Have you ever tried to become a Uber Driver?

Uberify your business and operating model

Have you ever tried to become an Uber driver?

Yes, you most likely have used an Uber but are you curious how Uber finds, vets, and hires 150,000 drivers within 3 years? The answer to this question is innovation, which is illustrative of how Uber has perfectly aligned its business and operating model. Uber has built every facet of their business with efficiency in mind. From adding drivers to high utilization of their assets, Uber has built effective processes into a competitive advantage.

Operating Model:

Let us take a deeper look at Uber’s operations – starting with driver’s seat.

Signing 160,000 drivers and counting

Without drivers, Uber would cease to exist. At the same time, signing and verifying drivers – especially at the magnitude Uber does – takes up significant resources. Facing this immense challenge, Uber innovated. The entire sign-up process can be completed in 20 minutes. At no point, does the prospective driver even talk to an Uber representative but merely uploads his or her documents (picture of license, insurance, and car). Even after the documents are uploaded, no person views them. In fact, Uber has developed a proprietary algorithm that can decipher the picture and match the information to the various databases (DMV, Criminal, etc). Once approved, the only thing left is for the new driver is to watch a 15 minute video.

https://www.youtube.com/watch?v=GWX9UoJbbJw

Hundreds of Millions Served

Many people are more familiar with the consumer facing side of Uber. At over 1 million Uber rides a day (Hue 2), Uber has clearly succeeded in implementing a convenient and well working operating model. Merely download Uber’s app, take a picture of your form of payment, and book your first ride with your personal drive. Total time from idea to booking is under 5 minutes. Less waiting time, less money, and better service.

Business Model

Giving customers a better product for less money and paying employees more

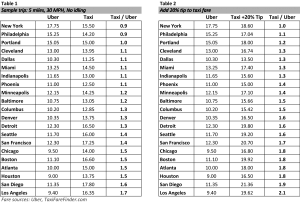

This is the Holy Grail for new businesses yet very few achieve it. As Uber shows, a business model must be in absolute sync with its operating model to realize this goal. Uber accomplished this objective by creating tremendous value. Uber is only able to sign up hundreds of thousands of drivers because of its business model. Not only is it easier to work for Uber, but also more lucrative with Uber drivers making on average 25-50% more than their counterparts (See Below).

In addition to creating value for the drivers, consumers also save big bucks. While there are a variety of factors that go into ride costs (mileage, idling, tipping), it is safe to conclude that Uber is on average 25-50% cheaper than traditional taxis.

Multiply these savings by the hundreds of millions of rides given and you can extrapolate the billions of dollars Uber saves customers.

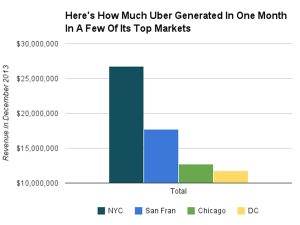

Of course, Uber captures value as well. By offering a more innovative and better product, Uber is rewarded with 20% revenue per ride. Leaked financials of Uber shows the company generated close to $70M in one month at 4 locations. While the extent of Uber’s profitability is classified, we are aware that the company was most recently valued at over $51B from private funding sources.

Uber has gone from an idea to a $51B company in three years due to the company’s alignment of its business and operating model. To reach its current market penetration, Uber made a better product that costs less and pays its employees more. However, Uber’s effective use of its capital, intellectual property, and R & D has allowed the company to expand rapidly and solidifying its competitive advantages.

Footnotes:

- Solomon, Brian. “The Numbers behind Uber.” Forbes. Forbes Magazine, 2015. Web. 01 Dec. 2015.

- Hue, Ellen. “Uber Says It Does 1 Million Rides…” Forbes. Forbes Magazine, 2014. Web. 01 Dec. 2015.

- “Uber.” Uber.com/cities. Uber, 2014. Web. 1 Dec. 2015.

- Solomon, Brian. “The Numbers behind Uber.” Forbes. Forbes Magazine, 2015. Web. 01 Dec. 2015.

