GENERAL ELECTRIC: HOW CAN A 126-YEAR OLD INCUMBENT NAVIGATE THE FOURTH INDUSTRIAL REVOLUTION?

While the rise of machine learning in the consumer space is widely discussed, its uses in mature industrial technologies are lesser-known, yet very important.

Machine learning applications for large-scale industrial assets, such as turbines and jet engines, hold powerful potential with the promise to generate massive impact in high-risk scenarios where failures can result in life-or-death situations [1]. Therefore, it is not surprising that new-age machine learning technology is rapidly re-shaping the future for General Electric (GE), a widely diversified manufacturing conglomerate with businesses across sectors, such as energy, aviation, and healthcare.

THE FOURTH INDUSTRIAL REVOLUTION IS THE NEW NORMAL

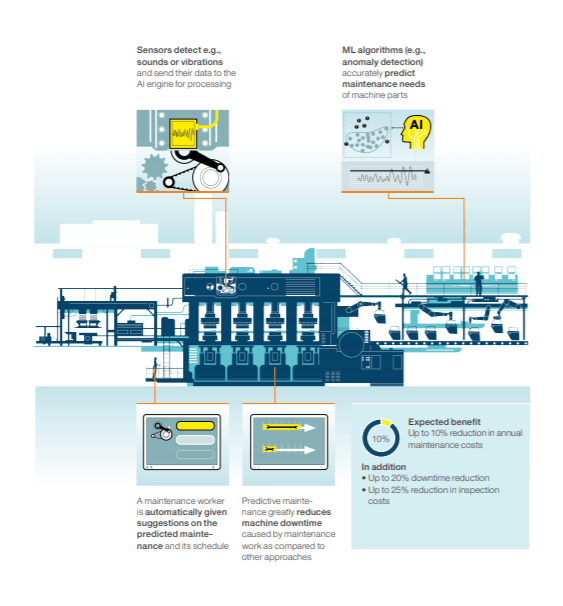

The world has previously witnessed three industrial revolutions – starting with the advent of the steam engine to the more recent computers and automated systems – that drove transformational changes [2]. Today, we face another inflection point amidst the fourth industrial revolution. Coined ‘Industry 4.0’, this phenomenon connects the digital and physical realms through sensors and the internet of things (IoT), collecting and analyzing big data to drive “autonomous, de-centralized decisions, with the aim of increasing industrial efficiency, productivity, safety, and transparency” [3]. For example, as shown in Figure 1, sensors placed on industrial machinery can collect real-time data, which can then be analyzed using machine learning algorithms to detect abnormalities and enable preventative maintenance, thereby driving efficiency, increasing utilization, minimizing downtime, and generating cost savings [4]. A simple analogy likens this to “personalized medicine” for machines [5].

Industry 4.0 represents a massive, yet inevitable, shift, and GE has invested significantly in building and acquiring capabilities to maintain its competitive advantage. At the core of its strategy lies Predix, a proprietary software platform that connects “people, data, and machines” [6]. Predix is enabled by advanced machine learning applications that create a “digital twin”, i.e. a virtual copy, of a physical machine. A digital twin is used to simulate outcomes by applying real-time data transmitted via the cloud from sensors placed on the physical twin. Machine learning algorithms that leverage historical data and pattern recognition are used to predict the impact of on-the-ground conditions on machine performance, enabling early intervention to eliminate system downtime and failures. This can be applied to a single machine and is also scalable to networks of machines [7].

- “GE for GE” (quick win): This involves applying Predix and existing machine learning capabilities in hundreds of GE factories to drive productivity in internal manufacturing processes.

- “GE for Customers” (short term): Perfecting its capabilities based on internal use, GE plans to deliver these capabilities to customers through applications, helping them improve productivity of their assets.

- “GE for the World” (short-medium term): Lastly, GE aspires to leverage Predix to crowd-source cutting-edge applications through an open-innovation model that democratizes access to its platform and drives innovation exponentially.

