Netflix and Chill? The Rise of a Tech Media Powerhouse

Netflix has set the standard in the new age of digital media. Its meteoric rise has challenged the status quo of traditional media companies and forced many industry traditionalists to rethink their strategies. How did Netflix do it? What drove the success of a former DVD rental business?

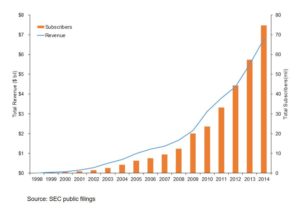

It’s hard to think of life before Netflix – tons of content right at our fingertips. Launched in 1997, Netflix started as a DVD rental business but quickly transitioned to subscription by 2000 (1). At the time, Netflix differentiated itself by providing consumers with an intuitive, online DVD library and no late fees. When the company introduced streaming in 2007, the on-demand nature of streaming, combined with no commitments, no contracts, no advertising, no-hassle sign up and cancellation, drove even more subscribers to the platform (2). While the impacts of digitization on Netflix’s business and operational models are numerous and nuanced, there are two main factors at the core of Netflix’s success which digital elevated to the next level: distribution and data.

Distribution

In the beginning, Netflix’s DVD business used a complex process to ensure timely delivery of DVDs to consumers. Bandwidth costs made streaming more expensive than mailing physical discs (2). DVDs, weighing about 1 oz per disc, cost 37 cents to ship via the US Postal Service (3). Operationally, Netflix had to manage the delivery and storage of millions of discs at 37 shipping centers around the country (4). To process returned DVDs, employees opened and scanned each red envelope DVD by hand, triggering a return notification email to the customer (4). The DVD was then logged back into inventory and reprocessed for the next customer with a cycle time of about a day. While employees handled the initial steps in the process flow, the majority of the sorting, storing, and selecting DVDs was mechanized, processing 3,200 DVDs per hour (5). Even though the DVD business jump started Netflix, Founder and CEO Reed Hastings knew the future was in digital streaming. Streaming provided several advantages over physical DVDs. Firstly, reducing the cost of physically storing, distributing, and maintaining a large library of physical discs. In 2005, Netflix had over 40 million individual DVDs in inventory with over 1 million in transit each day (4). Secondly, DVD obsolescence, whether due to physical degradation or non-returns, impacted the inventory if films. In 2002, Netflix managed the storage and delivery of 11,500 titles (2). In 2015, that number sat around 93,000 titles (6). Furthermore, old titles get significantly less play time than newer titles and sit for longer periods in storage. Thirdly, from a consumer standpoint, lead times for the delivery via the US Postal Service were long vs. the on-demand nature of streaming. Digital streaming eliminates these challenges and enables Netflix to re-deploy capital toward content acquisition and digital delivery costs.

Data

The move to digital has armed Netflix with tremendous insight through data. Analytics and a nuanced understanding of the behavior of 70+ million subscribers worldwide have helped make Netflix’s innovation funnel more efficient – whether it be choosing which films to license or determining which original productions to greenlight. Netflix tracks where and when users pause, stop, rewind, repeat, or fast forward. Time of day, duration, and location of viewing sessions are also logged. Browsing, searching, and scrolling behavior are recorded (7). Now, before we cry NSA, let us remember that Netflix has stringent privacy policies and uses the data to provide recommendations for users. After all, 75% of what we watch on Netflix is based on algorithmic recommendations (7). Ultimately, understanding user preferences enables Netflix to facilitate content discovery.

Data also gives Netflix an advantage when producing original content. In 2014, Netflix signed an exclusive 4 film deal with Adam Sandler after seeing that his movies were the most re-watched in the Netflix library (9). Similarly, Netflix commissioned the $5 million-per-episode show House of Cards after seeing 3 things: first, the British show House of Cards was very popular among subscribers; second, fans of British House of Cards were also avid viewers of films which starred actor Kevin Spacey or were directed by David Fincher; third, fans who watched David Fincher films watched the entire film in a single sitting rather than breaking off in the middle and watching something else (7). From the data, Netflix could take a calculated risk in creating House of Cards as we know it today.

In thinking about future steps, I believe Netflix must continue to push the boundary of digital entertainment and begin to think about interactivity and the user experience. Fundamental to viewing behavior and expectations of Gen Z and millennials is the ability to interact and experience the story on the screen. YouTube, for example, has led to a new way for creators and influencers to interact directly with their fans. The emphasis on present connection drives the popularity of Snapchat and Instagram. To capitalize on new viewing behavior, Netflix must go beyond merely collecting and drawing conclusions from data, toward a state of active involvement with users. (WC: 778)

References

- Fitzpatrick E. Netflix Drops PerMovie Rentals, Offers Monthly DVD Subscription. BILLBOARD. 2000;112(9):79.

- Mason S. Movies on demand: efficiency combines with new technology in Netflix’s DVD rental service. IIE solutions. 2002;34(10):25-33.

