Peloton’s Shift to Multidimensional Brand at the Right Timing

COVID 19 has reduced the number of physical experiences people engage in, and in some cases this shift the virtual version potentially is more valued than the physical. Peloton is an exemplary multidimensional brand that ultimately married physical and virtual to improve people’s experience of a product and service.

Peloton?

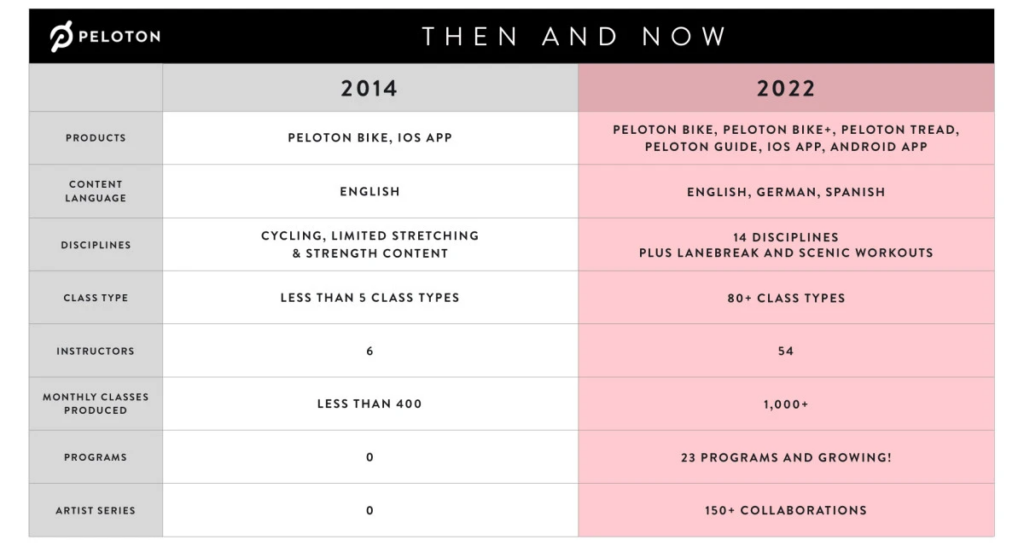

Peloton Interactive Inc, formerly Peloton Interactive LLC is a US-based exercise equipment and fitness media company known primarily for its flagship products, the Peloton Bike, and the Peloton Tread. Though it was founded on Kickstarter a decade ago, Peloton has grown exponentially over the past few years, especially as the COVID-19 pandemic forced people to work out efficiently at home. The company’s first-of-its-kind subscription platform allows users to stream fitness classes that they can take part in from home using their Peloton hardware.

Anyone who owns a Peloton Bike can subscribe to the service and take part in Peloton-exclusive indoor biking classes. Similarly, anyone with a Peloton Tread can attend live or on-demand indoor running training sessions.

Product Portfolio

- Internet-connected stationary bikes and treadmills

- Sports apparel and accessories: cycling shoes, dumbbells, resistance bands, and fitness apparel.

