Trade wars for aircraft OEMs: Can Boeing keep cruising?

International trade has “democratized” the aircraft industry. Can major players sustain control over an increasingly global supply chain and survive the threat of international OEMs?

Stable duopoly and healthy order books: Boeing has long held a secure position in the aviation industry. However, the rise of international trade and globalization have led to growing concerns over Boeing’s ability to retain control of a global supply chain, and its strategy to address the rise of international players.

A globalized economy

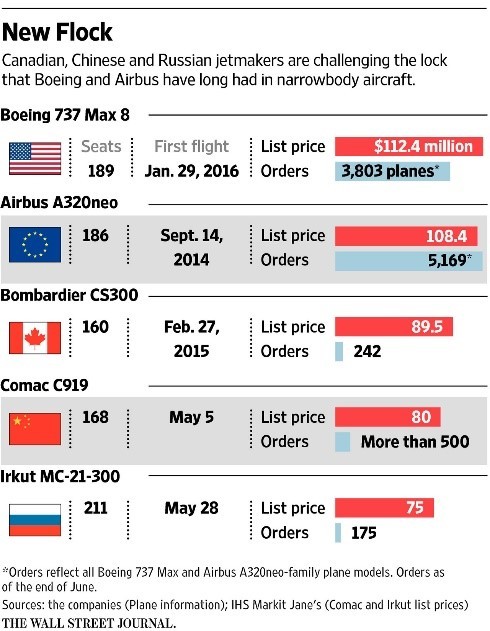

International trade has “democratized” the aircraft manufacturing industry, giving smaller players the opportunity to leverage a global supply chain to lower costs and compete with established power players such as Boeing. The introduction of the Cseries by Montreal-based Bombardier, as well as Chinese Russian aircrafts, has disrupted one of Boeing’s most stable and attractive segments: the single aisle market [1].

International trade has also offered airlines more opportunities to source aircrafts from these new players. In an era with favorable economic conditions for the airlines industry -low oil prices, robust customer demand, and player consolidation [2], the power has shifted to airlines and increased competitive pressure on OEMs.

Finally, Boeing’s own attempt at leveraging the global supply chain trend backfired: their bold strategy for the 787 Dreamliner, consisting in outsourcing 70% of its production to international suppliers [3], resulted in a 3-year delay and billions of dollars lost due to a complex and difficult to manage supply chain [4].

Regaining control

In an effort to control its global supply chain and retain its competitive edge in the long term, Boeing is now pursuing vertical integration into specific parts and services, particularly those with significant aftermarkets sales [5] -it just acquired Aurora Flight Services [6]. This long-term strategy allows them to regain control over their supply chain, and strengthen their relationship with their newly empowered airlines customers. For the parts they still plan to outsource, Boeing is establishing strong partnerships and investing in improving the operational excellence of its suppliers to ensure their proper integration in the Boeing value chain in the future. For instance, they have struck an agreement to improve efficiency and lower costs for Japan based Mitsubishi Heavy Industry, which produces 787 wings [7].

However, their strategy to deal with international players in the immediate future has been deeply flawed at worst, short-sighted at best. Years of aggressive dissuasion techniques and pressure on Bombardier culminated this October in “mighty Boeing [seeking] protection behind the skirts of the U.S. Department of Commerce” [8] by slapping a 219% tariff on Cseries imports. Boeing’s protectionism in response to the international trade threat was meant to keep competition out of the US and boost domestic sales. However, it has already set into action irreversible changes in the industry:

- A surprising Airbus-Bombardier partnership in an attempt to side-step the tariffs, which strengthens Airbus’s position in the single aisle market [9]. If it succeeds, then Boeing’s goal of protecting its domestic sales and keeping competition out has failed.

- Dissatisfied airlines and suppliers, who just lost access to an aircraft manufacturer, opposing the tariffs [10].

- Hostile governments in the UK and Canada where Bombardier employs thousands, potentially retaliating against Boeing by terminating military contracts [11].

Can Boeing stop the free-fall?

There is a path for Boeing to recover and address international trade threats:

- In the short term, the OEM needs to amend relationships with all stakeholders impacted by the tariffs to minimize consequences on its future sales, and its own global supply chain. This means allowing the Airbus/Bombardier partnership -the only way for Bombardier to keep producing and selling Cseries- to circumvent tariffs.

- In the medium term, lead a major cost reduction across its entire supply chain to achieve new levels of operational efficiencies. With the recent backlash to the tariffs, Boeing is now overpowered in the industry and will need to demonstrate superior production capabilities to remain relevant.

- In the long term, maximum automation and digitalization of the production lines and order processing for itself and its suppliers will ensure the sustainability of the global supply chain model. It will do so by reducing the risk of delays and poor integration along the supply chain by removing the human factor and ensuring suppliers can meet Boeing’s production ramp-up and takt-times. On that front, the aircraft industry has a lot to learn from companies in other industries such as Siemens, which have made great strides towards fully automated lines, or lights-out manufacturing [12].

