Netflix: Attracting Both Subscribers and Content Providers to the Party.

This post discusses Netflix’s reliance on network effects, and risks and benefits of their current model to attract users and content owners to their platform.

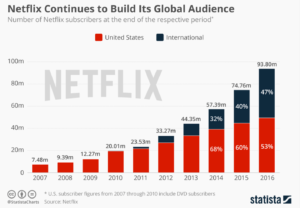

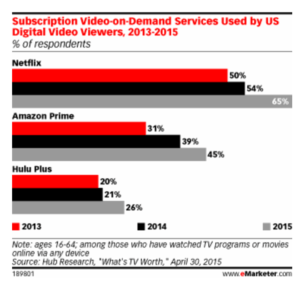

Netflix was a first mover in the now very competitive over-the-top (OTT) video programming market. With over 86 million subscribers, they offer a digital platform of movies and television shows that users can access via a monthly subscription. The platform relies heavily on both direct and indirect network effects, and thus must pay close attention to satisfying users, content owners, and content creators in order to be successful.

How Netflix Creates and Captures Value from Subscribers

Netflix creates value for subscribers by offering them a large catalogue of television and movies that they can watch on demand. Their content strategy so far is fivefold:

- Acquiring lower cost, long-tail content from studios at cheaper prices to build the size of their content offering.

- Acquiring higher cost, beloved hits from studios to attract mainstream audiences from more traditional viewing platforms (broadcast, cable, movie theaters).

- Betting big on brand new original content to decrease reliance on studios and distinguish their platform from competitors with exclusive content.

- Creating lower-risk original programming based on prior IP like Marvel characters, or older, beloved television shows (like the Full House, Gilmore Girls, and Arrested Development revivals) to attract their audiences.

- Creating original content specific to certain geographical regions to cater to new audiences as they expand globally.

Netflix captures this value with a monthly subscription payment. There are three tiers from $7.99 – $11.99 depending on the number of screens used.

How Netflix Creates and Captures Value from Content Providers

Historically, Netflix has depended on studios for content, paying a fee to license it for a certain amount of time. This was a valuable proposition for studios who could monetize their content beyond traditional windows with this new SVOD licensing revenue stream. However, Netflix came to see that this was risky for two main reasons: 1) studios, seeing cannibalization of their other revenue streams from OTT services (and now wanting to destroy these services or create their own), may refuse to license content in the future or charge more for it, and 2) studios can multi-home and give their content to competitors, decreasing its value to Netflix. Because of this, Netflix has invested heavily in original content.

However, attracting filmmakers and stars to create Netflix originals has its own issues. Netflix can offer a lot of value to creative talent including creative freedom, no pressure of ratings or mid-season cancelation, and large up-front payments. However, the platform’s unique positioning can also be a turn-off: many filmmakers still want to see their films on the “big-screen” via a traditional theatrical release, and the Netflix model does not allow creatives to share in the potential upside of a hit that a normal studio theatrical launch or broadcast/cable premiere deal allows (most A-list actors/directors get a share of the box office or syndication revenues). With Netflix, creative talent gets paid the same whether the content is watched by 1 person or 10 million people. This means lower risk for talent (with a larger upfront payment), but also means zero share in the potential riches that a hit could win from syndication in traditional windows.

Network Effects: Good for Users, Good for Netflix

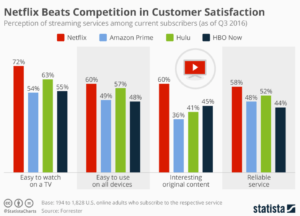

The Netflix platform has very strong indirect network effects. The more movies and TV shows on the platform, the more subscribers value the service. Users need to feel like there are getting access to high quality, new, and exclusive content in order to see value in the product. Because of this, in 2017, Netflix plans to spend $6 billion dollars on content in order to secure high quality and exclusive content from providers.

