From Facebook to finance: how kountable uses social media data to generate credit scores

A FinTech develops an innovative approach to credit decision-making in developing economies.

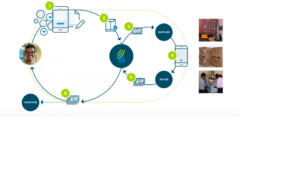

Forget what unconscious message your social media is sending to the kid you sat next to in middle school and never saw again; much more significantly, one day in the near future, it could hold the key to your – or your business’ – creditworthiness. kountable Inc is one company that is already testing the concept of using social media data to credit score entrepreneurs in need of trade finance. It is exemplifying what the Wall Street Journal calls “the Uberization of finance”[1] by using technology to disrupt traditional sources of funds. The business was set up to support an underserved SME community in Rwanda, and has plans for expansion into new markets, including the US, this year. It operates by using a proprietary algorithm to evaluate businesses’ social capital across social networking sites, text messages and emails. On the basis of this assessment, kountable generates a “kScore”, and promises that users can use the score “to secure funding for [their] project at very favorable rates”[2]. As well as scoring companies, the promise is also to connect businesses to investors, operating as an intermediary between the two and, in withholding payment to the entrepreneurs until goods are delivered, assuming much of the risk. Its revenue comes from financing fees.

The value proposition is clear: entrepreneurs are able to secure funding for growth, at reasonable rates, even if they don’t have some of the data and documentation that has been traditionally required for credit scoring. Entrepreneurs receive the funds they require in a much shorter timeframe than a bank could originate a loan – typically as little as three to four days[3]. It’s also easy to access, accepting data uploads by cellphone. And very importantly, there is also a positive social impact as SMES – which represent 80% of the region’s employment[4] – become more and more able to meet vital needs in their communities. Projects include providing healthcare equipment and supplies, classroom furniture and materials, and educational technology. No wonder the firm has received enthusiastic encouragement from the Rwandan government[5]. It also seems to work for investors; there have been zero defaults to date, with over $5M of financing provided[6]. The company puts this down to social media and email data enabling the measurement of performance risk rather than credit risk.

That said, there are definitely questions for kountable’s leadership team as they set out to scale their business. The first set of questions are around data integrity and the accuracy of the conclusions drawn. Is Kountable’s technology sufficiently robust to detect where data has been tampered with or pre-edited? Will the answer to that question change as it enters more developed markets? Is the current focus on performance risk (for example looking at the depth of someone’s networks) enough, or should the company also be focusing on risk of default? As the company grows, management may well need to re-consider their requirements – perhaps considering insisting on some customers securing their loans (which they currently do not need to do) or requiring additional documentation in some cases.

Additionally, the leadership must focus on the potential regulatory difficulties that will come with expansion into new markets. FinTech being a comparatively new space, regulators have yet to fully get to grips with what is and isn’t acceptable or ethical, and it may be that US authorities and others deem the use of this information invalid. There’s also the ‘creepy’ factor; will enough entrepreneurs continue to be happy to submit all this data to translate to meaningful volume for kountable? A real focus for the company moving forward should be to mitigate against this risk by building out their customer community and using them as champions for the process. Ensuring a high level of transparency as to the process will also be key.

Aside from the “Fin” part of the equation, kountable must also keep the “Tech” part at the top of the priority list, to defend against a proliferation of potential competitors developing similar or smarter credit-scoring technology. As banks look to push back against FinTechs by developing this technology, the space is becoming more and more crowded. Competing here will require significant upfront investment, but will likely pay dividends over the long-term for the business.

These are non-trivial challenges for kountable, but overall the company has an appealing opportunity to use digitization to great effect in many more markets than Rwanda. Un- and underbanked communities exist all over the world, even in highly developed economies. The potential impact is enormous and, if it can translate its learnings from Rwanda, maintain its encouraging default rate, and stay at the leading edge of algorithmic technology, so is the upside for kountable.

779 words (excl. footnotes)

[1] Wall Street Journal, ‘The Uberization Of Money — The familiar middlemen of 20th-century banking and investing are giving way to something very different; Are we ready for the opportunities — and the risks?’, 9 November 2015: http://www.wsj.com/articles/the-uberization-of-finance-1446835102

[2] Kountable website: www.kountable.com/about/

[3] Hope Magazine, ‘Kountable; Quick financial support for business needs’, http://www.hope-mag.com/index.php?com=news&option=read&ca=1&a=1993

[4] TradeStreaming.Com: ‘”When they win, we win”: Kountable brings social supply chain financing to Rwanda’: http://www.tradestreaming.com/digital-lending/when-they-win-we-win-kountable-brings-social-supply-chain-financing-to-rwanda

[5] TradeStreaming.Com: ‘”When they win, we win”: Kountable brings social supply chain financing to Rwanda’: http://www.tradestreaming.com/digital-lending/when-they-win-we-win-kountable-brings-social-supply-chain-financing-to-rwanda

[6] Kountable fact sheet, accessed via www.kountable.com/about

I worry about Type II errors here where kountable incorrectly allocates capital based on flawed reasoning behind its algorithm. The world is rife with businesses that appear popular on social media but consistently fail to turn a profit (ex. Twitter, Snapchat, Blackberry) and may never be able to repay its debt holders. The same problem would exist if one were to measure an individual’s creditworthiness based on number of Facebook friends or LinkedIn connections. There are people out there who appear to have over 500 connections, but in reality fall well short of that number in real life (see Section B Facebook stalker).

I really like this concept (specifically in emerging markets and microfinance context) given it’s ease of use and that it could help capable entrepreneurs who might otherwise be neglected by financiers get their businesses off the ground. However, like AJ, I am skeptical that social media connections and engagements alone are sufficient to merit any significant amount of financing. It is heartening to know that there have been no defaults thus far, but this is also a new concept and global markets have been relatively benign and supportive of new businesses. During market downturns, operations, cash flows, and overall business acumen are much more important in determining if a business can withstand the shock. For this reason, I think this information should be used in conjunction with other more traditional credit measures to get a more comprehensive picture of the financial health and potential for the companies seeking financing.

This is a fascinating post. I’m encouraged that there are companies like kountable out there using novel techniques to extend credit to those who have traditionally been unable to to access it. Data integrity feels like a huge issue here though, given their reliance on the depth of the social data to measure businesses, and kountable must focus on developing its technology to detect fraudulent data if it doesn’t want to fall prey to sophisticated scammers in the future.

Really interesting business model, and encouraging to hear that kountable has been so successful thus far in making a real impact on the business community in Rwanda. I do wonder whether they will be able to successfully expand to more developed markets, though. I was actually somewhat surprised to hear that the Rwandan government was supportive, and I think this model would almost certainly invite a lot more regulatory scrutiny in places like the U.S., as you mentioned. I think regulatory environment should be one of the most important considerations for kountable as it examines potential markets to enter.

Thanks for this LG! I wonder if this business creates the potential for people to adapt their social media identities to gain a better credit rating and therefore access to money. At least with the conventional old-fashioned credit assessment, hard facts are required with subjective evidence, thus making it hard to create a “fake profile” and dodge the reality of what one’s true credit score should be.

Thanks Lizzie, I think this is an inspiring concept with potential for great social impact. Like you, I am curious of the ability of kountable to scale across markets. Governments are trying to catch up with innovations in the fin-tech space which creates regulatory uncertainty risk for kountable. Furthermore, I am skeptical of kountable’s ability to compete with new entrants – is there anything about kountable’s business model that is proprietary or is it simply a network-play?