YPF: Securing the supply chain for developing Vaca Muerta

While Vaca Muerta formation provides a unique opportunity for Argentinean national oil company YPF, limitations to access international supply could become a major headache.

Shale Oil & Gas in Argentina

Natural resource avilability can define a whole country development thesis. This might be the case for Argentina: the Vaca Muerta oil & gas formation contains the world’s second largest shale gas and fourth largest shale oil reserve1. This constitutes a unique opportunity for the country to become energetically self-sufficient, commenters agree2 3.

Exhibit 1: Oil & Gas shale resources in Argentina

The opportunity will come along with massive impact: analysts expect annual investments of $10-15B, 40.000-60.000 new job positions and 3-4% impact on national GDP4. Requirements for the supply chain will simultaneously escalate with the increasing levels of well drilling. YPF, Argentina’s National oil company, holds roughly 40% of the Vaca Muerta acreage5, and therefore will have a key role.

Supply Chain for Shale operations

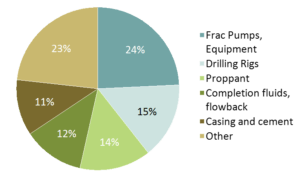

Field development requires a wide range of equipment, services and materials, with varying degrees of capital, technological and labor involvement. A typical well cost structure reflects this variety:

Exhibit 2: Typical well cost composition – based on IHS7

Exhibit 2: Typical well cost composition – based on IHS7

Some purchasing categories are typically sourced locally. Water, given its bulky nature, benefits from low transportation costs. Other categories are better suited for international supply; given a variety of reasons:

- Lack of local suppliers: for services that require advanced technological expertise, only available to a handful of global providers (e.g. directional drilling services).

- Price competitiveness of international sources: when lower total costs can be achieved by sourcing internationally (e.g. Chinese manufactured piping).

- Opportunistic access to favorable prices: e.g. for services or equipment with global excess capacities driving low rates (e.g. drilling rigs in 2015-16).

This global nature implies a strong exposure to changes in international trade regulations, which could limit the access (price or volume) to the supply markets.

YPF approach to major supply categories

Argentina’s recent history included heavy currency controls and import restrictions8; government officials and independent analysts recognized this regulations affected the industry sourcing cost9 10. Although special conditionsb have provided preferential treatment for the industry, YPF specific strategies helped secure local supply for key categories:

Proppanta: In-house development

Since 201511, YPF participates in sand production, as a way to replace imports. With investments of $500M, it owns capacity to extract, process and store 500,000 tons annually. While costs are stated as a major reason12, in-house also hedges against changes in import conditions.

Drilling rigs: Long term contracts

In 2014, YPF signed deals with American based Helmerich & Payne13 (H&P) and Bermuda-based Archer Limited for the supply of 15 movingc rigs. The contracts established a long-term (5 years) and monetary ($1.200M) commitment, securing the availability and nationalization for the subsequent years.

Exhibit 3: YPF walking rigs

Local supplier development

YPF has historically held programs to develop local suppliers. In December 2016, a supplier performance program was established to improve competitiveness of local providers through improved quality and efficiency. The program focuses on improving efficiency in topics including planning and control, cost management, plant lay-out and maintenance 14.

Additional preventive actions

While, globally, countries are increasingly flirting with ideas of nationalization and isolationism, Argentina has taken steps on the opposite direction. Most recently, a cut on import tariffs was established in August 201715. However, local content policies such as Compre Neuquino still persist16, and, local actors from pipe manufacturers to trade unions have expressed their concerns on globalized trade impact17 18. While costly, certain measures can be considered to cope with scenarios of future restriction in access to the global supply chain:

- Expand in-house development: evaluating potential vertical expansion to secure the supply for specific services, following the example of companies such as Pioneer19, which have business activities in services such as pressure pumping or well services.

- Leading local supplier development: being a major procurer, YPF can leverage its technological and engineering expertise, and provide conditions that enhance the long-term development of cost effective local solutions.

