Will Digitization Eat Blue Apron for Lunch?

Will a newly implemented automated fulfillment center and inventory management system be Blue Apron’s undoing?

Digitization and the future of fulfillment

Blue Apron helped to create the direct to consumer “meal kit” business, and now faces extreme competition from startups and technology behemoths alike. A core part of the company’s thesis is in realizing significant and rapid operational efficiencies in its fulfillment centers through digitization.

With the influence of new technologies in automation, prediction, communication, and delivery, supply chains have moved to not only become more efficient but also key levers in driving sales and releasing new products [1][2]. The importance of supply chain effectiveness is enhanced by the nature of Blue Apron’s business, as the margin for error with perishable foods is slim. Getting digitization right gives the company a path towards profitability and new product innovations. Indeed, as Amazon’s success has shown, the significant capital investments required for such efforts create an extremely effective moat in deterring would be competitors.

What is Blue Apron doing about it?

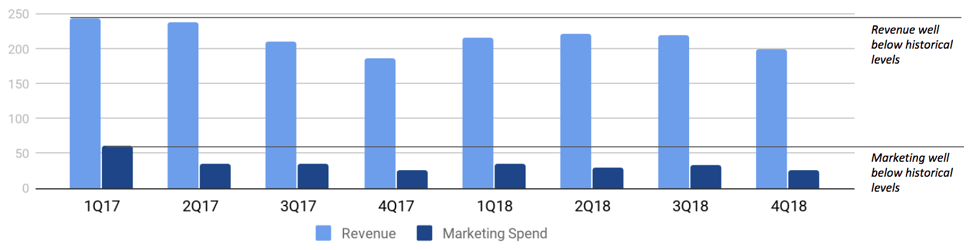

Blue Apron’s business model hinges on efficiency gains in its fulfillment centers (see figure 1) [3]. Labor utilization efforts have driven some improvement to margins, but at the cost of labor abuses and PR issues [4][5].

Figure 1: Blue Apron historical and forecasted COGS and EBITDA (% of Sales)

The management team has shifted its focus to investments in digitization within its fulfillment centers. Its short and long-term strategies are effectively the same – push automation as aggressively and rapidly as possible. In 2Q2017, Blue Apron made a major move towards digitization in a two-pronged effort. First, it opened a new, more automated, distribution center in Linden, NJ, and second, it rolled out new order management systems to 5,000 workers throughout its other warehouses to increase transparency and flexibility [6]. Currently, ~50% of their national demand is serviced out of Linden, and Blue Apron has been able to reduce their east coast fulfillment center workforce from ~2,000 to ~800 workers [7].

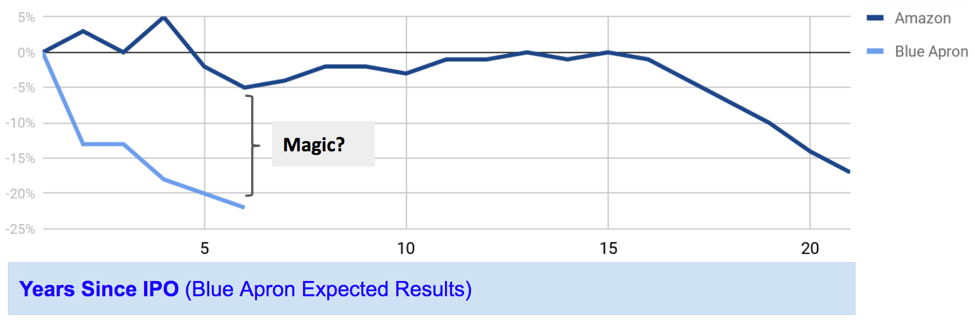

While these moves are expected to have long term benefits, they have led to a potentially disastrous immediate situation. The first warning sign was a consistent downtick in their OTIF rate (orders On Time and In Full), which has kicked off a potentially life-threatening death spiral for Blue Apron (see figure 2) [8].

