Maybe She’s Born With It, Maybe it’s Maybelline… or Maybe it’s Proven

As long as vanity exists there will be a market for skincare. Learn more about how innovative companies leverage artificial intelligence, machine learning, and big data to disrupt a $140B global skincare market.

Skincare is a large, global industry estimated to be worth $140B by 2019 where consumers are becoming increasingly focused on product efficacy – people solutions to specific concerns to work on their individual skin type1,2. The issue with seeking efficacy with skincare is that efficacy is highly personal. Individual responses of the human skin to external conditions are closely linked to differences in anatomy, physiology, and environmental factors. These differences are can affect the mechanisms of drug absorption, sensitization, and other longer-term effects from use of topical skin treatments. The unique characteristics of the individual skin function and, particularly, of ethnic skin types have shaped the future of skincare innovation as a basis for personalized skincare3. There is opportunity to leverage data to understand the correlations and interconnections between people’s skin and the ingredients that work for each person.

Skincare is a large, global industry estimated to be worth $140B by 2019 where consumers are becoming increasingly focused on product efficacy – people solutions to specific concerns to work on their individual skin type1,2. The issue with seeking efficacy with skincare is that efficacy is highly personal. Individual responses of the human skin to external conditions are closely linked to differences in anatomy, physiology, and environmental factors. These differences are can affect the mechanisms of drug absorption, sensitization, and other longer-term effects from use of topical skin treatments. The unique characteristics of the individual skin function and, particularly, of ethnic skin types have shaped the future of skincare innovation as a basis for personalized skincare3. There is opportunity to leverage data to understand the correlations and interconnections between people’s skin and the ingredients that work for each person.

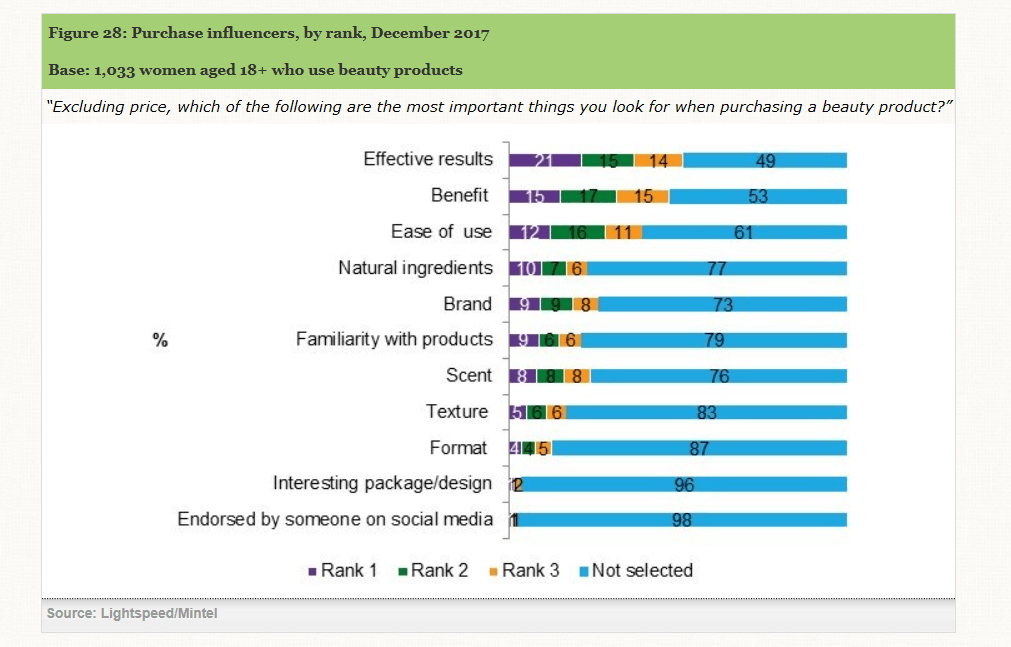

Exhibit from Source 2 (see citation)

