Spirit Airlines and the Success of the Ultra-Low Cost Carrier

How is one the most hated airlines also one of the most successful? By having a tightly aligned business and operating model.

Spirit Airlines may be the most hated airlines in the United States. The Better Business Bureau has over 2,000 complaints logged against the airlines[1], and the company has a one-star satisfaction rating on Consumer Affairs.[2] Spirit’s business model has never been about exceptional customer service. In response to a consumer complaint, Spirit’s CEO Ben Baldanza wrote in an email, “[He] will be back when we save him a penny.”[3] This is Spirit’s business model, to be the lowest cost airline ticket available, and the company has been highly effective at turning that business model into a very profitable business.

Business Model – “Bare Fares”

Spirit’s fares are completely unbundled. A customer pays an initial “bare fare,” which is typically much lower than other plane tickets on the market. However, the additional fees quickly add up. Spirit was one of the first airlines to charge its customers for checked baggage, and additionally charges customers $35-40 for overhead space.[4] The company’s website advises customers to print their boarding pass ahead of time, as printing at the airport will cost them $10.[5] To Spirit, this “frill control” means that passengers are only paying for what they want. If a customer doesn’t bring a suitcase, he or she should not have to have the cost included in their ticket, which would serve to subsidize the costs of other passengers who traveled less light.[6] To Spirit’s target customer, “price-sensitive travelers who pay for their own travel,”[7] this low cost model creates plenty of value. According to a press release in May 2014, Spirit’s all-in fares are 40% less than those of other airlines.[8]

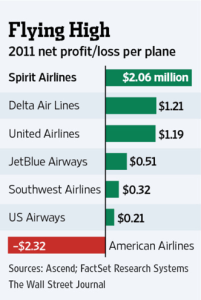

Spirit has been able to capture plenty of value through its low cost business model. In 2013, the company had the highest operating margins of any airline at 17.1%.[9] As of its 2015 third-quarter filings, its operating margins have gone up to 26.9%.[10] Much of the company’s business success has been thanks to its operating model, which is highly aligned to Spirit’s goals of cutting costs and providing no frills service.

Operating Model – High Utilization, Single Aircraft Type, and More Seats per Plane

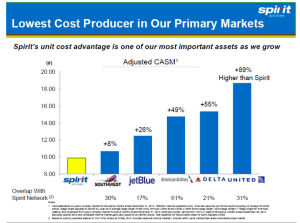

Spirit boasts on its website of its young fleet.[11] Due to its fairly new planes, the company has less maintenance and fewer breakdowns, which allows for higher airplane utilization. Moreover, Spirit is able to increase plane utilization through quick turnaround times between flights, sometimes having only 30 minutes in between a flight landing and the same plane taking off again.[12] In 2013 and 2014, Spirit had airplane utilization of 12.7 hours, compared to 10.4 hours for Southwest, one of its main competitors.[13] High airplane utilization means the company’s fixed costs are spread across more trips, leading to lower costs per flight, and thus tying to Spirit’s business model.

The company also only operates three models of Airbus planes: A319, A320, and A321.[14] The comparable planes allows for efficiencies when training its workers and with operating each aircraft. Given the similarities in operating mechanisms, Spirit can use any of its flight crews for any flight on any airplane, including any pilot. This diminishes complexity and saves on costs to train workers across different plane types. The airline also saves costs and reduces complexity when it comes to maintenance and spare parts due to having only one category of aircrafts.[15]

Spirit’s website refers to its “cozy seating,”[16] the ultimate euphemism for its cramped planes. The more uncomfortable ride is a prime example of a smart operating choice that leads to substantial cost savings for the company. Spirit’s planes have 16%-20% more seats then do other major airlines operating the same plane types.[17] The company manages this by having seats that do not recline and by limiting leg room. By packing more customers into each plane, Spirit can spread its fixed costs over more passengers, which lowers overall costs.

Conclusion

Ultimately, Spirit’s business and operating model are tightly aligned. The company makes operating decisions to cut costs, and then passes these costs on to its customers, who value the cheaper flights. The decision to pursue these goals clearly works, as can be seen in Spirit’s profits and the amount of people who take Spirit flights. Indeed, Spirit operates some of the fullest flights in the industry, averaging planes that are 85-90% full.[18]

End Notes:

[1] http://www.bbb.org/south-east-florida/business-reviews/airlines/spirit-airlines-in-miramar-fl-21000543/complaints

[2] http://www.consumeraffairs.com/travel/spirit.html

[3] http://www.chicagobooth.edu/capideas/magazine/summer-2015/why-spirit-airlines-is-so-terrible

[4] http://www.wsj.com/articles/SB10001424052702304749904577384383044911796

[5] http://marketing.spirit.com/how-to-fly-spirit-airlines/

[6] Ibid.

[7] http://finance.yahoo.com/news/spirit-airlines-profits-driven-low-182917159.html

[8] Ibid.

[9] http://www.bloomberg.com/bw/articles/2014-04-29/love-or-hate-it-spirit-airlines-has-found-a-solid-business-in-cheap-fares

[10] http://ir.spirit.com/releases.cfm?ReleasesType=General%20Releases

[12] wsj.com

[13] http://marketrealist.com/2015/11/spirit-airlines-manage-low-cost-structure/

[14] http://traveltips.usatoday.com/type-planes-spirit-airlines-use-62835.html

[15] finance.yahoo.com

[16] marketing.spirit.com

[17] marketrealist.com

[18] wsj.com

It kind of surprises me how well this business model seems to be working. I had no idea that Spirit led the airline industry in EPS. It makes you wonder what other industries this kind of model could work on? Also, I had no idea that high asset utilization was such a focus for the company. I wonder how long that strategy is sustainable and if running the airplanes 12-13 hours a day leads to serious reliability problems as the planes start to age?

Thanks for your post – I enjoyed reading about the operating model of low-cost airlines. Seems like Spirit Airlines has tightly aligned their operating model to their value proposition through maximizing plane utilization and space utilization in their planes. While I assume passengers do not mind little space for a short-haul flight (for a cheaper ticket), it’s more challenging to implement this business model for long-haul flights.

So, I started off as a Spirit hater. I will admit to never having flown them out of sheer distaste for perceived “nickel-and-diming” over things that other airlines include. However, having read this article and a variety of others, I have come to see the wisdom of the model. Spirit does not have lucrative contracts with corporate travel departments which guarantee high-priced tickets to offset the lower fares offered to leisure passengers. Spirit travelers probably skew much more toward the leisure segment, which means price-sensitivity, which means less room for “included” frills.

The executives at Spirit are delightfully honest about the model and what you will not get with Spirit, which is refreshing in an odd way even when it makes you wince. The truth is that nothing you get on an airplane is really free; it’s merely included in the price of your or someone else’s ticket. For folks who want to move about the country at rock bottom prices, Spirit is a good way to go.

The real innovations here seem to come primarily from the 4 Ps of marketing. The operational focus around standard aircraft types and fast turnaround times may be especially important for Spirit, but they are also strategies of other airlines (such as Southwest). It will be interesting to see how the landscape evolves in the future. Increasingly, carriers formerly known as “low-cost” such as JetBlue and Southwest are finding themselves in the no-man’s land between legacy carriers and ULCCs. I am doubtful this “middle space” will be a viable market segment in the future; these players will need to decide which direction to move and hope they can compete against younger entrants like Spirit.