The Brains Behind Olay Beauty Care Product Recommendations

What is Olay?

Olay is a 66-year-old global skin care products brand within Procter and Gamble’s (P&G) $65 billion-dollar product portfolio. Olay products were sold in 80+ countries, used by 60+ million consumers as of 2012, [3] and generated estimated revenues of $2.5 billion in 2015 [13]. The brand started in 1952 as “Oil of Olay” with a pink beauty fluid promising to provide deep hydration and has since grown into a full skin care portfolio including cleansers, moisturizers, and anti-aging products under the “Olay” brand. [3] [7]

Why is artificial intelligence important for Olay?

Industry Trends Context

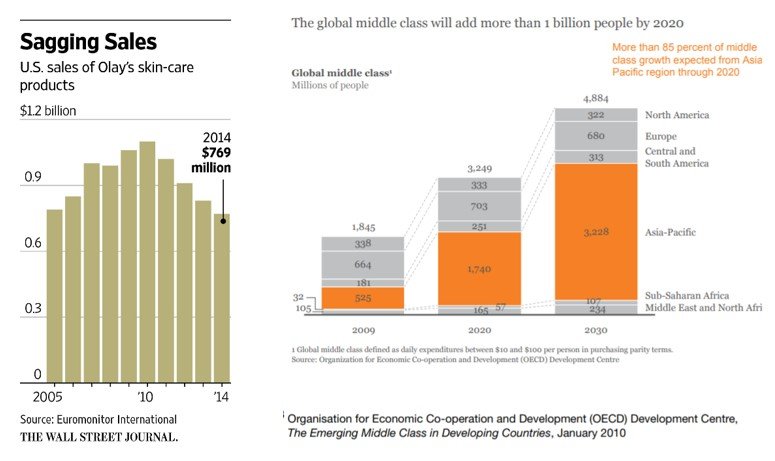

In the recent decade, growth in the skin care category has mostly come from small, independent brands at the expense of large brands like Olay [10] [11] [12]. In fact, since 2010, Olay sales have significantly declined (see chart below), especially in the US – the brand’s largest market. [13] The brand has also been struggling to keep pace in the fast growing Chinese market, which led to P&G shutting down 30% of Olay stores in China in 2017. [9]

Key Issue and Opportunity

With the explosion of skin care brands and products in the past decade, consumers often face decision paralysis in purchasing skin care products. “A 2013 consumer survey by P&G found one third of women were unable to find what they were looking for in facial skin care aisles and almost two-thirds say they have unused facial products at home.” [8] [14]. These frustrated consumers yearn for personalized skin care product advice from experts, but such expertise can be cost prohibitive for Olay’s large and growing middle class target market. [14] These conditions created an opportunity for a mass market brand like Olay to attract, retain, and trade-up consumers by using artificial intelligence and machine learning to provide personalized skin care product recommendations for millions of consumers.

How has Olay Leveraged Artificial Intelligence to Reinvigorate the Brand?

Application:

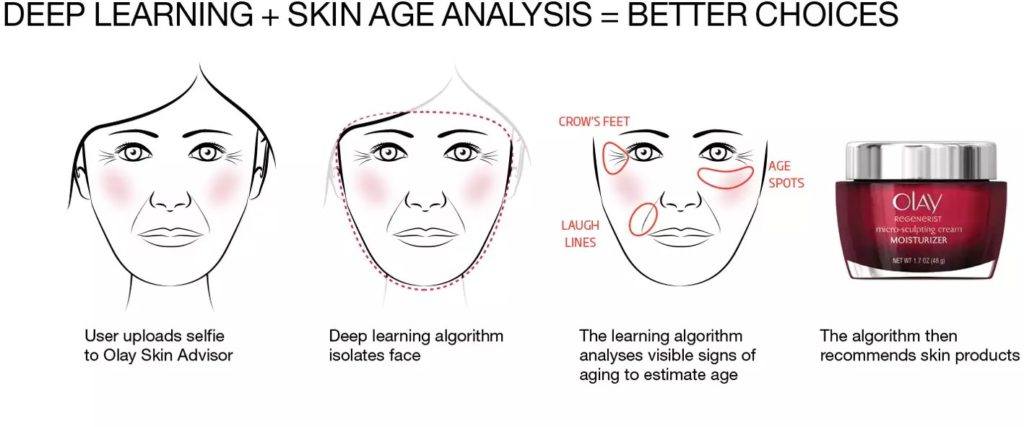

In February 2017, Olay launched the Olay Skin Advisor – a web-based skin analytics platform that provides women with precise, personalized skin product recommendations on their mobile phones or tablets.[8] The tool is based on an algorithm developed using the company’s 60+ years of skin research and 30+ years of image recognition and analysis software development. The tool uses an artificial intelligence technology called deep learning, which mimics the way human brains learn to estimate people’s ages. [14]

