Robots are Taking Over our Savings – but Don’t Worry, it Could Be Better(ment) this Way.

Robo-advisors are transforming the wealth management industry with digital innovation, but will they be able to hold off industry stalwarts as standalone companies?

Over the last two decades, the investment industry has seen drastic changes due to digital innovations – from checking stock prices in the newspaper to seamlessly placing trades on a smartphone, from boisterous trading floors to the silent monitoring of algorithmic trading programs, and from daytime domestic trading to around the clock global market access. Despite this change, the wealth management model has remained relatively intact – at least until recently.

The millennial generation is poised to become the global economic powerhouse – the generation currently boasts 1.3 trillion in financial assets [1] with an additional 30 trillion in assets expected to pass from the baby boomers in the next decades [2]. With investing as in many other facets of life, the millennials differ greatly from their parents. Millennials have a love of immediacy, ease, and low cost digital solutions and an inherent distrust of financial institutions and advice due to the Global Financial Crisis.

In this context, the traditional wealth management business and operating model is at risk. The traditional business model charges 1-2% of AUM* annually for advisory and planning services. The operating model generally involves spending considerable time and manual research to construct an investment portfolio suited to each client’s need and then meeting with that client in person on a quarterly basis to review performance and discuss investment changes. This high touch, slow paced operating environment simply won’t suffice for millennials.

Enter Betterment, a digital innovator and the biggest winner in the rise of “robo-advisors.” US News defines a robo-advisor as an “automated wealth management service that provides algorithm-based investment advice without human interaction” [3]. Betterment is a web platform that provides personalized investment recommendations based on age, retirement status, and income. They then provide low cost passive portfolios to reflect those recommendations, rebalance appropriately, and provide real time portfolio updates [4]. They charge a nominal fee ranging from 0.15%-0.35% based on account size. Importantly, since everything is algorithmic, they can accept any account size (in comparison to typical minimums of $250,000 for traditional advisors). This allows them to get clients at a young age and ideally, keep them throughout their lifecycle.

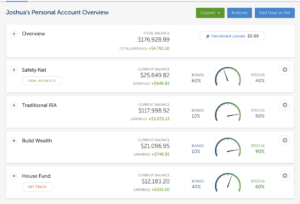

Setting up an account with Betterment is blissfully easy and intuitive (Exhibit 1), leading some to call it the “Apple of Finance” [5]. The company boasts $5bn in AUM as of July 2016 [5].

Exhibit 1 – Betterment Platform

Of course, where there is opportunity, there is competition. The digital advisory business has relatively low barriers to entry and has therefore seen a flood of entrants. Exhibit 2 shows Bloomberg’s projections for rapid AUM growth in the industry in the coming years. Since the first robo advisor launched in 2008, there have been 140 companies founded in the space with 80 of those coming in the last two years [6]. Betterment has fared well relative to this group, with its most formidable competitor, Wealthfront, managing $3bn in AUM as of mid 2016.

More alarming is the response from well-capitalized incumbents. UBS has partnered with SigFig to develop new online management tools, other big names like Goldman and Blackrock have been acquiring smaller players, and Charles Schwab and Vanguard have launched robo-advisors of their own (with the added benefit of human access for those who want it) [7].

Exhibit 2 – AUM Projections for Robo-Advisors

Another threat to Betterment is its own economics. A recent Morningstar report estimates that robo-advisors spend $300-$1,000 to acquire a new customer. While this is low in comparison to the estimated $4,000 spent by traditional advisors, it takes far longer for the digital advisors to breakeven given the small account sizes [1][8]. Some incumbents (e.g. Vanguard), also benefit from the fees earned on managing the passive portfolios themselves. The same report estimated that a robo-advisor would need around $40bn in assets to become profitable – a small component of the addressable market, but a tall order to accomplish when some competitors already have the assets and the capital to succeed.

If Betterment wants to remain a critical player, it must continue to do what it does best: innovate. Currently, most of its capital is deployed to marketing to grow the asset base, but if they want to have a sustainable competitive edge they need to drastically enhance their platform. They should be more innovative in their marketing campaigns to try and save costs while still creating buzz (think inbound marketing, partnerships, viral videos vs. taxi cabs and magazine ads as currently). The cost savings here should be deployed to make their platform more sophisticated. People’s financial situations are complex and their current program only suits investors with simple needs (and likely smaller account balances). They should push towards cognitive computing with the goal of being able to provide more complex advice to serve clients more effectively [8]. Without such enhancements, Betterment and the broader robo-advisor industry is at risk of permanently losing to endowed players.

Words: 800

*Assets Under Management

[1] Michael Wong. “Hungry Robo-Advisors Are Eyeing Wealth Management Assets.” Morningstar, March 2015.

[2] Andrew Osterland. “Advisors brace for the $30 trillion ‘great wealth transfer.’” CNBC, June 16, 2015. http://www.cnbc.com/2016/06/15/the-great-wealth-transfer-has-started.html, accessed November 2016.

