Wayfair – A Zillion Things Home

Wayfair is a company that has seen successful growth, a well-executed rebrand, a $1 billion IPO and international expansion.

Creating the Digital Experience:

Wayfair is a company that has seen successful growth, a well-executed rebrand, a $1 billion IPO and international expansion. The focus on digital transformation and innovation that the company has had is what has allowed Wayfair to flourish and grow in these ways. Wayfair was founded, as CSN Stores, in 2002 by serial entrepreneurs and co-founders, Niraj Shah and Steve Conine. Shah and Conine met whilst studying at Cornell University and prior to founding CSN Stores had started several successful businesses together. The initial premise of CSN Stores was to acquire and to create ~300 micro-sites across the internet, focused on selling household goods and furniture. This industry in the US is largely fragmented with no, key, dominant players. As well, many of the products are heavy, fragile or unwieldy to ship and so a company that was able to figure out how to ship these products effectively had a lot of margin to gain. With the way that Google’s algorithm worked at that time, having a highly specific and dedicated website, such as Cookware.com was a very efficient and effective way for the company to solicit customers in the burgeoning field of ecommerce furniture and home retail sales.

However, as the competition within ecommerce began to develop and to grow, CSN Stores realised that it was losing many repeat and extension purchases from customers who did not know that the company not only owned, Cookware.com, but also owned KitchenStools.com, etc. Each time a customer checked out on one site, the company would need to pay to re-acquire that customer for a sale on a sister or brother site. As well, around this time Google updated its algorithm for how search results were displayed and relevance to the search query, as well as links redirected to a site, suddenly increased in importance. This meant that, although CSN Stores had many highly targeted websites, the lack of breadth across the different sites, as they operated in silos, was affected the individual sites’ rankings in Google search results.

First Digital Transformation:

Subsequently, CSN Stores underwent its first major change with regards to digital transformation. In 2011, CSN Stores announced a complete re-branding of the company into one, cohesive, online storefront, ‘Wayfair.com’. As expected, the company suffered a loss in customer traffic after the rebranding due to the lack of consumer knowledge of the brand and its low ranking in Google’s search results – rankings have to be built over time as authenticity of the site is showcased. The delta in sales was more significant and lasted for longer than the company had expected, and as the company sought to find a way to make Wayfair a household name, it launched its second major digital transformation.

Second Digital Transformation:

Wayfair had held a strong belief that the company’s growth could be fueled by excellent customer service, word of mouth, and good fulfillment rates. As the company struggled to gain traction with the rebranding it realised that a key component of its 2.0 strategy that had been missing was digital marketing. As a result, the company moved quickly to start to build out a robust digital marketing team that looked at attracting customers in two different ways, top of the funnel – people who were searching for homegoods on the internet but did not have a specific product in mind – and bottom of the funnel – people who were searching for a specific product to purchase online. As the company began to focus more of its time and resources on this internal digital transformation and recognition that it had to create a proactive digital footprint to draw customers in, it also went against its previous statement of never needing to do television ads, and in 2012, the company launched its first television ad to a national audience. Wayfair’s ability to understand when it needed to pivot its policy on something in order to foster innovation and growth within its ecosystem has helped the company to develop and to thrive.

Third Digital Transformation:

Wayfair’s third major digital transformation was more ‘behind the scenes’ than the prior two. Having founded the company based on the idea of being a dropship intermediary between suppliers and customers, Wayfair had begun to recognise the importance of stocking many of its most popular or fastest moving items. This was for two reasons, both to do with the competitive landscape. One was to stop competition from blocking the inventory from Wayfair. Major competitors in the homegoods space who did stock items would purchase more than they needed and sit on the inventory so that Wayfair could not offer the products to its customers, or offer the products with a very delayed delivery date due to the inventory backlog from the supplier. The second reason was to allow Wayfair to compete with the two day delivery promises that customers of the industry were beginning to expect from all ecommerce retailers. With Wayfair’s dropship model, the company was not able to guarantee the products to customers within a two day shipping and delivery window and so was struggling to contend with others in the space. As a result, Wayfair begun to build out a very advanced shipping and fulfillment team whose prowess was enhanced by its use of machine learning and proprietary software algorithms, thus completing Wayfair’s third digital transformation.

