ESPN: The World Worldwide Leader in (the Digitization of) Sports (Media)?

ESPN’s ups, downs, and future with their migration into mobile in the face of declining subscriptions for the company’s flagship television networks.

ESPN Overview

ESPN, a subsidiary of The Walt Disney Company (NYSE: DIS), is a media company that includes television channels (such as their flagship ESPN channel), ESPN.com, a radio network, and other assets. The ESPN television network broadcasts live sports and other sports-related broadcasts in over 200 countries. ESPN’s pervasiveness, importance, and influence in the sporting world are undeniable – in 2014, it was ranked as the world’s most valuable media asset and second most valuable sports brand behind Nike1. The company’s first foray into digitization came in 2006 with Mobile ESPN, which provided sports content on demand for mobile phone users who downloaded the app. Below is a sample of the current ESPN app.

Trends in Cable

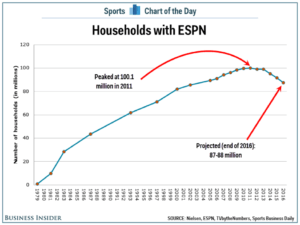

While ESPN gets the vast majority of their revenues from affiliate fees related to TV (approximately $6 billion3), there have been disturbing trends with the viewership. As shown in the chart below, the number of households with ESPN peaked in 2011 and has dropped precipitously in the past couple of years.

As revenues from the big cable bundles have dwindled, ESPN knew they had to re-position themselves to compete in this digital, cord-cutting age.

ESPN’s Initial Digital Media Strategy

ESPN adopted a strategy of “building digital verticals around stars and subjects”4; however, to date, there has been much uncertainty about their ability to implement the plan profitably and effectively. Grantland was a pop culture and sports blog started in 2011 by well-known (and occasionally controversial) sports writer Bill Simmons. While it reached decent levels of popularity, it was rumored to have never reached profitability and was shut down in 2015 after Simmons’ departure. Below is a sample of the Grantland website.

ESPN’s The Undefeated, a website exploring the intersections of culture, race, and sports, got off to a rough start with a long delay and the resignation of the founder4‑. The digital vertical at ESPN was also the source of many layoffs in 20155, perhaps signaling the firm’s lack of commitment to the strategy.

Rise of Mobile

ESPN’s app is one of the most popular: “in an average week, across all of its apps, ESPN delivers approximately 600 million alerts to tens of millions of phones”3. Moreover, the company has added a daily feature on Snapchat to appeal to a younger generation. Between all of its digital offerings, ESPN’s mobile audience is much bigger than its current TV audience; yet, the difficulty of monetization in mobile has plagued the company as it looks for ways to replace its fading revenue from cable subscriptions.

New Partnerships

In 2016, ESPN/Disney has forayed into new partnerships to strengthen their digital position. First, the company purchased one-third of Major League Baseball’s digital business (with an option to take a majority stake in the future). This business, called MLB Advanced Media, manages digital ticketing, live streams, and sponsorships. MLB Advanced Media “distributes 25,000 live events annually and 10 million streams daily” and, perhaps more importantly, “has the resources to support “millions of multi-platform subscribers and processes”6. Below is a sample of MLB Advanced Media’s live streaming.

ESPN also reached an agreement with Tencent to leverage potential synergies between ESPN’s sports content and Tencent’s user base. According to terms of the deal, “ESPN’s content will be localized and exclusively distributed and promoted by Tencent’s digital platforms in China”7. Tencent’s live sports and digital offerings in the Chinese market will now be exclusively Mandarin ESPN content. Through this arrangement, ESPN can quickly begin reaching millions of Chinese fans with their extensive coverage of basketball, soccer, and other sports.

Recommendation

- First recommendation to ESPN: stop investing significant capital in their non-sporting event television shows. They must accept that cord-cutting is inevitable and try to milk the channel for profits and not growth. High-priced personalities will not buck this trend – ESPN should let them walk if their contract demands escalate. The company must transform into a digital company, but it seems they have not yet accepted this stark reality. As a future approach to sports news and entertainment, ESPN should continue to try to solve the puzzle of individualization and customization to maximize the user experience and consumption process.

- Second recommendation to ESPN: create more partnerships with sports leagues (as they did with MLB Advanced Media) and individual teams. They are still developing their mobile platform as “both the content and business strategy is still an experiment in the personal feeds and phones of tens of millions of fans”3. In the future, live sports will continue to draw massive audiences – I believe ESPN must leverage their brand to expand access to these events. By using their massive brand equity, the company can find leagues and teams who want and need a reputable, trusted, and sophisticated home for their content.

(787 Words)

Sources:

1: Badenhausen, K. (2014, April 29). The value of ESPN surpasses $50 billion. Forbes. http://www.forbes.com/sites/kurtbadenhausen/2014/04/29/the-value-of-espn-surpasses- 50-billion/.

2: Vogan, T..ESPN: The Making of a Sports Media Empire. Champaign: University of Illinois Press, 2015. Project MUSE.

