Is Blockchain threat or opportunity for banks involved in supply chain finance? How does Standard Chartered Bank use the new technology?

Will banks benefit from Blockchain?

Blockchain Technology

The future of cryptocurrency and whether it can substitute traditional currencies is still uncertain; however substantial investments are made to exploit opportunities around bitcoin. As of today November 18th, Bitcoin is trading at its high above $750.

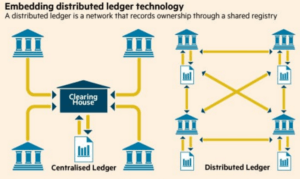

Bitcoin relies on Blockchain technology that comprises three main components: a network of computers, a network protocol and a consensus mechanism. The key point of the technology is that there is no central authority that ensures the validity of the transaction. In the traditional setting, clearing house would serve as a centralized ledger to clear the transaction, while blockchain relies on the entire network to approve the transaction. The system works as follows:

Blockchain technology is directly threatening clearing house and depositary institutions, which are important capital markets participants. However, blockchain has a potential to disrupt many other areas of financial services, one of which is supply chain finance. First, let’s overview how traditional supply chain finance work.

Supply Chain Finance

Supply chain contains multiple participants engaged in producing, purchasing, manufacturing and distributing products or services. The graph below shows simple representation of the supply chain:

At each level of the supply chain, participants need cash in different ways: suppliers need to pay for raw materials, manufacturers need to pay for inputs, etc. Rounds of negotiations take place among each parties to achieve better terms in order to reduce costs and manage working capital.

Banks are involved in these transactions as third-parties to remove the payment risk and the supply risk over the trade cycle, as well as provide financing when such needs arise across the entire supply chain. The process becomes more complex when the transactions are cross boarder and parties have to assume foreign counterparty risks. In such cases, multiple financial institutions are involved to distribute risks and make trade happen.

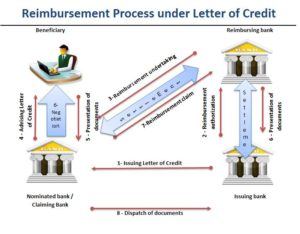

There are multiple financial instruments used in supply chain finance, some of the most popular ones are: letter of credit, standby, performance and advance payment guarantees, documentary collection, factoring (invoice financing), open account payment, supplier financing, etc. The differences lie in the distribution of risks and timing of the payments, as well as other terms of the agreement among participants. Letter of Credit is used for about 11% – 15% of trade transactions globally accounting for over a trillion US dollars volume per year. The mechanics of letter of credit is below:

As shown above, there are various forms of document presentations involved in the process. And the example above shows transaction between one buyer and one seller. How many documents exchange hands among multiple buyers and sellers across the entire supply chain? How can banks use blockchain technology to optimize the supply chain finance? Is blockchain threat or opportunity?

Standard Chartered Bank

Standard Chartered is a British multinational bank headquartered in London. The bank is actively involved in financing international trade and supply chain.

Standard Chartered has recently been involved in a large scale warehouse financing in metal industry, which resulted in huge losses. A warehouse company committed fraud and used the same stockpiles as a collateral in multiple banks to draw loans as part of the invoice financing transaction. As a result, Standard Chartered had to write-off $193 million to account for the loss.

Following the recent case, Standard Chartered has partnered with a bank in Singapore to develop blockchain-based trade finance platform. With the new platform, parties will rely on open source, consensus based protocol to executive trade finance transactions.

Is this a solution?

Supply chain financing is a documentary business. According to the Trade Finance Analytics, the financier needs the following tools for the effective execution:

- control of the use of funds, goods and sources of repayments

- visibility to monitor the transaction

- security over goods and receivables

Blockchain technology provides opportunity to address all the above challenges, therefore new platform seems to be a good solution to avoid similar losses incurred earlier by Standard Chartered.

The question remains: if all transactions are recorded on a public ledger, will this cannibalize some of the businesses banks currently do? Why can’t corporates set up its own blockchain platform in future and execute certain transactions without banks’ engagement?

Is blockchain threat or opportunity for the banks?