Figure 2: The Blue Apron death spiral

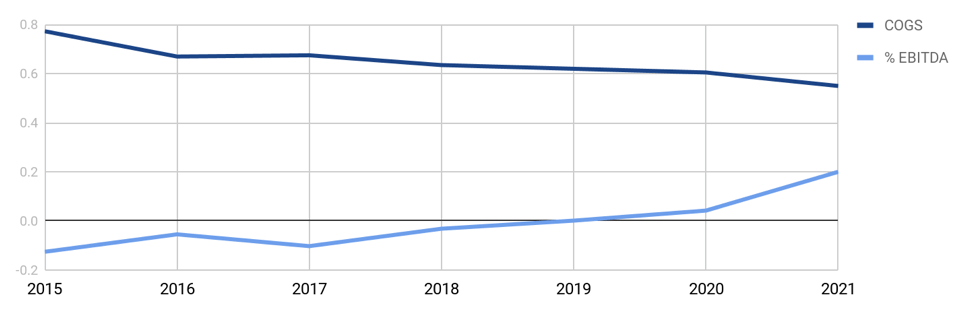

Blue Apron’s Q3 earnings and revised guidance do not give confidence that the company has figured out how to break this cycle. They have slashed their marketing budget, posted a net subscriber loss for the quarter, and don’t forecast a net revenue increase through 2018 (see figure 3) [9][10]. These issues have led to potential delays in launching new product and assortment options, and the resignation of Co-Founder and COO Matthew Wadiak [11].

Figure 3: Blue Apron Revenue and Marketing expectations ($M)

So, what should they do now?

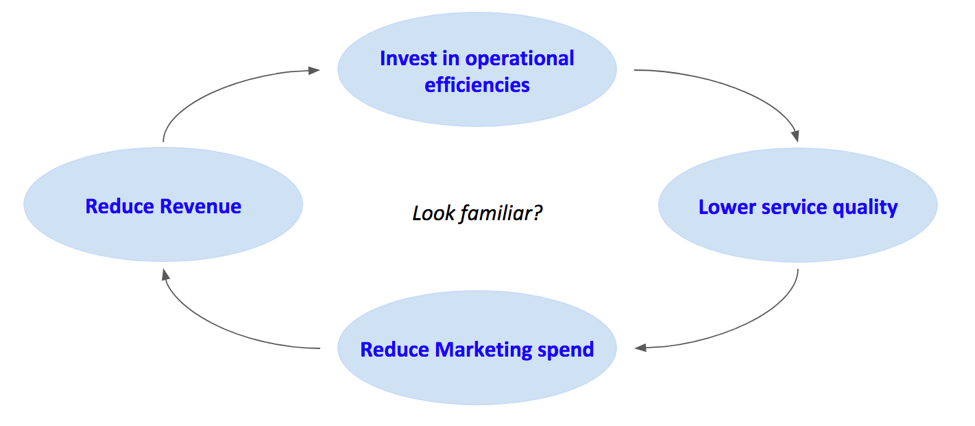

In retrospect, it is it is easy to diagnose what happened – Blue Apron bit off more than it could chew with sweeping, system wide changes. A comparison to Amazon illustrates what management got wrong (see figure 4) [12]. Digitization efforts represent a long-term company strategy, not short-term cost savings, and the company implemented too many radical changes without redundancies. Blue Apron’s management team have backed themselves into a tight corner, particularly with the specter of Amazon’s integration of Whole Foods [13].

Figure 4: Blue Apron and Amazon change in estimated fulfillment costs since IPO (% delta)

In the long-term, I believe that Blue Apron needs to be taken off of the public markets in order to operate effectively. Public markets create an excessive amount of short term pressure for the company to realize fulfillment center efficiencies too rapidly, which may have the effect of breaking the company. The company needs a mindset shift from a focus on short term profitability to long term sustainability – management have already demonstrated that they cannot withstand financial pressures in the manner of Bezos and Amazon. Simply put, they need to slow down.

