Wealthfront and the Future of Robo Advisors

Wealthfront has disrupted the financial advisory industry by using analytics and algorithms to automate investment decisions. Will it be able to sustain its success?

Over the past few years, a new set of companies has begun applying data analytics to disrupt the multi-trillion dollar investment services industry by automating investment decisions. Wealthfront, one of the fastest growing of such “robo advisors”, has raised $129.5M in venture capital financing and holds over $2B in assets under management.

Value Creation

Wealthfront was built on the idea that technology can be used to automate many of the services performed by traditional investment advisors (e.g., Charles Schwab, Fidelity), such as constructing a portfolio, rebalancing assets, trading ETFs, reinvesting dividends, and performing tax-loss harvesting. Without the overhead of traditional advisors, Wealthfront can perform these functions at a fraction of the cost and is targeted a tech-savvy millennials who are comfortable using technology and may even distrust financial institutions blamed for the 2008 financial crisis.

Wealthfront’s automated investment methodology underpins their ability to create value for customers. According to Wealthfront,

“Our investment methodology employs five steps:

- Identify an ideal set of asset classes for the current investment environment

- Select low cost ETFs to represent each asset class

- Determine your risk tolerance to create the appropriate portfolio for you

- Apply Modern Portfolio Theory to allocate among the chosen asset classes for your risk tolerance

- Monitor and periodically rebalance your portfolio”

(Read about Wealthfront’s detailed methodology here)

In addition to automating investment decisions, Wealthfront also uses its algorithms to customize a user’s portfolio based on individual risk tolerance, assessed through a series of questions on the user’s “objective capacity to take risk and subjective willingness to take risk. Our view is that sophisticated algorithms can do a better job of evaluating risk than the average traditional advisor.” (Wealthfront link here)

The result of Wealthfront’s data-based methodology is that it can manage customers’ portfolios simply, conveniently and automatically, with lower fees than traditional human advisors.

Value Capture

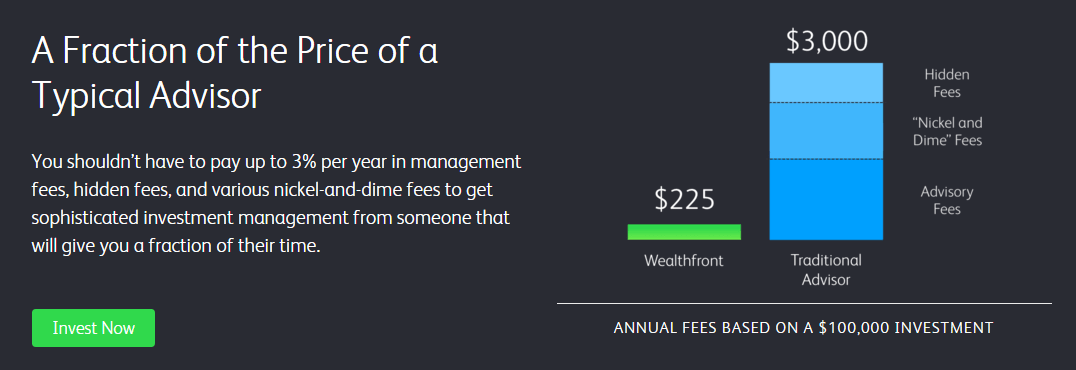

Wealthfront charges an annual fee of 0.25% of assets under management (AUM), with no fee on the first $10,000. Even with $2B AUM, Wealthfront could generate a maximum of $5M in revenue. Traditional advisors, on the other hand, earn up to 3% of from transaction fees, asset management fees, and other hidden fees, according to Wealthfront (see chart above). While this is an attractive value proposition for customers, low fees mean Wealthfront will need to reach greater scale in order to recoup its heavy upfront investments in building its technology and acquiring customers. Wealthfront’s fundraising history and recent aggressive marketing campaign imply it is burning cash quickly, and may have a ways to go before becoming cash-flow positive.

Competition and The Future for Pure Robo Advisors

The robo-advisor space has become highly competitive, putting pressure on fees and business models. Wealthfront’s competitors include Betterment, WiseBanyan, and FutureAdvisor, among others. In a bid to attract smaller investors, Wealthfront recently dropped its minimum account value from $5,000 to $500, critiquing Betterment’s business model which does not have any account minimums but charges $3 per month for accounts that deposit less than $100 per month.

Moreover, traditional players are entering the space. Charles Schwab and Vanguard have each launched their own automatic investing platforms with similar fees. Meanwhile, Blackrock – the world’s largest asset management firm – acquired FutureAdvisor in August 2015. Services that combine human and automated advice, with competitive fees, will present a challenge that pure robo advisors may not be able to meet. Although traditional advisors may offer exit opportunities for companies such as Wealthfront, the traditional players may also decide it is easier or less expensive to develop their own solutions.

Wealthfront and its peers have demonstrated there is massive value in automating investment decisions; however, in so doing they have provoked a daunting field of competition.

I’ve heard it argued that we won’t know how WF and Betterment perform until we see them go through a downturn (they’ve really come into existence following 2008) — however, it seems to me that they would be able to keep data from previous downturns as a factor in their predictions, regardless of whether or not they were around before. Probably more of a customer management challenge than a portfolio challenge.

Very interesting! I’m curious as to how far “data analytics” can go in the investment space and if it can truly “replace” human interaction. Wealthfront has done an incredible job at attracting and retaining the millennial crowd – but what happens when those millennials “grow up”? Do we think they will be comfortable relying purely on data to secure their – and their family’s – financial security?

I am definitely a believer in companies like wealthfront and betterment. For now, their technology is probably best suited for younger investors who have less complicated financial situations (fewer accounts to consider, not planning for retirement, etc.) but I think the technology can evolve over time to keep pace with its customer’s needs. While these companies haven’t undergone a downturn like 2008, they are also buffered from the emotional and sometimes irrational decisions humans make in stressful times. Their portfolios are pretty well diversified in terms of geography and asset class and don’t differ very much from more traditional asset managers so I don’t think they’ll do any worse in a downturn.