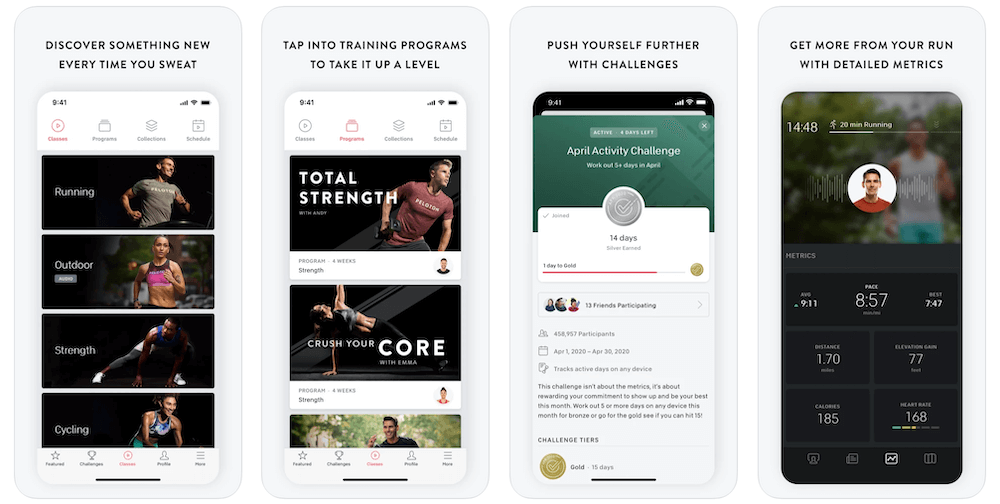

- Connected fitness subscriptions (access to live and on-demand fitness group classes at home that are led by its instructors), and the Peloton Digital app (for household users to access its classes).

As of June 2022, the company had approximately 6.9 million members. Peloton Interactive sells its products directly to customers through a multi-channel sales platform that includes showrooms, inside sales, and e-commerce.

Peloton Digital – Unique Value Proposition

- More than a stationary workout equipment

Peloton offers live classes just like traditional gyms or clubs would, but because it is multidimensional, the class serve 1. to simulate the feeling of group fitness, and 2. to create content to fill Peloton’s virtual library, allowing members to choose the type of class, music, specific instructor, and length in a personalized bespoke exercise. It empowers members to control and exercise completely on their own terms.

- More than a group fitness

Virtual high fives, digital leaderboards, and challenging friends are just a few of the cues Peloton has taken from in-person group fitness. Peloton uses its virtual platform to create emotional and social value as its instructors and members can use Peloton for culturally relevant issues (for example Black Lives Matter movement in 2021) and form an affinity group by their interests or workplace. It excels in the reach and scale, and the physical act of exercising with like-minded people which amplifies the emotional value of the users.

- More than a playlist

Peloton is strategically becoming one of the forefronts of music culture. It collaborates with celebrities like Beyonce, Taylor Swift, and Cavin Harris to not only power the workout but also encourage a multi-channel experience by allowing favorite songs during class and automatically building a playlist in Spotify to revisit. It recognizes the value of music in the experience and designed the platform to amplify artistry and build community.

- More than individual goals

By leveraging the relationships instructors have with members, Peloton has created a sense of intimacy in a virtual space where many other digital platforms have failed. This intimacy is key in building platform stickiness and lifetime buy-in from members. To do this, Peloton instructors personally connect with members in class, and also on social media platforms. Often during the live taping of a class, instructors will call attention to a story shared by members on social media. This intimacy fosters a sense of true connectedness among members and the Peloton experience.

After COVID and Sustainability

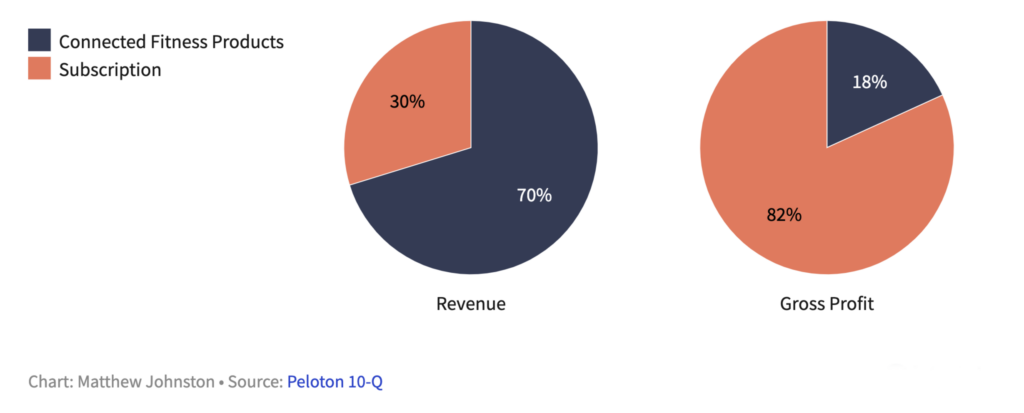

- Peloton’s Connected Fitness Products segment currently generates most of the company’s revenue, but its Subscription segment is more profitable and growing fast.

- The company announced a major business restructuring in February 2022 that includes plans to reduce its global workforce and scale back its manufacturing footprint.

