iFood delivers great results in Brazil going beyond connecting restaurants with customers.

From delivering food to improving restaurant management and diving into the food supply chain, the journey of iFood seems to be promising.

iFood dominance in Brazil

As the market of food delivery platforms becomes more crowded worldwide and investors move out of the business [1], iFood enjoys 86% of market share in Brazil, with order volume 16 times higher than its nearest competitor, UberEats. With 6 million actives customers and 26 million orders per month in more than 900 cities, iFood revenue reached $ 208M in 2019, and the company became one of the nine Brazilian unicorns, reaching the valuation of $ 1 billion in 2018.

What is their secret? How can they continue growing? As the market grows and big players enter the game, is iFood well positioned to scale the business and continue its dominance? For Carlos Moyses, the company’s CEO, “iFood’s main competitor today is the stove” as they need to grow the market by changing customer’s behavior and creating the habit of ordering food.

Largest tech funding in Latam

iFood was founded in 2011 in Sao Paulo, as a website, their business model soon attracted investors with deep pockets; and, through an aggressive strategy of acquisitions and high investments in technology, the company reached 80% of market share in Brazil in 2015. Having Movile[2] as its main shareholder, iFood experienced explosive growth. In 2018, they received another round of capital investment (around $ 500 M, the largest tech funding in Latin America to date) from Naspers[3] and Innova Capital.

Creating and delivering value

IFood creates value by orchestrating and strengthening the network effect in all the three pillars of food delivery business: customers, restaurants, and couriers.

Keeping customers away from the stove

Customers enjoy an increasing variety of restaurants and menus, tons of discounts and promotions, daily suggestions of meals based on their past behavior and profile, applying sophisticated A.I. algorithms. Strong customer support creates an excellent order experience even when things go wrong (everybody that tried to complain about UberEats; for example, know how hard it is to build that experience).

Building a long-term relationship with Restaurants

Another driver for value creation is the service the platform provides to restaurants (more than 130,000). In addition to tripling their revenue in some cases, the platform provides valuable data about demography, geography, and customer behavior; so restaurants can better plan and improve their offers. iFood also help partners to improve supplier’s management, for instance, by helping them to get discount with packaging supplies (iFood Shop). This continuous engagement creates a strong relationship, reducing the incentive for multihoming and creating barriers for other competitors.

Creating a relationship with couriers

Finally, the company has a loyalty program for independent couriers as well, with a scoring system that offers discounts on services and products to couriers and their families. iFood is the only company that provides accident insurance, and recently, announced a $ 1million fund to help couriers infected by the coronavirus.

Capturing Value

The monetization model for iFood is similar to other platforms, charging on both sides of the platform: a percentage of orders from restaurants (from 10 to 24%), a small delivery fee from customers, and a membership for restaurants that want more visibility.