- Strategic partnerships: For services that require advanced technology (ie. Directional drilling), given the unlikelihood of development locally or in-house, long-term partnerships with global providers can better secure provision of such services, instead of short-term contracts.

- Up-fronting capital investments: in periods of favorable import regulation, specific imports can be realized in advance, building supply inventories or drilled wells stocksd; these can be accessed in the future while local supply chain develops.

Looking forward

While recent developments in Argentina do not point to increased isolationism, the global zeitgeist and a complex local ecosystem endorse the prevalence of risks for international trade access. However, since preventive actions imply a heavy burden on operational and capital costs, two major questions arise:

- What is the best approach, considering the trade-off between cost of prevention and likelihood of trade restriction scenarios?

- Should the company follow a preventive approach or only act reactively when risks become real?

(Word count = 788)

Notes:

A. Proppant (Hydraulic fracturing proppant), typically sand, treated sand or other artificial ceramic materials, are injected into the well during the hydraulic fracturing stage, to keep an induced hydraulic fracture open.

B. Decree 927/2013 establishes a preferred import regime for the Oil & Gas industry.

C. Moving rigs are drilling rigs with capacity to laterally relocate within a field without need for dismantling, typically through a skidding or walking technology.

D. Wells can remain unfinished, for commercial or technical reasons, in different stages of development. For example, a drilled well can stay unfinished until a completion set is available; a completed well can remain offline, waiting for better commercial terms for production.

Citations:

- US Energy Information Administration; “Technically Recoverable Shale Oil and Shale Gas Resources: An Assessment of 137 Shale Formations in 41 Countries Outside the United States”; https://www.eia.gov/analysis/studies/worldshalegas/pdf/overview.pdf

- Cristian Folgar (Atlantic Council); “The New Argentina: Time to Double Down on the Energy Sector?”; http://publications.atlanticcouncil.org/argentina-energy/ac_argentina.pdf

- E&P Mag; “Argentina’s Vaca Muerta Shale”; https://www.epmag.com/argentinas-vaca-muerta-shale-718661#p=full

- Argentine Oil & Gas Institute (IAPG); “Análisis y Proyección de Impactos Económicos Esperados del Desarrollo de los Hidrocarburos No Convencionales en Argentina: Cuantificación de Impactos Económicos del Desarrollo en Escala de Vaca Muerta en la Provincia de Neuquén”; http://www.iapg.org.ar/download/1000pozos.pdf

- Jean Grey, “Which lessons can Vaca Muerta learn from the US?”; https://d3.harvard.edu/platform-rctom/submission/which-lessons-can-vaca-muerta-learn-from-the-us/

- Carlos T. James: “Challenges to developing Argentina’s shale gas reserves”; http://carlosstjames.com/renewable-energy/challenges-to-developing-argentinas-shale-gas-reserves/

- Trends in U.S. Oil and Natural Gas Upstream Costs; EIA; https://www.eia.gov/analysis/studies/drilling/pdf/upstream.pdf

- “Cepo cambiario: cronología de estos cuatro años de restricciones”; December 2015; http://www.lanacion.com.ar/1854739-cepo-cambiario-cronologia-de-estos-cuatro-anos-de-restricciones

- “Moreno advirtió que el cepo a las importaciones seguirá otros dos años”; September 2015; http://www.lanacion.com.ar/1616084-moreno-advirtio-que-el-cepo-a-las-importaciones-seguira-otros-dos-anos

- KJETIL SOLBRÆKKE AND BIELENIS VILLANUEVA TRIANA, Rystad Energy; “IS VACA MUERTA COMPETITIVE IN TODAY’S MARKET?”; http://www.ogfj.com/articles/print/volume-13/issue-11/features/market-development-in-argentina.html

- Esteban Lafuente, Apertura; “Qué son las arenas de sostén, la nueva apuesta de YPF”; http://www.apertura.com/negocios/Que-son-las-arenas-de-sosten-la-nueva-apuesta-de-YPF-20150423-0006.html

