Greetings from Hallmark

• Network Security Architect.

• Marketing Data Analytics Storyteller.

• Application Security Analyst.

Are all openings for jobs posted on the Hallmark Careers website in the last week. Surprised? You shouldn’t be.

Over the last few years, paperless substitutes and online competitors have posed challenges for greeting cards companies. [1]

In this context, the story of Hallmark Cards is the story of a market leader that has lasted over 100 years old whilst having its business and operating model disrupted by technology. It has not always been easy; between 1999 and 2008, Hallmark laid off over a quarter of its workforce. [2]

A business model transformed

Hallmark Cards is best known for its greeting cards, and before the 1990s, its customer promise would have been supplying greetings cards to retailers that appeal to consumers. This required designing a limited amount of designs (given limited shelf space in a store) that resonated with the broadest customer base possible.

Today, Hallmark Cards has interests across general merchandise, specialty retailing, CPG and entertainment, including Crayola, LLC and the Hallmark Channel. If you asked them, they would say they have transformed their customer promise to “creating a more emotionally-connected world”. [3]

Their business model centres around facilitating expression that feels personal, at scale, though this may sound like a contradiction. With this in mind, ‘access to niche markets’ is identified as the key contributor of success within their industry. [2] It implies a need to be less generic in their product. This shift in business model has been made possible by interesting shifts in their operating model.

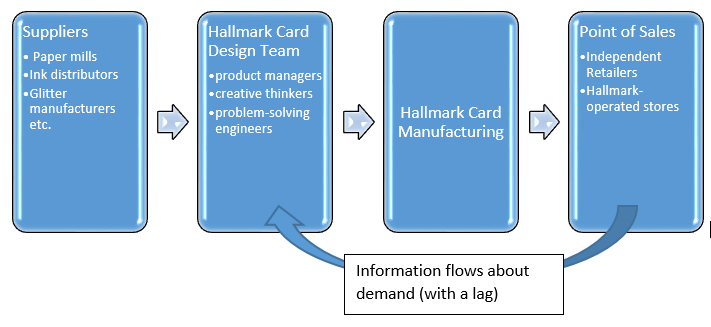

Information Flows in the Supply Chain

“Hallmark’s business is based on its ability to help people worldwide communicate their feelings” states Tony Marshall, their decision support specialist. “In this kind of business, you need information systems to keep the company in touch with its customer base.” [4]

Traditional Supply Chain:

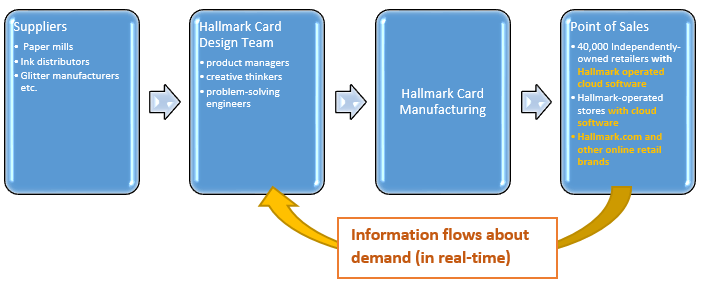

Over the last few years, the company implemented a cloud-based, retail-as-a-service solution, that included a point-of-sale (PoS), real-time inventory management and a web portal ordering service. [6]

Over the last few years, the company implemented a cloud-based, retail-as-a-service solution, that included a point-of-sale (PoS), real-time inventory management and a web portal ordering service. [6]

Having services provided through the cloud was cost effective (little capital investment per store), gave the company the flexibility to add capabilities as needed in the future, as well as allowed for rapid scaling.

Their new supply chain:

This reduces the ‘bullwhip effect’. Much of the greeting cards demand is seasonal, making it particularly susceptible to having minor signal variations from the retail end being amplified at the production order stage, creating significant distortion.

Predictive analytics using real-time data, allows the team to better determine how to market to various consumer segments during holidays and special occasions, and optimise production.