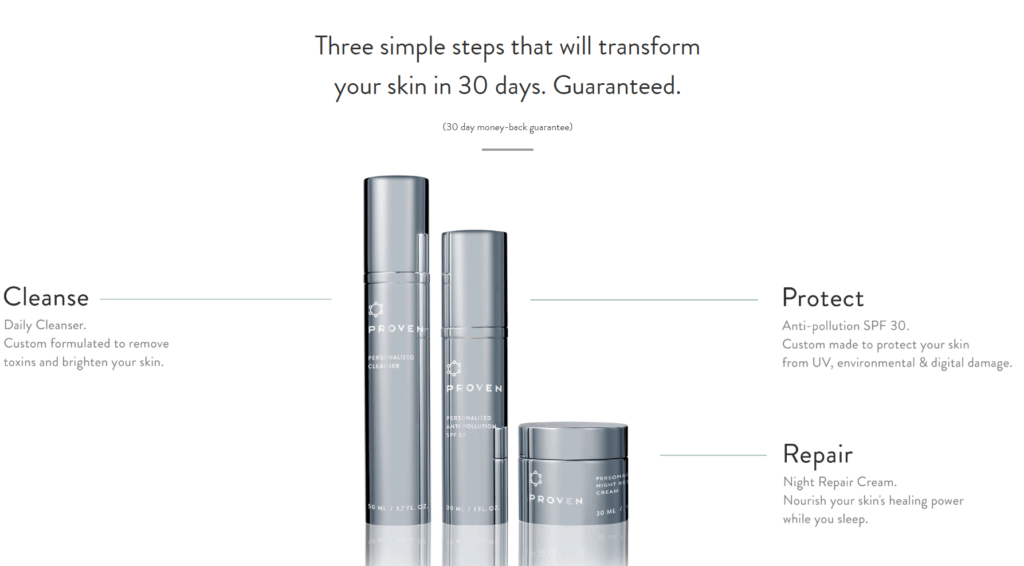

Proven Skincare is a consumer application that plays in this space, using machine learning to eliminate the trial-and-error process of discovering skincare that works. Proven creates personalized skincare regimens based on a customer’s unique skin type. The Company leverages their proprietary database, The Beauty Genome Project, to create their recommendations. The Beauty Genome Project is a database of +8 million customer product reviews, 100,000 skincare products, 20,000 ingredients, and information from scientific journal articles. Proven also requires customers to input data on their skin condition (e.g., dryness, pigmentation, etc.) and exogenous factors that could affect skin condition, such as age, sun exposure, race, diet, sleep habit, work and fitness regimen. They feed this data into their AI platform to formulate a tailored solution for the customer2,4.

In the short term the opportunity for Proven is to increase skincare efficacy for customers using their tailored product approach; however their longer-term aspiration is to expand into the broader personal care category5.

Proven needs to successfully gather robust data from their initial customers and drive wide-spread consumer adoption of their product across a wide breadth of skin types and ethnicities. The company has taken steps to ensure they can accomplish these goals by (1) pricing the product at a non-luxury price point to increase accessibility of the product across a wider audience base, and (2) creating a two-month check-in cadence with their customers. Currently the price for Proven is ~$30 per product per month which is in-line with the cost of premium, non-luxury products1. Each product bundle is purposely limited to a two-month supply to ensure that new customer data is collected and changing environmental inputs are assessed for returning customers.

The data collection and database building they are doing now will also greatly benefit the success of their longer-term vision. The lifestyle data they are collecting will help train models to understand how these factors impact broader skin health and bodily health of a person.

One recommendation I have for the business is to collect a broader set of relevant data to assess skincare efficacy. Given skin is often a representation of health in the broader human body I think the company could increase the number of data points collected on the overall health of the individual, such as: history of health conditions / diseases, family health history, etc6. This data could be a powerful indicator of skin quality and need.

The company could also do a better job at driving consumer adoption across a wide breadth of skin types and ethnicities. Collecting a diverse dataset will be critical to tease out impacts of physiological differences. To enhance data collection here, Proven could better target minority social media and publisher outlets globally.

To successfully expand into hair care I recommend that Proven identify what characteristics between skin quality and hair quality are correlated. This could help them better assess what additional data points they can collect from their skincare business today that could also contribute to a haircare database they will need to build without making customers feel like they are being asked for excessive, irrelevant information.

The key concerns I have for this company are (1) if consumers will truly view the personalized skincare category as more effective than traditional products and (2) whether Proven can differentiate itself in the market. Ultimately, there is no silver bullet for skin health. Though products can mitigate negative agents for skin health, skin is also a lagging indicator of life style choices. In the competitive industry of skincare, will consumers be able to tell if a personalized solution is more effective if it does not solve their skin conditions? Perhaps the solution for many people require more fundamental lifestyle changes. Also, in an environment where all personalized skincare players are leveraging machine learning to create predictive recommendations, what will allow Proven to sustain a competitive advantage?

(word count: 780)

- Taylor, Meggen. 2018. “PROVEN: This Female-Led Tech Start-Up Is Using AI To Customize Skincare”. Forbes. https://www.forbes.com/sites/meggentaylor/2018/11/07/proven-this-female-led-tech-start-up-is-using-ai-to-customize-skincare/#a28b479744fa.

