Teaching an Old Bank New Tricks: Open Innovation at Barclays

Who would you trust more for financial advice: 100 randomly selected people or Barclays, a 300-year old bank?

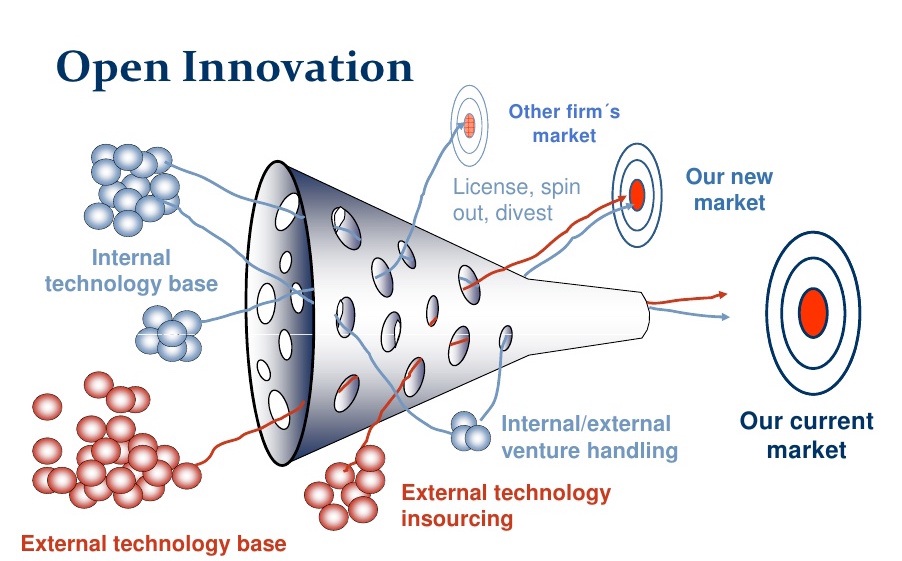

Intuition would say Barclays. However, open innovation – the use of external content and partners in internal product and process development – would contend that the group of 100 could offer some unexpected insights.

Background

Barclays is a large multinational bank offering services from retail banking in the UK to trading. A key driver of its success has been its ability to leverage customer data for products such as credit analytics[2]. This has led Barclays to safeguard customer data and other tools, limiting product development to internal processes only.

However, in the aftermath of the 2007 financial crisis, this strategy became challenged by:

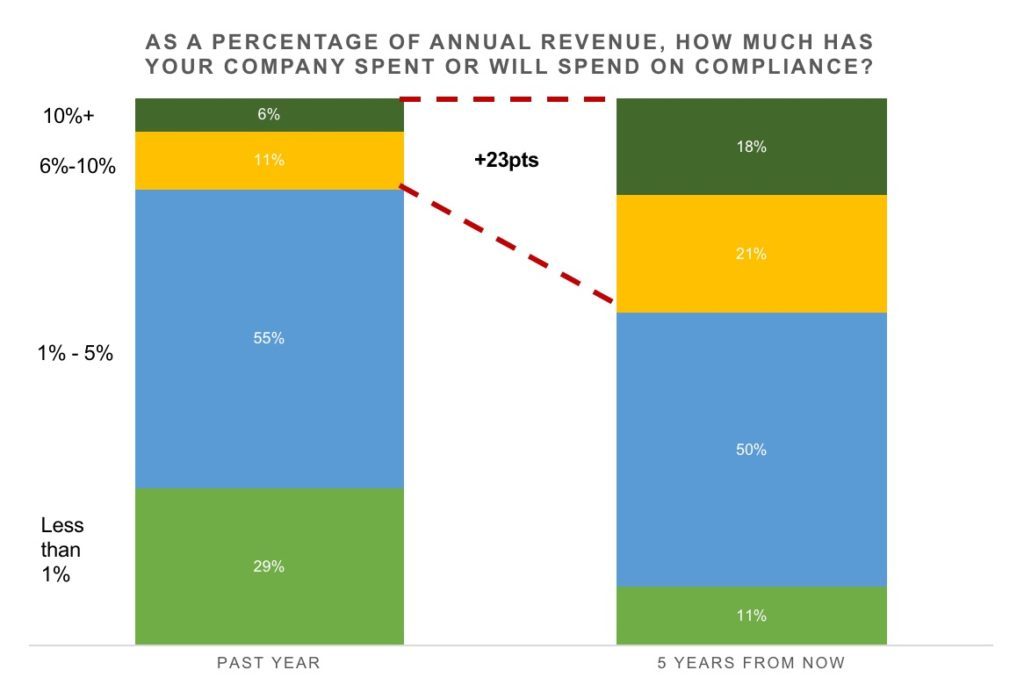

- Constrained resources: The financial crisis and rise of regulation has constrained Barclays’ ability to invest in product development. 40% of Barclay’s IT budget is now spent on compliance[3] (industry trend below).

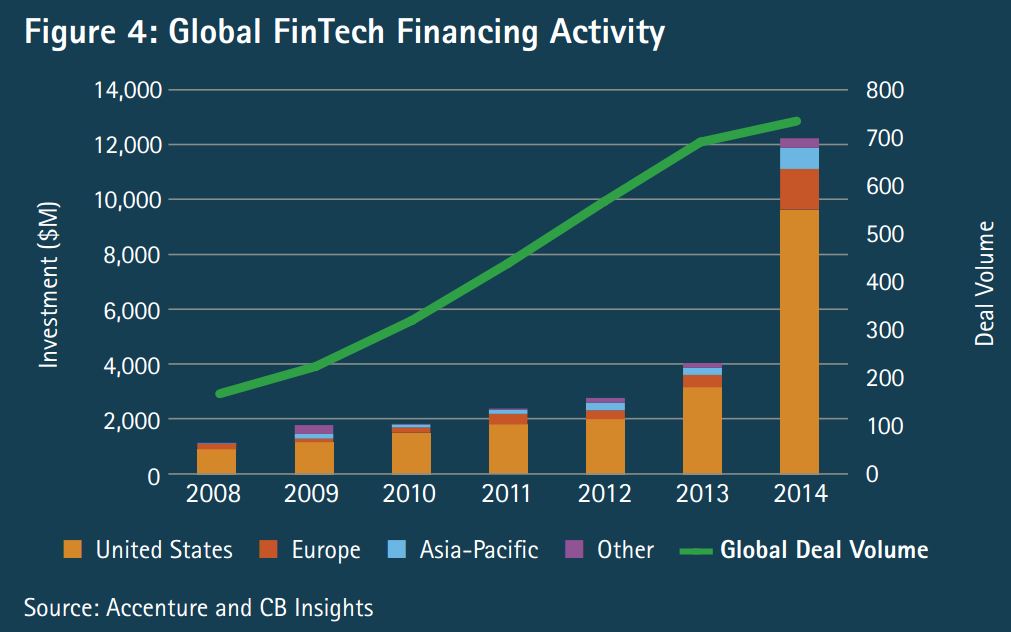

- Rise of fintechs[5]: One-third of total banking revenue is at risk from fintech disruption[6] (industry trend below).Unlike Barclays’ traditional competitors, fintechs have faster speed-to-market and product updates which are partly driven by their use of open innovation. Examples include:

- Mint: aggregates user data from banks to create budgeting tools

- Vetr: crowdsourced stock research

- Regulation: Open Banking requires UK banks to share customer data with third-parties via APIs[8].

With constrained resources and unfavorable regulatory changes, Barclays’ internal-only product development cannot compete against fintechs’ speed. Consequently, it began to experiment with open innovation as a cheaper, faster, and more expansive form of R&D.

