In Airbnb We Trust

Airbnb has cleverly built a platform to create trust among complete strangers.

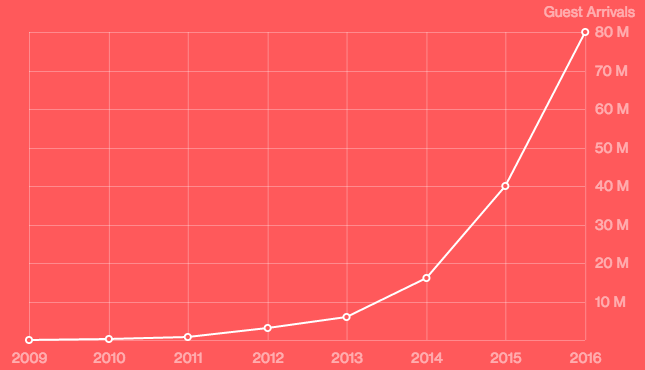

Launched almost a decade ago as “AirBed & Breakfast,” Airbnb has grown into a $30 billion pillar of the sharing economy. Property owners and renters use it to rent millions of beds, rooms, and entire properties to hundreds of millions of guests around the world. Beyond its core rental service, the platform recently launched Trips, an adjacent “experiences” platform for travelers and enterprising hosts. Reports also suggest that that the firm is building a flight-booking tool to compete with incumbents like Expedia. The firm’s success suggests a vision to not merely create a platform for accommodations, but to “platformize” travel itself.

Value in Trust

For guests, Airbnb creates value by providing access to diverse travel accommodations and experiences. Many of these heterogeneous offerings could not be easily sold or discovered in the pre-Airbnb world, though some conventional hotels have begun using the service to market their own inventory. Hosts use the platform to turn spare space or short-term vacancies into extra income, rent out properties full time, or make money selling experiences to visitors. Both sides benefit from the platform’s network effects, and Airbnb captures guest and host service fees on bookings in compensation.

Beyond the transactional features of Airbnb’s marketplace is perhaps a more profound form of value creation: the firm’s focus on trust. Anyone who has received an “A+++++” eBay rating will recognize that platform rating and verification systems have existed for a long time. But inviting strangers into one’s home or staying in an unseen property is a far more intimate experience than buying someone’s old golf clubs. Airbnb’s reputation management system—and system of guarantees when it fails—is crucial for creating value in its network.

The Chicken & The Egg

Of course, networks and trust seldom arise out of nothing, and Airbnb spent years with little traction despite its stint in the vaunted Y Combinator accelerator. To garner attention and raise money, they even resorted to selling election-themed Obama O’s and Cap’n McCains:

Airbnb found a solution in Craigslist’s already-extensive user base and active rental market. Leveraging that firm’s network effects, Airbnb built tools to facilitate cross-posting between the platforms, and ensured that Airbnb-created Craigslist ads would be more attractive and inviting than that platform’s users were used to. Perhaps more “nefariously,” Airbnb also began to automatically email Craigslist posters, soliciting cross-posting on Airbnb. This “growth hacking” method may seem underhanded, particularly in light of CTO Nathan Blecharczyk’s history of profiting from email spam. But it appears to have worked, feeding Airbnb’s “flywheel” of growth that it has ridden to a nosebleed valuation.

Competitive Moats & Trustworthy Bridges

While listing properties and searching for accommodations on other services sounds straightforward, Airbnb’s “ownership” of trust is a powerful incentive for buyers and sellers to stick with one platform. Using a new travel platform to rent one’s home or find a place to sleep entails real risks to property and safety; contrast that with browsing and purchasing from a new “daily deals” platform, which entails little cost or risk (and may partially explain Groupon’s struggles). Minor frictions of multi-homing (managing multiple calendars, payment methods, etc.) aside, once one has established trust in Airbnb’s platform, they have a powerful reason to remain in its network.