The Netflix platform also relies on direct network effects to decrease marketing spend and to create their personalization and data tools. Water cooler and social media conversations are often dominated by shows and movies, so people feel the need to be watching what their friends are watching. In this way, people gain value from also having their friends on the platform. Netflix also gains value from this direct network effect as word-of-mouth recommendations and press on new shows are free marketing.

Subscribers also derive more value from Netflix when more subscribe to it because more customers means more data and a better content recommendation engine. The recommendations tool is important for retaining users because it connects them to personally relevant content that keeps them watching and subscribing. More viewership data allows Netflix to create better content and negotiate better content prices with providers.

Great post! I though about netflix during the Amazon/Paintball X Fire case. I wonder if Netflix will start to feel pressure from the traditional content providers as it continues to create its own content? It feels like they can use the consumption patterns of 3rd party content to design and develop perfect content for their subscribers, and steal share-of-wallet away from other movies or tv shows.

Hi Andrew – That’s an interesting thought. I’ve read about some studios (such as Legendary Pictures apparently) using big data to figure out what content to produce, but I have a lot of doubts about that strategy. Thus far, it doesn’t seemed to have worked particularly well for Legendary (if World of Warcraft and The Great Wall are any indication). I also think that in the entertainment business, creative execution is so critical that it is difficult to just say, “make a movie on this IP” and bank on its success. I do think that it is important to make sure that there is a potential market for entertainment content that is created, but good execution is ultimately a more important driver of both creative and financial success.

Here’s the link to an article on what Legendary is doing: https://www.bostonglobe.com/business/technology/2016/03/31/making-movies-moneyball-way/Uzgwh2cdGthA1N3nZHqz0N/story.html

Interesting analogy to think about, Andrew. I agree with Sijia –in my view, even if Netflix is able to leverage its subscriber patterns to identify what types of content / themes are currently attractive to consumers, I don’t believe the studios will see it as that much of a threat to their content (especially if they also distribute through Netflix). Ultimately, a studio’s brand on a piece of content typically only indicates quality / budget and perhaps the bounds within which it operates (ie. Disney & no swearing), but each new content piece needs to still needs to stand on its own, develop and connect to its own fan base based on its creative, storytelling and production quality. Where I could see the studios getting nervous would be if creatives and actors eventually decided to only work with Netflix and not studios (perhaps because of more attractive deals or larger audience base). This shift might already be starting to happen as the Netflix Originals portfolio is getting much more established and prestigious, and as demonstrated by the announcement of Martin Scorsese’s upcoming film to premiere on Netflix.

Thanks for the post! It’s a great analysis of Netflix’s strategy to date.

I think one of Netflix’s key risks is that as content becomes more and more important, traditional content creators and distributors will demand more from Netflix for streaming rights. I believe that these content deals are also becoming more complex, with studios negotiating terms that allow them to get paid per number of views of their content over certain viewership thresholds. IMO these dramatic increases in content costs will not necessarily get offset by increases in customers’ willingness to pay. To make matters worse, Netflix will have to spend billions of dollars to purchase huge amounts of content internationally as well, as many local markets have very different preferences for what viewers want to watch. In addition, since content deals are negotiated on a region-by-region basis, Netflix may have to pay even more to gain access to content it already has in the US for new international markets. At the same time, many people in developing markets are not willing to pay the same $7.99+ per month price point that Netflix’s US customers pay. Netflix has thus far failed in India due to this combination of inadequate content and way-too-high price point. This article does a good job of examining Netflix’s poor expansion strategy in India: https://backchannel.com/amazon-is-out-punching-netflix-in-the-worlds-most-important-market-india-1faf3f4a067c#.g6k7sxmao

My view on Netflix’s business model is that it will eventually become a margins-focused business in the long-term that is quite similar to traditional cable providers today. It will have to balance increasing content costs by adding new subscribers while cutting opex. In the medium-term, however, Netflix is essentially done growing in the US in terms of the number of subscribers, so it must expand aggressively into international markets (number of subs is the primary metric that investors use to evaluate Netflix). I’m pretty bearish on Netflix’s long-term prospects given its poor execution to date in international markets—it’ll certainly be really interesting to see what happens.