Black Knight Financial Services – Leveraging Mortgage Data & Analytics

Black Knight Financial Services (BKFS), primarily known for offering a workflow management tool for servicing mortgage loans for large banks and other institutions, has recently aggregated and expanded its capabilities in data & analytics, looking to create and capture value by leveraging data already in its platform. The company’s data includes commercial and residential property data collected from tax records, deeds, mortgages, foreclosure filings, assignments and release records. Currently, BKFS has data covering 99.9% of all U.S. properties with 580 million records containing on average 200 data fields per record.

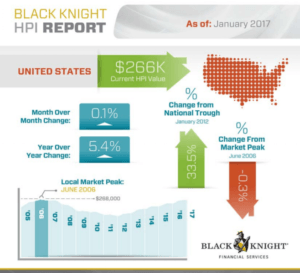

BKFS’s goal is to leverage its current data and analytics capabilities to help its customers better manage risk, improve their origination processes, identify future business opportunities and monitor assets in ways that are more efficient than many of the manual or disparate ways traditional financial services have managed these aspects of their businesses. In addition to information regarding current properties and performance, BKFS is leveraging historical performance data from its servicing platform to help its customers better assess the likely performance of loans over time. The company has information on over 160 million loans over 20+ years, offering a unique insight into loan performance.

BKFS creates value for customers through its data by (1) aggregating and collecting of data  from disparate sources and (2) creating analytical tools that allow clients to improve business decision making. Over a number of years, BKFS has built a database of information, collected often physically from local county offices and records departments. By combining the data regarding home prices at sale to mortgage data to tax records, BKFS was able to create a more powerful understanding of properties across all relevant aspects. After years of collection and aggregation, BKFS developed a series of tools in order to better understand trends underlying their data repository. While initially created as independent advisory projects in order to tackle customer needs, BKFS has sought to create standardized platforms that allow for data manipulation and integration with outside businesses’ systems. Today, the company offers dozens of a la carte analytics offerings that can be combined to help banks, insurance companies, lawyers, real estate companies and others grow and improve their businesses.

from disparate sources and (2) creating analytical tools that allow clients to improve business decision making. Over a number of years, BKFS has built a database of information, collected often physically from local county offices and records departments. By combining the data regarding home prices at sale to mortgage data to tax records, BKFS was able to create a more powerful understanding of properties across all relevant aspects. After years of collection and aggregation, BKFS developed a series of tools in order to better understand trends underlying their data repository. While initially created as independent advisory projects in order to tackle customer needs, BKFS has sought to create standardized platforms that allow for data manipulation and integration with outside businesses’ systems. Today, the company offers dozens of a la carte analytics offerings that can be combined to help banks, insurance companies, lawyers, real estate companies and others grow and improve their businesses.

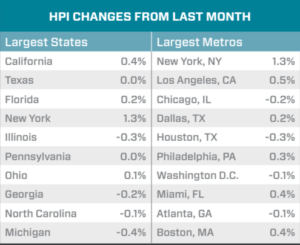

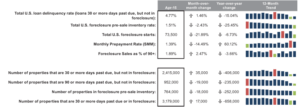

A s an example, BKFS has created a portfolio management and due diligence solutions platform which can model prepayment speeds, predict home price appreciation, provide rent estimates and perform other valuation and risk management tasks. Mortgage participants can use this platform to monitor current loans and prepare for potential foreclosures, assess loan quality prior to origination, determine reasonable sale and rental prices and reduce foreclosure losses.

s an example, BKFS has created a portfolio management and due diligence solutions platform which can model prepayment speeds, predict home price appreciation, provide rent estimates and perform other valuation and risk management tasks. Mortgage participants can use this platform to monitor current loans and prepare for potential foreclosures, assess loan quality prior to origination, determine reasonable sale and rental prices and reduce foreclosure losses.

BKFS seeks to capture value through its data & analytics offering by charging customers for use of its databases, analytical platform and for implementation. Contracts are generally customized for larger institutions that require greater integration, but generally are structured based on data requirements, analytical depth, loan or other quantity requirements, number of internal users and internal costs to maintain data. Similar to other products, many of these offerings are price on a per loan, per seat basis, while others are subscription- or license-based allowing for particular use cases.

BKFS was able to build this platform given its standing as the leading provider of mortgage  servicing and default technology solutions. With more than 50% coverage of U.S. 1st lien mortgages, BKFS was ideally positioned to accumulate property and mortgage data in order to satisfy customer needs. After the mortgage crisis in 2008, the company accelerated collection of data assets, often manually, in order to aid its struggling customers to improve their operations. With a highly proprietary data set, BKFS is uniquely able to offer decision making tools that customers need.

servicing and default technology solutions. With more than 50% coverage of U.S. 1st lien mortgages, BKFS was ideally positioned to accumulate property and mortgage data in order to satisfy customer needs. After the mortgage crisis in 2008, the company accelerated collection of data assets, often manually, in order to aid its struggling customers to improve their operations. With a highly proprietary data set, BKFS is uniquely able to offer decision making tools that customers need.

Currently, the largest challenge for BKFS is finding ways to monetize its data assets at sufficient scale to compensate investors for the costs of aggregation and maintenance of data records and development of new, innovative tools. Many origination lenders have been materially impacted by the mortgage crisis and are reticent to invest significantly in new capabilities given lower margins. BKFS continues to leverage its existing relationships and educate customers on the profitability enhancing capabilities of leveraging data in their operations, but have to date seen slower progress than anticipated. Over time, I expect customers to gain comfort with the quality and power of these solutions to improve their bottom lines.