Orbitz: Turning Digital Distribution from a Challenge to an Opportunity

It was the year 2001. The leaders of five major airlines (Delta, United, American, Continental, and Northwest Airlines) were greatly concerned about the rising threat of digital distribution through 3rd-party online travel agencies/exchanges such as Expedia. In contrast to traditional distribution channels of live travel agents and brokers, in digital distribution the sale of a plane ticket takes place online, with data entry and sale finalization executed digitally by the consumer. Some consumers also receive on-demand help from live support representative via text chat or phone.

In 2001, digital distribution was becoming more relevant in the airline ticketing space than ever before due to factors such as consumer demand (more consumers regularly shopping online) and airline cost pressure (billions of dollars spent on agent commissions, a cost which could be reduced if distribution was shifted online).

At the time, airlines were faced with three main possible digital distribution strategies:

- Rely primarily on 3rd-party exchanges (e.g., Hawaiian Airlines): embrace exchanges as the primary digital distribution channel, cutting costs elsewhere to fund commissions

- Participate in 3rd-party exchanges, but prioritize direct-to-consumer channel (e.g., United Airlines): participate broadly in 3rd-party exchanges, but use tactics to pull customers to own website

- Exclusively focus on direct-to-consumer sales (e.g., Southwest Airlines): distribute exclusively through own website using strong differentiation to attract customers

However, in the eyes of Delta, United, American, Continental, and Northwest Airlines, the options above posed 4 main challenges:

Uncertainty around how large the nascent digital channel would become

In 2001, only 7% of airline bookings were being made over digital channels [1]; however, researchers projected a 28-50% annual digital growth rate through 2005.

High cost to distribute through 3rd-party exchanges

In 2001, there was an ~$26 commission cost per ticket booked, similar to the cost of an live agent [1]. This represented ~8% of the price of an average airline ticket price ($320) [2].

Unlevel playing field on some 3rd-party exchanges

For example, the SABRE digital booking system was accused of being biased towards American Airlines, its parent company.

Low volume through carrier-owned websites/exchanges

Only 3% of airline bookings at the time occurred on an airline’s owned website [1].

Thus, these 5 airlines decided to band together to form a joint venture called Orbitz in order to cut out the middleman. By creating their own joint digital distribution platform, the airlines created the following benefits for themselves:

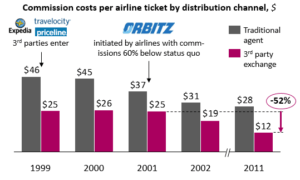

- Lowered digital commission cost structure: Before Orbitz, digital sales commissions for airfare were stubbornly high (see Figure A below). When Orbitz launched, it instituted digital commission rates that were 60% lower than the status quo.

- Inclusivessness (i.e., open to all airlines)

- Objectivity and fairness in how plans are compared: Unlike Expedia and some of its other competitors that charged airlines fees for more favorable placement of their flights, Orbitz created a level playing field by listing flights in an unbiased order [3]

- Shared ownership and decision making

- Controls to protect proprietary data

As a joint venture, Orbitz worked because the airlines shared challenges and goals with the other airlines and there were limited vested interests that would have created tension among the airlines because the digital channel still nascent.

By applying collective pressure on 3rd-party exchanges, the launch of Orbitz catalyzed industry-wide reductions in digital commission rates (see Figure A). The standard industry digital commission rate dropped 15% within one year and eventually dropped more than 50%. As digital commissions declined, traditional agent commissions also dropped [1].

Figure A

Orbitz was a big success: it cost the 5 airlines ~$250M to build and fund Orbitz until it reached self-sustaining profitability, and it was acquired by Cendant in 2004 for $1.25B [3], showing the potential rewards that could be created by companies that can successfuly turn digital distribution from a threat to an opportunity.

[629 words]

[1] “Impact of Changes in the Airline Ticket Distribution Industry,” United States General Accounting Office, 2003 http://www.gao.gov/new.items/d03749.pdf

[2] “Annual US Domestic Average Itinerary Fare in Current and Constant Dollars,” Bureau of Transportation Statistics, 2016 http://www.rita.dot.gov/bts/airfares/programs/economics_and_finance/air_travel_price_index/html/AnnualFares.html

[3] “How to Hedge Your Strategic Bets,” Harvard Business Review, 2016 https://hbr.org/2016/05/how-to-hedge-your-strategic-bets

It’s interesting how Orbitz was responsible for lowering commission rates as now airlines pay minimal commissions to online travel sites, whose primary revenue streams come from hotel and hotel package bookings. The industry is also facing tremendous consolidation and there are now just two large players in the business: Expedia–whose portfolio include Orbitz, Travelocity, Hotwire, Hotel.com and Cheaptickets, among others– and Priceline–which owns Kayak, booking.com and Agoda, among others. (Source: http://ehotelier.com/insights/2015/12/16/the-ota-duopoly-priceline-vs-expedia/) Hotels now have less leverage than ever with online travel agencies given the lack of competition, meaning that Expedia and Priceline have can demand higher commissions without leaving them much resource. And in all likelihood, prices will be higher for consumers given that they don’t have many real competitors to choose from — the “choice” is only an illusion.

Lanny, this is of my favorite posts so far, thanks. Its interesting how having vertical consolidation can greatly improve the margins of a company. Delta recently tried to follow this principle by purchasing a refinery that produces its jet fuel. The financial success of this venture is still being determined. There certainly are some challenges to vertical integration (i.e. an airline having to learn how to operate a refinery), but if the synergies between businesses are high enough the profits can be large. In this case it’s interesting how the Airlines used Orbitz to create a price war with the other booking sites and keep a higher portion of the ticket price for themselves.

It’s amazing how these traditional airlines forced both online and offline agent commissions to go down significantly through their collaborative efforts. It makes sense for them to do this to push out the online booking sites from the ticket purchasing process, while still allowing customers to compare between multiple airlines – which is essentially all a customer wants. I’ve definitely noticed over the years, the price difference between directly going to the airlines and going through the online booking sites have been smaller – and hotels, similarly, have now began to offer “exclusive perks” to those who book online directly vs hotels.com in order to get rid of the middleman. Very interesting post!

Thanks for the interesting post! I have used Orbitz for many years, but I’m never aware that actually it’s operated by airlines! This is really a brilliant idea to cut the middlemen and directly contact with consumers. As the internet becomes more and more prevalent in the world, many traditional companies started facing the problems that how to define their relationship with emerging online competitors. Most of the time, they chose to cooperate but couldn’t get any profit from it as the online competitors have taken all profits away, so the Orbitz business model would be a good example for companies to grow online. If available, I’m also wondering that if Orbitz can also consolidate hotels, rental and B&B guesthouse functions into it, so the customers can experience the one-stop shopping model on it.

Woah! I didn’t know that Orbitz was initially funded by airlines. That feels…fishy.

While it seems from your post that the joint venture was done completely above board and there were no collusion worries (though it was investigated by the Transportation and Justice Departments for possible anti-trust violations: http://articles.latimes.com/2002/mar/30/business/fi-orbitz30), you could clearly see how other industries make collude to hurt customers. The most notorious example is OPEC, which is a collection of countries that bands together to manipulate oil prices rather than having regular supply and demand shape equilibrium prices and quantities.

Furthermore, while you show how commission rates changed after Orbitz was launched, doesn’t economics tell us that the market would have made this correction eventually anyways? If companies could survive charging a smaller commission and passing that savings onto consumers, then more companies would enter at this lower price point until an equilibrium was reached. But perhaps it took the airlines banding together to really push this initiative forward.