Open Questions

Despite Airbnb’s advantages, several questions remain about the firm’s prospects and scaling ability. As shown, trust mechanisms deter vandalism and theft; after all, guests want to be trusted by prospective hosts. But these systems have failed in other ways: minority guests have documented several cases of apparent racial discrimination by hosts or their neighbors. This phenomenon may block many from booking (let alone rating) properties in the first place: HBS researchers have found evidence of discrimination against prospective guests with African American names. These effectively represent “negative” network effects, where the platform’s decentralized nature enables participants to harm or deter others, rather than transact with them. Airbnb has taken steps to combat discrimination; time will tell if they prove effective.

Further, Airbnb’s ability to capture the large and lucrative business travel market remains uncertain. The firm has lagged other platform players like Uber in claiming wallet share from incumbents, though recent trends are promising. Firms staffed by frequent business travelers employ support staff and enforce purchasing policies that favor major hotel brands with standardized offerings and dedicated B2B marketing efforts. It remains to be seen if Airbnb can compete for this market with its current host base. Perhaps the firm will need to solicit more traditional hotel listings (and thus share value with incumbents) to compete.

Finally, Airbnb has faced a litany of regulatory roadblocks, recently culminating in highly-visible legal battles with San Francisco and New York. Politically-powerful incumbent firms and activists concerned with urban livability and affordable housing have raised barriers to Airbnb’s expansion the world over. The firm will likely fight many such battles as it scales, particularly in gentrifying urban areas with rising home prices. But given the value that it creates for users, Airbnb may succeed by tapping its devoted platform participants as citizen lobbyists (à la de Blasio’s Uber).

Challenges aside, Airbnb has built a lucrative and devoted platform of travelers and hosts. When properly nurtured, network effects and the firm’s ownership of trust will likely constitute a durable competitive advantage, making Airbnb a platform to watch in the future.

Nice post, Micah! Question for you: AirBnB clearly benefits from strong indirect network effects (more properties –> more users). What do you think the prospects are for niche competitors to take share? For example, could a hyper-focused, hyper-premium property manager compete effectively for high-end business? Or could a “destination-specific” (e.g. “Alaskan Fishing”) property manager compete effectively for his or her niche? Or do you think AirBnB is basically a runaway train and the game has been won?

Good questions, Cameron. Overall, I am skeptical about individual sellers avoiding Airbnb, or of the possibility that a similarly “broad” platform will arise to challenge Airbnb. Given that sellers can set their own prices and vet their customers (in contrast to Uber), I suspect that many high-end individual sellers will ultimately find value in listing on Airbnb. We have seen shades of this in boutique hotels doing so (https://www.fastcompany.com/3054570/behind-the-brand/to-fill-rooms-hotels-are-turning-to-airbnb). And in my response to Adam’s comment, I discussed a few reasons why I’ve come to think that Airbnb might leverage its renter relationships to perhaps build a durable advantage and achieve market dominance.

That said, I think there are opportunities for others to compete in certain spaces. Christy wrote a great post about Hotel Tonight: https://d3.harvard.edu/platform-digit/submission/the-procrastinator-gets-the-worm-hoteltonight-creates-a-win-win-for-hotels-and-last-minute-travelers/. At first glance, I would expect Airbnb to fare poorly against Hotel Tonight in “spontaneous” bookings, as hotels (many of which remain adversarial toward Airbnb) can more easily accommodate those guests and universally recognize the foregone value of a vacant room. Airbnb’s “trust” model also relies on contact and disclosure, which are hard to execute last-minute.

Some alternative platforms have arisen that cater to other specific niches, like long-term accommodations for visiting professors or those on sabbaticals. Such a platform might differentiate itself by length of stay (though Airbnb does compete there), and it leverages existing academic networks to attract participants and establish trust. For example, I would be happy to rent to this guy because he is motivated to protect his established reputation as an esteemed academic: http://www.hbs.edu/faculty/Pages/profile.aspx?facId=240491. These can be lucrative businesses and Airbnb will likely not be the only game in town, but I would be surprised if a competitor can truly beat them at their own game.