In leveraging a protectionist government to protect itself from international trade threats, Boeing is now on the defensive and a new question arises: Would the tariffs have occurred under a different administration? Assuming a change of administration and global policy in the next 3-8 years, can Boeing build capabilities quickly enough to be equipped to face international trade headwinds on its own?

Word count: 791

[1] Robert Wall, “New Jets Threaten Airbus and Boeing Duopoly”, Wall Street Journal, July 16, 2017, https://www.wsj.com/articles/new-jets-threaten-airbus-and-boeing-duopoly-1500202802, accessed November 2017.

[2] Jonathan Kletzel, “2016 Commercial Aviation Industry Trends”, Strategy& Industry perspectives, https://www.strategyand.pwc.com/trends/2016-commercial-aviation-industry-trends, accessed November 2017.

[3] Phaedra Hise, “The remarkable story of Boeing’s 787”, CNN Money, July 9, 2007, http://money.cnn.com/magazines/fsb/fsb_archive/2007/07/01/100123032/index.htm, accessed November 2017.

[4] Ruairi O’Donnellan, “Project Failures: Boeing’s 787 Dreamliner”, Brightwork (blog), May 13, 2016, https://www.brightwork.com/blog/project-failures-boeings-787-dreamliner#.WgPJmsanE2w, accessed November 2017.

[5] Dominic Gates, “Boeing creates new in-house avionics unit, reversing years of outsourcing”, The Seattle Times, July 31, 2017, https://www.seattletimes.com/business/boeing-aerospace/boeing-setting-up-new-in-house-unit-to-build-avionics-controls/, accessed November 2017.

[6] “Boeing completes acquisition of Aurora Flight science”, press release, Nov 8, 2017, on PR newsletter, https://www.prnewswire.com/news-releases/boeing-completes-acquisition-of-aurora-flight-sciences-300551647.html, accessed November 2017.

[7] James Pozzi, “Boeing transforms its supply chain”, MRO Network, October 23, 2017, http://www.mro-network.com/manufacturing-distribution/boeing-transforms-its-supply-chain, accessed November 2017.

[8] George Will, “The radiating mischief of protectionism”, National Review, October 28, 2017, http://www.nationalreview.com/article/453189/boeing-bombardier-tariffs-protectionist-mischief-hurts-americans, accessed November 2017.

[9] “Why Airbus’s tie-up with Bombardier is so damaging for Boeing”, The Economist, October 19th, 2017, https://www.economist.com/news/business/21730466-american-aerospace-giants-campaign-tariffs-against-c-series-aircraft-has, accessed November 2017.

[10] Steve Forbes, “Crony capitalism flies high in Boeing’s anti-trade allegations”, October 29, 2017, http://thehill.com/opinion/finance/357674-crony-capitalism-flies-high-in-boeings-anti-trade-allegations, accessed November 2017.

[11] Rob Davies, Henri McDonald, “UK warns Boeing it could lose contracts over Bombardier dispute”, September 27, 2017, https://www.theguardian.com/business/2017/sep/27/uk-boeing-contracts-bombardier-us, accessed November 2017.

[12] Alessi, C. and C. Gummer, “Germany Bets on ‘Smart Factories’ to Keep its Manufacturing Edge,” Wall Street Journal, October 26, 2014.

Lynn, your suggestions are very impressive and I agree with them wholeheartedly. I find it bizarre that a company like Boeing, which operates in a effective duopoly alongside Airbus, wastes so many resources in protectionist battles which will likely – to your point – only come to harm their OEM relationships. Boeing is operating in a very global industry and is the most vulnerable company in the US (given its size as percent of U.S. market) to the ramifications of the protectionism it embraces–getting cut off from global trade outright.

Your automation point really resonated with me. At its core, Boeing needs to revolutionize its manufacturing process by embracing automation. Boeing to date has benefited from being one of two incumbents in the aircraft manufacturing space, but that seat is by no means defensible. China plans to spend more than $60bn annually on robotic research and development, which will account for more than 30% of global robotic spending. Once China leads global robotics adoption, it is unlikely that they will need companies like Boeing for any portion of their supply chain as economies of scale will enable them to make the same parts with more precision and accuracy at a lower cost.

http://www.scmp.com/tech/china-tech/article/2084740/manufacturing-automation-drive-chinas-robotics-spending-us59b-2020

Pretty amazing that Boeing, a company that has spent the better part of the last 2-3 decades taking the EU to task over unfair trade practices with Airbus has taken this approach themselves. But I guess if you can’t beat ’em, join ’em?

I agree that Boeing should be looking to 2020/2024 as the horizons for these protectionist policies and investing heavily in an actual sustained advantage, but I’m also wondering if they will need to worry about that by then? Given the long replacement cycles on aircraft, will Bombardier miss out on an entire generation of sales to single aisle aircraft purchasers? Will that have such a substantial financial impact on the business that they may not survive long enough to see a change of administration?