- Voigt K, Buliga O, Michl K. Entertainment on Demand: The Case of Netflix. In: Business Model Pioneers. Springer; 2017. p. 127-41.

- Drickhamer D. All queued up: how the Netflix distribution network supports the company’s business model. Material Handling Management. 2005 Nov 1,;60(11):9.

- Netflix Refines Its DVD Business, Even as Streaming Unit Booms [Internet].; 2015 [updated JULY 26,; ]. Available from: http://www.nytimes.com/2015/07/27/business/while-its-streaming-service-booms-netflix-streamlines-old-business.html?_r=0.

- Wall St. Cheat Sheet: Yes, People Still Use Netflix’s DVD Service: But Why? [Internet]. Chatham: Newstex; 2015 [updated Aug 2,; ]. Available from: http://search.proquest.com/docview/1700566551.

- How Netflix Uses Analytics To Select Movies, Create Content, and Make Multimillion Dollar Decisions [Internet].; 2013 [updated Sep 06,; ]. Available from: https://blog.kissmetrics.com/how-netflix-uses-analytics/.

- Adam Sandler Signs An Exclusive 4-Movie Deal With Netflix Because ‘It Rhymes With Wet Chicks’ [Internet].; 2014 [updated Oct. 2,; ]. Available from: http://www.businessinsider.com/netflix-signs-adam-sandler-to-a-4-year-movie-deal-2014-10.

Great post! What exactly could the active involvement with the user look like? Would that be in the form of social media? By now what do you think is Netflix’s key competitive advantage versus for example Amazon? There could be several angles to look at it: a) the amount of deals it can close to get licenses for existing blockbuster, b) the Netflix original content produces, c) global expansion, d) technology and user interface.

From my experience relatively few people truly cherish the Netflix recommendations and so far a lot of the content on streaming services is old and partly outdated. Do you see this changing in the future? What will be the impact on the film industry as a whole? How can film studios, cinema operators and others respond and may Netflix expand into any of those areas? The entertainment industry is super interesting and it remains to be seen whether in the future all my needs are dealt with through Spotify and Netflix.

Interesting point on interactivity and user experience as your recommended next steps for Netflix. What technologies can you imagine that Netflix can use the capitalize on this idea of interaction with the consumer? Consumer Polls? Augmented Reality? Virtual Reality? A lot of big tech (Facebook, Google, Microsoft) are toying with these new concepts and could definitely eat away at Netflix’ share of viewer-time. Even YouTube has introduced 360 viewing experiences alongside their own developed content. It would definitely be interesting to see Netflix’ next step in line with the competitors – given that they have achieved their original future goal (and namesake) which is streaming through the net.

I definitely agree that there is a lot more that we can do with the data that Netflix has collected. What worries me is Netflix potentially selling some of its data to 3rd party companies. This could be a huge opportunity for advertisers, as they will have a deeper understanding of consumers’ preferences and interests on a personalized level. Another area of concern is the potential loss in quality due to increasing activities in online streaming. According to an article, 70% of broadband traffic comes from internet video streaming sites like Netflix and Amazon [1], which reduces consumers’ overall buffer time and video quality. So as Netflix increases its platform, it is important for the company to consider potential ways to partner with private broadband services like Google Fiber in order to accommodate for its growing user base.

[1] http://www.pcworld.com/article/3012625/streaming-services/video-audio-streaming-gobble-up-70-of-peak-internet-traffic-in-north-america.html

Great post! With regards to distribution, as traditional Pay-TV providers who also provide Internet services) continue to lose subscribers I think it will be important to monitor how they deal with Netflix. Many have threatened to throttle Netflix speeds which poses an interesting dilemma for the company – either pay to play (i.e., pay providers to connect directly to their servers to reach the last mile) or let consumer experience suffer. Either way, as the Net Neutrality debate continues to shake out, Netflix’s bottom line may start to suffer.

Additionally, I’m a little skeptical on Netflix’s content advantage – particularly with regard to its original programming. They’ve shared virtually nothing with the public outside of the success stories, and even then I’m not entirely sure success had much to do with data – House of Cards was being shopped to other networks and was widely thought to be a smash hit before production. Further, I think content creation is not something that can be completely outsourced via data – it is much more of an art than a science.

Thanks for the post! A few thoughts:

– How should Netflix adapt its business model / operating model to compete against someone like Amazon, who has significant amounts of hosting capacity and capital to spare? Amazon is trying to aggressively expand its own video streaming and original content offerings. Perhaps something along the lines of personalization and consumer engagement?

– Do you know how profitable some of Netflix’s original content is? Some shows, like House of Cards, are bound to be profitable and cash generative, but it’s also possible that as Netflix increases its original content offerings, the quality may start to diffuse and slip.

– From a regulatory standpoint, with a Trump administration, is there a chance that net neutrality goes away? This would be very bad for Netflix if ISPs can limit bandwidth allocated to Netflix or charge Netflix for allowing higher bandwidth.