Gotta Catch Em’ All: Nintendo’s Mobile Breakthrough with Pokemon Go

After losing the latest battle in the video game console war, how can Nintendo utilize new advancements in mobile gaming and augmented reality to remain relevant in a continuously changing gaming industry?

Since the early 80’s, Nintendo has largely dominated the video game industry through innovative hardware breakthroughs and long-standing successful franchises such as Mario and Zelda. But after losing ground in the console wars to competitors Microsoft and Sony, Nintendo has had to look to a new frontier that may permanently alter its decades old business model – augmented reality and mobile gaming.

Playstation 4 and Xbox One want to battle! Go! Wii U!

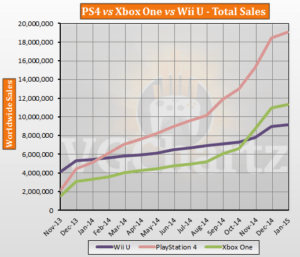

The most recent battle in the video game console war pitted Nintendo’s Wii U against Sony’s Playstation 4 and Microsoft’s Xbox One. While Nintendo had traditionally beaten its primary competitors in the past with innovative consoles such as the Wii, this next generation of hardware had a different outcome. The Wii U was poorly received by critics and fans, with Microsoft and Sony selling nearly two and four times as many Xbox One and Playstation 4 consoles respectively [1]. The Wii U is on the path of being discontinued, going down as the worst selling console in Nintendo history [2].

The Wii U’s miss had massive ramifications on the company’s financial performance, with profits falling over 60% year over year [3]. As Nintendo regrouped from the losses, they also looked forward to the next generation of hardware, unveiling a prototype for its next project called Switch. However, this too was met with investor skepticism, resulting in another 6% drop in share price [4]. With its traditional hardware business falling further behind to the competition, Nintendo had to make significant changes to regain relevance in the evolving industry.

A wild Niantic appeared!

When Google restructured in late 2015, its mobile game development division spun off to become an independent entity called Niantic [5]. With a focus on innovation in augmented reality technology (AR), Niantic created its first game “Ingress,” integrating video gaming with the real world through GPS and a mobile phone [5].

Through this success Nintendo saw an opportunity to capitalize on both a mobile platform and AR technology, investing in Niantic to collaborate on a new game with one of its key joint venture franchises, Pokemon [6]. The companies began working on an AR game titled “Pokemon Go” that would allow users to interact with virtual Pokemon via their phones, bringing the hunt for catching the franchise’s famous creatures into parks, restaurants and other everyday settings.

As the game prepared for launch in July 2016, questions remained on whether Nintendo could capitalize on such a drastic deviation from its traditional hardware business model. AR was largely unproven in the market, and this was Nintendo’s first venture into mobile gaming. How successful could it be?

It’s super effective!

It turns out, pretty damn successful. As Pokemon Go was free to download and play, it quickly shot up to the top of the App Store with over 500 million downloads by the end of the month [7]. The game received additional publicity and attention from numerous media reports, from general coverage of the game-turned-phenomenon to incidents of unintended accidents and injuries while playing the game [8].

Pokemon Go was also massively successful financially. The game was structured in a “freemium” model, in which it was free to download and play but offered in-app purchases for additional in-game items. Within just a few weeks of the game’s launch, nearly $260 million in-app purchases had been made using this freemium model [9]. Although Nintendo did not reap the entirety of these sales, as it was Niantic that directly distributed the game, the company did benefit greatly from the success of its joint venture.

