Activision Blizzard: It’s a New Era of Interactive Entertainment

One video game company is riding the wave of digital transformation to introduce its long-adored franchises to new audiences around the world.

Video games are no longer confined to personal computers and living room consoles. The present technology cycle has seen the advent of mobile-centric gaming as well as other new ways to experience gaming culture through alternative media channels. Activision Blizzard, Inc., a leading developer and publisher of traditional PC and console game software, has made bold moves to transform into a next-gen global entertainment conglomerate that can take advantage of these emerging trends.

Challenges and opportunities

Due to the mass-market saturation of mobile smartphones with multi-core processors, advanced graphics chips, and precision touch screens, the vast majority of people in the developed world now carry powerful gaming devices in their pockets. With Wi-Fi and high-speed cellular networks blanketing most populated areas, current-gen devices have enabled consumers to instanteously find, order, download, and play games on demand. Ease of access and a slew of free-to-play (F2P) offerings have attracted a mass audience of “casual gamers” with increasing engagement across historically non-core market segments. A recent study by the Pew Research Center found that 49% of all American adults now commonly play video games – a figure that is split almost evenly between men and women.1

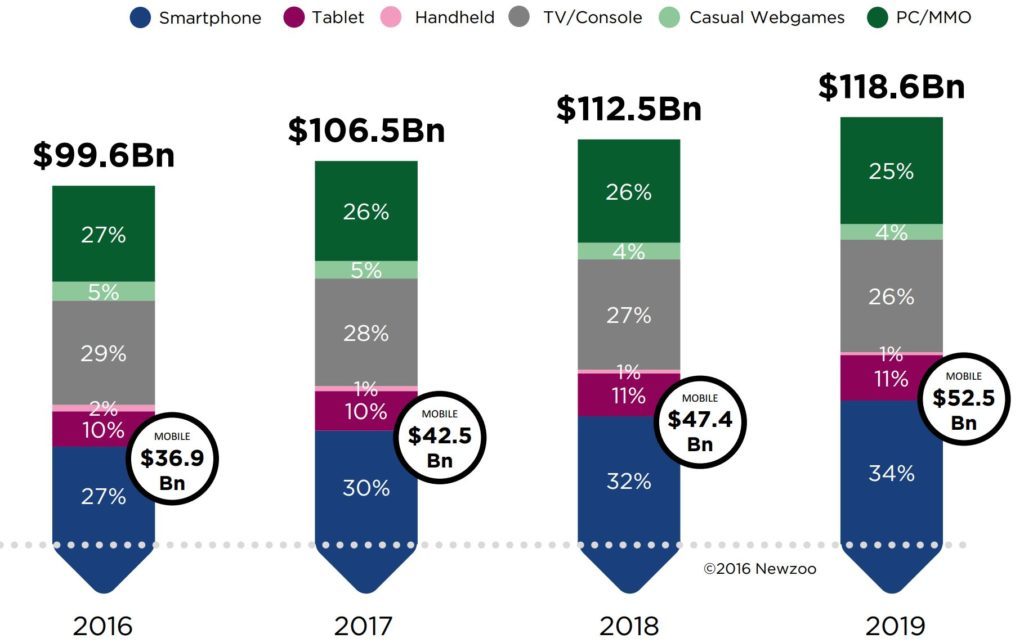

All this has driven the rapid growth of mobile and tablet game revenues, which include revenues from ads, freemium-type micropayments, and sales of pay-to-play (P2P) games. The mobile gaming market is forecast to grow at a 12.4% CAGR, reaching $52.5B by 2019, comparing favorably with the projected 3% annual growth of revenues from PC and console games.2 Traditional game developers must adapt as the percentage share of devoted gaming platforms shrinks in relation to the overall market.

Meanwhile, the market for competitive gaming is exploding at a growth rate of 40% YoY, with global revenues expected to surpass $1B by 2019.3 The rise of eSports is a major phenomenon, as Jordan pointed out in his terrific post, but this also presents a question for developers like Activision: can they still capture revenues from people choosing to watch games, rather than purchase and play them on their own devices?