Big Data

Keeping in mind the importance of predictive analytics, Hallmark Cards has created a veritable data warehouse. 13 million loyalty program members who purchase thousands of different greeting card SKUs are combined with a POS database with over 4 billion rows of data, and other data sets. [7]

It is often difficult to quantify the value that data has within in an operating model. In Hallmark’s case, a fascinating court-case in 2014 gives us some insight. A four-year old powerpoint presentation based on just a fraction of Hallmark’s data, was determined to have stolen by a PE firm. The compensatory damages awarded by the court? $21.3 million. [8] [9]

Production Efficiency

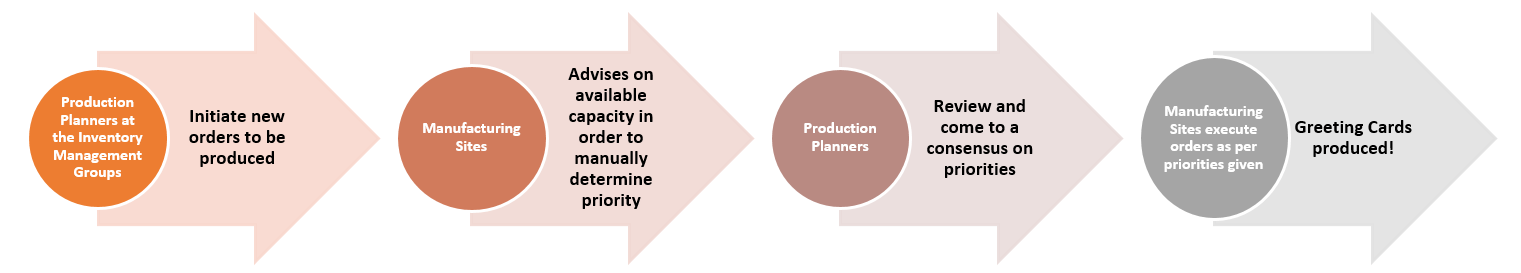

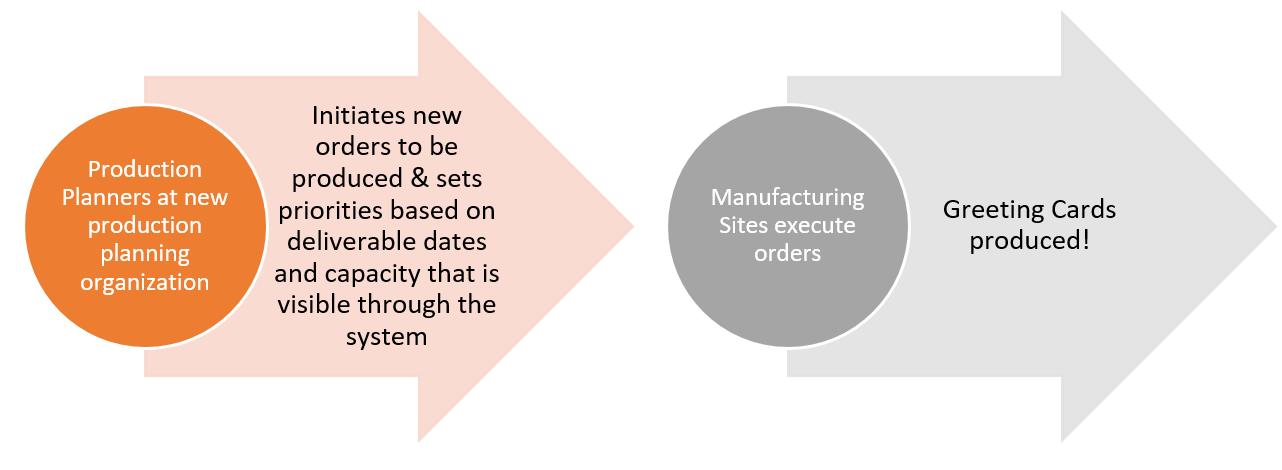

It is not just on the retail end where facilitating information flows has value. On the design and production end, take the example of determining the priority of orders.

The Process Before Digitizing the Flow:

After:

[10]

Greeting the future

Hallmark is home to a 4 billion dollar industry that releases 10,000 new card designs each year. Industry revenue is expected to decline 3.2% annually. [11] However, there is room for Hallmark to leverage its brand:

- Product Development: Greater Personalisation and Rapid Shipping

Given the ability to economically personalise cards using technology, there is still no Hallmark app to customise a card and have it sent out for you. In order to stay at forefront of where this industry, they need to innovate with their online distribution more. In the UK alone, moonpig.com has over 50% of the online greeting card share, whilst Hallmark has less than 5%. [12] - Product Development: eCards

In March 2015, the company launched its first Hallmark eCard app, which is widely expected to boost revenues. Whilst the traditional greeting card industry is on the decline, the online greeting industry is projected to grow, and greater attention needs to be given to this channel. [13] - Data partnerships

In June 2012, Hallmark and Shutterfly created a alliance, which allowed customers to translate customer-generated media into individualized cards. [14] If the Hallmark customer promise is truly to leverage emotional relationships, and their USP is leveraging data in order to do this, they need to proactively seek more of these data-sharing partnerships.

