purchase will satisfy their needs.

I’m curious to understand how much of Sephora’s predictive analytics or customization technology is actually powered in-house. For example, you reference Visual Artist, the AR feature on the mobile app that enables users to try on color makeup using their own image. ModiFace is a leading provider of augmented reality technology to the industry, including Sephora (referenced here: https://digiday.com/marketing/modiface-becoming-go-provider-augmented-reality-beauty-brands/). They are the company that’s behind the mobile and web app visualization, as well as many of Sephora’s in-store digital experiences (e.g., ‘magic’ mirrors and the like). I believe the lion’s share of data is owned and collected by Sephora, but I question whether or not the organization hires highly sophisticated engineers with the capabilities to translate that data into algorithms or databases that can be analyzed through machine learning.

Brand loyalty is an interesting concept when it comes to Sephora because you want to have a connection to your customer as a retailer (and therefore drive loyalty for your retailer brand) but also want customers who have both brand loyalty to manufacturers and those who have the desire to switch brands to drive demand and growth. The 80% of loyal customers to Sephora is a very high statistic but I wonder what the split between customers who only order the same items (loyal to manufacturer brands) and those who love to try samples and switch products very often. This will shed light on how best to use machine learning to drive demand. If the majority is just customers who order the same brands, I wonder if investments in programs such as the Google Home hub to play makeup videos from Sephora’s YouTube makes sense as an advertising vehicle and if promotions or other discounts of items they consistently buy would make more sense.

Great read! I do believe AR could play a huge role in creating a personalized and unique experience at the brick-and-mortar store. With the advent of HoloLens, MagicLeap and advances being made in the field of AR, there is huge scope for the customer to have a virtual view of the products and carry the experience ahead to the online store. Some supermarkets are also working with this technology to provide a virtual store shopping experience, which Sephora could also work towards. There are many apps that do allow you to apply various products (although limited) on one of your photos and get a sense of how it would look. Although these products have a long way to go, Sephora could consider acquiring these companies and hence stay ahead of the curve.

This was a great read with some very comprehensive and thorough analysis. Well done! I think your question of how Sephora can use data to individualize the customer’s brick and mortar experience is a great one – not just for Sephora but for all retailers looking to offer a unique in-store experience to compliment their online presence. I don’t have a solution for this, but I believe that finding the solution starts with adopting the same online data gathering tactics that companies like Sephora for online marketing. Specifically, retailers need to find a way to measure the actions of customers in their brick and mortar locations. Just like ecommerce is able to do with understanding what products a consumer has looked at, what items have they searched for, and what pages they’ve visited; brick and mortar must find a way to dig beyond what products people end up buying. To actually individualize the brick and mortar experience, companies like Sephora need to find a way to identify what products consumers looked at without buying, what part of the store they spent the most time in, how long they were in the store before they decided to purchase a product, etc. I think this is the way forward with actually individualizing a consumer’s brick and mortar experience the same way ecommerce does. As for how this will be implemented, I’m interested to find out!

This is a really interesting analysis of the application of new technology in a long-established industry. As you noted, Sephora is definitely prioritizing personalization and leveraging data to do it. I am most interested in exploring the point you briefly raised around beauty being a fast replenishment category and the challenge for brands to “predict what consumers want before they buy it from a competitor.” How is Sephora using their data analytics capabilities to anticipate the consumer replenishment need and interrupt the potential convenience purchase that meets an unexpected need? Namely,

how might they extend personalization beyond predicting products or services that might be of interest to a customer, and start to use the same data to construct a unique purchasing journey / timeline to ensure an uninterrupted interaction loop that doesn’t leave room for the competition? Amazon and some specialty athletic retailers have started to leverage this data to send prompts to consumers to replenish household goods or replace a worn out pair of running shoes based on number of miles logged on a fitness ap. Can Sephora take a similar approach? While 80% of surveyed Beauty Insiders profess complete loyalty to the brand, does that number directly correlate to sales? Or might there be room to better align purchasing intent with purchasing opportunity? They seem to be zeroing in on this application and I think it will have significant benefits if they can create a complete ecosystem for the customer.

Particularly in the beauty space, I think loyalty is a critical issue. Consumers want to feel connected to their products on a very emotional level, since they’re supposed to help them look and feel better. If you have effective products, personalization can have a huge impact in customer loyalty. Machine learning (and other applications of AI), as you mentioned, has a huge role to play here, and I’m excited to see what companies like Sephora do with this technology.