The short-term prospects for the company are challenging, but there is some light at the end of the tunnel as OTIF rates appear to have hit their nadir [14]. They should focus on two areas, which will likely come at the expense of short term profits (feeding in to my long-term recommendation for the company). First, they should delay new product and assortment launches to refocus on improvements to their OTIF rates and double down on investments in training and their employees. Second, once their OTIF rates are back to acceptable levels, they need to ramp up their marketing budget back to 1Q17 levels to regain market share quickly.

A key question that remains is how Amazon will take advantage of this stumble. They have dipped a toe in the meal kit space, presumably as they have focused on their Whole Foods integration, but this opening may spur further investment.

Word Count: 800

[1] Knut Alicke, Daniel Rexhausen, and Andreas Seyfert, “Supply Chain 4.0 in Consumer Packaged Goods,” McKinsey & Co., April 2017, https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/supply-chain-4-0-in-consumer-goods, accessed November 2017.

[2] Dale Benton, “Supply Chain 4.0: Adidas and Amazon Re-Write the Rules on Supply Chain Management,” Supply Chain Digital, February 10, 2017, http://www.supplychaindigital.com/scm/supply-chain-40-adidas-and-amazon-re-write-rules-supply-chain-management, accessed November 2017.

[3] Heath Terry, “Creating a Category and the Competition to Go With It; Initiate Buy,” The Goldman Sachs Group, July 24, 2017, page 14, accessed November 2017.

[4] David Morris, “Report Details Blue Apron’s Violent, Unsafe, High-Pressure Packing Facility,” Fortune.com, October 2, 2016, http://fortune.com/2016/10/02/blue-apron-packing-facility/, accessed November 2017.

[5] Edwin Lopez, “Rush to Scale Supply Chain Leads to Warehouse Troubles in CA,” Supply Chain Dive, October 5, 2016, https://www.supplychaindive.com/news/blue-apron-warehouse-mismanagement-ca/427534/, accessed November 2017.

[6] Jason Del Ray, “Blue Apron Stuck in Dangerous Cycle that has Nothing to do with Amazon,” recode, August 11, 2017, https://www.recode.net/2017/8/11/16127050/blue-apron-q2-earnings-warehouse-issues-linden-new-jersey-matt-salzberg, accessed November 2017.

[7] Jennifer McKevitt, “Blue Apron Alleviates Supply Chain Angst with Move to Automation,” Supply Chain Dive, August 8, 2017, https://www.supplychaindive.com/news/blue-apron-jersey-city-linden-losses-public-offering/448800/, accessed November 2017.

[8] Blue Apron, FQ3 2017 Earnings Call Transcript, page 4, via CapitalIQ, accessed November 2017.

[9] Heath Terry, “Q3: Growth Slows as Operational Issues Force Marketing Reduction,” The Goldman Sachs Group, November 3, 2017, page 5, accessed November 2017.

[10] Adam Levy, “Blue Apron’s Failed Execution Just Opened the Door for the Competition,” The Motley Fool, August 15, 2017, https://www.fool.com/investing/2017/08/15/blue-aprons-failed-execution-just-opened-the-door.aspx, accessed November 2017.

[11] Del Ray, “Blue Apron Stuck in Dangerous Cycle that has Nothing to do with Amazon.”

[12] Amazon, Historical Financial Results, via CapitalIQ, accessed November 2017.

[13] Levy, “Blue Apron’s Failed Execution Just Opened the Door for the Competition.”

[14] Blue Apron, FQ3 2017 Earnings Call Transcript, page 4, via CapitalIQ, accessed November 2017.

I’m completely in agreement with the fact that public markets often create an excessive amount of short term pressure for companies to realize improvements too rapidly, which in turn spurs the death spiral you illustrated with Blue Apron. This seems to be a pattern in the startup market, as entrepreneurs and investors are let down following artificially public high valuations.

