The new Thanksgiving weekend activity … “Spying Saturday”

Using smartphones as barcode scanners has created a showrooming phenomenon. How can traditional retailers catch up?

In 1932, a group of students at Harvard Business School proposed a system in which customers choose products from a catalog by taking out the associated punch cards. The punch cards would be fed to a reader, which would trigger the system to automatically pull the product from inventory and deliver it to the checkout. A receipt will be produced and inventory records updated. This was the beginning of the modern barcode [5].

Nowadays, barcodes are not only used by stores to complete sale and monitor inventory, but we are seeing an increasing trend consumers directly interacting with barcodes to identify products. Traditionally, specific hardware was required for barcode scanning, but now any smartphone with a camera has capability to function as a scanner. This has led to a wave of apps that that utilize the scanning function, with applications ranging from placing QR codes on advertisements to quickly link a consumer to the advertiser’s webpage and creating a fast way for people to add each other as friends on social media platforms such as Snapchat and Wechat.

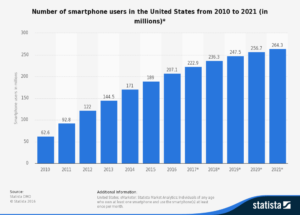

Exhibit 1: Projected number of smartphones in the United States in next few years [6]

In 2011, Amazon introduced the Amazon Price Check app, which enabled consumers to scan the barcode of any product and the app will pull up the product’s listing on Amazon with the price. Although Amazon Price Check does not exist anymore as a standalone app, the core functionality has been integrated into the overall Amazon app. The use of this price check functionality has created the phenomenon of showrooming – where consumers will go to a brick and mortar store, see and experience a selection of products, identify the product they like, scan the barcode using the Amazon app, and complete the purchase through Amazon. This trend has been so prevalent across the US that people are referring to the Saturday between Black Friday and Cyber Monday as “Spying Saturday” – the day to check out electronic goods in stores like Best Buy before committing to a purchase online on Cyber Monday [2].

From the traditional retailers’ perspective, the use of the price check functionality is extremely detrimental to their business. Large retailers such as Best Buy, Target, Walmart, Staples, and Toys R Us are heavily impacted because many of their products are available from Amazon, often for a lower price [1]. The business model of these retailers is to purchase products from suppliers, hold inventory of products in warehouses and in store displays, allow consumers to see and interact with products, and complete sales of products in store. A significant portion of their cost is the cost of holding inventory and rent of physical stores for displaying products. With consumers using the Amazon app, traditional retailers are stuck having to pay the same costs while Amazon generates more sales revenue without incurring those costs.

In addition, Amazon benefits from the vast amount of data collected on consumer behavior and competitor’s inventory. Every time a consumer scans a product, Amazon creates one additional data point linking the consumer’s preferences and purchasing behavior. This can be used for targeted ads when the consumer later logs into Amazon.com. Based on the consumer’s location while scanning the product, Amazon also creates one data point on what products are available at competitor’s store and can calculate which products are in demand based on frequency of scans [3].

One of the primary barriers for online shopping is that consumers cannot physical see, touch, or experience the product prior to purchase. However, the showroom phenomenon, enabled by the Amazon app, has broken that barrier by allowing consumers to experience the product at the expense of traditional retailers [2]. Some retailers, such as Best Buy, made operating model adjustments such as instituting price match policies. However, this is still a losing game for traditional retailers because they continue to carry the store costs and cut deeper into their margins. Other retailers such as Walmart have been heavily investing in their online platforms, like Walmart.com and ShippingPass, a subscription similar to Amazon Prime [3].

Despite traditional retailers making genuine effort to adapt to the digital age, the future may not look so bright for them. With the introduction of Amazon Dash, consumers can now scan any Amazon Fresh product in their home, and the item will be automatically purchased and delivered (or at the push of a button with product-specific Dash buttons) [4]. Amazon is allowing consumers to cut out an entire chunk of the traditional shopping process and in turn, making the services of traditional retailers obsolete.

(761 words)

Sources:

1. http://www.businessinsider.com/analyst-amazons-price-check-app-is-creaming-best-buy-2012-10

2. http://www.timesunion.com/business/article/Amazon-s-scanning-app-scaring-retailers-2393595.php

4. https://www.cnet.com/news/appliance-science-how-the-amazon-dash-button-works/

5. http://www.barcode.ro/tutorials/barcodes/history.html

6. https://www.statista.com/statistics/201182/forecast-of-smartphone-users-in-the-us/

I believe that traditional shops will slowly go extinct; There’s no reason to have a showroom AND inventory at the same time. I think we’ll evolve towards a world in which there are showrooms (so people can test out the product) and order it immediately online.