Further Digital Transformations:

As a company founded and firmly routed in the digital world, Wayfair has done a good job of understanding the importance of continually improving and innovating on its digital offerings, both consumer facing and internal to company operations, as well as focusing on staying abreast of the latest transformations in the digital world in order to remain competitive. There are several key areas of digital transformation that the company should emphasize over the coming years to ensure that it continues its growth and dominance in the space. Technical hiring is an area of weakness for the company. Wayfair has been growing so quickly that its demand for engineers, data analysts and affiliated positions has outstripped the ready supply that it has been able to find. In order for the company to be able to grow at the pace that it needs to, it will need to continue to augment its hiring offering, specifically for technical roles, to be able to attract enough talent to fill its demand.

Another internal focus for the company has been to build out its consumer offerings around virtual reality, allowing customers to ‘experience’ the products and pieces in their homes before actually purchasing them. This is a very compelling tool for customers to be able to interact with and helps to mitigate some of the hesitation that many consumers feel about purchasing furniture online with seeing it first. However, the application of the technology is not very widely understood currently and its user experience is not as smooth as might be hoped for. If Wayfair hopes to make this a key differentiator down the road then it would behoove the company to continue to invest in its capabilities to increase ease of use.

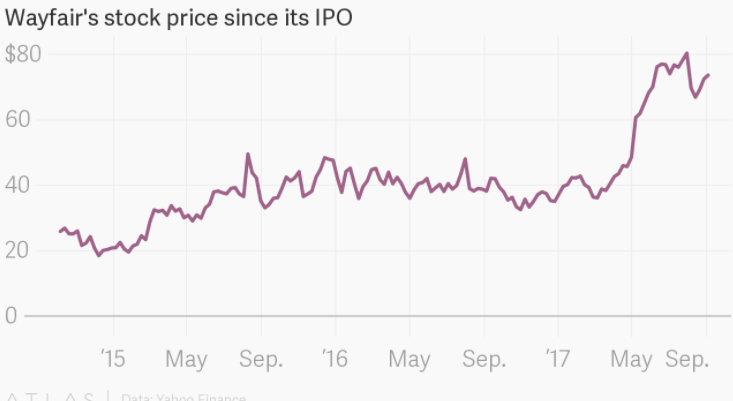

Wayfair’s stock price has continued to increase since the company’s IPO in 2014, largely due to the company’s focus on digital transformation and innovation within its platform and ecosystem. In order for the company to continue to see a positive return on equity, Wayfair should continue this relentless pursuit of digital perfection, especially with regards to the “worry areas” mentioned above, and maintain its dedication to being at the forefront of digital transformation.

Sources:

https://en.wikipedia.org/wiki/Wayfair

https://cb.hbsp.harvard.edu/cbmp/pl/73707352/73708069/cd1abbc9e7a4cd9826005cd5680210bf

https://www.americaninno.com/boston/csn-stores-wayfair-rebrand/

https://www.bizjournals.com/boston/…/csn-stores-launches-wayfair-e-commerce.html

https://www.facebook.com/wayfair/posts/301136579993902

Thanks for this interesting post! As an ecommerce platform, Wayfair has a lot of data on customer browsing and buying habits. For their next digital transformation, it would be interesting to see how they could take my information to create recommendations and design a room for me. As other ecommerce brands move online direct to consumer, it will be interesting to see how Wayfair uses its technology, data, and infrastructure to maintain its competitive advantage.

Tagging on to this comment … completely agree that user data could be used in interesting ways to personalize offerings. This is especially important for Wayfair dealing in experience goods, where eCommerce has not yet done a good enough job to substitute for the brick and mortar experience in discovering new types of product. VR/AR could change that! One interesting thought is if the customer starts using AR to see how new furniture will fit in her/his house, this will enable Wayfair to not only read browsing preference, but also understand what furniture the user currently has installed. Tons of interesting ways to use that data … of course with some privacy concerns.