Blue Apron’s failed execution clearly opened the door for competition like Amazon, however I don’t think all competition will benefit from Blue Apron’s failure. HelloFresh, the Berlin-based cooking kit delivery company, recently revealed that it’s planning to raise up to $353 million in an IPO on the Frankfurt Stock Exchange [1], and given its similarity to Blue Apron, there’s no reason it won’t head down the same path as Blue Apron. It’s also backed by Rocket Internet, an incubator known for taking existing business models (i.e. Blue Apron’s) and applying them elsewhere (in this case, Germany/Europe). While Amazon’s size and resources prevent it from facing the same kind of pressure as Blue Apron, I doubt that startup competitors headed towards IPOs will be able to learn from Blue Apron’s mistakes.

[1]: Roof, Katie. “Blue Apron competitor HelloFresh planning to raise up to $353 million in IPO” TechCrunch, Oct 17, 17: https://techcrunch.com/2017/10/10/blue-apron-competitor-hellofresh-planning-to-raise-up-to-353-million-in-ipo/

The meal kit delivery industry is a really tough space to compete in. There are so many players between Hello Fresh, Plated, Dinnerly. The issue here is that digitization efforts almost become tablestakes if the goal is to be the largest player. To be the largest player in the industry, you have to be the logistics master and digitization is what gets you there. In that respect, Amazon absolutely excels.

There are two big things that come to mind here for me. One, is whether or not Blue Apron wants to be THE player or sees themselves as potentially one of many players. Is this a space where people become loyal to one meal delivery kit or continue to rotate across several based on preferences? If it’s not a winner take all space then Blue Apron needs some level of product differentiation that makes people choose it time and time again. I don’t think digtization and logistics makes you the winner in that way necessarily. Delivering fresh food is just something you have to do. I agree that right now they’re distracted by rolling out too many changes at once, but they need some broader poitn of differentiation

As for Amazon, they’re definitely going to become a major player in this industry. That said, I wonder at what point people become frustrated or leery of Amazon. How much exposure is too much exposure? The time may not be soon, but I can imagine a future where people choose not to use Amazon simply because they’re sick of having their whole lives run by one company. Broadening their reach into every aspect of our lives, including meal delivery, only increases this risk

As Patrick mentioned, Blue Apron is in a really tough space in an industry without much room for error. Launched with a great marketing plan, Blue Apron has yet to understand what it takes to operate its facilities efficiently. Though an endless stream of new meal options and ingredients is great for marketing, it is a nightmare for the operations themselves. As a company, Blue Apron seems completely lost on what direction to take. Though Patrick mentioned these actions of investing heavily in inventory management and other operating systems as well as labor reductions to get production under control, Blue Apron management has also explored outsourcing its production entirely– a seemingly completely different strategy. And while Patrick mentions that maybe Blue Apron needs to slow down in order to get its arms around its operations themselves, the entry of Amazon into the meal kits arena does not afford them that luxury. As Patrick alludes, however, there is still time for Blue Apron to figure it out, but it will probably require some drastic changes led by some TOM students rather than Marketing class stars. These changes will most likely involve a consolidation of ingredient SKU offerings, in which the company can still offer a wide variety of offering using a more consolidated menu of goods. By consolidating its ingredients used, Blue Apron will be able to leverage economies of scale to unlock operating efficiencies as well as lower procurement prices.

While I agree with Patrick that the intensifying competition is a big problem for Blue Apron, I question the inevitability of the death spiral diagnosis in figure 2. Does investing in operational efficiencies necessarily lead to lower service quality? I suspect that investing in efficiencies such as delivery system speed and agility could improve both operational efficiency and service quality. As btaylor mentioned in his comment, TOM students can help them get out of their rut, and they can do it by increasing their top as well as their bottom line.