This begs an interesting question about Bombardier’s competitive response. Do they focus on less protectionist, if smaller markets? Or do they invest heavily in dramatically reducing costs to be competitive even with tariffs, which would result in a pretty significant cost advantage if (when?) the tariffs come down.

A great representation of how most companies and people espouse free trade as a value, but actively support protectionist policies when they are in their favor. Reminds me of the Canadian dairy industry actually….

I agree that all of Boeing’s work to isolate themselves only gives them a short window with which to increase their efficiency before the policies are removed. Future administrations (of either party) are much less likely to be supportive of protectionism and removing tariffs from the airline industry is an easy win for any politician looking to win international favor while claiming to support average consumers over big business. However, 3-8 years is a long time in any industry and Boeing can use that time very effectively to streamline their operations and build their supplier’s capabilities. While supporting controversial policies is not generally a good decision for most companies, Boeing does find itself in a position to maximize the current opportunity it is presented.

Lynn, your essay was well-written, well-researched, and articulate.

I took a slightly different approach when viewing the issue in terms of what makes Boeing competitive. Some might call this the other side of the story, but I believe it reflects an economic reality that Boeing needs to cope with to stay “aloft.”

According to Boeing, Airbus has received over $20 billion of illegal launch subsidies from European Union countries. This means that Airbus is effectively being subsidized in its manufacturing and production, leading to an ability to charge lower prices for its aircraft to maintain the same level of profitability. Furthermore, the WTO has ruled these subsidies as illegal.

The claim can be found here: http://www.boeing.com/company/key-orgs/government-operations/wto.page

Correspondingly, the U.S. government has also aided Boeing unfairly. However, this is to a much smaller magnitude – under $1 billion. In the context of a fundamentally unfair trade situation, one may argue that Boeing needs to resort to these lobbying measures to maintain an even playing field. Why shouldn’t Boeing lobby the U.S. government to implement these tariffs if the competition is being subsidized by the EU?

Excellent article. Free trade and open markets depend on trust. Boeing’s protectionist posture has eroded that trust and we see the backlash from customers, suppliers, and competitors. It is a prisoner’s dilemma, and once one party breaks the trust it is hard to re-create a virtuous circle and fair competition. Calvin points out that perhaps the only way to win an unfair game is break the rules and match what your competitors are doing. I would like to point out that while we have a prisoner’s dilemma that seems to encourage “cheating,” this prisoner’s dilemma is one with iterative play. These two players, along with the smaller competitors, will compete over and over again in the future. It behooves all parties to establish a fair set of rules and to abide by them. This is should be better for all parties, as it discourages any party from undercutting one another.

So, how do they re-create this trust? A summit of some sort is a good place to start. This can be a forum to discuss and agree to ground rules. As a next step, players need to be able to verify all parties are playing but the established rules. This can be in the form of audits or other 3rd party reports. Ideally, the industry can create an environment with fair rules that allows companies to compete and win based on product innovation and customer service, not trade wars. This is also best for the consumer.

Great essay Lynn and a very relevant topic nowadays. I think the question you pose about whether tariffs would have been placed under a different administration is a good one. In my opinion I think they would have been implemented, given the relationships governments have with their domestic airplane manufacturers and how much protection and funding they provide to them.

To be clear, I agree that markets should allow competition, but the aerospace industry seems to be operate somewhat differently given that all OEM’s are directly or indirectly subsidized by their governments. If this was not the case, I would be more inclined to accept the argument that free competition should be allowed. However, if the aerospace industry operated without government subsidies, would Airbus and Bombardier even exist given how they have been bailed out multiple times by the EU and the Canadian government respectively? It is a difficult conversation to have, and relationships amongst governments must be taken into account when having them.

I am inclined to agree that Boeing maybe lobbied for tariffs that were too high/unrealistic. At the same time I would post the question of what else could they have done when competing against companies that aren’t concerned with turning a profit and can just dump their prices to enter new markets?

While Boeing has massively benefited from protectionist policies in the US, I wonder what the impact would be if countries that Boeing exports to start implementing more protectionist policies beyond just the cancelling of military contracts in the UK and Canada. Given that Boeing is the largest exporter in the United States (https://www.forbes.com/sites/lorenthompson/2017/06/14/boeing-biggest-u-s-exporter-streamlines-defense-ops-as-new-services-unit-launches), there are major implications for the US economy and Boeing’s business if Boeing receives a taste of its own medicine. I imagine the impact would be the greatest in China and Russia, especially since Boeing is already facing competition from the new entrants Comac and Irkut. In order to compete, then, Boeing should not only invest in initiatives to lower its production costs as you mention, but also initiatives such as making its planes more fuel efficient so they are more appealing to clients from foreign airlines.