(771 words)

Bibliography:

[1] IBISWorld iExpert Risk Summary 51119, “Greeting Cards & Other Publishing in the US” June 2016

[2] The Verge “Detours: Hallmark, Kansas City, and the decline of the greeting card industry”, YouTube, published 4 Sep 2013, https://www.youtube.com/watch?v=l9x49TkQyQw Accessed Nov 18, 2016

[3] “Hallmark Signature Cards Help People Connect this Holiday Season” Press Release, Hallmark.com (Kansas City, Mo., Nov. 14, 2016)

[4] Dychel, Jill. E-Data: Turning Data into Information with Data Warehousing. Reading, MA: Addison-Wesley, 2000.

[5] SAP Insider “Pushing the Supply Chain Envelope at Hallmark with Data-Driven Capacity Planning” Dave Hannon. Jul 1, 2012. http://sapinsider.wispubs.com/Assets/Case-Studies/2012/July/Pushing-The-Supply-Chain-Envelope-At-Hallmark-With-Data-Driven-Capacity-Planning Accessed Nov 18, 2016

[6] Fujitsu. Global Intelligence for the CIO. “Hallmark Cards transforms retail with the power of the cloud” Kenny MacIver. October 2012. Available at http://www.i-cio.com/strategy/cloud/item/hallmark-cards-transforms-retail-with-the-power-of-cloud Accessed Nov 18, 2016

More information available through a Case Study published by Fujitsu http://www.fujitsu.com/us/Images/CS_April2014_Hallmark_Eng_v2.pdf

[7] DycheÌ, Jill. E-Data: Turning Data into Information with Data Warehousing. Reading, MA: Addison-Wesley, 2000.

[8] Kansas City Business Journal “Judge upholds $31M Hallmark trade secrets verdict” Jul 15, 2014 http://www.bizjournals.com/kansascity/news/2014/07/15/hallmark-trade-secrets-verdict-monitor-clipper.html Accessed Nov 18, 2016

[9] Hallmark Cards v. Monitor Clipper Partners, No. 13-1905 (8th Cir. 2014) Available at: http://law.justia.com/cases/federal/appellate-courts/ca8/13-1905/13-1905-2014-07-15.html Accessed Nov 18, 2016

[10] SAP Insider “Pushing the Supply Chain Envelope at Hallmark with Data-Driven Capacity Planning” Dave Hannon. Jul 1, 2012. http://sapinsider.wispubs.com/Assets/Case-Studies/2012/July/Pushing-The-Supply-Chain-Envelope-At-Hallmark-With-Data-Driven-Capacity-Planning Accessed Nov 18, 2016

[11] IBISWorld Industry Report 51119. Sarah Turk. “Greeting Cards & Other Publishing in the US.” June 2016

[12] IBISWorld Industry Report UK0.017.Ted Scanlan. “Online Greetings Card Retailers in the UK” April 2016

[13] IBISWorld Industry Report OD5449. Taylor Palmer. “Online Greeting Card Sales in the US” June 2016

[14] ibid.

Bonus:

A look inside the Hallmark distribution center:

Apeksha- great article! Also really enjoyed the video- very informative!

A few thoughts regarding Hallmark- If Hallmark releases 10,000 new SKUs every year, how many SKUs do they have in total and what is their minimum production quantity? I’m assuming that the reason Hallmark has not invested in a mobile app to customize cards and send them out would be because allowing the customer to customize cards would mean a minimum production quantity of 1, which is perhaps just too inefficient for their factories to execute. Additionally since the paper card industry is declining at 3.2%, would it not benefit Hallmark to reduce their SKU count? Hallmark could do an 80-20 study on their SKUs- that is, analyze which 20% of SKUs provide 80% of the revenue, while getting rid of the the remaining 80% of SKUs that only bring in 20% of revenue. Such a move would help realize production efficiencies, and help Hallmark identify better which SKUs tend to be more popular, thus allowing them to concentrate their marketing budget more on the bestsellers.

