Topps Baseball Cards: A 25-Year Digital Rollercoaster

Baseball cards seemed like an obvious casualty of the digital revolution. But 20 years later, Topps is leveraging digital technology to revive the iconic American pastime.

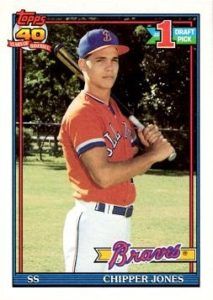

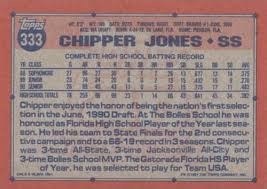

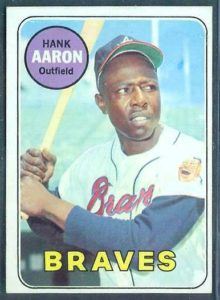

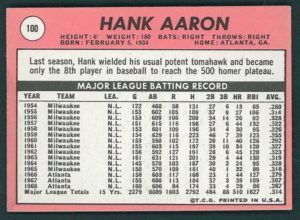

Baseball cards, depicted in Figure 1(1), are collectibles featuring a picture of one of the sport’s best players on the front side, with his statistics and biography on the back. Card collecting was a cultural institution in America for most of the 20th century. Millions of kids experienced the thrill of opening a pack to hunt for their favorite player or that rare, 1-in-1,000 ‘insert’. By the industry’s peak in the early 1990s, baseball cards generated $1 billion in sales annually(2), and as the market share leader, the Topps Company and its Topps brand were synonymous with the pastime.

Figure 1

Chipper Jones, 1991 Topps (Front & Back) Hank Aaron, 1969 Topps (Front & Back)

Fast forward just a few years, and the booming industry had shriveled to ~$200 million.(2) Industry-specific factors were a definite catalyst, particularly the Major League Baseball labor strike of 1994, which ended the season prematurely and disillusioned millions of fans.(3) In hindsight, the immense growth in digital technologies throughout the 1990s appears to have been the true driving force of disruption. At their core, baseball cards were a form of entertainment, and exciting digital platforms were quickly emerging as substitutes. One example is the video game industry, which grew rapidly in the mid-90s, in part, behind revolutionary product releases like the Sony Playstation and Nintendo 64. In 1998 alone, the industry grew 24% and added $1.2 billion in sales to reach $6.3 billion.(4) Additionally, the internet made the back sides of baseball cards irrelevant. Netscape’s Navigator web browser was released in 1994, followed quickly by popular search engines like Yahoo and AskJeeves, and soon kids had all the baseball statistics they wanted at the tips of their fingers.

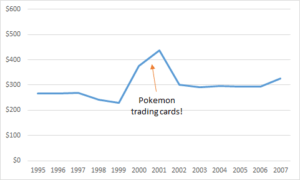

But baseball cards did not quite die completely. The industry managed to subsist as a niche hobby, held afloat mostly by adult collectors with “demand for nostalgia-based products.”(3) Total revenue at Topps Company, which included other trading cards and a $100-$150 million confectionery business, remained mostly flat for more than a decade, as Figure 2 shows.(5) Formerly a giant in the entertainment realm, Topps baseball now lay dormant.

Figure 2 – Topps Company Total Revenue ($ in millions)

Digital transformation may have been a key cause in the downfall of Topps baseball, but nearly 20 years later, it would also be the backdrop for its revival. Beginning in 2007, three key events changed the foundation for Topps and its iconic baseball card business. That year, Topps was acquired by private equity firm Madison Dearborn Partners alongside former Disney CEO Michael Eisner, who announced plans of “redirecting the entire category towards kids.”(6) In 2011, Topps acquired GMG Entertainment, a leading provider of digital currency products and services.(7) And maybe most importantly, over that time period, the internet-connected phone took over the US. Smartphone penetration increased from 18% in Fall 2009 to 44% in just twenty-four months.(8) Armed with new leadership, in-house digital capabilities, and a new pervasive distribution channel via mobile phones, Topps was ready to bring the baseball card industry into the digital age.

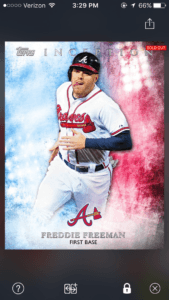

In 2012 Topps launched BUNT, its digital trading card application, shown in Figure 3. Like with paper trading cards, users could buy packs, hunt for rare cards, and trade with each other. With the flexibility to introduce new packs throughout the year, versus large production runs of physical cards, Topps could drive engagement around key events during the baseball season and adapt more quickly to user preferences. Users could now trade cards with an entire online network, rather than just the few collectors they went to school with. BUNT could also be played as an interactive game, in which users accumulated points based on the performance of the players depicted on each of their cards. Atleast initially, the app had success. Topps BUNT 2014 was named a “Best New App” on the iPhone by Apple, peaking as high as No. 25 in The App Store.(9) Motley Fool estimates that the app grossed about $33 million within its first two years.(10)

Figure 3 – Snapshots of Topps BUNT app

Looking forward, Topps has set out to integrate its digital platform with its physical cards to create a single ecosystem, where owning a card digitally also provides access to the paper version, and vice versa. A key to success will be minimizing production and logistics lead times for physical cards, so that Topps does not have to sacrifice the flexibility that its digital app provides. Technology can play a pivotal role in this process, such as through seamless integration of digital card design and physical production specifications at the factory. Once physical cards reach the hands of users, scanning technologies could allow users to quickly sync their newest cards with the digital app. Topps took its first step along this path in 2016, releasing a limited set of physical cards that unlocked free digital cards.(11) While a longer-term goal of complete digital-to-physical synchronization is ambitious, it would represent some closure for Topps baseball’s down-and-up digital experience. (797 words)

(1) Topps Company, taken from Ebay websites

(2) NYTimes. Amy Chozick. “Apps Take Positions in the Topps Baseball Lineup”. April 8, 2012. http://www.nytimes.com/2012/04/09/business/media/apps-take-positions-in-the-topps-baseball-lineup.html

(3) The Topps Company, 1997 10-K, accessed via SEC EDGAR.