Scalability & Sustainability

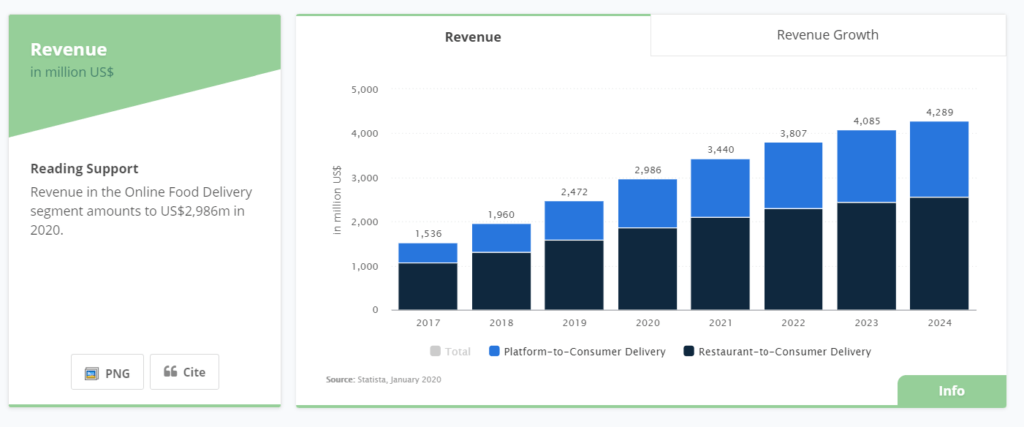

Leveraged by an efficient and affordable delivery system using motorcycles and bicycles [4], food delivery in Brazil is growing at a rate of 30-40% per year and has a great potential to continue that trend as only 12% of the population order food online today.

iFood seems to be well-positioned to scale up its business as it continues strengthening its network both in numbers of users and cities covered.

In the quest to grow the market, the platform recently developed its own private label (called “Loop”) to attract more price-sensitive customers.  Under the Loop brand, iFood works with anonymous restaurants to offer low-cost lunch meals (priced at R$ 10 or $ 2.5), with no delivery fees.

Under the Loop brand, iFood works with anonymous restaurants to offer low-cost lunch meals (priced at R$ 10 or $ 2.5), with no delivery fees.

On the other front, the company is working to bridge its network of customers and restaurants with other services to create new revenue streams, like the platform “iFood Shop”, and is also talking with supermarket chains to enter the grocery delivery business [5].

Competitors

It is not easy to maintain 80% of market share, and competitors like UBER Eats and Rappi are playing hard, in some cases, their apps are even better in terms of tracking orders and delivery speed. However, customers are sticking to iFood, and the reason apparently is that the company understands the business, and deep dive into customer experience and into the restaurant business.

Recently, the Chinese Didi entered the Brazilian market, buying the 99Food, building on the expertise of its ride-sharing platform 99Taxis, so things are getting more exciting competition-wise.

The path forward.

The future for iFood looks bright. Competitors are still trying to catch up, the network effects are on the company’s side, and the company is well-positioned to respond. At the same time, investing heavily in technology [6] and moving into the restaurants’ supply chain seems to be a smart move as it enables iFood to explore new revenue streams, while reaching more price sensitives customers, eventually winning the war against the stove.

[1] Second Measure. “Which Company Is Winning the Food Delivery War?,” February 19, 2020. https://secondmeasure.com/datapoints/food-delivery-services-grubhub-uber-eats-doordash-postmates/.

[2] Movile is a leader in mobile marketplaces. The company, which operates in Brazil, the United States, France, Mexico, Colombia, Peru, and Argentina, already has more than 150 million active users.

[3] Founded in 1915, Naspers is a global internet and entertainment group and one of the largest technology investors in the world. Operating in more than 120 countries.

[4]”An Overview of Latin America’s Food Delivery Industry – Nathan Lustig.” Accessed March 22, 2020. https://www.nathanlustig.com/an-overview-of-latin-americas-food-delivery-industry/.

[5] “Brazilian Food Delivery App IFood Looks to Grow in Retail in 2020.” Reuters, December 13, 2019. https://www.reuters.com/article/us-brazil-retail-ifood-idUSKBN1YH2JV.

[6] Mari, Angelica. “Brazilian Unicorn IFood Announces Acqui-Hire to Boost AI Talent Base.” ZDNet. Accessed March 23, 2020. https://www.zdnet.com/article/brazilian-unicorn-ifood-announces-acqui-hire-to-boost-ai-talent-base/

This was a super interesting read! I found their relationship-building approach with delivery and restaurant folks very unique and something to try in other e-platforms as well. In an attempt to avoid the race to the bottom like in most other food-delivery platforms, relationships will be key in maintaining market share.

Cross-side network effects are the strongest here. Customers can drive people onto or away from the platform. Given their standard revenue streams with added services, I wonder if they are putting a strain on their finances for the long term. If Uber decides to slash delivery cost down to zero, most customers will try to order there (multi-homing and price-comparisons). How is the company approaching locking-down customers?