Fascinating post! I was unaware of the history of the company and the first few digital transformations that it underwent. I’m curious as to how the personalities of the founders dictated the culture of the company in a way that it was able to transform. Or did they keep the company small enough from the beginning to be nimble to change?

Thanks for the post, Eliza! It seems Wayfair has gone through continuous waves of digital transformation since since inception, and I wonder if the company would even be alive today if not for its ability to persistently and rapidly evolve. Selling heavy goods and furniture online has always struck me as a super problematic concept — as we used to say in RC Strategy, it’s a “five-star crappy industry.” I don’t think they’ve ever made a profit; if they do, one day, manage to fully prove out their business model and show sustainable profitability, I feel like Wayfair will go down in the books as a historic case of a company totally defying the odds through digital innovation.

Great post Eliza. I wonder what the supply chain implications are for Wayfair’s shift to digital. You’ve mentioned holding inventory both as a defensive move against competitors but also to serve customers better. I would imagine their storage costs increasing (either capex or cap leases) in addition to hiring supply chain staff to handle the volume of goods. Furthermore, do they sell their own private label goods or are they staunchly 3rd party goods only? To compete, I also wonder what payment terms they get from their suppliers (e.g., days payable) to help with their transition into holding inventory. The other question I have is regarding technical talent. Similar to the challenge that GE faced when trying to hire developers, how does Wayfair differentiate itself? When I think of great tech companies Wayfair doesn’t immediately come to mind. Are they targeting specific programs or have particularly attractive offerings?

Thanks for the post, Eliza! I think that VR experience could be an amazing boost to company’s sales and I was wondering how Wayfair can improve the adoption of this new unique tool. Looking back at some of our cases, I think that the idea of having several physical locations aka “pop-up stores” could help solving the problem. While asset-lite model of Wayfair makes their business model viable, I think opening pop-up stores in a form of showrooms for the new tools like VR, could improve customer loyalty and drive VR usage online. These pop-up stores don’t need large space – all they need is 1 or 2 consultants, few catalogues for clients who are waiting (with a possibility to order online on the spot), a white wall and a VR head-set. These stores can migrate to a new location every 1-2 months. Another idea of physical stores could be to combine the VR showroom and storage space for picking the orders. This idea will require larger space and probably will be more expensive, but on the other hand, it can help improving delivery times – one of Wayfair’s key objectives.

Great post, Eliza! Following Kat’s recommendation, I wonder whether Wayfair could form some kind of partnership with (or even acquire) new services like Modsy. By crafting interior designs for their customers, they can gather data on what customers are looking for and thus improve the relevance of what’s shown on their platform based on customers’ age, region, budget, etc. Also they can recommend products within their platform that have greater margins, and upsell customers once they have all the info on their houses and interior design. I think about it as a Spotify’s “Discover Weekly” but for Wayfair: it’s a retention tool, it gathers valuable data, and it balances the power of suppliers.

Thanks for the post! Interesting to see the multiple transformations. My question with Wayfair is always “how are they so Amazon-proof?”. I wonder if Wayfair’s advantage is purely in the operational processes (e.g., warehouses designed for big furniture items), or if there are other digital tools they could utilize to build and maintain an advantage over Amazon?

Thanks for the post, Eliza! I think the VR is such a great way to understand client preferences and upsell them on products they didn’t even know they wanted. I think a lot of times people use products differently than they are intended to be used – for example maybe I use a book shelf as a TV stand. I wonder if Wayfair is able to learn about how their customers use their products differently than they may intend and if that can play into future designs of products. I think the upselling from VR is such a great opportunitiy as well because when I’m designing a new living room and spending a few thousand dollars on new couches, tables, etc., if they recommend a few decor pieces that would look nice, it seems so minimally incremental at that time when I’m spending a lot anyway.