3: Thompson, Derek. (2015, July 9). “ESPN’s Plan to Dominate the Post-TV World”. Atlantic Media. https://global-factiva-com.prd2.ezproxy-prod.hbs.edu/redir/default.aspx?P=sa&an=ATLCOM0020150709eb7900004&cat=a&ep=ASE.

4: Guthrie, Marisa. “ESPN’s Digital Dilemma: Branding Or Profits.” Hollywood Reporter 421.36 (2015): 20. Business Source Complete. Web. 11 Nov. 2016.

5: Ramachandran, Shalini. “ESPN to Lay Off 300 Employees.” Wall Street Journal. 21 October 2015. Print.

6: Low, Elaine. “What A Disney Stake In MLB’s Digital Unit Would Mean For ESPN.” Investors Business Daily July 2016: 54. Business Source Complete. Web. 11 Nov. 2016.

7: Gross, C. (2016, Feb 03). ESPN, Tencent to collaborate on content for Tencent’s media platforms in china. Benzinga Newswires Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1761979496?accountid=11311.

Thanks for the post, Zach! I think ESPN is a very unique case to consider when thinking about the changing media landscape. A couple questions/thoughts that come to mind:

1. What should ESPN’s strategy be around sports distribution rights on television? I think conventional wisdom suggests that sports are insulated from the DVR threat given the necessary live-viewing. Should ESPN continue to pay top dollar for these rights or do you think the market for live sports is frothy and peaking? I know we’ve started to see NFL viewership decline this season – is that a one-off phenomenon or do you view it as a broader trend?

2. I understand from your chart that ESPN subscribers have been decreasing but does that also mean its viewership is declining? My assumption would be that those individuals who are pursuing skinny bundles (ie. dropping ESPN from their package) would probably be the ones who weren’t watching ESPN to begin with. So, while subscribers are decreasing, and subsequently fees from cable distributors, are advertising rates actually decreasing as well? Revenue is declining but the model wouldn’t necessarily by breaking completely.

Thanks for the post Zach, to add to the points raised by CJ I was wondering whether ESPN could leverage its position as the provider of live sports events and as “the glue that holds the cable bundle together” to drive higher pricing in lieu of its position in the focal point of this media ecosystem. With such a unique foothold on customers, and content that is so valuable to the cable networks, isn’t ESPN worthy of charing more?

Thanks for the post Zach. The key thought that sticks out to me about entertainment like sports is a decoupling of content and distribution. As the digital world makes distribution easier, content is less reliant on a platform like ESPN and talk shows can be hosted on sites like Youtube and gain significant popularity. In other words, easier distribution makes premier content key – do you see any systematic approach by them in terms of capturing that exclusive content especially as they pop up all around the web?

Very interesting post, Zach! I am intrigued by your suggestion that ESPN invest less in their non-sporting event television shows. I would think that as users migrate online, they would want to have more unique content available through their platforms, rather than less. In my opinion, getting people to pay for very much for OTT subscriptions is tough, given the proliferation of services available. Subscribing to multiple OTT services can become expensive, eventually approximating the cost of the cable bundle they were meant to replace. So, I’d think ESPN would need to have a really compelling offering in order for people to add the service onto a so-called “skinny bundle.” Some premium non-sporting event content might be one way to do that.

Interesting post Zach. As we see, every kind of content and respective media companies are evaluating their business model with the digitalization of this industry. I agree that they need to focus on their core strength of sports media however I struggle to see how in the long run, when the media can so easily be connected to end user with digitalization, these companies will be able to capture in any value in this chain. This will become even more difficult for media channels like ESPN that don’t have their own content as primary attraction of revenue stream. I wonder if they risk being eliminated by the content owners in the long run. What do you think?

Great post Zach. I agree with your assessment that ESPN has not yet acknowledged the fact that it needs to pivot to a digital age. The ESPN brand was carried by cable-driven revenues, which, as you mentioned, are dwindling. ESPN needs to find alternate ways to generate revenue. I also agree with your second recommendation that ESPN partner with more leagues. My post was on the NFL’s use of digitization and I think ESPN could really benefit from a partnership with the NFL in this regard. ESPN can pivot towards interactive viewing through the utilization of the NFL’s Internet of Things strategy it is beginning to implement with things like RFID pads, electronic mouthpieces, and more. ESPN needs to capitalize on the millennial demands of interactive viewing, short attention spans, and hyper-connected social networks. While I think ESPN does need to do something bold to digitize, I do sympathize with their challenging predicament. I know I will continue to use ESPN.com! Thanks for the great insights!

Love this- thank you, Zach. As a long-time consumer of ESPN (as I’m sure many in our section are) I can say that I’ve definitely purchased more in cable than I would otherwise just to have ESPN on my channel line-up. Do you feel that ESPN’s TV presence will eventually be completely a thing of the past, or will they be able to at least flat line their subscribers to protect some part of that business? As a suggestion, perhaps they could renegotiate their fee structure with television providers? Do you think that they could make up in volume what they lost in revenues from substitution?

Zach thanks for the thoughtful look at ESPN. It is super interesting how quickly ESPN turned from Disney’s white knight into it’s achilles heel. I am concerned about the long-term viability of ESPN given its significant fixed cost base given its massive sports rights deals and its declining revenue base as both subscribers and ratings tumble. Even the NFL is seeing ratings drops of over 20%[1]!

