Rest Easy, Global Giant: additive manufacturing as risk mitigator

For infrastructure-builder AECOM, additive manufacturing represents a way to address a set of its most-pressing risks–but is the technology ready?

A global giant’s fears

A good night’s sleep might be understandably elusive for Michael S. Burke, CEO of $18B infrastructure design and construction firm AECOM. The scale and variety of risks his firm faces each day are staggering; the firm’s most recent regulatory filings lay out more than 40 of them, ranging from government funding shifts to industry cyclicality.1 While many of these risks are beyond his control, Burke could look to one future technology to improve his company’s processes by de-risking them: additive manufacturing (also known as 3D printing). In particular, the technology could address three major risk categories:

Speed. AECOM cites “failure to meet contractual schedule” as a high-level risk across its global construction business.1 Additive manufacturing is well-positioned to cut construction times and reduce variability. An analysis by The Boston Consulting Group (BCG) suggests that “by operating 24/7 and by reducing onsite glitches and hence delays, 3D printers can cut construction times dramatically,” in part by reducing “deliveries of building materials” and “complex interactions between various trades.”2

Safety. When AECOM admits its “project sites are inherently dangerous workplaces,” with risks including “employee death,” it is not imagining hypotheticals: just this year, an AECOM subsidiary suffered a fatality on a tunnel job-site near San Francisco, and on at least one occasion in the last five years, the U.S. Occupational Safety and Health Administration has levied fines on AECOM for “serious violations” resulting in a fatality.1,3,4 Autonomous 3D printers could lessen the need to put workers in the most-hazardous sites, and in turn reduce the chance of fatality or serious injury.

Environmental impact. Many of AECOM’s contracts require them to “manage, handle, remove, treat, transport and dispose of toxic or hazardous substances” in “sensitive environmental areas” and in compliance with environmental regulation in over 150 countries.1 On this front, BCG also found additive manufacturing to be advantaged, suggesting it could “reduce the construction sector’s harmful impact on the environment” by allowing “contractors to use less material,” enabling “up to 50%” of that material to come from recycled sources, and reducing the need for “separate structural units.”2

Playing the waiting game

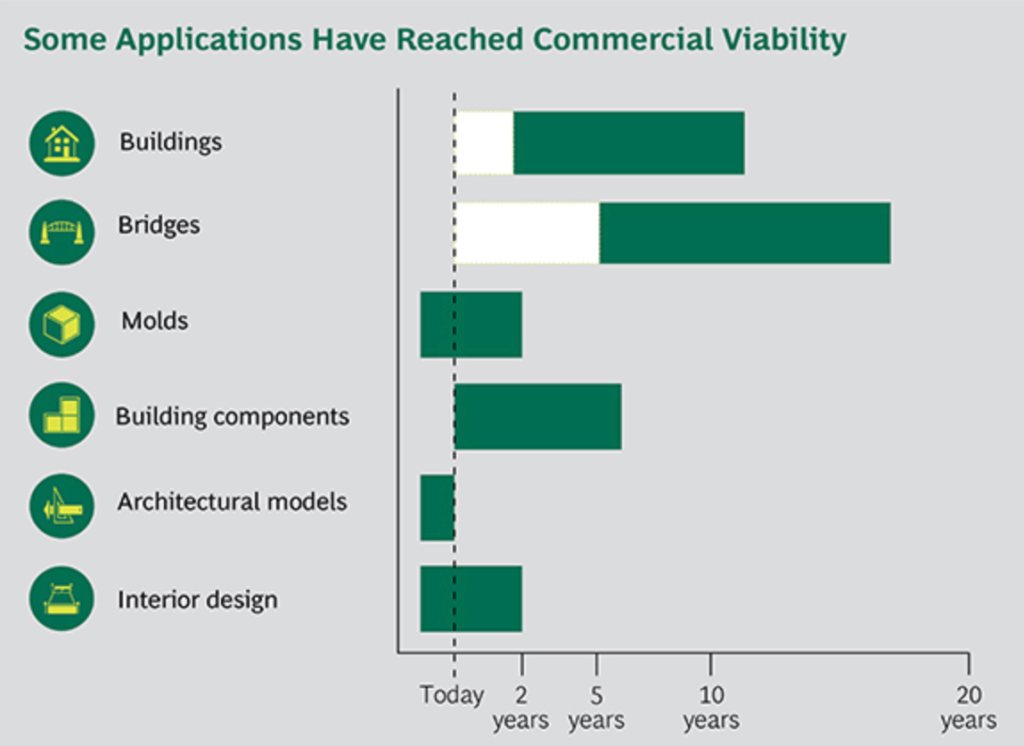

For additive manufacturing to be an attractive risk-mitigation tool for AECOM, it must first be commercially viable. And while publications like The Economist may expect “3D printing” to “revolutionise construction,” the headlines are ahead of the reality.5 Just how far depends on the application. As shown in Figure 1, by one estimate, whole building- or bridge- scale 3D printing sufficient for AECOM’s infrastructure projects may be nearly 20 years away.