In just three months, Nintendo recorded a nearly $100 million profit through its partnerships – equaling 75% of the previous year’s net income [10]. Furthermore, the popularity of Pokemon Go impacted Nintendo’s traditional businesses as well, with improved sales of both regular hardware as well as a 30-50% increase in sales of Pokemon related products including games and trading cards [11]. A quick glance at Nintendo’s share price after game release in July shows the magnitude of impact Pokemon Go has made to the company:

I wanna be the very best…

After the unprecedented success of Pokemon Go, Nintendo has begun to shift its focus towards the new opportunities in the ever-changing video game landscape. The company announced the upcoming release of another mobile game based on its most iconic franchise, Mario, in mid-December 2016 – an announcement that led to an additional stock increase of nearly 20% [12]. As technology continues to advance, Nintendo has shown it has the flexibility needed to adapt to this new market. And as its business model continues to evolve, beyond hardware and into mobile gaming and even further into unchartered territory such as virtual and augmented reality, the future looks bright for this iconic video game company.

[794 words]

References:

[1] Ben Gilbert, “The PlayStation 4 is the most popular game console in the world,” Business Insider, May 26, 2016, http://www.businessinsider.com/playstation-4-sales-2016-5, accessed November 2016.

[2] Nikkei, “For Nintendo’s Wii U, uniqueness was its downfall,” Nikkei Asian Review, Nov 12, 2016, http://asia.nikkei.com/Business/Companies/For-Nintendo-s-Wii-U-uniqueness-was-its-downfall, accessed November 2016.

[3] Hudson Lockett, “Nintendo forecasts disappoint as FY profits slide,” Financial Times, April 27, 2016, https://www.ft.com/content/09de77b2-d615-32db-8388-2b2da8672b4e, accessed November 2016.

[4] Jonathan Soble, “Nintendo Switch Console Is Met With Skepticism From Investors,” The New York Times, October 21, 2016, http://www.nytimes.com/2016/10/22/business/international/nintendo-stock-switch-console.html?_r=0, accessed November 2016.

[5] Sophie Estienne, “Pokemon hunt leads to glory for Google-born Niantic,” AFP, August 14, 2016, https://www.yahoo.com/news/pokemon-hunt-leads-glory-google-born-niantic-065922769.html, accessed November 2016.

[6] Patrick Seitz, “‘Pokemon Go’ Craze has Retailers Hunting for Revenue,” Investor’s Business Daily, July 14, 2016, http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1804402603?accountid=11311, accessed November 2016.

[7] Business Wire, ” Pokemon GO Exceeds 500 Million Downloads Worldwide,” Business Wire, September 7, 2016, http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1817357376?accountid=11311, accessed November 2016.

[8] CBS News, ” This new Pokemon game is causing some real-world bruises,” CBS News, July 8, 2016, http://www.cbsnews.com/news/this-new-pokemon-game-is-causing-some-real-world-bruises/, accessed November 2016.

[9] Madhumita Murgia, ” Pokémon Go crosses $250m in revenues since launch,” CBS News, August 12, 2016, https://www.ft.com/content/2dd63522-5fdf-11e6-ae3f-77baadeb1c93, accessed November 2016.

[10] Jacky Wong, ” Pokémon shows Nintendo Still has Path to Glory; Solid Profits from Nintendo’s Stake in Pokémon Go is further Proof that Mobile Gaming–Not Consoles–is the Company’s Future,” Wall Street Journal, October 26, 2016, http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1832158033?accountid=11311, accessed November 2016.

[11] Takashi Mochizuki, ” Pokémon to Create Games for Nintendo’s Next System; Sales of Pokémon Products have been Lifted by Popularity of Smartphone App ‘Pokémon Go’,” Wall Street Journal, September 20, 2016, http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1821096026?accountid=11311, accessed November 2016.

[12] Wataru Suzuki, “Super Mario iPhone game set for December 15 release,” Financial Times, November 15, 2016, https://www.ft.com/content/a978fc6f-7203-3826-8191-a7a99bfaa15b, accessed November 2016.