(4) Wall Street Journal, with statistics from the NPD Group. Dean Takahashi. “Nintendo Is Top Scorer in Game Sales, But Sony Sees Bigger Hardware Growth.” January 19, 1996. Accessed via ProQuest (Baker Library).

(5) The Topps Company, 10-K filings from 1997-2007, accessed via SEC EDGAR. Note: The Topps Company did not disclose specific results for its baseball card products.

(6) NYTimes. Richard Sandomir. “Topps Gets Exclusive Deal with Baseball, Landing a Blow to Upper Deck.” August 5, 2009. http://www.nytimes.com/2009/08/06/sports/baseball/06cards.html

(7) The Topps Company, Inc. “Topps Announces Acquisition of Leading Digital Currency Card Company, GMG Entertainment.” July 26, 2011. http://www.prnewswire.com/news-releases/topps-announces-acquisition-of-leading-digital-currency-card-company-gmg-entertainment-126163153.html

(8) BGR Media, with statistics from Nielsen. Zach Epstein. “Smartphone penetration skyrockets in 2011, iPhone becomes No.1 handset.” December 11, 2015. http://bgr.com/2011/12/15/smartphone-penetration-skyrockets-in-2011-iphone-becomes-no-1-handset/

(9) Beckett Media. Chris Olds. “TOPPS BUNT PLAYERS CREATE REAL DEMAND FOR VIRTUAL BASEBALL CARDS.” Interview with Chris R. Vaccaro, head of app operations for Topps Digital. June 4, 2014. http://www.beckett.com/news/topps-bunt-players-create-real-demand-for-virtual-baseball-cards/

(10) The Motley Fool. Jake Mann. “Digital Baseball Cards Brighten Future for Topps.” April 16, 2014. http://www.fool.com/investing/general/2014/04/16/digital-baseball-cards-brighten-future-for-topps.aspx

(11) The Topps Company. “TOPPS BUNT DIGITAL CARDS ARE GOING PHYSICAL THIS SUMMER.” https://www.topps.com/blog/topps-bunt-digital-cards-are-going-physical-this-summer/

Awesome article, Brian. As someone who was really into baseball cards as a kid, it was super interesting to read about how Topps is looking to transform itself! The BUNT 2014 sales numbers on the App Store are pretty impressive, but I wonder how they break out across demographics. Is BUNT just capturing revenue from older users (people who used to love baseball cards as kids), or are they actually engaging the younger population as well? I know that baseball is becoming much less popular among kids today, so I wonder how many kids are actually interested in this type of digital product. [1] Have the NFL and NHL apps had similar success?

I’m somewhat skeptical that Topps can survive this type of digital transformation alone, and I think they need to look more aggressively into partnerships. Since Topps doesn’t own any sort of differentiated IP and instead relies on the leagues and players, it is hard for them to transform itself rapidly the way that a product like Pokemon has over the years. Could Topps look to partner with companies like Electronic Arts or Take-Two Interactive in order to provide some sort of integrated video game-trading card product?

[1] http://www.wsj.com/articles/why-baseball-is-losing-children-1432136172

Awesome post, Brian! This totally brought me back to my days where my friends and I would sit on the floor in one of our bedrooms and show off our baseball cards and strike deals with one another. (It is where I first began to learn the art of negotiation, so I probably owe my HBS acceptance to my Chipper Jones rookie card). It is interesting to see Topps finding a way to stay relevant with the BUNT app.

Thinking back to what made baseball cards so appealing to me as a kid, I wonder if Topps has or will integrate a social/sharing element into their app. There are so many fora for reading about sports online these day, but not as many social ecosystems for discussing sports, so maybe they could integrate social into their app to drive downloads. The other thing that I was curious about reading your post was how the company thinks about the rarity of cards in the digital space. As a kid, it was always the best when you came across a rare card and could impress your friends and dream about the millions you’d be able to cash it in for down the road. (Turns out there is still a robust market for baseball cards . Has Topps been able to replicate this kind of exclusivity with their move to digital? If not, might that be a way to keep kids engaged in a world where there are now so many more avenues for entertainment competing for their time and interest?

Nice post, Brian. I am interested to know what the MLB thinks of the digital cards? Linked to Kevin’s comment about declining baseball participation, why hasn’t the MLB teamed up with Topps to increase awareness and cross-selling? People who like baseball cards (presumably play / watch baseball), so imagine a situation where if you buy Topps cards, you get a ticket to a game (and vice versa). Hopefully this partnership (should it ever happen) would increase awareness and interest in the sport, which in turn, could increase baseball card usage.

That said, it is great to see Topps adapt to digital trends, allowing many to relive the glory days as a child.

Brian, thank you so much for writing this piece. Like others, your article definitely took me back to card shop days! Great use of visuals. I am curious if Topps plans to transfer this digital card platform to other trading card genres. I am also curious about the engagement level among its users. Do they stay for long or use it for a month and ditch? The fantasy baseball point system should help with perpetuating engagement, but will that be enough? Along the lines of your thinking combining digital and physical initiatives, I would love it if they added prizes to the game, such as baseball bobble heads or exclusive caps.