Great post, and especially pertinent since many HBS students go on to work for Wayfair after graduating. It is great that Wayfair is continually improving through digital transformation. However, I wonder if that is disruptive innovation or incremental innovation. It seems to me that it might be the latter. I am curious is Wayfair has the organizational processes and culture to allow them to disrupt themselves. This could include a culture focused on exploration (rather than exploiting their existing processes) as well as allowing nascent business areas that may be slower to grow and “move the needle” to prosper.

Thanks for a great post! As someone who’s currently going through the process of furnishing a new home, I had the opportunity to browse through many furniture companies. I have to say I can see the fruitful results transmitting through its multiple waves of digital transformation, and I look forward to its future growth in digitalization. I’m most curious that as Wayfair drives so many rounds of transformations, how has the leadership been able to successfully bring the employees along, and what organizational processes were implemented to set themselves for success?

Thanks for an interesting read! Other than what was discussed above, I’m curious about what internal capabilities and culture Wayfair has built in order to manage successful transformations. If there’s any resistance at the beginning and how did the founders/management solve it. I wonder if there’s any generalized lessons based on its success.

Thanks for this interesting post, Eliza! It is so impressive that Wayfair successfully drove many digital transformations within its organization. I think the application of AR will be very cool and transform how customers shop furniture. It solved a pain point of buying furniture online (vs. in person) and will help furniture business shift online. IKEA recently also released their AR featured app – IKEA Place.

In addition to AR, I think there be even a bigger potential in leveraging AI to better serve customers. With a large amount of data and visual search capability, Wayfair can build algorithms to make decoration recommendations for customers, providing suggested items that can go well together with the customer’s personal style and purchase history, for example, the algorithms will be able to determine which sofa matches better with the customer’s carpet purchased earlier and push recommendation accordingly.

Thank you for the post! I’m curious as to whether the unit economics of its 1P services are and will ever be profitable. As it moves towards TV advertising, my worry is the Company is dumping tons of money to acquire new customers. Furthermore, the inventory costs are expensive, esp for unprofitable companies that dont have access to the cheapest forms of financing. So far the market has turned a blind eye to Wayfair’s cash burn, but investor mood can change quickly.

Hi great post! Whenever it comes to Wayfair, I tend to judge every single move made by them as either a reaction or proactive move in their dance to exist besides Amazon. Do you believe their digital experience, with AR/VR among its features, is not just good or even great – but makes Wayfair’s position defensible from Amazon’s? I see an acquisition on the far horizon…

Thanks for the interesting post! Given that fulfillment plays such an important role in customer satisfaction I wonder how they are thinking about insourcing their logistics. While bringing logistics can be a great source of differentiation, it is a complex operational challenge as well as capital intensive. I think they should start by focusing on building out the supply chain infrastructure for a specific geographic region and test it out before expanding nationally. If they get the logistics right and reduce fulfilment times, I can see how they could actually compete with Amazon in their e-commerce vertical.

Thanks for the post! The Comppany seems to acknowledge weaknesses or gaps pretty quickly and is able to adapt. I think the logistics aspect will become even more important over time as competitors such as Amazon and Overstock put more emphasis and money on home goods and larger items. Being able to ship quickly and damage-free will create a virtuous cycle for the Company

Great post. It’s interesting to learn about the company’s history and evolution overtime. I particularly appreciate the juxtaposition they’ve had with places like Amazon, opting to focus on larger home goods as their competitive focus. I’m curious to see if there will be much clearer crossover in their target markets in the future.

It’s great to hear about these various phases of Wayfair’s evolution. In the future, I also wonder about their ability to adapt to changing customer retail experiences. As Amazon moves into brick and mortar, following a variety of e-commerce brands from Warby Parker to Bonobos to Allbirds, there is a question if the company can provide the kind of sophisticated tech-enabled retail experience that Amazon is developing in other product categories and would complement the online offerings.

Thank you for the post. very interesting article.