Thanks for the feedback and for sharing your experience, Adam. I was conflicted about how to discuss Airbnb’s multi-homing potential absent hard data about how buyers and sellers actually use both platforms, and I wonder if I might have been too quick to dismiss the possibility that multi-homing isn’t so difficult. Still, I get the impression that there is a significant “mindshare” gap between Airbnb and its competitors. E.g., AppAnnie shows a rankings gap between Airbnb and its competitors, and Google Trends shows wide gaps in search activity: [https://trends.google.com/trends/explore?q=airbnb,homeaway,vrbo,flipkey,couchsurfing]. I am sure that renters vastly outnumber hosts, so this gap suggests that the former might eschew multi-homing, despite my expectation that doing so would be easier for them than for hosts.

Thinking about the product experience, I wonder if the browsing process discourages renters from using multiple platforms. Selecting a rental property on a platform defined by diverse options, and coordinating with hosts, takes non-trivial effort (especially compared to booking a hotel room). A typical traveler may want to use only one platform for tasks like comparing listings (say, by saving options and sharing them with fellow travelers) and communicating with hosts. This is similar to the way that Amazon has captured retail spending from a lot of consumers: I “could” use Google to find and compare buying options, but Amazon offers a frictionless and trustworthy experience, so I just go there first for everything.

I also wonder how Airbnb’s recent moves—expansion into experiences and (maybe) flights, and purchasing Tilt—might affect multi-homing in the future. If Airbnb’s “job” grows from booking unique accommodations to “booking travel” more generally, they may be in a better position to capture exclusive relationships with renters. Sure, a user “can” book discrete parts of travel on different services, but I suspect many won’t. And to your observation about “socializing” Airbnb’s experience, the firm bought Tilt ostensibly to further its group travel initiatives ([https://techcrunch.com/2017/02/22/airbnb-finalizes-deal-to-buy-social-payments-startups-tilt/]). If Airbnb can cultivate direct network effects though these efforts, users might settle on the most popular platform simply because it’s the one that all of their friends use.

Whoops, pardon the poorly formatted links. If you don’t want to copy and paste them:

– https://trends.google.com/trends/explore?q=airbnb,homeaway,vrbo,flipkey,couchsurfing

– https://techcrunch.com/2017/02/22/airbnb-finalizes-deal-to-buy-social-payments-startups-tilt/

Great post Micah! I’m very curious about the open question about whether or not Airbnb will continue to steal market share in the business traveler segment. I imagine Airbnb will struggle due to the fact that business oriented travelers prefer the services associated with traditional hotel models, and it will be very difficult for Airbnb to complete on the services side without a dramatic shift in strategy. It is a highly lucrative market however, so it will be interesting to see what they do to continue to grab wallet share.

Great post Michal. I think probably the strongest thing that Airbnb has going for its platform, is the fact that travel is many times an international experience (especially considering that Europe is Airbnb’s largest geography); therefore, Airbnb is subject to a global network effect rather than a local one. If we take Uber for example, the reason why Didi can exist and get so large is because most people using Didi probably take 99% of their rides in China; the fact that they can use Uber in Barcelona, Spain or Bogota, Colombia doesn’t really matter as much to them since the large majority of the rides happen locally. Airbnb benefits from the fact that a lot of travel takes place internationally; there are Airbnb “clones” like Tujia in China, which have a much bigger presence domestically in China than Airbnb (although Airbnb is aggressively expanding this year). However, Tujia has very limited international inventory (they are partnered with Homeaway), so if you’re a Chinese citizen trying to go visit San Francisco or Paris, you can’t really use Tujia. Having a big business in Barcelona or Bogota, actually does strengthen your Chinese platform, because travelers are going to want to go there. It would be really inconvenient to have to find a new Airbnb “clone” every time you wanted to visit a different country. On the otherside, to build a competitive platform with Airbnb you’re gonna need to build your supply globally. You have to have scale at hundreds of cities across the world to offer a competitive product to the outbound traveler. This can be done, but would be very hard, and very expensive for somebody to do now that Airbnb has a 7 year head start.