Ibstock Brick – No longer a commodity?

A stone-age product experiencing venture-like growth driven by a unique supply/demand imbalance.

Company description

Ibstock plc is a UK based company (LSE: IBST) that manufactures and sells a portfolio of products used in the construction industry. Its primary products includes bricks, tiles and concrete solutions, with bricks constituting the bulk of the business. The company sells primarily in the UK, but also operates a smaller subsidiary selling bricks in the US.

Ibstock is an example of a company whose operations align well with its business model. As such it has been able to capitalize on an improving construction market in the UK and especially an imbalance in the supply of domestic housing. In the last three years, Ibstock has leveraged its integrated value chain, broad and well-invested manufacturing footprint, flexible cost structure, and established customer relationships to drive impressive growth in volumes and profits. In this time period, EBITDA has grown by ~55% p.a.

Business model

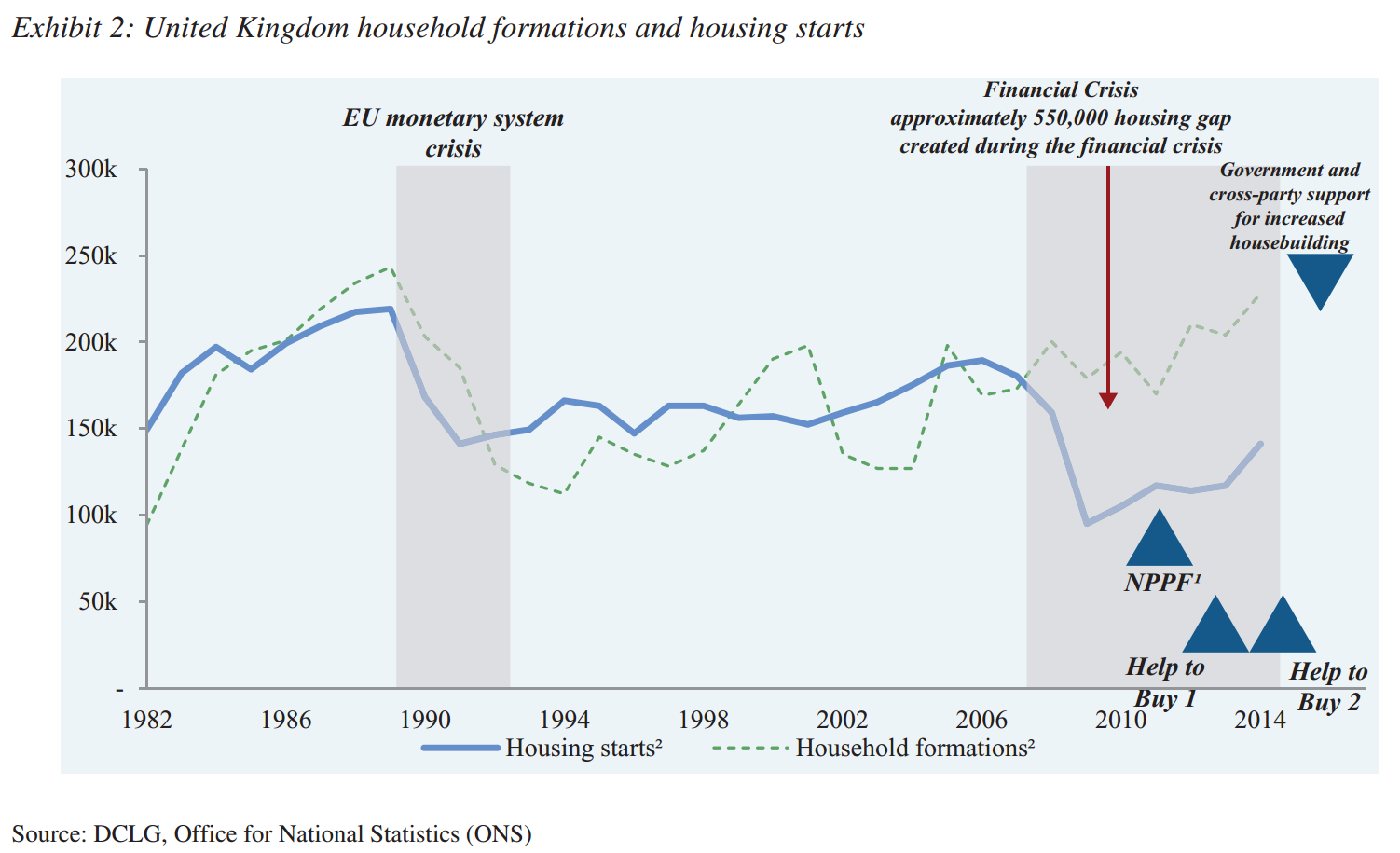

Ibstock’s business model includes manufacturing and selling bricks that are primarily used for house building. Bricks are used as the outer cladding for 80% of new houses in the UK and sales volumes are closely linked to the number of houses being built. A rapidly growing UK population and a systemic lack of housing due to lack of available land and regulatory approvals, has contributed to the significant need for increased house building.

