Square: A Winning Playbook for Data & Analytics Monetization

Square has brought millions of transactions online by providing an easy way for SMBs to accept credit cards instead of cash. Subsequently, the company has designed a business model that leverages this powerful data in an elegant way.

Founded in 2009 by Jack Dorsey (co-Founder of Twitter) and Jim MicKelvey, Square, Inc. (“Square”) first started as a POS solution for small and medium sized businesses. The payment solution allowed merchants to use a small square-shaped attachment in conjunction with their mobile phones or tablets in order to accept credit card payments from consumers. This innovation brought millions of transactions that otherwise would have been completed with cash into the digital realm, unlocking a wealth of data.

Using Data for Value Creation

Square has since expanded into several different service offerings that leverage its largest asset: data. These include merchant analytics, CRM tools, and inventory management. Square employs machine learning and data analytics to provide value to its customers across these segments in the following ways:

Point of Sale Business: Square continuously improves its core service offering by using its transaction data to predict fraud, which the company believes it can do more accurately than competitors. Because of this, Square is able to pay merchants much faster than they would be paid otherwise. Typically, Square pays merchants cash the next day, whereas a typical credit card transaction will take several days. In addition, Square’s fraud prediction capabilities allow it to instantly approve new merchants, so that merchants can instantly begin accepting payments once they activate a device for the first time. Square believes that its fraud prediction capabilities are its biggest innovation and is a sustaining advantage over competitors.

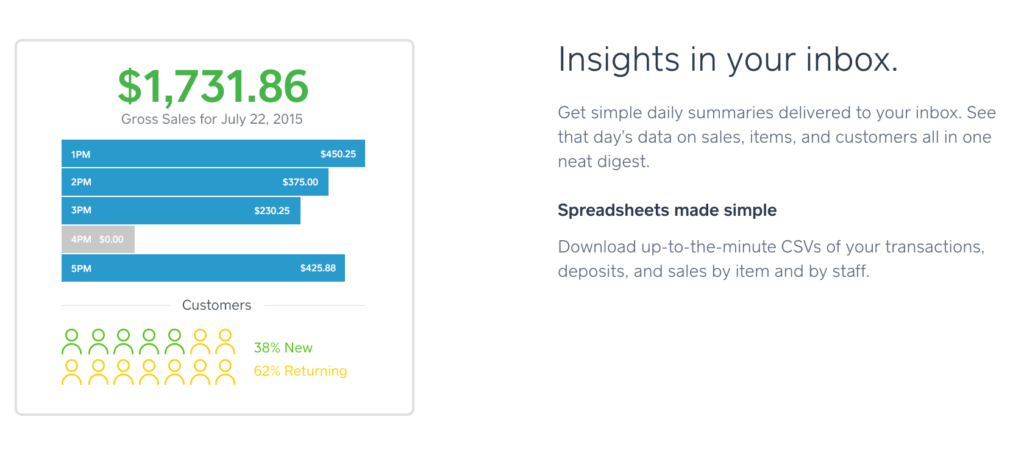

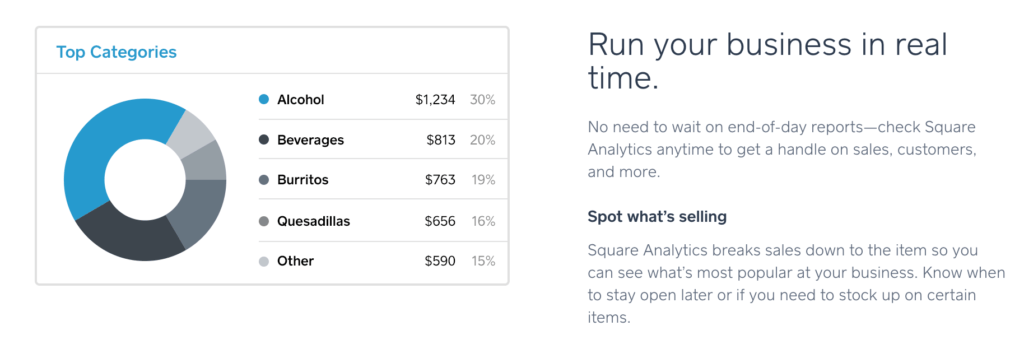

Analytics Dashboard: After finding success in the POS arena, Square launched a dashboard product to expose the rich transaction data it had been accumulating since inception. Square helps merchants interpret their data by surfacing their transaction data in a dashboard that is intuitive and actionable. It is available on desktop and mobile devices. Merchants can easily dissect their data to extract what their best performing categories are (gross margin and inventory management) and do things like determine which days of the week or times of day they tend to sell the most items (see figures below). Further, the company employs machine learning to provide recommendations for growth derived from transaction level data (e.g., consumers typically buy coffee along with a bagel in your store, try offering discounted bagels to boost coffee sales).