(706 words)

Sources:

https://www.ft.com/content/454be1c8-2577-11e5-9c4e-a775d2b173ca

http://blogs.wsj.com/cio/2016/02/02/cio-explainer-what-is-blockchain/

http://www.thepaypers.com/expert-opinion/how-corporates-can-use-blockchain-technology-in-supply-chain-finance/763456

https://www.cryptocoinsnews.com/standard-chartered-dbs-work-on-blockchain-tech-for-trade-finance/

http://blogs.wsj.com/cio/2016/02/02/blockchain-catalyst-for-massive-change-across-industries/

https://www.swtc.edu/academics/programs/business/supply-chain-management

http://www.letterofcredit.biz/Reimbursement-and-Reimbursing-Bank.html

https://tradefinanceanalytics.com/what-is-trade-finance

https://www.cryptocoinsnews.com/standard-chartered-dbs-work-on-blockchain-tech-for-trade-finance/

http://www.coindesk.com/price/

https://www.swtc.edu/academics/programs/business/supply-chain-management

https://www.loaddelivered.com/blog/why-blockchain-is-a-game-changer-for-supply-chain-management/

https://bitcoinmagazine.com/articles/blockchain-technology-will-profoundly-change-the-derivatives-industry-1464368431

Thanks for the very interesting article – one that highlights a very exciting and high-potential area within the blockchain space. I also appreciate the cogent, concise explanation of blockchain technology and supply chain chain. This isn’t easy given the word count constraint.

I agree that financial institutions and supply chain / trade finance are areas of immense opportunity for blockchain-based systems to disrupt and create value. This is an exciting time as both well-established players and startups are positioning themselves to win, but the jury is still out on who will capture the most value in the future. For example, multiple banks around the world have partnered and join R3, a blockchain consortium to pilot and prototype various blockchain applications related to finance. Recently, there has been an increasing focus on trade finance (http://www.bankingtech.com/551002/r3-blockchain-consortium-gets-smart-on-trade-finance/). However, there are also startups (that were started in Boston!) that are also tackling the same issue. ExImChain (eximchain.com) is a company that is targeting international trade finance as an application of a blockchain-based system.

In my experience, blockchain talent will be the key issue going forward. A lot of the experts are younger (“millennials”) that have the appetite and energy to start companies and innovate quickly. However, given the incredible power (and resources) that well-established financial institutions have, it is more likely that the future will have room for both.

Great summary! I think Bitcoin + blockchain is definitely the future (would love to talk about this more!). If banks are not careful, they will be disrupted. While blockchain is not a magic technology that solves every problem, it is perfect when multiple parties need to send money or information but do not trust one another. Like you said, rather than using trusted third parties as middlemen (like banks), blockchain removes the middleman entirely.

Most banks, anticipating this problem, are working on blockchain research. For example, in Boston, Santander and Fidelity both have blockchain teams. We’ll see if they can actually turn this research into valuable product offerings.

Thanks for the article, I agree with Andrew and Zach, quite an efficient summary! I do believe that Bitcoin / Blockchain are the future in terms of how we’re going to do all our business transactions. Nevertheless, I do incline towards the threat side for big banks of today’s financial services industry, mainly because it is such a disruptive technology and usually this type of innovation comes from new players in the industry that believe and execute such an incredible vision. It is a huge opportunity for innovating our economy though completely unattainable for big banks in my opinion primarily due to all the different business interests they would need to balance, their incredibly complex network of transactions and partners, and the highly dependable economy on today’s status quo (think regulation). They would have to eventually adopt this technology, but I don’t think they would be the protagonist of this transition. More of this point of view is explained thoroughly in the following article from the Financial Times: https://www.ft.com/content/8fc96cbc-8ed9-11e6-a72e-b428cb934b78

Great article. I do think that block chain technology can be a great opportunity for banks to develop more security of goods and receivables. I wonder if all of the banks will have to connect their systems together for the block-chain technology to work? Also, I am curious about the cyber security risks of using blockchain technology? It appears that the blockchain technology is a great way to improve cyber security risks (http://www.huffingtonpost.com/sergio-fernandez-de-cordova/is-blockchain-the-future-_b_11398600.html).

I also think that the blockchain technology presents an opportunity for the banks because I would assume that the banks would rather find a new way to use their employees, rather than right off losses from fraudulent transactions. The savings from better use of their employees can be used to finance other projects for the bank.

Lastly, I think blockchain technology has so many possible use cases (http://www.blockchaintechnologies.com/blockchain-applications), I wonder which industries will truly adopt the technology?

Thanks for sharing. Blockchain will be the next internet and disrupt any type of business dramatically from B2B to B2C. Last week I had a chance to caht with head of blockchain at IBM. She basically mentioned that, IBM’s number one priority is to commercialize Blockchain in a way to create meaningful disruoptions and value across all businesses. Obviously, finance will be the most important business to be effected by this innovation.