Which lessons can Vaca Muerta learn from the US?

Vaca Muerta is not an opportunity for YPF, but for Argentina as a whole. The exploitation of unconventionals will lead the country to regain energy self-sufficiency”

YPF Ex-CEO, Miguel Galuccio at the HBS LatinAmerican Conference 2016

YPF, Argentina’s National Oil Company (NOC), has under concession 12.000km2 (~40%) of Vaca Muerta, one of the most prominent geological formations of Shale oil and gas in the World.

Argentina is the only country producing commercial quantities of Shale oil in Latin America, with YPF leading the efforts. The Company has reported results for 2Q2016 of +500 producing wells, Shale production levels of 51.6Kboe/d(1), and horizontal wells average costs of U$16.0M.

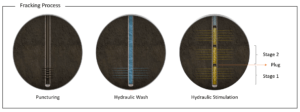

The extracting method for Shale oil & gas:

The oil or gas in Shale formations is embedded in the rock, and therefore, needs to be extracted through a fracking process called hydraulic stimulation. This process involves injecting a mixture of 95% of water, 4.5% of sand and 0.5% of chemicals into the well at high pressure, creating a shockwave that fractures the rock and releases the oil or gas. The sand in the mixture has the functionality of keeping the new cracks “opened” allowing the oil and gas to flow into the well.

Source: https://youtu.be/ZAQQC-KS680

Extraction of unconventionals: a threat to the environment?

Although Shale development is still a “young” industry, it is evolving fast. Moreover, within a global context of low oil prices, the required pace of innovation to enable a profitable development of Shale resources needs to be even faster – rapidly changing technologies and processes are key to allow companies seek cost reductions while improving wells productivity with every well drilled.

In that context, to the traditional potential damage O&G companies can create to the environment, Shale development brings new environmental concerns, focused mainly on water, air and land damage:

- Disposal of waste water: during the hydraulic fracturing process water is mixed with sand and chemicals. ~25% of that contaminated water returns to the surface and needs to be either “reused” or disposed of in special disposal pools or wells.

- Quantity of water used (in remote areas): hydraulic fracturing requires huge volumes of water – ranging from ~7-60M liters per well (~2-16M gallons). Also, many Shale locations might not necessary be close to water resources, making this an even bigger problem.

- Release of methane to the atmosphere: Due to water reflux and possible surges of natural gas during fracking, Shale wells can release x230 times more natural gas and other compounds, that could act as smog to the atmosphere, versus regular wells.

- Air pollution from trucks and pumping equipment during fracking.

- Damage to land surface through clearing, land and roads preparations.

Unique political momentum to think about policy:

The lack of international capital has been a top constraint to further develop YPF’s Shale reserves. Still, the renewed political-context in Argentina is expected to bring investments to the energy sector, and has also started a new era of energy policy and cooperation with the United States. Additionally, Argentina has announced its commitment to strengthen its national climate change plan: which means we should expect regulations on climate change to evolve — and potentially address the new concerns that affects the Shale industry. In this context, Argentina has a unique opportunity to look at the US experience in designing and implementing environmental regulations, leveraging what has worked and learning from what have failed.

3 key lessons learned that can be replicated in Argentina:

- Federal vs Provincial regulation flexibility: environmental standards should be established at a national level to a limited extent. It is prominent to allow some regional-level regulatory framework flexibility to keep up with business rapid development (permitting fast innovation and avoiding regulation becoming the bottleneck). This will require technical/qualified talent to control compliance to environmental regulations, but also, to update the legislation accordingly, in line with the continuous technology and process improvements.

- Efficiencies in information sharing and transparency across all stakeholders: Coordination between companies, government, and society can contribute to a robust regulation evolution, and help build public confidence and clarification towards real versus perceived environmental risks associated with Shale development.

- Improve access to data about Shale development as industry grows: actors will need to balance the disclosure of relevant public information versus the need of protecting confidential agreements to continue developing Shale production and regulation. Knowledge transfer, Best Practice sharing, disclosure of fracking chemical components, and baselines on natural resources environmental conditions are few examples of valuable information elements for regulators, education institutions, government, NGOs and other companies. Still many times this information needs to be kept private to foster R&D and E&P investments.

Conclusion:

YPF and Argentina’s energy sector face an unparalleled development opportunity in the exploitation of unconventionals. Shale’s potential is immense. Still, climate change policies and regulations will play a key role on determining the pace and sustainability of such development. In this setting, YPF should emerge as a key economic actor, providing business knowledge and transparency that can result in efficient regulatory frameworks that will help achieve Vaca Muerta’s full potential.

Sources:

http://www.lanacion.com.ar/1642155-ypf-repsol-cronologia-de-un-conflicto-que-duro-un-ano-y-medio

http://www.ypf.com/Vacamuertachallenge/Paginas/index.html

http://www.reuters.com/article/us-usa-argentina-climatechange-idUSKCN0WP23K

http://www.thedialogue.org/resources/energy-in-argentina-a-new-investment-climate/

Notes:

(1) Thousand barrels of equivalent oil per day

Word count: 800

One other piece to consider is the impact of international oil prices on ROI of shale extraction- shale has tremendous potential but investing in shale extraction when oil/gas prices are low is much more difficult. Oil prices can change rapidly, suddenly making shale oil extraction a lot less profitable as happened in the US in North Dakota a few years ago. Thus, if shale is to be developed further in Argentina, there would also need to be a longer-term perspective and potential long-term investor or government support to reduce the impact of monthly/yearly oil price variation.