… Still Got Milk?

Climate Resilience for Dairy in India

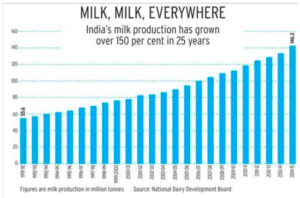

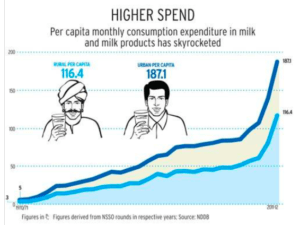

India is the world’s largest producer of milk,[1] accounting for 18.5 percent of global supply, or about 400 million liters a day in 2014-15.[2] The industry is growing at a CAGR of 15-16 percent, of which the formal milk economy is worth approximately USD 12 billion. Milk value-added products, like cheese and ice cream, see high profits, with EBITDAs ranging between 25 and 40 percent.[3]

These figures and the fast-rising demand for milk and dairy products in India present attractive opportunities for cooperatives and businesses in India, but rising temperatures pose a lot of challenges. Maitree Fresh,[4] a small producers’ company of female dairy farmers in Tonk, Rajasthan, faces lower yield because of heat stress among buffalo and cows[5] as well as rising and more volatile input costs (for feed, fuel, electricity, and shelf-life extension).

Indian Milk Production 101

India’s milk production ecosystem is unique in the world, 55 percent dominated by cooperatives that have wide and complex milk sourcing schemes from millions of small farmers. Typical dairy businesses source small-farmer milk through a massive network of milk collection centers (MCCs), where milk is collected once or twice daily from local farmers, stored in chilling units, and then transported to processing plants for pasteurization and conversion to raw bulk, powder, or other value-added products like cream, ghee, cheese, and yogurt. Success depends heavily on the ability to streamline logistics (collection and transportation times and routes) in order to manage short shelf life and quality variability. Major seasonality in prices and production are also major challenges faced by the dairy industry, which provides secondary income to millions of small farmers.

Actions and Opportunities for Climate Change Response

Businesses like Maitree Fresh are trying to insulate themselves by increasing milk shelf life through improved pasteurization and storage logistics and by diversifying into longer shelf-life value-added dairy products like ghee and cheese.[6] This helps to buffer against the increasing challenges of maintaining shelf-life in light of rising temperatures, and it also helps to step into higher-margin products and more diversified revenue streams. Businesses also insulate through long-term livestock feed procurement.

But this leaves them exposed to anticipated falls in animal milk yield and anticipated rises and volatility in most input costs. They’re going to need to look at many more solutions, including improved and diversified animal breeding and sourcing, improved animal care, insurance, and perhaps hedging with production of countercyclical commodities like organic manure. Strengthened breeding will prove a major challenge in light of anticipated shortages in high-quality livestock, and perhaps government will play a role here. Sourcing from both cows and buffalos can help because the animals have opposite production trends across the year. Moreover, increased veterinary care has been found to make huge differences in yield, as many small farmers go without (Stutilina, 2010).

[1] Considering cow and buffalo milk

[2] Press Release: 26 February 2016. Press Information Bureau. Ministry of Finance. Government of India. Accessed 3 November 2016. http://pib.nic.in/newsite/PrintRelease.aspx?relid=136849

[3] Shashidhar, Anita. “The Rs 80,000 crore milk business.” Business Today. Accessed 29 July 2016. www.businesstoday.in/magazine/cover-story/indian-dairy-market-is-on-a-tear-due-to-new-players/story/232545.html

[4] Stutilina, P. and Debasish Pradhan. Case Study: The Establishment Of Maitree, A Producers’ Company Of Women. SRIJAN.

[5] Sreenivasaiah, K. 2016. “Climate Change and Its Impact on Milk Production in India.” Climate Change Challenge (3C) and Social-Economic-Ecological Interface-Building, pp.531-547.

[6] “New chilling unit to augment milk supply.” The Hindu. Accessed 10 October 2007. www.thehindu.com/todays-paper/tp-national/tp-otherstates/new-chilling-unit-to-augment-milk-supply/article1926969.ece

Images Source: Ajita Shashidhar (www.business today.in)

As I understand a critical portion of the milk producers in India are still small independent farmers that do not have the required money to invest into innovative technology or do not have much power over the supply chain. Should the government incentivise a wider development of Dairy cooperatives as well as investments from the private sector to modernise the overall dairy product supply chain?