- Businessinsider.com. N.p., n.d. Web. 1 Dec. 2015

- Shontell, Alyson. “LEAKED: Internal Uber Deck Reveals Staggering Revenue And Growth Metrics.” Business Insider. Business Insider, Inc, 20 Nov. 2014. Web. 01 Dec. 2015.

- “Uber Is worth Way Less than $51 Billion: Expert.” CNBC. CNBC, 16 Oct. 2015. Web. 01 Dec. 2015.

I am a long-time UBER rider and learned a lot from your overview. I’m curious to hear your perspective, though, on the quality of UBER drivers who are effectively brand stewards for the company. Given that the business and operating models are aligned — making it possible for UBER to quickly scale its workforce of drivers — how does UBER mitigate the natural risks associated with vetting, training, and deploying so many new drivers? How do they maintain quality control over the UBER brand experience? Or, alternatively, does the model actually hand over too much control to UBER, allowing them to lower fares on a whim to please riders, in turn punishing drivers who become reliant on the service?

Great analysis. Uber has created a lot of value by connecting passengers and drivers in an efficient and painless way. As the company keeps growing to more countries and receiving new funding (just closed a funding round that valued the company at more than $60 bn), two big risks of the operating model should be considered: (i) screening of drivers, guaranteeing a safe environment for passengers, and (ii) labor contingencies (common to all companies in the “Gig” economy) due to the fact that drivers must follow Uber’s rules but are not officially employees.

Great insight into a company everyone is talking about these days. The 2 sided market model is clear but their operating model is what really makes it work. Cheaper for customers, cheaper for drivers. It amazing how low the barrier to entry is for a driver. 20 min of application time + a 16 min video compared to over $1 million for a NYC taxi medallion. It’s no wonder every cab company is up in arms. It’s nice to be reminded that they are truly a technology company. From the app that we interface with as riders, to the algorithmic database comparison system, everything that Uber does seems to scale nicely. I’m looking forward to what they come up with next.

Reading this post, I couldn’t help but remember the conversations I had with UBER and Lyft drivers while commuting. Obviously, as a Business School students I always asked them questions to probe for the secret sauce in their operating model that is making Uber more successful than Lyft. (When compared to its main competitor Lyft, estimates show that Uber is valued at around $ 50-60 Billion, ~20x the estimated value of Lyft).

As Yi mentioned in the previous comment, this 2 sided business model needs a strong operating model to make it work. One element of this operating model is how Uber engages with its drivers from one side and customers from another side. I learned from my chats that Uber, as oppose to Lyft, focuses on maintaining a high level of loyalty among its drivers. In several occasions where there was a dispute between the driver and the rider, Uber took the driver’s side and banned the rider from using Uber’s service in the future. This balance create a fair environment for both sides and helped Uber deliver on its 2 sided business model and win the market.

Very interesting post Peter! In San Francisco everyone I know uses uber, lyft, sidecar and flywheel and will only take a taxi as a last resort. I’m curious about Antoine’s point. Aside from driver loyalty, do you know what competitive advantage uber has over lyft with regard to its operating and business models? I recognize that uber drivers receive higher compensation than taxi drivers but assumed the uber payout structure was comparable to lyft & sidecar.

Peter, interesting insights but I’m not sure how the math works. Riders pay less, drivers earn more, and Uber gets a 20% of gross revenue. What part of the traditional cab service value chain was removed in order to enable this? Also, does this contemplate that rides are often at a premium price (surge) to the published base rates? Also, does the analysis adjust for the fact that Uber drivers are contractors without traditional workplace benefits, eg healthcare? Although I love using Uber, I’m sometimes frustrated by the lack of local knowledge that many drivers have about the cities. In NYC, cab drivers know all the tricks to get you from point A to point B as fast as possible. I find that when you inevitably hit traffic, a yellow cab driver will find his or her way around it while an Uber driver will begin to fiddle with his or her smartphone. For this reason, I still prefer yellow cabs in NYC.