An evolving business model

Through organic growth and opportunistic M&A, the company is expanding a portfolio of mutually-supporting businesses that provide value to the legacy customer base while also satisfying demand for new forms of interactive media consumption. The company now has five primary operating units: Activision, Blizzard Entertainment, Activision Blizzard Studios (founded Nov 2015), Media Networks (Major League Gaming, acquired Jan 2016 for $46MM), and King Digital Entertainment (acquired Feb 2016 for $5.9B).4

If eSports is the new football, then Major League Gaming (MLG) is the new NFL. Likewise, with smash hits like Candy Crush Saga, King Digital is a market leader in mobile gaming. Combined with the launch of Activision Blizzard Studios, the characters and worlds of an emerging “Blizzard universe” can reach a growing base of consumers through nearly any media device. By diversifying its revenue streams across complementary entertainment verticals, pricing models (F2P, P2P, and subscriptions), and customer demographics, the company has positioned itself to sustain long-term growth.

A global operating model

Activision Blizzard’s core strategy depends on its ability to connect with diverse audiences through the generation of captivating franchises and delivery of high-quality interactive content. A key metric of the company’s success in delivering on its customer promise is its number of monthly active users (MAUs), which currently stands at 482 million MAUs across 196 countries.5 As the customer base has globalized, Activision has expanded the employee talent pool to reflect its audience mix. The company has opened dozens of studios and offices in the Americas, Europe, and Asia, and now employs thousands of producers, designers, programmers, artists, and support personnel worldwide. To fully leverage each employee’s talent throughout game development cycles, executives have invested heavily to outfit every studio with cutting-edge computer hardware and software development tools. Activision also reinvests cash flows to periodically refresh its networking and communications capabilities so cross-border teams can effectively collaborate on major projects and IPs.6,7

The preservation of Activision’s deep competitive moat hinges on the its ability to attract creative and talented employees who share a passion for the company’s franchises and sense of personal commitment toward delivering the very best experiences to the fanbase. By maintaining a creative culture in which each employee is also encouraged to enjoy content as an end-user and fan, Activision can drive the continued production of high-quality content and stimulate additional growth in user engagement.

History has shown that all major technology trends simultaneously create winners and losers across each TMT sub-sector.8 The current wave of digitization poses many challenges to the traditional game software industry, but with its current strategy, Activision Blizzard is likely to grow stronger through the cycle and create increasing value for its stakeholders.

[wc: 785]

[1] Maeve Duggan, "Gaming and Gamers,” Pew Research Center, Dec 2015.

[2] “Global Games Market 2016 Report,” Newzoo Games Market Research, Apr 2016.

[3] Emily Souza, “The eSports Industry to Date: Drivers Behind Current and Future Growth,” Newzoo Games Market Research, Aug 2015.

[4] Data accessed via Bloomberg Professional.

[5] Activision Blizzard (ATVI) Third Quarter 2016 Results, Nov 2016.

[6] Activision Blizzard (ATVI) Investor Day Presentation 2015, Nov 2015.

[7] Activision Blizzard (ATVI) Third Quarter 2016 Financial Model, Nov 2016. Excel file.

[8] Philippe Laffonte, “Technology Investing in 2009,” Coatue Management LLC, May 2009.

Additional sources:

Activision Blizzard (ATVI) Third Quarter Calendar 2016 Results Conference Call, Nov 2016. Audio.

Activision Blizzard (ATVI) Form 10-Q, Third Quarter 2016, Nov 2016.

Activision Blizzard (ATVI) 2015 Annual Report, Feb 2016.

King Digital (KING) and Activision Blizzard (ATVI) Acquisition Presentation, Feb 2016.

Awesome post, Chris. As a longtime Blizzard fan and player (Starcraft 1 and 2, Diablo 2 and 3), this post hits close to home. Fully agree that mobile gaming is an under-exploited opportunity for them given these incredible franchises. I have a hard time, however, imagining fully standalone mobile games just because of the nature of the platform and the nature of the company. Blizzard is well-known as a company focused on the creative process and building compelling storylines, with P&L considerations being an afterthought. For example, they spent years developing a fully functioning first person shooter game based on the Starcraft universe called Starcraft Ghost, and killed the project at the last minute despite the fact that it would have been a commercial success (by virtue of the franchise strength), because they deemed the story “not good enough.” Mobile games cater to a lowest-common-denominator playing style (a la Candy Crush) and I can’t imagine that kind of game passing muster at Blizzard.

I do think there is great potential in “companion” games to their existing desktop offerings – imagine a World of Warcraft iOS game that is linked to your main World of Warcraft account, where you can play mini games and earn rewards across both universes.

