3D Printing and Robots…for your Running Shoes?

Anyone who has ordered the NikeID customized shoe has likely felt the pain of waiting up to 5 weeks to receive their order. What if Nike could mitigate this by reducing lead time to 10 days?

That’s precisely what Nike is aiming to do. Through digitizing its supply chain, Nike is recognizing how supply chain can increasingly becoming a source of competitive advantage1. The timing couldn’t be more ripe, as competitors are applying pressure: Adidas opened its first “Speedfactory” in October 2017, with robots making a complete pair of shoes in just 5 hours; Under Armour has already gone to market with its 3D printed “ArchiTect Futurist” shoe.

With aggressive goals to reach $50B in sales by 2020 and expected shipping of 1.3B shoes in 2018 alone, Nike’s speed from manufacturing to market is critical.

While existing efforts to optimize its supply chain have revolved around moving to low-cost labor and rationalizing its factory footprint, Nike’s focus is now on shifting from its historic “futures order” approach requiring 6 months of lead time, to a direct-to-consumer model. Critical to this model is digitizing the supply chain to enable shorter lead times. So how are they doing this?

How Nike is digitizing the supply chain

In the short term, Nike has invested in a multi-year partnership with global manufacturer Flex to innovate ways to enable products to reach consumers more quickly. Two demonstrated improvements are automating gluing and using lasers to cut materials, contributing to Nike’s ability to cut end-to-end lead times from 60 days to 10 days or less2. Nike also plans to install 1,200 automated machines at its Asian factories for cutting, cementing, shoe assembly, and making soles.

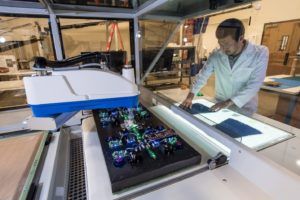

In addition, in 2015 Nike opened its Advanced Product Creation Center, through which the team has identified ways to reduce labor for footwear uppers by as much as 50%33. The center also houses development efforts for knitting machines, 3D printing, and automation technologies.

Most recently, in August 2017 the first facilities using robots to assemble footwear uppers began operations through Nike’s partnership with Grabit, a robotics startup backed by Nike. These robots take what would be a 10-20 minute task to arrange upper pieces into a 50-75 second task, reducing assembly time by over 90%4.

In the medium term, Nike plans to grow its manufacturing abilities to produce tens of millions of shoes through Flex, with 25%+ of these shoes delivered through Nike’s short lead-time responsive model.

The benefits

The benefits of Nike’s efforts are two-fold: an improvement in profit margins, and quicker design delivery.

From a financial perspective, Nike’s labor cost is expected to decrease by 50%, and material costs by 20%, generating a 12.5% lift in gross margin5. If Flex reached production of 30% of North American footwear sales, this translates to a $400M savings and a 5% EPS bump5.

From a product development and consumer lens, lead times can be reduced from 3-4 weeks to 10 days or less, creating a competitive advantage through lowering both go-to-market time for new products and time consumers must wait for their customized shoes.

What else can Nike do?

In the short term, Nike should consider the following:

- Continue to invest in robotics and advanced analytics

- Capture better planning, transportation, and logistics data that would improve end-to-end transparency and planning to anticipate demand and reduce waste

- Continue monitoring the cost of labor (e.g., as China loses its position as the lowest cost labor market7) for potential reallocation

The medium term generates more potential for digitization:

- Invest in smart warehousing, which could boost Nike’s efficiency and safety through automating all warehousing activities (e.g., inbound logistics, autonomous transportation)

- Further explore 3D printing, which could simplify the supply chain, reduce labor / transportation / delivery costs, quicken delivery, and reduce inventory

- Progress toward prescriptive supply chain analytics – beyond transparency and predictability over supply chain elements, being able to optimize and act on the supply chain across various circumstances

What about the workers?

A massive open question exists – if Nike continues along its digitization path, will the ~500,000 line workers across 15 countries with manufacturing facilities become obsolete and displaced5?

This question is particularly pertinent for Nike, as it has been the subject of significant backlash first arising in the 1990s over accusations of low wages, poor working conditions, and use of child labor overseas5,6. Although Nike has since raised the minimum wage, improved oversight of its labor practices, and provided transparency through issuing a 108-page report on factory working conditions, the company will be under severe scrutiny if it displaces a significant portion of its labor force.

Nike’s EVP and COO Erik Sprunk claims that they “don’t expect there to be any displaced workers” – but in a world of growing supply chain digitization, only time will tell.

(WORD COUNT: 792)

SOURCES

1 Anandhi Bharadwaj, Omar El Sawy, Paul Pavlou, N. Venkatraman, “Digital Business Strategy: Toward a Next Generation of Insights,” Management Information Systems Quarterly, June 2013.

2 Marc Bain, “Nike’s plan to shave a month off its shoe delivery times,” Quartz, October 26, 2017.

https://qz.com/1112641/nike-is-racing-adidas-to-speed-up-sneaker-manufacturing/

3 Brendan Dunne, “12 Things You Need to Know About the Future of Nike (According to Its Top Execs),” Sole Collector, October 19, 2015.

https://solecollector.com/news/2015/10/nike-investor-day-2015

4 Joshua Brustein, “These Robots Are Using Static Electricity to Make Nikes,” Bloomberg, August 30, 2017.

5 Jennifer Bissell-Linsk, “Nike’s focus on robotics threatens Asia’s low-cost workforce,” Financial Times, October 22, 2017.

https://www.ft.com/content/585866fc-a841-11e7-ab55-27219df83c97

6 Ashley Lutz, “How Nike shed its sweatshop image to dominate the shoe industry,” Business Insider, June 6, 2015.

http://www.businessinsider.com/how-nike-fixed-its-sweatshop-image-2015-6

7 CNBC.com staff, “World no longer sees China as a cheap outsourcing destination: Survey,” CNBC, January 31, 2017.

Great post, aninnymouse! As a sneaker fan, I really enjoyed reading about Nike’s manufacturing process of running shoes and how it is not incorporating automation and digital technology to improve its operational efficiency. I find it particularly amazing that the use of robots can reduce assembly time by over 90% – wow, I can’t stop thinking about Dennis’s comment in class the other day – robots are taking over the world!

I think Nike makes a smart move of investing in the robots and automation equipment supplier. The footwear industry has become increasingly competitive as customers now see running shoes not just as sportswear but also as fashion products. Nike’s top competitor, Addidas’s sales soars over 31% in the second quarter of 2017 by listening to customers and quickly delivering the design they like. The go-to-market time is the key to beat competition. Once Nike obtain improved operational efficiency, it will be able to transform customer experience to be more interactive and personalized. On the other hand, not only should Nike keep investing in reducing is production time, but it should also implement data analytics to better capture consumer preferences.

Excellent post aninnymouse! I think that the move towards 3-D printing is a unique initiative not only because it will reduce their lead time significantly but also because it can probably allow for better use of materials and reduced waste as well. I also think this could have enormous implications for the NikeID platform, allowing people to make their shoes to more exact specifications than just the colors of their shoes, but taking into account the foot shape, the weight of the shoe, and the required sole support. Finally, you raised an excellent question regarding the potential loss of jobs in their Asian factories in the future. From my understanding, 3-D printing is currently a rather slow process in most of the examples I’ve seen in the past, and creating mass-production models may prove challenging to move towards 3-D printing. But their investment in robots could be threatening for manufacturing jobs in Asia, and may even be a proactive strategy if isolationist policies cause them to move facilities to North America, but without the creation of manufacturing jobs that such a move would traditionally entail!