[3] Zina Kumok. “3 Reasons Millennials Should Consider a Robo-Advisor.” US News, April 7, 2016. http://money.usnews.com/money/personal-finance/articles/2016-04-07/3-reasons-millennials-should-consider-a-robo-advisor , accessed November 2016.

[4] Betterment. “Why Betterment.” https://www.betterment.com/why-betterment/, accessed November 2016.

[5] Wikepedia. “Betterment.” https://en.wikipedia.org/wiki/Betterment, accessed Novemember 2016.

[6] Barbara Novick, Bo Lu, Tom Fortin, Shahriar Haifizi, Martin Parkes, Rachel Barry. “DIGITAL INVESTMENT ADVICE: Robo-Advisors Come of Age.” Blackrock, September 2016.

[7] Jon Marino. “Big banks are fighting robo-advisors head on.” CNBC, June 26, 2016. http://www.cnbc.com/2016/06/25/big-banks-are-fighting-robo-advisors-head-on.html, accessed November 2016.

[8] Alessandra Malito. “Startup robo-advisers grapple with client acquisition costs.” Investment News, May 9, 2016. http://www.investmentnews.com/article/20160509/FREE/160509928/startup-robo-advisers-grapple-with-client-acquisition-costs, accessed November 2016.

[9] Charles Ludden, Kendra Thompson, Imon Mohsin. “The Rise of Robo-Advice.” Accenture 2015.

LST – excellent write-up.

I’m a huge fan of what Betterment is doing for society. You could probably throw in Wealthfront or Nutmeg in the same category. As a citizen and as a fan of setups that maximize societal utility, I am glad that Betterment exists. There will invariably be losers. Frankly, the ‘right’ size for the investment management industry is one where 50% of all RIAs, 50% of brokers, 50% of all mutual fund houses and 50% of all hedge funds go away; and all who do survive will not actually be better off because lower-cost solutions such as Betterment (and Vanguard) will capture the larger portion of the pie. Even if the incumbents’ response to Betterment is somewhat effective, Betterment would have achieved its goal of bringing some much needed innovation to the sector that has long been ripping off the consumer. One analogy that I can think of is Interactive Brokers – they have not taken over the world, but they have kicked off a trend of declining costs across the industry, with consumers as the ultimate winner.

LST, thanks for this thought-provoking post. I agree that Betterment (and its fellow roboadvisors) are bringing some needed digital transformation to investment management. However, given the low barriers to entry in this market and the high cost of customer acquisition, if I were Betterment I’d be extremely worried about the response of well-capitalized incumbents with enormous head starts in AUM and client accounts. Perhaps the saving grace for Betterment is that for incumbent investment managers to crowd out Betterment would require large transformations to their existing business model (of high-priced, individualized investment advice) that they might not want to do. Your suggestions for how Betterment might create some barriers to entry seem like good ones, though also hard.

LST,

Thanks for the really clear post on a topic that many of us should be thinking about!

I agree with you that the unit economics must make sense. If Betterment charges an average of .25%, and its customer acquisition cost is on average $650, Betterment would only earn revenue of around $72.50 per customer per year, given an average account size of $29,000 (which is where it is now according to Bloomberg).

My understanding of Figure 1 is that Betterment’s algorithms focus on asset allocation and trying to maximize the Sharpe ratio, given a few input on the client’s preferences. I agree with you that inbound marketing and partnerships are key to helping Betterment enhance its platform to be more relevant to millennials’ needs. I’d like to see Betterment partner with MOOCs, so that young people can invest their returns in short, online classes that can enhance their human capital and guide them into more productive careers. Nanodegrees on AI or product design can be as low as $14 on platforms like Udacity, and often, taking such courses allows students to move to higher paying jobs that provide them enough savings to consider passive investing – a win-win for Betterment and the client. Having Betterment fit into the daily lives of its clients will help it differentiate from its competitors.

Awesome post – I think you captured a lot of the threats and opportunities perfectly here. A couple of comments to add from the FutureAdvisor / Fidelity…

First, I thought it was interesting to read your comment on changing the customer acquisition mix. At FutureAdvisor, the marketing team started off as digital-only, primarily sourcing investors through content marketing, SEO / SEM, and Facebook in particular (spending ~$500 – 600 to acquire a customer worth ~$5,000 in lifetime value). However, they realized over time that these acquisition channels didn’t scale, and as a result had to broaden to radio and other offline advertising–I suspect that Betterment may have seen something similar with its push into TV.

One thing that will help their asset gathering in the future is the new business lines they’ve launched (e.g., Betterment for Advisors and Betterment for Business) – financial advisors and retirement plans are both huge markets, and few other roboadvisors have made as much progress in targeting them. These lines may be what ends up differentiating Betterment over the long run.

Either way, Betterment has a long way to go. They listed $6.1B in AUM as of their last ADV filing, and at 25bps are earning ~$15M in revenue per year; we estimated they would have to get to at least $50B in assets the reach IPO scale. They’ve already raised $200M+ in VC funding at pretty high valuations, so I’m skeptical they’ll be able to get there without a down round in the future.