To get the skin analytics, a user takes a selfie and completes a questionnaire, which the tool analyzes against millions of images to estimate the skin’s age, identifies the specific areas of the face that could be improved the most with products, and provides a personalized and specific skin care product recommendations for the user. Millions of women have already used the web-based tool. The company is focused on increasing utilization of the tool over the next few years, which will further improve the results as the algorithm learns and improves from the additional image processing. The additional data will also help inform product innovation based on the most commonly analyzed skin care concerns. [4][8] [14]

To get the skin analytics, a user takes a selfie and completes a questionnaire, which the tool analyzes against millions of images to estimate the skin’s age, identifies the specific areas of the face that could be improved the most with products, and provides a personalized and specific skin care product recommendations for the user. Millions of women have already used the web-based tool. The company is focused on increasing utilization of the tool over the next few years, which will further improve the results as the algorithm learns and improves from the additional image processing. The additional data will also help inform product innovation based on the most commonly analyzed skin care concerns. [4][8] [14]

Results:

A survey of Olay Skin Advisor users by P&G indicated that 94% of the users agreed that the products recommended by the algorithm were right for them and 88 % of the users were still using the same products four weeks later. [14] As a result of product formulation and digital marketing improvement and increased product engagement through this tool, the Olay brand is leading P&G’s growth in 2018, with double digit growth in the Chinese market. [4] [1].

How can Olay further leverage this technology for sustainable growth?

The personalized recommendations from Olay Skin Advisor tool can help retain, attract, and trade-up middle-class consumers who use Olay or similar products, but the tool does not yet address two major trends in the skin care category:

- Consumers are seeking organic/natural skin care products: In 2015, natural skin care products grew by 7% in the U.S., compared to a 2% growth in the overall beauty market; in fact, natural skin care products are outselling traditional brands like Olay by two to threefold. [11]. Therefore, to ensure continued growth, Olay should strengthen its naturals portfolio and adapt the Olay Skin Advisor tool to allow consumers to opt for organic/natural products. The data and insights gained from the tool so far can help expedite and prioritize the specific product development within naturals.

- Male consumers are seeking skin care products: About 87% of males between ages 18 and 44 use skincare products; [2] however, Olay currently does not offer skin care products or recommendations for men. In order to capture this growing market, the company should quickly expand the capability of the Olay Skin Advisor tool to include male skin analysis and leverage the insights to develop Men’s Skin Care products under the Olay brand or another brand.

What should Olay consider as it moves forward with this technology?

Historically, Olay’s competitive advantage has been product development, not technology or artificial intelligence. Moving forward, the brand should consider whether to further develop this technology in house or outsource it? What are the implications to the brand’s competitive advantage with each choice?

(789 words)

References

[1] Andria Cheng. Procter & Gamble Is Surging, And Beauty Brands SK-II And Olay Are Leading The Way. Forbes. (October 19, 2018).

[2] Andria Cheng. The Surprising Trend In Beauty? Skincare Sales Growing The Fastest Among Men’s Grooming Products. Forbes. (June 15, 2018).

[3] Anna Chesters. A brief history of Olay. The Guardian. (March 12, 2012)

[4] Dan Monk. How Procter & Gamble Co. scientists cracked the code on skin aging. WCPO Cincinnati. (July 9 2018).

