The Race to ROI: Can Adidas’s Speedfactory Make Hyper-Customized Sneakers and a Profit?

Adidas’s Speedfactory holds the promise of “radical, accelerated footwear production, with hyper-flexible, localized, open-source co-creation, and athlete data-driven design.” While the goal of “mass customized” sneakers is ambitious, will the investment bear returns or burn out?

Sneakers and digitalization are two words not often associated with one another. However, Adidas’s “Speedfactory” aims to interlace the two, creating a new factory model that 1) shortens the product development timeline, 2) consolidates the supply chain, and 3) improves unit economics of small batches. For Adidas, the goal is “radical, accelerated footwear production, with hyper-flexible, localized, open-source co-creation, and athlete data-driven design.”[1] McKinsey estimates that Supply Chain 4.0 initiatives like the Speedfactory could drive 30% lower operational expenses and 75% less inventory as lead times shorten.[2]

Exhibit 1: Adidas Speedfactory advertisement[3]

https://www.youtube.com/watch?v=kyum6GZp3r4

Why should Adidas care about ramping up the production curve in the Speedfactory?

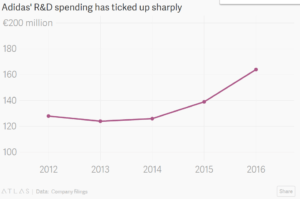

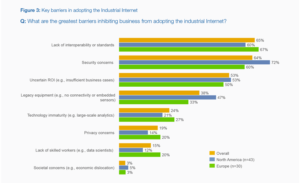

While the potential benefits of Supply Chain 4.0 are promising, they are not guaranteed. After growing R&D at a 10% CAGR, Adidas now faces the challenge of generating a return on its Speedfactory investment. This is consistent with 53% of respondents in a recent World Economic Forum study, who cited the lack of a clearly defined ROI as a major hurdle in implementing digitization.[4] To break even, Adidas will need to 1) ramp the production yield curve, and 2) prove market demand exists for “mass customized shoes.” In September 2016, Adidas introduced a 500-pair batch of Speedfactory sneakers at €250 per pair, with the goal of bringing down prices as production ramps up.[5] If Adidas cannot drive efficiencies from here, it will struggle to justify the Speedfactory investment, particularly given that Adidas operates at 6.5% operating margin, well below Nike at 13.9%.[6]

Exhibit 2: Adidas’s R&D has risen, but ROI is unproven[7]

Exhibit 3: “Uncertain ROI” is a key barrier to digitizing supply chains[8]

What is Adidas’s management doing to generate ROI?

Near term, Adidas is focused on proving out its concept in a pilot form. This stage involves 1) establishing partnerships with Oechsler on new insole technology and Siemens to run digital-twin simulations of its facility production, 2) developing proprietary computer-aided technology to run the design and manufacturing process simultaneously, and 3) running pilot programs at its first three Speedfactory facilities. After its first pilot in September 2016, Adidas is planning to launch pilots at its second Speedfactory in the U.S., and a third in western Europe.

Over the medium-term, Adidas’s goal is to scale up Speedfactory manufacturing to 1 mn shoes per year (~0.3% of annual production).[9] Adidas also aims to use NFC chips in its sneakers, so that users can send feedback directly to the factory on “how the shoes fit and perform…The more chipped shoes it sells and the more data it receives, the better it can make each new generation of products.”[10]

Further recommendations:

Adidas should also focus on forming predictive demand models that can reduce inventory carrying costs, and test the optimal degree of customization. Per McKinsey, it is important to pursue rapid cycles of development, testing and implementation in the early stages of digitization, to gain immediate feedback that directs the next phase.[11] Adidas should experiment with ways to use data from NFC chips in shoes, to analyze potential product improvements, the lifetime of the shoe, and new functionality. Adidas can also use this data toward developing dynamic pricing, and reducing excess products that would be sold at a discount and negatively impact margins. Practically, Adidas should also begin discussions with materials suppliers to work on the logistics of moving toward just-in-time manufacturing.

Questions to consider:

Ultimately, Adidas will need to define Speedfactory’s core differentiation and objectives. Namely, 1) Should Adidas pursue hyper-customization (i.e., reaching “lot size 1”) in addition to accelerating time-to-market? 2) Is the Speedfactory merely a product innovation lab, or a model that should be rolled out across Adidas’s traditional factories?

(793)

Endnotes

[1] Chris Smith, “Adidas Speedfactory shoes: Made by robots for humans,” October 5, 2017, BGR, http://bgr.com/2017/10/05/adidas-speedfactory-shoes-made-by-robots/, accessed November 2017.

[2] Knut Alicke, Daniel Rexhausen, and Andreas Seyfert, “Supply Chain 4.0 in consumer goods,” McKinsey, April 2017, p. 10.