- Barry McCarthy was named Peloton’s new CEO and president on Feb. 8, 2022, replacing John Foley, who was named the company’s new executive chair.

- Peloton announced that it would be reducing its global workforce by approximately 2,800 positions, and corporate positions by about 20%. Peloton also said it would reduce its manufacturing and delivery footprints and cut back its planned capital expenditures in 2022 by approximately $150 million.

Reference

- https://businessmodelanalyst.com/peloton-business-model/

- https://dl.acm.org/doi/10.1145/3460231.3474610

- https://sk.sagepub.com/cases/peloton-interactive-inc-valuation-during-a-global-pandemic

- https://sk.sagepub.com/cases/peloton-brand-damage-from-holiday-advertising

- https://www.academia.edu/42974048/A_Worldwide_Overview_of_the_Wellness_Economy_Market_The_Technogym_and_Peloton_Case_Studies?auto=citations&from=cover_page

- https://nymag.com/intelligencer/2019/12/why-paying-more-for-fitness-is-part-of-pelotons-proposition.html

- https://digitalcommons.library.umaine.edu/honors/621/

- https://sk.sagepub.com/cases/pelotons-safety-issues

- https://www.musicbusinessworldwide.com/peloton-has-lost-nearly-40bn-in-market-cap-value-in-the-past-year-could-apple-swoop-for-a-cut-price-acquisition/

- Peloton Interactive Inc. “PELOTON ANNOUNCES COMPREHENSIVE PROGRAM TO REDUCE COSTS AND DRIVE GROWTH, PROFITABILITY, AND FREE CASH FLOW”, https://investor.onepeloton.com/news-releases/news-release-details/peloton-announces-comprehensive-program-reduce-costs-and-drive

Thank you for writing this post, Jiwon! I’ve had my Peloton bike since 2018, and I’m a huge believer in the sustainability of its platform given its connecting world-class instructors with a passionate community of at-home work out fanatics. I think you hit it spot on when referencing the personal connections between the instructors and at-home riders – between the personalized shout-outs for milestones and birthdays to the instructors’ active social media engagement, I think Peloton has done an excellent job fostering the match and ongoing relationship between riders and instructors. I also find it interesting that Peloton constantly adds new instructors to the platform and strives to have such a diverse set of instructors so that riders continue to come back to the platform for fresh content and new connections with instructors.

Thanks Jiwon, very good read! 🙂

Peloton is definitely a very exciting example of a platform. I think the company has benefited extremely from the Covid pandemic and the lockdowns that came with it, so you can stay fit at home as well. I, like I think most people, thought it was just bike fitness, but then I saw the other day at Harvard Gym that the classes also included HIIT workouts with weights, etc. I wonder if Peloton will manage to get away from their signature piece, the bike, and sell other home workout products like workout mirrors etc. I also wonder if Peloton will remain a pure do-at-home product or if they will scale into the outside world where the competition from bootcamps and spinning classes is already miles ahead..

Thanks for your post. I never really got into Peloton but from a business model perspective, I was always curious about the high barrier to entry for new consumers (aka the price of the bike). During the pandemic when people were stuck at home, investing in a $2K bike seemed like a great idea, but in a post pandemic world when there are many cheaper ways to exercise, the value prop feels shaky.

I like that Peloton was able to diversify its business model to include offerings like classes and programs that are not dependent on the purchase of the bike.

Hi Jiwon, thank you for your post! We discussed in another class about how Peloton was expanding their business from hardware connected stationary bikes and treadmills. It was interesting to see how they were incorporating this connected fitness subscription on their virtual platform in order to provide better fitness experiences for people at home.I was wondering how this subscription platform and course could be further expanded to include a connection perspective with other subscribers, such as a social interaction perspective, in addition to personalization and connection with instructors on social media.

This is great! I’m curious how Peloton’s retention will be post-COVID now that gyms have reopened. The chart showing the Connected Fitness income vs. profit indicates to me that they’re operating a platform of selling hardware near cost and earning on the software. I’m curious what happens to them if/when hardware sales slow. That said, I love the pelotons at Shad, I’m curious if there’s an avenue where they shift focus from home gyms to commercial ones.