- YPF, “YPF empezará a producir arena para bajar un 10% el costo de pozos en Vaca Muerta”, http://www.ypf.com/energiaypf/Novedades/Paginas/YPF-empezara-a-producir-arena-para-bajar-un-10-porciento-el-costo-de-pozos-en-Vaca-Muerta.aspx

- YPF, “Sumamos 15 nuevos equipos de perforación de última generación”, http://www.ypf.com/YPFHoy/YPFSalaPrensa/Paginas/Noticias/15-nuevos-equipos-de-perforacion-de-ultima-generacion.aspx

- TELAM, “YPF y um programa para mejorar la eficiência y productividad de sus proveedores”, http://www.telam.com.ar/notas/201612/173911-ypf-productividad-proveedores.html

- Linkedin, “Argentina cuts tariffs on used oil equipment imports to develop Vaca Muerta”, https://www.linkedin.com/pulse/argentina-cuts-tariffs-used-oil-equipment-imports-develop-leporati

- Compre Neuquino, http://cvh.cpymeadeneu.com.ar/pdf/LEY2755%20-%20Compre%20Neuquino%20para%20Operadoras%20Hidrocarburos%20y%20Mineria.pdf

- Luc Cohen, Reuters, “RPT-Tariff fight roils Argentina’s shale patch as Macri opens trade”, https://www.reuters.com/article/argentina-shale/rpt-tariff-fight-roils-argentinas-shale-patch-as-macri-opens-trade-idUSL1N1K301X

- Francisco Aldaya, Buenos Aires Herald, “Chinese threat looms large over local steel industry”, http://www.buenosairesherald.com/article/223631/chinese-threat-looms-large–over-local-steel-industry-

- Pioneer website; accessed November 2017; http://www.pxd.com/operations/vertical-integration

Very informative summary and interesting questions!

It’s good to hear that Argentina is moving in the opposite direction of many other countries with increasingly isolationist policies. The oil and gas industry as the power to transform an entire economy. Thus it would in theory be in the Argentinian government’s best interest to “grease the wheels” of YPF’s operations by ensuring access to cheap industrial goods imports, at least in the initial phases of resource collection. If YPF can later help produce cheap energy for Argentinian industrial goods producers and disseminate skills and industry knowledge among the Argentinian workforce, perhaps this will spur local production of the types of equipment YPF requires.

To hedge against the threat of isolationist trade policies, should they arise, the preventive actions you laid out make sense and could be categorized as, ‘take more control over the supply chain and produce locally.’ If executed successfully, owning more of the value chain can also mean capturing more value at each step: chemical production, pump manufacturing, transport. Because YPF is partially owned by the government, even value that is usually externalized to the general public (increased employment, income taxes paid, well-being of citizens) are at least partially captured by the company’s owners. This could help tip the balance between the benefits of producing locally and the cost savings from sourcing abroad.

My cynical side would like to raise an additional challenge with common to ‘local content’ requirements for resource projects. Often these requirements serve as a de facto means of ensuring that connected actors within a nation-state are able to capture a share of the value created by resource production, often resulting in decreased efficiency and higher cost. Local content requirements are only truly effective as a hedge if they can induce a true local ecosystem of suppliers, talent and technical expertise to serve the resource sector.

Great article, T. I agree with Jen in wondering whether YPF has enough influence to keep the Argentinian Government’s idea of isolationist tendencies at bay. Regardless of the answer, I think it would behoove YPF to engage in preventative behavior that helps grow their access to exploration, production, and development technologies of their own that they could draw upon in the event of drastic governmental actions. In fact, I think YPF’s semi-precarious situation provides an excellent opportunity to examine and implement some tactics currently used by leading US E&P companies like EOG. EOG has developed significant expertise in subsurface analysis, completion design, and sourcing capabilities and is well known for being a company that has divested from reliance on service company knowledge and technology. Replicating this type of strategy could be an interesting and perhaps less obvious use of capital that might fuel long-term productivity for the company, in both Vaca Muerta and beyond.