Figure 1: Estimates of time to full commercial adoption of additive manufacturing, by application

Source: Romain de Laubier, et al., “Will 3D Printing Remodel the Construction Industry?,” The Boston Consulting Group, January 23, 2018

Given the state of additive manufacturing development, AECOM’s current interest in the technology is twofold: (1) applying the technique, where possible, to building components and models, and (2) partnering with smaller companies innovating in the space.

Applying the technique has so far been limited to the United States, where The Wall Street Journal reported AECOM is “printing jail cells out of concrete,” in order to “precisely place openings for plumbing and other fixtures” and ensure security.6

With regard to partnerships, AECOM has been slower to act, signing just one agreement in 2017 with ambitious Chinese 3D printing company WinSun. The pair have been quiet on details of the partnership, though Antonio Ng, AECOM’s Executive Director of Innovation for Greater China, has said publicly that the two promise to “work together on future construction projects” and send “56 members of AECOM from around the world” to a workshop at WinSun’s facility in China.7 Some of AECOM’s competitors, too, seem to have opted for the partnership path—construction companies Vinci and Bouygues have also established partnerships with startups and universities, respectively, on the topic of 3D printing.8

The path forward

Given 3D printing’s potential to substantially reduce risks in AECOM’s processes, the company could more aggressively pursue the technology:

The short-term: sponsorship. With interest and investment continuing to grow in the space, AECOM can move quickly to broaden its set of 3D printing partnerships. This may take the form of projects/tests with additional startups in different geographies, research with universities, and/or agreements with larger corporations also interested in advancing additive manufacturing.

The medium-term: research. AECOM could leverage its global scale, relationships, and resources to directly invest in developing cutting-edge technology that would move 3D printing forward. Though it would require substantial investment in human capital and equipment, recent work in autonomous driving—where stalwarts like GM have attracted billions in partnership investment and aim to launch early products by next year—provides a proof point for the type of acceleration possible.9

Open Questions

Though promising, the future of 3D printing in construction is far from clear. As AECOM grapples with it, foundational questions arise: Is 3D printing revolutionary enough to warrant funding research, or should management wait-and-see?

(790 words)

Endnotes

1 AECOM, September 30, 2017 Form 10-K, http://phx.corporate-ir.net/phoenix.zhtml?c=131318&p=irol-sec, accessed November 2018, p.18-22.

2 Romain de Laubier, et al., “Will 3D Printing Remodel the Construction Industry?,” The Boston Consulting Group, January 23, 2018, https://www.bcg.com/en-us/publications/2018/will-3d-printing-remodel-construction-industry.aspx. Accessed November 2018.

3 Michael Barba, “Twin Peaks Tunnel Construction Resumes After Accidental Death Of Worker,” San Francisco Examiner, August 12, 2018, http://www.sfexaminer.com/sf-twin-peaks-tunnel-construction-resume-accidental-death-worker/, accessed November 2018.

4 Occupational Safety and Health Administration, “Inspection: 1050255.015,” September 30, 2016, https://www.osha.gov/pls/imis/establishment.inspection_detail?id=1050255.015, accessed November 2018.

5 “3D printing and clever computers could revolutionise construction,” The Economist, June 3, 2017, https://www.economist.com/science-and-technology/2017/06/03/3d-printing-and-clever-computers-could-revolutionise-construction, accessed November 2018.

6 “3-D Printed Buildings Are a Tech Twist on Ancient Construction Techniques,” The Wall Street Journal, April 1, 2018, https://www.wsj.com/articles/3-d-printed-buildings-are-a-tech-twist-on-ancient-construction-techniques-1522580400, accessed November 2018.

7 Antonio Ng, “Additive Construction: From the 3D-Printed House to the 3D-Printed High-Rise,” interview by Michael Molitch-Hou, Engineering.com, May 31, 2018, https://www.engineering.com/3DPrinting/3DPrintingArticles/ArticleID/17038/Additive-Construction-From-the-3D-Printed-House-to-the-3D-Printed-High-Rise.aspx, accessed November 2018.