Ibstock provides value to buyers by delivering on several key purchasing criteria. Firstly, supply guarantee is critical. Housebuilding is a volatile industry, and material is often needed at short notice. Also, bricks remain a relatively small (~2%) share of total building cost, but are integral to its completion. Ibstock maintains close relationships with key customers (house builders, distributors and wholesalers) operating a large network of plants (19 brick plants) and distribution centers and can therefore be responsive to demands.

Additionally, brick quality and appearance can influence the ultimate house price and attractiveness. Also, bricks often need to comply with local building requirements to align with neighboring building styles. With a long history of making bricks, Ibstock has experience with a broad range of products, but more importantly, it has access to the specific clay reserves needed to produce specific styles and colors.

Finally, buyers obviously consider price. With 40% market share, Ibstock has the best cost position in the industry, coupled with the broadest reach. Ibstock is therefore highly competitive relative to its competitors. Additionally, while bricks are a commodity, the market remains local due to the considerable transportation costs associated with a ‘cheap’, but heavy product.

Operating model

With transportation costs being prohibitive, plant locations are critical. Additionally, access to raw material is a key differentiator, both to minimize costs, but also since getting regulatory approval to mine clay is highly controlled. With the broadest plant footprint in the market, all co-located with clay reserves, Ibstock is well-positioned to maintain its operational advantage. Developing new clay reserves is both difficult and time consuming, limiting the threat of new market entrants.

With transportation costs being prohibitive, plant locations are critical. Additionally, access to raw material is a key differentiator, both to minimize costs, but also since getting regulatory approval to mine clay is highly controlled. With the broadest plant footprint in the market, all co-located with clay reserves, Ibstock is well-positioned to maintain its operational advantage. Developing new clay reserves is both difficult and time consuming, limiting the threat of new market entrants.

Ibstock also benefits from an organization that is adept at adjusting its resources as business varies. Driven by ‘capex’ cycles, construction markets are inherently cyclical, and being able to maintain a large share of variable cost allows the company to weather troughs well. Ibstock is able to vary its two main input factors (energy and labor) seasonally, and cyclically. Being the largest domestic manufacturer, Ibstock has scale to negotiate energy contracts and also enough plants to manage fluctuating labor needs across locations.

As the market leader, Ibstock is also able to invest in production technology that most other players cannot afford. In a cyclical market, smaller firms are less likely to tolerate the risk of a large capital investment. Whereas the industry is dominated by relatively old production technology, recent capacity additions have been made by Ibstock and its main competitor. Building scale has been an important operational differentiator.

Summary

The two models are aligned in ensuring that the customers’ key purchasing criteria are met. Specifically, the scale, footprint and location allow the company to be responsive to customer demand. Being vertically integrated enables the company to manage the value chain, absorbing volatility and reducing transaction costs. In addition, these traits have enabled the firm to build a dominant position in an attractive industry while also creating barriers to entry. A large and flexible organization is also able to cater to industry demand for a large number of SKUs that are required to meet regulatory demands.

References

http://www.ibstockplc.com/~/media/Files/I/Ibstock/investor-docs/results-and-presentations/ibstock-plc-prospectus.pdf

http://www.bbc.com/news/magazine-30776306

http://www.ibstockplc.com/

Interesting article, I had never considered brick production as an industry where operating strategies could separate firms. It seems the difference between Ibstock and other firms is the ability to whether the down cycles inherent in the industry. Does their operating model allow for this or is it their financing arrangement with outside entities?

Their numerous and strategically located factories, along with their access to input materials, seems to be more of a result of being an early and long-standing participant in the industry rather than a unique operating model. But I do see how they have leveraged those characteristics to use a different operating model than others in the industry.

This is a nice comment, but I wonder the extent of the company’s operating flexibility. The UK housing market is, as you say, know for its cycles, but it has also several times been questioned for its stability. The UK government home-to-buy, for example, was allegedly implemented to foster housing market and house prices and prevent a likely decline in price result in higher mortgage NPLs just when the UK was getting out of a recession.

In other words I am wondering how much operating flexibility is actually built in should house prices and housing starts in the UK come to a significant halt. Being not very geographically diversified and vertically integrated, it seems like its operating model could be quite prone to shocks. As a consequence the alignment you describe might be a mere result of favorable economic and regulatory conditions. I would be happy to know more about this and let you answer this doubt.

Interesting comment. While I understand concerns about external shocks, I disagree that the company has merely profited from a strong economy and government subsidies. Given the high transportation costs in this industry, I would expect significant barriers to entry for international competition. And among domestic players, Ibstock’s broad plant footprint, flexible cost structure and pricing power seem to set it apart from its peers. I see how downturns and capex cycles present an issue in this market, but Ibstock seems as prepared and robust as anyone in the industry.

Henrik,

It appears Ibstock has an very advantageous market position relative to other brick companies, I am curious as to whether it is only the brick companies they see as competition? Are there other building material substitutes, such as concrete or even a faux brick substitute that provides the same look and feel? And if so, how does Ibstock differentiate its business and operational models relatively?

Similarly, I wonder how Ibstock views future company growth. Given what appears to be an effective operational model, do they have international aspirations? Or is their competitive advantage relevant only in the UK?

Thank you for your thoughts.