Chris, I was super happy to see the title of your article as I have invested some days of my life, as fellow Vince above, playing Starcraft. I totally agree that there is a huge market in online gaming but it is a different market than the PC/Console one. Judging from personal taste, when I have time and want to play video games, I use my PC or my PS4. I do not use my phone. On the other hand, nowadays, I only play games on my phone but these are killing time games. For example, when I am in public transport facilities, I may read an article on my phone, or check Facebook or play a “silly” game on my phone. For me it is a totally different experience and requires different approach from the game developers.

Hey Chris,

Great article and thanks for the shout out. Activision Blizzard has definitely been aggressive about staying ahead of the trends in their industry. Two of the acquisitions that you mentioned really stand out to me in this regard: King Digital and Major League Gaming. King Digital seems like a high risk high reward acquisition. Mobile game development seems to have very similar economics to movie studios. It is difficult (though not impossible) to predict which games are going to be hits, and most games fail. But when they succeed, the profits are astronomical. Case in point is King Digital’s financial performance in 2013 – the year that Candy Crush went viral. They grew from $160 million in revenue to $1.8 billion in revenue (over 1,000% growth) while expanding their EBITDA margin to 38%. If Activision is able to get one or two more games like that out of King Digital they will have hit a home run with their acquisition. Mobile gaming is clearly a massive market.

The acquisition of MLG is very interesting as well. As you mentioned in your post, if Major League Gaming is able to establish themselves as the defacto league for eSports competition then Activision will made an incredible purchase. They will have positioned themselves as gatekeepers to eSports – certainly a powerful position to be in. As of yet, however, I don’t think any single league has been able to establish itself as the clear cut platform for competition. Just like how the NHL, MLB and NFL formed from the competition, fighting and eventual merging of several different professional leagues, I would expect that the next few years will see a good amount of consolidation of different eSports leagues. MLG appears to be the frontrunner at this point.

Chris, love the post! I, too, believe gaming is the next big entertainment industry, both for consumption/use and viewership through eSports and MLG. Like Vincent’s post, I am interested to see where Blizzard takes their mobile games. It seems like a few major names have made mobile games, but they are often very simple compared to the console/PC counterparts, such as the Final Fantasy mobile games or EA Sports and Sims games. The pricing strategies for the mobile games often vary from console/PC with them mostly being free with the microtransactions, so I wonder if pricing will evolve as the larger gaming companies move to mobile platforms.

Very interesting post, Chris. As someone who worked for an online gaming company that primarily focused on more “casual” games, I have similar concerns to what Jordan mentions above. While some games already have loyal followers that will continue to purchase similarly branded games (Warcraft, FIFA, etc.), developing new games is a very “hit-or-miss” proposition as Jordan mentions. I’ve seen first-hand millions of dollars be dedicated to the development of a game only to see the game abandoned shortly before launch. Similarly, I’ve seen games with stunning graphics, great gameplay, and positive reviews fall completely flat. Online and social gaming is very much a “hits-driven” industry, but the biggest problem is identifying what the next “hit” will be. Candy Crush was a massive success, however its gameplay mechanics and graphics were no better than its competitors. So what made it so successful? Similarly, why did its popularity decline so quickly?

Mobile gaming is a massive market opportunity. However, I’m very skeptical that there is an easily replicable process to develop hit games and maintain a pipeline of future hits.

Interesting read, Chris! Very cool to see what Activision Blizzard is doing in the video games space. It’s intriguing to think where the industry could go from here – and I’m particularly curious to see how the business model of video game companies evolves as technological innovation transpires. When there was a big shift in video games from consoles to mobile devices, the industry saw a lot more free applications that upsold you within the app and other pay-to-play types of games.

Effectively, the game would cost very little to start playing but the game would quickly find ways to monetize you in-app once you were playing. This largely differed from consoles, where games had a large upfront cost (i.e., $50 to purchase the game disk), but a low to no ongoing cost. In essence, the different device led to a different ecosystem where developers devised different ways to acquire and monetize customers.

Given that now the industry is moving more to virtual reality – which will have a completely different set of hardware to complement the experience – I’m interested to see how the business model of these companies will shift to adapt. Given such a drastic shift in business model when moving from physical consoles to mobile devices, I’m interested to see how it evolves once headsets and other virtual reality hardware are introduced.

Very interesting post. I’m wondering if the shift from traditional PC gaming to mobile PC gaming can help smooth out ATVI’s earnings going forward. As most mobile games have shorter and cheaper development cycles, they are inherently less risky, while traditional PC games require much more investment before any financial gain is realized. I bet this shift is something that will help the company in the future.