Convenience at Your Fingertips: Rappi – Colombia & Latam’s One-Stop Shop

A unicorn capitalizing on convenience changed the game in Colombia and continues to grow as it enters new markets across Latam

Rappi, one of Colombia’s first unicorn startups, has created a platform which has been exported to other countries across Latin America. It was initially conceived as a marketplace to match consumers and entrepreneurs for food deliveries but has grown to become almost a one-stop shop for many items and even experiences any consumer might imagine, all in the convenience of one app.

Rappi’s stated mission is “to drive economic development across cities in Latin America by accelerating e-commerce adoption”. Rappi followed the delivery model of many platforms across the world by first starting with food delivery services in Colombia’s capital and expanding to other main cities before exporting the model to other countries. To date, Rappi’s platform offers not only food delivery but also grocery shopping, pharmacy delivery, ATM withdrawals in case users need cash, ability to find a plumber, Rappi Travel – travel agency, and many more.

The platform creates value for customers by focusing on convenience. For customers that are busy at work and can’t cook, Rappi offers an easy delivery method with the ability to order from hundreds of restaurants which are georeferenced given the user’s location. Other examples include the ability to select grocery items and interact with the personal shopper when a specific brand or item isn’t available. All of this delivered to the address of the customer’s choice. Further, Rappi later expanded to a freemium model. It still offers the same services but charges a fee per delivery or a monthly/annual subscription that waives the delivery fee (roughly the premium fee was the equivalent of the delivery fee in 3-4 deliveries). For heavy use customers (such as myself) it made sense to purchase the subscription. The subscription included tiers (based on how many deliveries a user ordered) which translated into faster customer support.

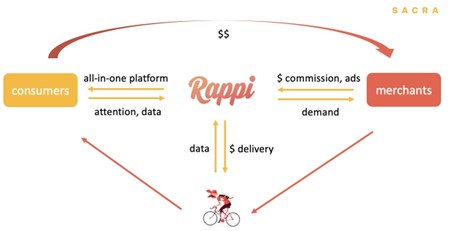

Rappi benefited from first-mover advantage in Colombia, enabling it to capture exponential customer growth and benefit from the flywheel of network effects: Customers want to be on the app where they can access the most merchants (ie: restaurants), merchants want to be on the platform that has the most users and will generate the most order volume, and ultimately, drivers want to be delivery people with the platform that has the most users as it will generate for them the most trips and highest potential for tips. Rappi faced competition in Colombia, for instance from Uber Eats in the food delivery segment, and other start-ups focused on other segments such as Merqueo (grocery delivery). However, in the case of food delivery, Rappi’s first-mover advantage, even though merchants and consumers multi-home, was so overpowering that it drove Uber Eats out of the Colombian market.

Rappi captures value from merchants primarily through commissions on order value, premium subscription, and advertising (banners inside the app, push notifications). Additionally, Rappi is actively collecting immense amounts of data on consumers: their preferences: favorite restaurants, favorite items at a particular restaurant or supermarket (ie: Favorites section) as well as a combination of items typically bought together at a merchant or in grocery markets or even in anticipation of a specific date. This is likely being monetized through targeted marketing campaigns for vendors (ie: marketing activation campaigns, promotions/deals for a specific vendor). Further, similar to Alibaba’s Alipay, Rappi launched Rappi pay and developed a suite of fintech capabilities including a debit card (offering higher cashback or Rappi credits), credit card, etc.

Rappi has raised US$2.3 billion in total funding including a US$1 billion investment from SoftBank in 2019. Their model has proven to be scalable in the sense that they have been able to grow the offerings of the marketplace to increase average order size and continue to attract users and merchants to the platform. Additionally, Rappi has been able to scale to new countries in Latin America and replicate its success in Colombia – targeting similar consumers. However, the sustainability of the business model remains in question. Given that the mentality has been primarily to grow at all costs, it is unknown whether the business model can be profitable in the long term. The company has employed several high discount/offering strategies to drive volume and user adoption. Whether these can be sustained as the company prepares for an eventual IPO remains to be seen.