Barclays and Open Innovation – Today

In the short-term, Barclays is addressing the above challenges by using crowdsourcing, an open innovation technique, to develop incremental products and tools:

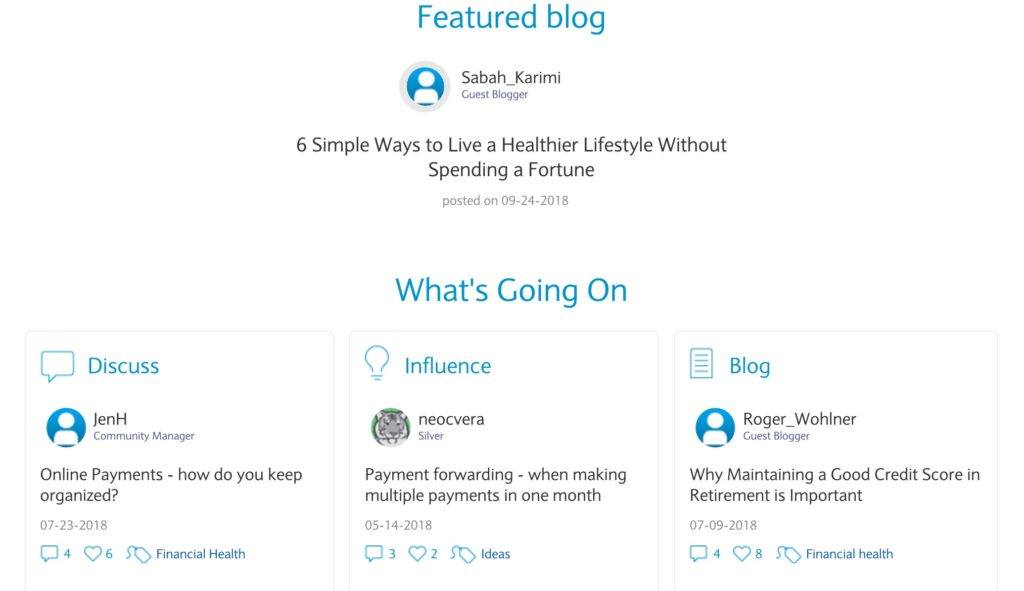

- Barclaycard Ring Mastercard: Ring is a crowdsourced credit card where customers can propose and vote on changes to the card through a forum. Past votes include removing foreign transaction fee and redesigning the physical card[9]. By crowdsourcing Ring’s features, Barclays was able to customize it to the needs of its customers and increase customer engagement.

- Open source partnerships: Barclays partnered with Australian bank CommScore to release a data extraction tool to the open-source community[10]. This allowed Barclays to replace expensive, proprietary ETLs with a free alternative.

In the medium-term, Barclays is using fintech partnerships to enhance their product development exploration funnel and enable long-term process improvements. Per Magdalena Krön, VP of Open Innovation at Barclays, fintech partnerships are “the new R&D function.”[11]

Barclays engage fintechs through their Accelerator and Rise initiatives. Accelerator provides fintechs with access to Barclays’ technology and network in exchange for equity. Rise are co-working spaces that also host workshops and hackathons. Barclays uses these programs as a funnel to identify and maintain a relationship with high-potential startups (see below), so that Barclays can later launch products by acquiring or partnering with these startups (vs. building in-house). In addition, Rise encourages employees to interact with startups, empowering employees with the skills to “challenge the traditional internal way of doing things [at Barclays].”[11]

Over the next two years, Barclays should incorporate fintech crowdsourcing into their main product line vs. keeping them at arms-length with Accelerator and Rise. Longer term, they should use open innovation to fundamentally change processes within whole functional areas.