- “Beauty Retailing – US – September 2018”. 2018. Mintel Reports: Academic Edition47 (11): 47-6023-47-6023. http://academic.mintel.com.ezp-prod1.hul.harvard.edu/display/860639/.

- Markiewicz, Ewa, and Olusola Idowu. 2018. “Personalized Skincare: From Molecular Basis To Clinical And Commercial Applications”. Clinical, Cosmetic And Investigational DermatologyVolume 11: 161-171. doi:10.2147/ccid.s163799.

- Jesus, Ayn. 2018. “Artificial Intelligence For Beauty And Cosmetics – Current Applications”. Techemergence. https://www.techemergence.com/artificial-intelligence-for-beauty-and-cosmetics-current-applications/.

- Lomas, Natasha. 2018. “Proven Wants To Sell AI Distilled Custom Skincare”. Techcrunch. https://techcrunch.com/2018/02/22/proven-wants-to-sell-ai-distilled-custom-skincare/.

- “Face Mapping: What Your Skin Says About Your Health”. 2018. Mindbodygreen. https://www.mindbodygreen.com/0-18257/face-mapping-what-your-skin-says-about-your-health.html

Really interesting article! I think that beauty is an industry that is ripe for machine learning innovation, but as you called out, it is going to be very challenging to win in this space. One thing that Proven needs to be wary of is creating a biased data-set. If they are only inputting data from satisfied customers that repurchase, they are not creating the neural networks of the failures (those that did not repurchase because the product did not work). I wonder how they can incorporate both the positive and the negative matches to further improve the recommendation engine.

I completely agree. I also think that an opportunity for Proven will be to address the different skin types on a person’s face (dry cheeks and an oily forehead), which could be the source of customer satisfaction. Likely this will come from a more granular analysis of data which could be difficult for Proven to obtain.

I really enjoyed this post, as I agree that the beauty industry will see meaningful disruption in years to come. In terms of business model efficacy, one concern I have is around the amount of data and length of time that it will take to create a truly personalized recommendation that a consumer is happy with. For an individual customer, can Proven collect enough months of data and personalize the product well enough to ensure customer satisfaction before she/he churns? What happens if I’m dissatisfied with the product after one month and I stop using the product/service, and I don’t give the algorithm enough time and data to adjust to my individual needs and preferences?

This is a very informative article. I really appreciate how you walked through the specific strategies that Proven is pursuing to obtain robust customer data (e.g., starting at an accessible price point, having bi-monthly check-ins with customers, etc.). One key question I have is related to how Proven can effectively close its data feedback loop. The algorithms that Proven runs will only be as good as it’s able to determine the good outcomes from the bad. As another user, JC, points out, there doesn’t seem to be an explicit mechanism for capturing the bad (“failure”) outcomes, as customers with bad experiences may just stop engaging in the regular check-ins (and these bad outcome users could be conflated with users who might have had good outcomes but just chose not to follow-up). Without requiring (or incentivizing) customers to report back their results (good or bad), I’d imagine this feedback loop will be hard to close. Also, this company will really benefit from having longitudinal (time-series) data for its customers, but given its start-up status, I think there will be a meaningful runway ahead in terms of data collection efforts. I’ll be interested to see how this company manages these issues over time!

I enjoyed reading this article, especially in the context of our Dove case. We talked about how “real” beauty is personal, not a one size fits all approach. Proven has capitalized on this trend by allowing its users to optimize for their specific skin type. I believe the recent focus on personalization within the beauty industry will continue. While some have expressed concerns around the lead time of building a large unbiased database, I see a long runway.

There is definitely a barrier for consumers to switch from traditional skincare brands/products and switch to the personalized skincare category. Companies like Proven needs to prove themselves that they can be more effective than traditional skincare brands in increasing skincare efficacy. I agree with you that they would need to have a much more robust set of data from both satisfied and unsatisfied consumers coming from a spectrum of skin types and ethnicity, and then increase the speed of adoption in consumers to try their products in order to track and gather data on its product efficacy. If Proven can do this initial steps successfully, I do see a potential for them to take over shares from the traditional skincare brands in the long run.

Chris, thank you for sharing such an important piece on Proven. I really enjoyed reading your article! It’s a good sign that the beauty industry is putting more emphasis on not just the aesthetics but also the health perspective of customers, and also leveraging big data to better understand their customer’s skin conditions–correlating that data with personalized ingredient. I completely agree with your analysis around the limitation of data although there are many benefits when it comes to skin a broader set of data also should be explored to understand consumers life styles in order to generate even better recommendations. One thing I wonder and would like to hear your views more is around consumer adoption? How much do consumers take the recommendations after the company has generated its suggestions for products, and what is the level of trust that happens?