[5] Ishan Chatterjee. The decade ahead: Trends that will shape the consumer goods industry. McKinsey & Company. (December 2010)

[6] Jeremy Bowman. Why Procter & Gamble Co Stock Surged Today. Nasdaq. (October 19, 2018)

[7] Our History. Olay

[8] P&G Press Release. Olay Unveils Global Skin Analysis Platform Olay Skin Advisor – The First-Of-Its-Kind Application of Deep Learning in the Beauty Industry. Procter and Gamble. (February 27, 2017)

[9] P&G Shuts Down 30% of Olay Stores in China for Low Sales. YICAI GLOBAL. (March 24, 2017)

[10] Richard Kestenbaum. The Biggest Trends In The Beauty Industry. Forbes. (September 9, 2018)

[11] Rina Raphael. What’s Driving The Billion-Dollar Natural Beauty Movement?. Fast Company. (May 26, 2017)

[12] Sarah Mahoney. Olay Tries To Rebuild Interest In Fading Anti-Aging Category. MediaPost. (January 25, 2017)

[13] Serena Ng. P&G Looks to Lift Olay Sales With Fewer Choices on the Shelf. Wall Street Journal. (December 28, 2015).

[14] Skin care gets smart with AI. NewScientist. (May 24, 2017).

Great read!

For me, the use of machine learning to increase sales was unexpected given the market trend showed large players losing market share to small independent brands. I would have expected P&G to acquire a smaller skin care brand or create a sub-line of products branded under a new name with new reference to P&G.

I’m interested to know how the software accommodates for poor lighting, different facial expressions, and appearance with or without makeup. For instance, we are more likely to see crow’s feet when smiling rather than straight faced. Additionally, it would be interesting if Olay had users re-submit selfies over a period of time to compare their skin from before and after the product’s use. With the new photos, Olay could also provide updated recommendations. Finally, I’m interested to know how the frequency of the algorithm recommending a product correlates with the product’s price (i.e. does the algorithm regularly recommend Olay’s most expensive products).

Very interesting to see AI being used effectively to identify skin age. Humans actually struggle with that all of the time. I am curious to know if the algorithm is actually good at determining age, or simply the presence of ‘defects’ and what in the product line attempts to address those defects. Additionally, it is well known – via the issues with the iPhone X – that face algorithms can be quite inaccurate — but it seems like Olay has found a way to hit the nail on the head. Did P&G purchase/team up with an preexisting AI company or did they develop their own unit in house?

Great article on a very interesting topic! I find Olay’s use of both deep learning and a questionnaire to be particularly interesting, and for me it begs the questions – to what degree are Olay’s recommendations driven by it photographic analysis vs. the responses inputted by users? Depending on the questions asked, both methods could yield similar results, and I’m curious to know the degree to which Olay is currently leveraging one vs. the other to determine product recommendations. Especially since the potential set of recommended products is quite small, I’d be interested to know how much of the technology is truly driven by AI vs. predetermined adjacencies between responses and products (e.g., if the user indicates “aging” as a concern, recommend Olay Regenerist cream).

Great piece – very well laid out. Makes me wonder whether open source facial recognition software exists or if companies that want to build this into their product development offerings (like Olay) need to build these technologies from scratch.

Very interesting article! My biggest question is who is using this technology? Is it Olay brand loyalists who are now buying more/ higher priced goods? Or is Olay stealing share from the smaller brands as consumers seek out the more personalized experience? I also agree with your point that men’s is a huge opportunity for growth, especially given the opportunity to educate men new to the category.

I would love to see the demographics of Olay’s user population. This brand is extremely stogy and tired – I can’t imagine that this new offering alone will endear itself to younger consumers. Is there a way that Olay could use the data gleaned from this new functionality to produce marketing campaigns that would further its appeal to younger consumers? However, I like how you can use this application anywhere unlike Sephora where you have to enter a store to access their facial recognition software.

I had a similar thought to Sasha – no matter how effective the tool is at matching consumers with products, the brand has to resonate with consumers if they are going to try it in the first place, let alone make a purchase off of the results. I think it’s easy to look at what Sephora has done with ColorIQ, for instance, and assume that something similar would work here…but I see the context as fundamentally different because Sephora is trying to increase sales among their existing consumers, whereas it seems Olay is trying to re-earn a spot on consumers’ consideration sets.

Thank you. This is a very interesting piece. I agree that product development is Olay’s competitive advantage, but at the same time, I think it should hold the AI technology inhouse to gather the important data to continue to innovate and develop great products for its consumers. This is like a virtuous cycle where the more data you gather from consumers, the more you know about your consumers’ needs and preference, and the more likely you will develop a good product that would meet the consumers’ needs. I think they should continue promote this technology to more users.