RECOMMENDATIONS FOR BETTER OUTCOMES

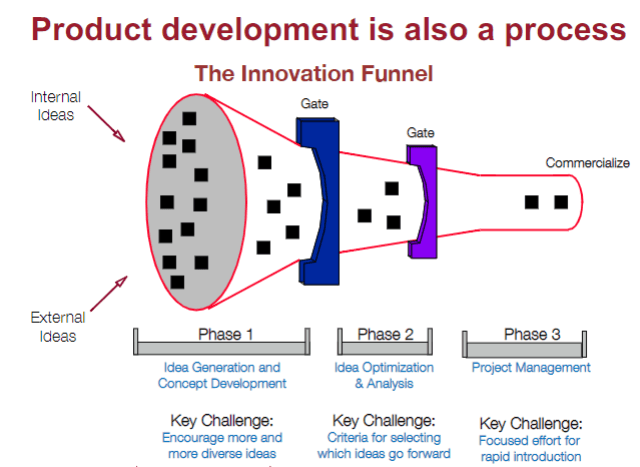

While GE’s strategy outlined above effectively addresses all its stakeholders, separating its implementation into the three distinct phases may prevent GE from unlocking the full potential in the short term. Specifically, the open-innovation model can generate benefit if applied across all three phases through the innovation funnel approach (see Figure 3). By constantly in-sourcing the best ideas from around the world, GE can push the boundaries and design for compelling extreme use-cases and unknown unknowns.

In the short-to-medium term, as GE proves its technology with successful use-cases, the company must also leverage its leading capabilities to address big challenges facing all manufacturers grappling with Industry 4.0. For example, GE can take the lead to invest in building solutions that tackle major cyber security risks inherent to cloud-based technologies, and/or can establish a best-in-class approach for integrating large volumes of disparate data needed for machine learning applications [9]. In doing so, GE can not only create value for itself, but can also emerge as a pioneer that helps raise the industry’s potential.

GE’s recent troubles, with shrinking profitability and a struggling stock price, have resulted in significant investor pressure and sweeping management changes. Given this uncertainty, there is growing speculation about the future of GE’s digital business. Regardless, most would agree that it is difficult to imagine a world where GE can thrive, or even survive, without embracing machine learning, and other Industry 4.0 trends.

To that end, how should GE’s management balance the need for short-term financial gain to satisfy shareholders, with the more long-term value creation outlook needed to invest in R&D for new-age technologies?

Taking a step back, should we even be looking at GE and other incumbents to drive the next generation of innovation, or will new start-ups emerge to conquer this space? (777 words)

SOURCES

[1] GE Website. “Everything you need to know about the Industrial Internet of Things”. Web. Accessed Nov 10, 2018. https://www.ge.com/digital/blog/everything-you-need-know-about-industrial-internet-things

[2] Carvalho, Nubia et al. “Manufacturing in the fourth industrial revolution: A positive prospect in Sustainable Manufacturing”. Procedia Manufacturing, Volume 21 (2018). Web. Accessed Nov 10, 2018. https://ac.els-cdn.com/S2351978918302105/1-s2.0-S2351978918302105-main.pdf?_tid=d372b7b7-8069-4ce8-aefd-175ccf4dd79e&acdnat=1542090531_346d5d8c93f9405cf862e16e72dc561b

[3] Boyles, Hugh et al. “The industrial internet of things (IIoT): An analysis framework”. Computers in Industry, Volume 101 (2018). Web. Accessed Nov 10, 2018. https://reader.elsevier.com/reader/sd/pii/S0166361517307285?token=9640180C99D32AC6DA475E7A546A0E10BEFE586171E355E8014790274FEA9638010A27B9857AB7CA2B818A39074C8E79

[4] McKinsey & Co. “Smartening up with Artificial Intelligence (AI) – What’s in it for Germany and its Industrial Sector?” (2017). Web. Accessed Nov 10, 2018. https://www.mckinsey.com/~/media/McKinsey/Industries/Semiconductors/Our%20Insights/Smartening%20up%20with% 20artificial%20intelligence/Smartening-up-with-artificial-intelligence.ashx

[5] NY Times. “G.E., the 124-Year-Old Software Start-Up” (2016). Web. Accessed Nov 10, 2018. https://www.nytimes.com/2016/08/28/technology/ge-the-124-year-old-software-start-up.html

[6] GE Reports. “Everything You Always Wanted to Know About Predix, But Were Afraid to Ask” (2014). Web. Accessed Nov 10, 2018. https://www.ge.com/reports/post/99494485070/everything-you-always-wanted-to-know-about-predix-2/

[7] Forbes. “How AI And Machine Learning Are Helping Drive The GE Digital Transformation” (2017). Web. Accessed Nov 10, 2018. https://www.forbes.com/sites/ciocentral/2017/06/07/how-ai-and-machine-learning-are-helping-drive-the-ge-digital-transformation/#6cf21361686b

[8] GE Whitepaper. “GE’s Digital Industrial Transformation Playbook” (2017). Web. Accessed Nov 10, 2018. https://www.ge.com/uk/sites/www.ge.com.uk/files/ge-digital-industrial-transformation-playbook-whitepaper.pdf

[9] McKinsey & Co. “Industry 4.0 after the initial hype: Where manufacturers are finding value and how they can best capture it” (2016). Web. Accessed Nov 10, 2018. https://www.mckinsey.com/~/media/mckinsey/business%20functions/mckinsey%20digital/our%20insights/ getting%20the%20most%20out%20of%20industry%204%200/mckinsey_industry_40_2016.ashx

[10] Harvard Business School RC Technology & Operations Management, “Module 2 to 3 transition” (2018).