Also, I never realized that Hallmark card warehouses would be so labor intensive, but in this declining business, maybe Hallmark is not able to afford automation. The whole collection and distribution method shown above seems very inefficient and physically difficult on employees. Maybe there are some operating efficiencies that can be realized here.

Thanks for the post – I am somewhat of a greeting card enthusiast (!) and I totally buy in to the idea of using greeting cards to spread cheer! Highlighted in the article below is that consumers have an immense number of options when choosing a greeting card (I’m always so overwhelmed looking through a wall of cards inside a store). In this way, I think it becomes even more critical to have cards as customized as possible so as to differentiate them from the sea of otherwise substitutable options. I feel as though personalized greeting cards (especially for the holidays!) are becoming more prevalent, and with competitors like Minted springing up left and right, Hallmark may find itself up a creek sooner rather than later if it doesn’t adapt and provide a platform for customization.

Also, as you mentioned in your post, the greeting card industry is having a tough time staying relevant. In a way, I think you can draw parallels to the newspaper industry. I’m surprised that Hallmark hasn’t made more of an effort to go digital with its products – e-Cards give consumers a more efficient, time-saving option to send a quick note. And even then, when sticking to physical products, people are moving to buying almost everything online (from groceries to mattresses and even cars), and thus that Hallmark too needs to recognize that this shift in shopping behavior will undoubtedly affect its business model. A bigger push for online sales is likely necessary for sustained prosperity and growth (less than 5% isn’t going to cut it!).

http://www.economist.com/blogs/schumpeter/2012/05/greeting-card-industry-0

I really liked your post, Apeksha! Like Kimberly, I’m surprised to see that Hallmark hasn’t made a bigger move into the e-card space. There are now many companies through which you can send e-cards for free or for a nominal price. Do you have a sense for why they haven’t tried to carve out market share? On the one hand, one might think that moving towards e-cards could cannibalize their printed card revenue, but in fact I don’t think that is the case. Namely, I think that e-cards aren’t true substitutes and that printed cards are likely to remain superior when someone wants to give a card to someone else face-to-face (e.g. at a birthday party, a baby shower, or a wedding.) I imagine Hallmark’s margins on printed cards are orders of magnitude higher than they would be on e-cards, but if Hallmark is serious about “creating a more emotionally-connected world” they need to take a broader approach. I don’t think that customizable cards will alone enable them to ride the digital tide that’s coming to wash them away.

Interesting post! More than once, I have browsed the greeting card aisle at a convenience store and thought of how difficult of a business it must be. Tons of competing designs trying to appeal to all sorts of people with different tastes during different seasonal cycles, many of which impose an inventory expiration date… all on top of the limited barrier to entry and obvious attractiveness of the e-solution model. Never seemed too attractive to me. However, when you reference Hallmark’s legacy and the immense database of information they have accumulated over the years, I start to see why perhaps they have legs. I was particularly interested by the legal settlement you referenced where a multi-million dollar value was implied for a small subset of this information. I am very interested to see how Hallmark leverages this competitive advantage in the digital age and whether it will have a creative e-solution. While Hallmark does have a brand and a chest of consumer insight, it also has a major problem with competitors who can easily do what they do.

Great post, thanks for sharing! It is interesting to see how Hallmark has leveraged technology to improve their supply chain. This is a great example of how a traditional company is improving its operating model as technology progresses. Another example of a company in the space is Lovepop (https://www.lovepopcards.com/). Like Hallmark, they make cards, but instead, Lovepop built its business using innovative technology and cutting edge software to build design-forward cards. Take a look! They are also Harvard i-lab alums. It will be interesting to see how the greeting card interesting develops as technology becomes even more important in business. Maybe Hallmark will even create or acquire business units like Lovepop in the future?

Thanks for sharing! I think it’s unfortunate that the day of paper cards is going away. I know we live in a digital world, and e-cards are very convenient, but there is still a market for personal physical cards. I do hope that Hallmark moves in the direction of personalization. The company could really improve the product development by allowing online personal designs and then pushing them to print. Hallmark reminds me of other businesses that were once leaders in the market, but due to their delay in digital advancements, the companies lost profits.