Some companies have already embraced this concept, e.g., The Groomsman came to campus in order to have male students try out their tuxedo’s and then send it through mail. Convenient and cost-efficient.

Cranberry Farmer – It is amazing to see how Amazon is using its advanced systems to stay so far ahead of its traditional retail competitors. This is a great example of how increased competition and technological advancement are being used to drive prices down and ultimately create tremendous value for consumers.

Another interesting aspect of Amazon’s Black Friday strategy is its willingness to offer black Friday deals over a longer period of time. Given the Company’s position as the fastest growing retailer in the united states, Amazon’s surge in demand during the holiday season has led to customers not receiving orders on time. To avoid shipment bottlenecks, like it has experienced over recent years, the Company has created larger “sale windows” to incentivize purchases to be spread out over a longer period of time. By rolling out limited time deals weeks before the traditional Black Friday sale period, it is able to influence customer behavior and match orders with its shipping capacity. This has also shifted competitive pressure to retailers by establishing price floors on comparable goods. Amazon’s actions have raised the question on if there is anything traditional retailers can do to stay competitive? As you stated these retail competitors face high inventory holding costs coupled with large wages payable in order to stay open during extended holiday hours. I believe this will ultimately handcuff their ability to lower margins through sales and keep up with Amazon’s asset-lite business model.

http://www.cbsnews.com/news/amazon-upends-black-friday-by-starting-sales-today/

I agree with Pieterjan and Tim about how indefensible the traditional retail channel is from Amazon, given how Amazon’s Price Check eliminates one of the last benefits retailers have over Amazon. Since retailers can’t offer cheaper prices than Amazon in the long run, I just can’t see any recourse those retailers have to stop this type of behavior.

I think the only way Amazon fails to capitalize on this opportunity is if, as Tim said above, consumers have large bottlenecks and delays in receiving their ordered products and opt instead to buy items off the shelves of retailers, but I am sure that Amazon will rationalize their supply chain and create an efficient process to quickly connect customers with their orders.

I completely agree that traditional brick-and-mortar retail stores will have to change their models if they want to survive in the new world of Amazon–the costs are too high and customers are too used to buying products online. For commoditized goods like televisions or washing machines where the range of options is relatively limited and personal preference does not play a huge role, retailers that sell these products are most at risk. However, for items like apparel, customers still like to touch and try on clothes in-person–and they’re more likely to buy in-store because the small financial outlay can generate a lot of instant gratification. One play against Amazon is to not sell proprietary products on the site: if you can drive people to your own website instead, you capture the desired margin and retain control of customer data. It’s hard for brands to resist the lure of Amazon’s customer base, but it may be the only way to prevent a slow death.

Great post, Anonymous Sectionmate. Are there tech countermeasures that retailers can use to either hinder the Amazon app (switching over from barcodes to other types of inventory management tech); or, on the other side, recognize that someone is using the Amazon app over the store wifi and figure out a way to offer discounts / better shipping to the individual? The main advantage of big box retailers is obviously the immediacy and instant gratification of being able to buy and deliver the goods to someone’s house that very moment. Are there ways the retailers can offer value-added services (set up, for example) for discounts that would tip the scales in their favor? I’m always hesitant to sign off retail as being a lost cause but in this case it feels like a very challenging problem.

Loved this post! It is clear that the digital age will have a massive impact on traditional brick and mortar retail stores. As your post notes, the practice of “showrooming” has become ubiquitous and is an enormous problem for retailers. Amazon was smart to develop an app that simultaneously capitalizes on this trend but also drives customers to its website. Retailers such as Saks Fifth Avenue are acutely aware of showrooming and are brainstorming creative ways to adapt their business models to today’s online-focused consumer. For instance, retailers have adopted mobile point-of-sale systems that cater to consumers demanding an increasingly immersive shopping experience, and are looking at ways to connect the physical shopping experience to a consumer’s digital experience. I found this article (http://www.starmount.com/news/making-mobile-happen) interesting as it discusses potential future innovations in the retail space, including apps that enable consumers to purchase inventory directly from their smartphones.

This is so cool, anonymous! It is certainly a pretty scary time for big box retailers. I think they need to focus on their relationships with suppliers as a way to potentially get an edge on Amazon if their demand side with customers is going to be harder to compete with. Perhaps if they can optimize for better JIT delivery of each specific product on order they will be able to service their clients in a more efficient manner. To be honest though I’m not optimistic– maybe if they have cheaper and faster delivery some customers will stick with them but I think the ubiquity and massive product selection of Amazon is much better. That being said, while our generation does not care as much about touching and feeling things in the showroom, maybe big box retailers should focus on converting ppl to that side of shopping before its too late for them.