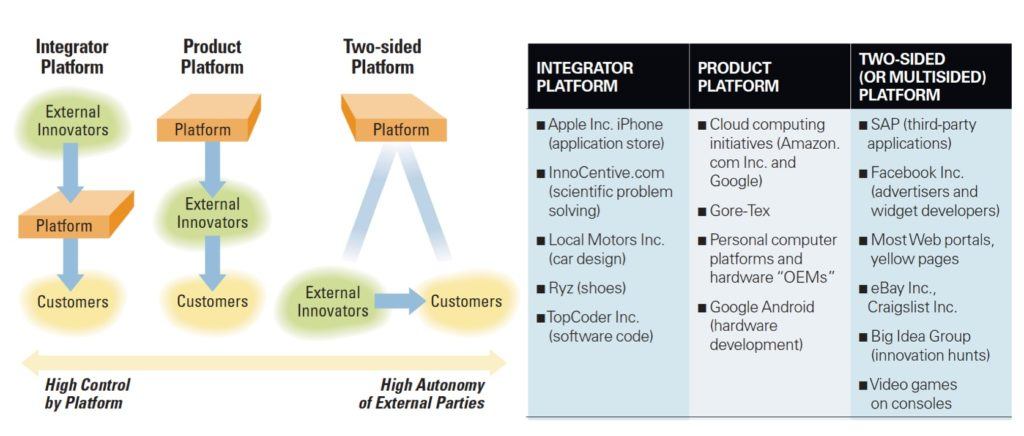

In the short-term, one area of application are the APIs required by Open Banking regulation. Instead of just offering the APIs, Barclays should also create a two-sided platform (see below) available to its customers. Access to Barclays’ wide customer base will encourage third-parties to develop on Barclays platform, which in turn helps Barclays by generating a diverse range of products at lower cost.

More broadly, Barclays should institute a formalized system of crowdsourcing customers for product ideas. 44% of computerized banking services today were first built by a customer[14]. Similar to how software gaming companies use “mods” – alterations made by users to a game – to enhance their core product, Barclays can encourage homemade computerized banking services (e.g., account aggregators, budget tools), potentially via the two-sided platform described above.

Conclusion

In the face of limited resources and increasing competition and regulation, Barclays has experimented with crowdsourcing and fintech partnerships. Early success of these open innovation programs suggest that Barclays should consider further embedding open innovation into their core products and services instead of ring-fencing them.

Nevertheless, key questions remain as to the effectiveness and unintended consequences of using open innovation in banking, including:

- Does open innovation increase Barclays’ risks of commoditization and disintermediation?

- How should Barclays maintain controls and cybersecurity within an open innovation ecosystem?

(794 words)

[1] Chesbrough, H. (2004). Open Innovation: Renewing Growth from Industrial R&D. In 10th Annual Innovation Convergence. Minneapolis.

[2] Gohman, K. (2018). Open Banking: What U.S. Banks Need To Watch. Retrieved from https://www.forbes.com/sites/forbesfinancecouncil/2018/03/15/open-banking-what-u-s-banks-need-to-watch/#65dc828d2af9

[3] Riley, J. (2018). Compliance projects take 40% of Barclays Bank’s IT budget. Retrieved from https://www.computerweekly.com/feature/Compliance-projects-take-40-of-Barclays-Banks-IT-budget-says-technology-chief

[4] Korek, J. (2018). Global Regulatory Outlook 2018. Duff & Phelps. Retrieved from https://www.duffandphelps.com/-/media/assets/pdfs/publications/compliance-and-regulatory-consulting/global-regulatory-outlook-2018.ashx?la=en

[5] Fintechs stand for Financial Technology firms. In general, fintechs refer to non-bank startups.

[6] Hardie, S., Wood, J., & Gee, D. (2018). Innovation, Distributed: Mapping the fintech bridge in the open source era [Ebook]. MagnaCarta Communications, ACI. Retrieved from https://www.aciworldwide.com/-/media/files/collateral/other/aci-magna-carta-fintech-disruptors-report.pdf

[7] Accenture. (2018). The Future of FinTech and Banking: Global Fin Tech Investment Triples In 2014. Retrieved from https://www.cbinsights.com/research/fintech-and-banking-accenture/

[8] APIs are protocols for how software components should interact and talk with each other.