Image References:

http://www.secretcharacters.com/category/pokemon-go/

http://bgr.com/2015/02/18/ps4-vs-xbox-one-vs-wii-u-lifetime-console-sales/

https://www.ft.com/content/237ab9e6-4724-11e6-b387-64ab0a67014c

http://www.vox.com/2016/7/11/12129162/pokemon-go-android-ios-game

http://www.cnn.com/2016/07/15/health/pokemon-go-players-fall-down-cliff/

Nice post! I was fascinated by the sudden rise of Pokemon Go last summer — I remember one night was out in a public park hanging out with a friend when we started to realize that everyone around us was playing Pokemon Go. My biggest question is whether this was a one-hit-wonder or is replicable? It seems like Pokemon Go brought together a perfect storm – it launched in the summer and encouraged people to get outside, it was nostalgic in its theme, but novel in its application. That said, it doesn’t seem like something people are still playing – it seemed like it was a flash in the pan last summer and now is a fad we laugh about. I’m curious to see what they will launch for Mario in December and if this success can be achieved again, and more importantly, sustained.

I am a big fan of Niantic because I think Niantic has the potential to emerge as the primary AR location-based platform, layering on novel experiences that go far beyond just Pokemon. One thing that I found interesting about the rise of Pokemon Go was that it took a while for the market to actually realize that Nintendo would only get a portion of the earnings from the game. It was a fascinating situation where the market was pricing the company as if it had a breakout hit on its hands, even though it was publicly acknowledged that Nintendo had just invested in Niantic and would take a cut of the earnings. Eventually the market realized the structure of the partnership, and the stock price plummeted as a result! https://www.theguardian.com/technology/2016/jul/25/pokemon-go-nintendo-shares-tokyo-stock-exchange-niantic

Great post!

It’s been interesting seeing Nintendo embrace a shift–however slowly–to the mobile market. Their core belief was always hardware first, with consumers only able to play the Nintendo IP on Nintendo hardware. Mario I think will be one of the first, if not the first, times that you can play a completely Nintendo-owned IP game on a non-Nintendo system (Pokemon is not completely owned by Nintendo, and actually had a few mobile games available before Pokemon Go, such as Pokemon Shuffle). I echo Sarah in wondering how the mobile Mario game will do; I imagine quite well. They have the full support of Apple’s marketing, as the Mario game was announced at an Apple conference and has a key placement in the App Store, along with an unusual (for the App Store) preorder feature. I wonder if Nintendo will go the way of Sega and shift to a software/IP only company. Sega shifted to a focus in mobile games in recent years, and hasn’t produced any hardware in over a decade.

Another interesting aspect of PokemonGo is the new forms of monetization that the app has. For example, retailers or restaurants can pay Niantic to “send” Pokemons to their locations in order to attract potential customers.

http://www.bloomberg.com/news/articles/2016-07-11/pok-mon-go-brings-real-money-to-random-bars-and-pizzerias

Great article! As you mentioned, I think the success of Pokemon Go was the nice combination of software asset of Nintendo, as well as the Niantic’s existing investment in AR and location information. One question that comes to my mind: Is this new business model sustainable? In other words, what happens if Nintendo has consumed all the popular characters, such as Mario or Zelda? In the old, hardware-based business model, it was easier for a gaming company to dominate the market once the hardware was successful. This market dominance enabled Nintendo to create globally popular characters. In our mobile gaming world, it is difficult to create such characters since there are thousands of games to play. Therefore, I’m interested how gaming companies like Nintendo will create next “Mario” to make their business models sustainable.

Interesting article, Andrew! Although I agree that Nintendo made great strides in expanding past hardware to areas like mobile, I’m not sold on your optimism on relying so much on alternative gaming. The barriers to entry to the mobile space are incredibly low; for every lucky win Pokémon Go, there are numerous failures as well. It’s not realistic to think Nintendo’s business model will sustain purely on this mobile or AR platform. In my opinion, Nintendo will still need to rely on solid innovation in the hardware space. Recall our LEAD case with Valve, and how even a successful software company needed to diversify into hardware in order to remain relevant in the industry. The Wii was absolutely revolutionary in the video game industry, and that is the type of hardware innovation that Nintendo will need to recapture in order to properly compete with Microsoft and Sony in the future. Mobile Apps and AR will supplement hardware success, not replace it.