I liked the concept of Predix and GE’s vision of the Industrial Internet and find it sad that GE grew too big for its own good under Jeff Immelt’s watch. Given GE’s leverage and the unhealthy finances of its power business[1], it seems the company will not have the ability to invest significantly in innovation and will instead have to focus more on cash flow. In fact, earlier this year, it was reported that GE planned to sell its digital assets, including Predix[2]. This said, I do not believe GE’s woes portend doom for innovation in the industrial sector, or even at GE. For example, GE Healthcare and Intel are jointly developing machine learning powered imaging tools[3], and these are likely to yield benefits quite soon: some of the tools they are developing are already being piloted at select hospitals. I would propose that what we will see at GE in the Larry Culp era is a company that, after slimming its portfolio to two operating units (GE Healthcare and GE Power most likely) builds machine learning into products and services those businesses offer.

[1] Thomas Gryta and Saumya Vaishampayan, “GE Shares Fall Again, Hit New Low,” November 12, 2018, https://www.wsj.com/articles/general-electric-shares-keep-falling-on-track-for-fourth-straight-session-of-declines-1542039574?mod=searchresults&page=1&pos=8, accessed November 2018.

[2] Dana Cimilluca, Dana Mattioli and Thomas Gryta, “GE Puts Digital Assets on the Block,” July 30, 2018, https://www.wsj.com/articles/ge-puts-digital-assets-on-the-block-1532972822, accessed November 2018.

[3] GE Healthcare, “Beyond Imaging: the paradox of AI and medical imaging innovation,” http://newsroom.gehealthcare.com/beyond-imaging-ai-imaging-innovation/, accessed November 2018.

Very interesting read. I think you raise a great question – why aren’t large companies leading the charge on this next era of innovation? GE appears to be a great candidate for self created machine learning products that could be highly cash generative in the medium term. The business has the product base needed to collect the information required and I speculate Prong 1 & 2 listed above are very attainable. Given the path toward creating Predix is already underway, I’d hope the Board of Directors gives management the time they need finalize this product and start showing cash flows. It will be interesting to see if GE is successful and if other large business decide to join the innovation wave.

I think you did a great job summarising GE’s short term and long term plans with regards to applying its preventative maintenance algorithm. However, I question whether GE as the OEM is the best suited party to develop such algorithms. There is an inherent conflict of interest since I would imagine GE derives a significant amount of its revenues from its maintenance contracts, which I know to be the case for gas turbines. Moreover, since machine learning algorithms do not utilise causal relationships (just correlated ones), I don’t see an advantage of the OEM developing such algorithms, apart from the fact that it is the only entity that can easily compile maintenance data from its customers around the world. If GE’s intention is truly to improve up-time of its machines, then it would make the raw data available on an open access platform for 3rd parties to develop their own machine learning algorithms.

Thanks a lot for sharing the article – I really enjoyed the read. Coming to your question on whether large corporations should even bother about innovating or whether small startups and small companies should do the job – I believe that in order to stay relevant in the long-run and in order to avoid large multiples for acquisitions, a do-it-yourself strategy makes more sense. Large conglomerates, like GE, need to create space for innovation and allow their teams to make mistakes in order to create room for innovation. Internal innovation funds can help create resources for innovative ideas. Giving workers dedicated hours to look at moonshot projects and how to integrate AI into the overall strategy can allow companies to strive and prevent them from overpaying for innovative startups.

Awesome read. The tension you explore here between GE’s position as an incumbent vs. more agile competitors is one that will become increasingly important as GE struggles to improve performance. GE may be somewhat constrained by the fact that it hasn’t traditionally focused on cutting edge innovation like machine learning, but I think it ultimately has a strong resource base in terms of technical expertise and capital. If the organization chooses to truly focus on innovation through initiatives like an in-house incubator and cross-functional teams dedicated 100% to innovation projects, it could produce results as revolutionary as those of a startup. The appetite for risk needed to succeed here is different from GE’s conservative mindset, but as long as the innovation arm of the conglomerate has significant autonomy I think it has the potential to be very effective and transformative.