[9] Harkness, B. (2018). 2018 Review: Barclaycard Ring Mastercard – Most Unique Credit Card?. Retrieved from https://www.creditcardinsider.com/reviews/barclaycard-ring-mastercard-review/#the-ring-community

[10] Tony Kerrison – Head of Infrastructure Services, Barclays bank PLC (2017). . San Francisco: Boardroom Insiders, Inc. Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1891116054?accountid=11311

[11] How Barclays is waking up to open innovation | Barclays. (2018). Retrieved from https://www.home.barclays/news/2016/11/northern-light–magdalena-kroen-talks-fintech–innovation-and-ge.html

[12] Rose, L. (2018). “Barclays Accelerator: Tel Aviv 2017”. Retrieved from https://www.slideshare.net/Dataconomy/barclays-accelerator-liron-rose-managing-director-at-tech-stars-tel-aviv

[13] Boudreau, K., & Lakhani, K. (2018). How to Manage Outside Innovation. MIT Sloan Management Review, Summer 2009, 69-76.

[14] Oliveira, P., & von Hippel, E. (2011). Users as service innovators: The case of banking services. Research Policy, 40(6), 806. Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/871974573?accountid=11311

Hi Annie,

Great job on a thorough and well-structured essay. I liked the graphs and examples of recent successes. In terms of how these startups can impact the bottom line at Barclays, I am curious about which use cases or topics need to be prioritized.

My takeaway is that all companies should look at instituting the “mod” model to crowdsource product enhancements from their customers.

It is fascinating to hear how a “large old” bank is doing its best to stay young and with the times. I couldn’t help but think about the opening comment and how consumers don’t trust big banks for financial advice. The majority of Americans are considered financially illiterate and the nation is in desperate need of an improvement in financial education. It seems that the community the bank created could help them find ways to better encourage customers to educate themselves or providing them with a platform to learn basic financial principles. Ultimately they run the risk of losing customers but should create new products or services to help customers improve their financial lives.

This article leaves me wondering what kind of bias a company might face when using open innovation and how reliable that information will be about their customer base. For the Vetr example you used, I can imagine that the crowd sourced data set might be overly bias towards the technology sector due to the nature of it being a web-based platform. For the Barclaycard Ring Mastercard, I would question if the voting mechanism accurately represents the cardholder’s interests. There are ways to ensure that open innovation is coming from the target customer. The best example of this done right is the one you provided about gaming mods. This is a bottom up approach driven by early adopters and high frequency gamers that drive the industry trends. If Barclays can ensure that their open innovation data is not biased and are aware of the specific customer base that is contributing the majority of the information, then I agree that it will be a competitive advantage for the bank.

I really liked this article–thanks for sharing! I am impressed by the Ring product and how Barclays uses the forum to incorporate customer feedback into product development. I am curious to know whether the feedback/conversation is one- or two-sided. E.g., does Barclays communicate to the Ring community the trade-offs that they may have to face as they add new features to the card, or is that communicated via the fees and features of the next release of the product? I love the idea of crowdsourcing customer service. I see this done by Apple a lot; the Apple forums provide great answers to all of my Apple tech questions. It’s great to see big banks working to be more innovative–would love to see more of this!

This is a very interesting application of crowdsourcing. Something I was left wondering is how this might impact them in terms of competitors. If other (similar) banks begin to use the same process to drive product innovation, how would Barclays ensure a competitive advantage? By this I mean, if product innovation is coming from crowdsourced ideas, what would stop other banks from getting the same ideas from customers?

I loved your suggestion for creating a two-sided platform and crowdsourcing in customer service! They are brilliant ideas that would make the “old institutes” adapt to the new era better. I agree that open source will help with the product development cycle but definitely will also bring down the quality and controls Barclays maintained in the past. On a separate note, it was great to know that Barclays was able to customize based on customer feedbacks and increase customer engagement. But who are they going to listen to, the louder one or the less profitable to bank one? I see a conflict of interest in an openly designed banking product.