Square Capital: More recently, Square has entered the financing business, offering loans to its thousands of merchants. Many of these merchants are too small or too risky for traditional loans, but Square is able to leverage its transaction data to get a real time estimate of their solvency and lend to the merchants that it deems creditworthy. Moreover, Square can make an accurate assessment of a merchant’s credit quality before a traditional lender. This is a strong way to leverage their data assets, and they plan to extend hundreds of millions of loans in doing so.

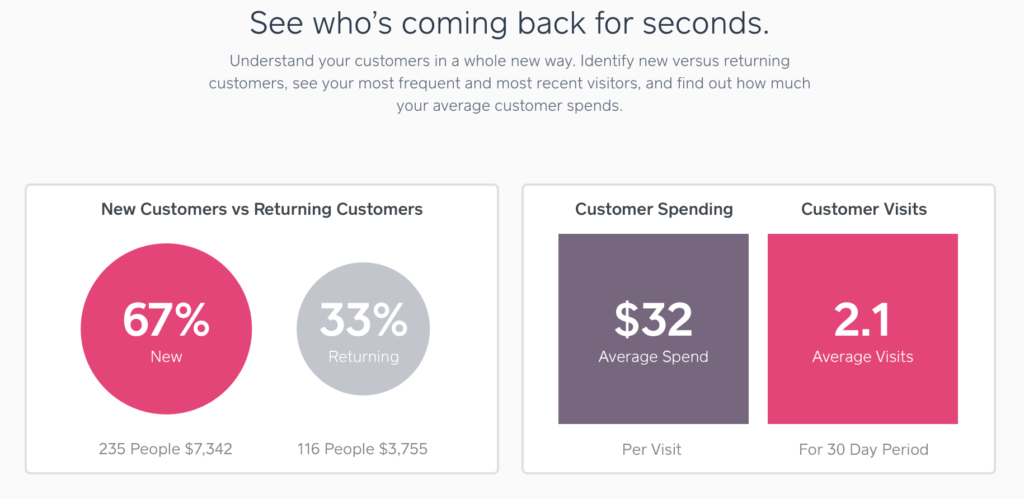

CRM Tools: SMBs are often not sophisticated enough and typically do not have the time to maintain a CRM or track customer level data. Square maintains customer data at the transaction level, and provides its merchant customers (for a subscription fee) a real time analysis on their customers, allowing businesses to determine who their best customers are and how to engage them. Square will also manage analytics around customer engagement and outreach.

Value Capture

Square captures value exclusively from the merchant side, not from the end consumer. The company charges 2.75% per transaction for the POS system and an unbundled subscription fee for the other value added services: CRM, Inventory Management, etc. However, the analytics dashboard is included free for users of the POS system. Square uses its elegant analytics dashboards as a leg up over emerging competition that has come in at a lower price point (i.e. charging less than 2.75% per transaction).

Challenges and Opportunities

Square has overcome a large challenge to get where it is today: the company completed the technical feat of bringing millions of transactions online and triangulating it with social and other publicly available data. Square leveraged this data to develop sophisticated fraud prediction techniques, which enabled the company to pay merchants much faster than alternatives. Further, it empowered merchants to user their own data to make smart operational decisions and help themselves grow. Last, it leveraged data to open up new lines of business such as Square Capital. Each step the business has taken has been a logical one that continues to leverage and reinforce the company’s data. Going forward, the company may target opportunities such as data aggregation (e.g., foot traffic analysis, industry analysis) and consumer product recommendations (similar to amazon recommendations) but for SMBs.

Sources:

https://techcrunch.com/2014/08/21/square-announces-analytics-tools-for-merchants/

https://ieondemand.com/presentations/data-science-and-machine-learning-square

https://squareup.com/pos/dashboard/analytics

https://www.wired.com/2014/05/square-wants-to-give-your-business-money-before-you-even-ask-for-it/