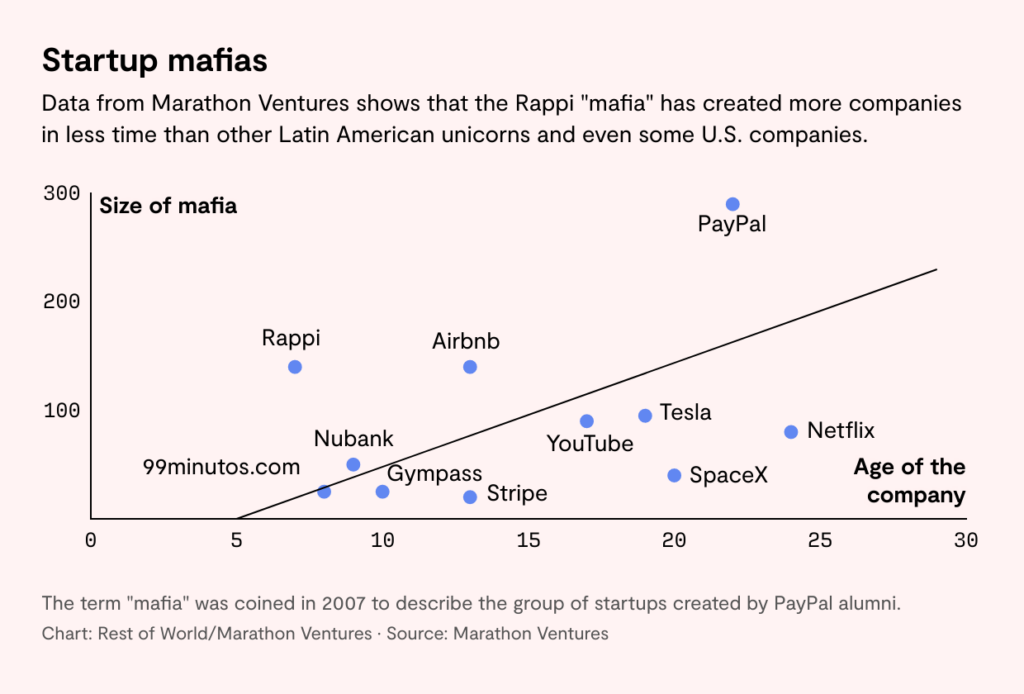

Finally, of note, is the impact that Rappi has generated in the Colombian and by extension Latam tech ecosystem which is known as the “Rappi Mafia”. It has attracted a lot of talent which has developed significant operator skills that have in turn created a highly dynamic platform/tech startup ecosystem with at least 100 startups founded by ex-Rappi employees seeking to disrupt traditional industries in Latam.

Sources:

https://about.rappi.com/about-us

https://www.crunchbase.com/organization/rappi

https://restofworld.org/2022/rappi-mafia-delivery-startup-colombia-tech-scene/

https://medium.com/@RafaTihanyi/understanding-rappi-the-colombian-unicorn-ff908a9c55d0

https://sacra.com/research/rappi-the-meituan-of-latin-america/

Thanks for your post Isabella! I enjoyed reading about Rappi. I found it interesting that Rappi (and many other superapps in developing economies) is able to consistently capture value and scale quickly even when facing challenges from multiple specialized competitors and a high level of multihoming. Your comment on first-mover advantage (as well as the fact that data is a highly scalable resource here) helped me make sense of this! And the growth potential is always there when there are so many institutional voids to fill. Your last comment on Rappi’s role in talent development is also extremely interesting. I’ve come across a few academic studies that look at how Rappi/digital disruptions render certain traditional jobs obsolete and make people lose jobs, but as you pointed out it also creates jobs and boosts entrepreneurship! One aspect I’m curious to learn more about is how Rappi deals with regulations and consumer complaints. I imagine this type of issues would become more pronounced as Rappi continues to increase its scope.

Thanks for the post, Isa! I think your point on profitability is spot on. Rappi has burned through billions of investors’ money but has yet to prove profitability on a unit economics basis. Margins for 30-minute delivery are just not there for Rappi to validate a $5bn valuation. We have seen companies like Doordash, Deliveroo and Uber fall dramatically in value as investors realize the scale needed to get to unit economics breakeven. I believe Rappi will have to raise capital again soon, at a lower valuation, and an IPO in the near to medium term is definitely out of the question.

Awesome article, Isabella! I know you mention Rappi’s first mover advantage inured it from competition from Uber Eats; do you think this will continue to protect it over time? I find functional services like Rappi’s interesting, because they seem so prone to disruption or a price war, I was curious if there was any sort of complementary service Rappi offered that gave it a more unique value proposition?

Isabella, really interesting post! Though I had heard of Rappi before, I was surprised when I visited Argentina last year to see just how ubiquitous the platform is — nearly every food establishment had the Rappi logo posted outside, and there were delivery people everywhere. It’s interesting to me how regionalized food delivery startups are (i.e., US = DoorDash, Europe = Deliveroo, LATAM = Rappi… etc.), given that they all seem to replicate a similar business model. However it was interesting to read in your post that Rappi has differentiated itself immensely on the level of talent it brought and graduated from its organization. This is a cool metric to look at and think about when building disruptive platforms.