[3] Adidas, “SPEEDFACTORY: The Future of How We Create,” YouTube, published October 4, 2017, https://www.youtube.com/watch?v=kyum6GZp3r4, accessed November 2017.

[4] “Industrial Internet of Things: Unleashing the Potential of Connected Products and Services,” World Economic Forum, http://reports.weforum.org/industrial-internet-of-things/, accessed November 2017.

[5] Marc Bain, “Adidas can now make specialized shoes for runners in different cities, thanks to robots,” Quartz, October 4, 2017, https://qz.com/1081511/adidas-can-now-make-specialized-shoes-for-runners-in-different-cities-thanks-to-robots/, accessed November 2017.

[6] James Shotter, Lindsay Whipp, “Robot revolution helps Adidas bring shoemaking back to Germany,” Financial Times, June 8, 2016, https://www.ft.com/content/7eaffc5a-289c-11e6-8b18-91555f2f4fde, accessed November 2017.

[7] Bain, “Adidas can now make specialized shoes for runners in different cities, thanks to robots.”

[8] “Industrial Internet of Things: Unleashing the Potential of Connected Products and Services,” World Economic Forum.

[9] Shotter and Whipp, “Robot revolution helps Adidas bring shoemaking back to Germany.”

[10] Bain, “Adidas can now make specialized shoes for runners in different cities, thanks to robots.”

[11] Alicke et al., “Supply Chain 4.0 in consumer goods,” p. 13.

Ultimately, I think this more than a product innovation lab and should be rolled out across traditional factories. Since automation and digitization is becoming increasingly common in sneaker manufacturing (Nike using static electricity to make shoes 20x faster than an assembly worker, Under Armour utilizing 3D printing for shoe soles, etc.), differentiation is of utmost importance since this trend of shorter cycles will become the norm across the industry. Adidas can do this by developing the technology to become the fastest, and by keeping the designs in-house and unique to the brand.

Like Brandon above, I too think about this as larger than a pure product innovation lab experiment but I think the fact of which that we are able to have that debate is an issue in and of itself. Adidas needs to be much more clear in what it is ultimately hoping to get from their Speedfactories. I say this because investor relations will depend on it, but also because I think the development and approach to scaling is different for them depending on whether this is really about innovating on a product or innovation in manufacturing.

For the former, innovating on the product, they should have and would need to first prove that demand for this product would warrant the R&D investment and capital costs to develop. Many competitors have already gone to market, Nike being the obvious one, with customizable shoes and to my knowledge the penetration hasn’t been large enough yet to warrant a huge investment in “hyper-customization”. Alternatively, if this were the latter, innovating in manufacturing, that I agree that the ROI is harder to define but I would argue that even under the most extreme of assumptions one would conclude that the potential for this far exceeds that of the simple product innovation. The ability to radically redefine and localize their entire production has far greater potential impacts for the company and the entire supply chain. I would assert based on their goal that they are certainly targeting this latter innovation in making such a large investment.

Super interesting topic! One of the biggest issues I see with this strategy lies in your first question: Should Adidas pursue hyper-customization (i.e., reaching “lot size 1”) in addition to accelerating time-to-market? Ultimately, I don’t think it’s a question of should they… it’s a question of can they. The biggest hurdle to achieving both of these goals at the same time is consumer trends / preferences. We know that consumers are moving towards individualization in clothing and other personal products; they want customization beyond even what Adidas is doing with the city specific shoes. Given lead times and set up times for different product lines, it would be virtually impossible to achieve a “Nike ID” level of customization with an automatic/digitized manufacturing process. So – while Adidas might be able to use Speedfactory to somewhat customize shoes and cut down on labor costs/production lead times for more mass products, I’m curious to see what the brand team / product innovation teams think about individual customization and how a digital supply chain can respond to that consumer trend.

I’m also concerned about the PR backlash that Adidas might face with this digitized supply chain. From one of your sources, I understand Adidas is opening these factories near the locations where they are selling these products. As they expand and move into more developing nations, I can imagine that people will fault Adidas for not developing the labor force in some of these markets. Additionally, there will likely be a large capex investment to set up these production lines in each new place; to your point at the start of the essay, the ROI is incredibly uncertain and the investment incredibly high. Is Adidas ramping up marketing / branding / sales to make sure that the shoes it is producing in this new way are actually selling? I wonder how the company is strategically trying to make sure that investment was worthwhile.

While not the original intention of the “Speedfactory”, one positive side effect of this new production method is as a potential hedge against the impact of increased isolationism. As “Anonymous 8” discussed in an article about Nike, the athletic wear market is currently facing challenges as the world trends away from globalization. Isolationism hurts companies with complex supply chains that span multiple countries such as Nike and Adidas. By simplifying and localizing their supply chain with innovations such as the “Speedfactory”, Adidas has the opportunity to achieve multiple objectives at once – in addition to the advantages from “mass customization” and faster time to market, they are also reducing their reliance on a global supply chain which might be increasingly threatened in the future.