8 “AECOM forms alliance with Chinese 3D printer WinSun,” Global Construction Review, May 19, 2017, http://www.globalconstructionreview.com/companies/aecom-forms-alliance-ch7inese-3d-prin7ter-win7sun/, accessed November 2018.

9 Neal E. Boudette, “Honda Putting $2.75 Billion Into G.M.’s Self-Driving Venture,” The New York Times, October 3, 2018, https://www.nytimes.com/2018/10/03/business/honda-gm-cruise-autonomous.html, accessed November 2018.

Prior to reading your post, I always believed additive manufacturing was in a precarious position — it’s not fully adopted, yet it’s not unknown to people. However, after reading through your analysis, I’ve concluded that the concept is extremely mature and will definitely disrupt infrastructure design and construction within the next 2-10 years. With this in mind, Michael Burke should invest heavily in 3D printing technology. He needs to focus the first on “Big Bets” to maintain their competitive advantage. If Burke fails to do this, he may last another 10 years, but eventually he’ll go from $18B to $0B.

thank you for your insights. For me, the key question of whether to invest or not is how proprietary additive manufacturing advancements are to the company developing them. Since some aspects of it are still ground research level I am not sure whether it makes sense to invest significant resources just to push the technology as a whole but not necessarily create competitive advantages for your company. If however, the capabilities you invest in can actually provide a sustainable advantage, I would definitely commit resources for this.

Very informational piece! I believe that the construction industry has lacked any material innovation and productivity has lagged behind general productivity increases and that AECOM is at a position of strength from a sheer size standpoint and therefore should take on this potentially industry-revolutionizing trend in the market because the competition is fierce in this industry. Therefore, if I were the CEO of AECOM, I would implement 3D printing as much as possible now with AECOM’s current processes and procedures.

Very interesting to apply additive manufacturing for construction. I agree that it can help solve a lot of the key issues that you pointed out, but my question would be: at what cost. Construction companies are extremely cost conscious, and I wonder if getting additive manufacturing into the mix would make their project unprofitable. Perhaps they can start small with certain pieces that they know they can save money on.

Really enjoyed this article! One of the interesting questions that I think you raise is in relation to what value-add additive manufacturing brings to the construction industry. When you deal with heavy, low value items like construction materials it certainly seems that it would make sense to do as much ‘manufacturing’ as possible on site. Another question may be to what extent it makes sense to actually ‘own’ rather than ‘lease’ the intellectual property required to carry this forward. I’m not quite sure how you’d cost it but it may be interesting to consider.

Great article. I can understand the potential of additive technology in the construction business. I imagine that the costs in this industry are astronomical and additive manufacturing has the potential to drastically lower the costs of development and part creation, especially when these steps have to be done for thousands of projects. This also has the potential to decrease safety risks and increase precision in construction and architecture. I do find it interesting that people consider this technology’s wide use in the industry so far away (almost 20 years according to this post). I wonder if the true reason is the heavy costs associated with investing in 3D printing and the relatively unproven nature of the technology. Do we know that additive technology mitigates risk? Is this actually a less costly option in the long run?

I also wonder whether this company should partner with a 3D printing company or simply invest in developing the technology themselves. My instinct is that this is a gamechanger for the industry, but I completely understand how someone may balk at the upfront costs necessary to truly make inroads in internal additive manufacturing.

While I can understand the hesitancy to fully jump into the 3D printing space given a number of uncertainties remain, the ability to significantly reduce the risks related to construction is highly compelling and is one that I believe AECON should pursue more aggressively. With that, the company can consider alternative ways to speed up the process, including considering whether to go beyond partnerships and instead acquire some of these 3D printing companies, or perhaps fund an open innovation program that pools in 3D printing expertise given the industry appears to be largely collaborative in nature.

Thoughtful essay.

You touched an important point on the costs of 3D printing for construction applications and 20-year period to reach profitability seems discouraging. My guess would be that 3D-printing in the construction industry is at a significant disadvantage due to lack of economies of scale. Another concern would be that 3D-printers maintenance and logistics costs would make its application economically unsustainable even in the long-term.

In addition, on the safety risk mitigation, I would be interested in potential new risks that additive manufacturing would create. Somebody still has to deliver the printers on site, service them, and finally, still do construction jobs even with additive manufacturing outputs.

A very interesting read and thank you so much for your time!

3D printing is an upcoming technology but still have a lot of unanswered questions, the technology itself is still under development. I would suggest management team to wait and see.