A major risk of global warming is what Mckinsey calls “physical risks” i.e the ones related to infrastructure and assets damage due to the increased frequency and intensity of extreme weather events. Factories or the supply chain of Mairee Fresh could be severely damaged thus interrupting business. So shouldn’t Mairee Fresh assess how exposed it is to such a risk and take appropriate measures to mitigate it?

Interesting read – do you think that the changes you recommended are within grasp for a company like Maitree Fresh or will they be too capital-intensive to achieve on a short timescale? What do you think the timeline/horizon looks like for companies trying to make these shifts toward sustainability? How urgent are these measures, and will they potentially lead to some consolidation in the dairy industry in India? And how should these companies prioritize shelf life, etc. vs innovations closer to the top of the supply chain (combating lower yield, e.g.)?

Great read! Having lived in India for over 20 years, I didn’t know the severity of the impact of climate change on the milk industry in India. I would be curious to learn how the cooperatives intend to improve pasteurization and logistics? What kind of technology improvement are they considering? How much would this cost and is it viable? My guess is that in order to implement this on a large scale, the cooperatives would probably need access to significant upfront capital. Perhaps, groups of cooperatives in the same area can work together in this regard to jointly test and scale these initiatives.

Thank you for sharing! I have to admit I’m somewhat ashamed I did not know how big the dairy industry is in India. I really do think with the right cooperation and organization between small farmers, the industry as a whole can pull together enough resources to diversify their cattle breeds as well as build infrastructure to go into more stable products (is milk powder well received in India? I can imagine it could be successfully exported to much of the Middle East). The reason that I say so is that the Dutch dairy industry is built as a cooperative structure as well. One issue we didn’t address was how cattle farming does contribute to methane production and therefore is a part of the problem that is plaguing the industry itself. Dutch cooperatives have started trying to turn cow-dung into biofuel – perhaps that’s another source of income to supplement dairy sales? https://www.theguardian.com/sustainable-business/2016/nov/02/netherlands-europe-dairy-industry-agriculture-biogas-cows-manure-poo-power

Fascinating read. I am curious regarding how much of India’s milk production is exported, if any? If their production is so high without exports, their consumption must be very high too, which intrigues me. I am also interested in the best investments for these firms regarding milk processing and extended shelf life. Perhaps it’s improved pasteurization techniques, but as you mention, it could be treatment of the cows and milk’s inputs. My guess would be that the farmers would appreciate more research on the different techniques to improve shelf life before ultimately making a large investment decision.

Thanks for the article, great insights in the Indian milk industry. Producer’s fragmentation seems like a huge challenge to overcome along with logistic issues. I was wondering what you think of the possibility of companies such as Maitree Fresh to seek vertical integration and take the leap into the milk production industry. Barriers to enter the market appear limited and the advantages in term of decreased logistics’ cost and complexity compelling. Finally, the company could gain control over breeding and product mix.

Good Read. I think while the rising temperatures is a key reason affecting the Indian milk supply- there are numerous other factors that should be addressed first to improve yields- predominantly the quality of breeding and care for these animals, which is not the best amongst these small independent milk producers. These producers also have lower incentive to invest in better care, since several of them are squeezed out of the business by large corporations who have started to sell highly processed and often times fortified milk. Quality control is also a major issue that farmers face resulting in milk spoiling a lot more quickly. So while I agree that rising temperatures is a major issue that needs to be addressed in the long run, in the short run we could try to streamline processes first.

I wonder how the fragmented nature of the industry impacts this issue. On the one hand, cooperatives are sourcing milk from thousands of milk producers, which diversifies their supplier base and can ameliorate fluctuations in supply. On the other hand, larger farms have greater resources and can invest in technologies to soften the effect of climate change on the production and storage of milk. My guess is that smaller farmers are especially susceptible to the impact of global warming, and based on the portrait you’ve painted here, that can be an especially massive issue for the dairy industry in India.