I agree with both your suggestions, but want to build on the second one. I believe instead of a tentpole strategy – ESPN should pursue a “super fan” niche sports strategy in this new mobile direct to consumer world. (1) Rights for sports like Skiing, Speedskating, Gymnastics, etc. are much cheaper to acquire which will allow them to manage their cost base more effectively. (2) Leveraging their investment in BAM tech, they can build world-class direct to consumer products that are targeted toward each sports “superfans”. These “super fans” have a high willingness to pay – and will be more engaged in the content than the average fan is in the tentpole events.

[1] https://www.washingtonpost.com/business/economy/nfl-ratings-plunge-could-spell-doom-for-traditional-tv/2016/10/14/a7a23dc2-915f-11e6-9c85-ac42097b8cc0_story.html

Great post Zach, very interesting. In line with what CJ said, do you think the people that dropped ESPN could be the ones that moved to 100% online, and watch sports through ESPN Live or similar pages?

I really liked your recommendation to partner with more leagues and teams. Do you think that can help ESPN in their long term sustainability as they aren’t the producers of the content they show? Also a way to maintain revenues as more and more online options for watching sports appear, and are directly competing with ESPN. However, you also recommended that ESPN transform into a digital company, but you mentioned also that monetization is difficult in the mobile world. How would you suggest they transform without leaving money on the table by not being able to monetize their products?

Great post Zach – I’ve been following this closely and you did a great job of touching on all the major issues.

Specifically focusing on one of your first recommendation, I think you may have highlighted ESPN’s hubris. Shows like SportsCenter are what made ESPN, but as you said they are becoming less and less valuable. We consume media in such a variety of ways and there is so much great content out there – it is really difficult for ESPN to differentiate in sports commentary or any other non-live sports media. They need to be willing to pull the plug on anything – even if that thing is what vaulted them to greatness.

I too think their partnership with Tencent is a really smart one, and likewise what they have done with MLB digital. ESPN needs to leverage their considerable capital advantages and invest heavily to own as much of the live-sporting event viewing process as they can.

Where I have doubts is in ESPN’s ability to stay ahead of the curve and “solve the puzzle of individualization and customization to maximize the user experience and consumption process.” The Tencent and MLB deals are helpful, but I am still uncertain as to how ESPN will be nimble or innovative enough to meet consumer demands and when it comes to content and user experience.

Given the strategies you’ve outlined (which I totally agreed with), I was so surprised to see that ESPN shut down Grantland. Personal conflicts between ESPN and Grantland aside, it really seemed like the Grantland was the perfect foray for ESPN into the digital world.

In addition, I wonder if ESPN’s physical location could be a problem with this pivot. Being in a small city could limit the kind of talent needed to implement some of the changes you’ve suggested, and I love the idea of partnering with smaller, more nimble, technology companies.

Thanks for the article, Zach!

Great post, Zach! While it was interesting to read about ESPN’s efforts to leverage technology and react to the increasing changes in fan’s consumption of sporting events. Haibo alluded to the decoupling of content and distribution, and as you’ve mentioned much of ESPN’s original content is likely to get more expensive over time. ESPN is at the crosswords of both content generation in its Sportscenter and commentary shows, but also as a distributor of sporting content for the major sports. ESPN seems to be quite vulnerable to being disintermediated by the major sports that are creating independent channels like NFL Access, the MLB Network, etc. If ESPN is circumvented by distributors of “skinny bundles” or major sports channels go directly to consumers via Apple TV apps and future streaming innovations, ESPN will only have its original commentary content to provide customers. The question at that point is whether customers will be willing to pay for that content or whether it will be offered as a value-add by the major sports via their channels.

Either way, ESPN (and by extension Disney, where ESPN is the largest contributor to profits for the company) seem very vulnerable to technology advancements and further digitization. Thanks again for a great case study and analysis!

Great blog post! I’ve actually worked with MLBAM in the past, and they have some great tech — definitely an exciting partnership. No doubt ESPN should be worried about its rising costs, subscriber loss, and decreasing revenues (from both affiliate fees and advertising). However, ESPN hasn’t struggled like Sports Illustrated in moving their audience to the web, and their audience on online/mobile is MASSIVE. I think the issue is less the programming and more the distribution strategy — if you’re ESPN, what emerging platforms do you bet on (how do you allocate your resources), and how do you monetize/get people to pay for the content? Furthermore, how do you convince brands to pay higher advertising fees for these new distribution platforms? Furthermore, how do you package your existing content and create new content optimized for the viewing habits of your audience on these different platforms (cohesive cross-platform strategy)? We’re also seeing a lot more second screening viewing among millenials, and ESPN has done a good job capitalizing on this trend through its fantasy sports app, ESPN app, highlights on ESPN.com, acquisition of fivethirtyeight, social media presence, etc. Younger people today have short attention spans. We may still watch sports live, but we’re on our phones while we watch. What are other ways ESPN can maximize the second-screen experience — more customization, exclusive behind-the-scenes content, stats/data, etc.?

Awesome post Zach, thanks. It does seem like ESPN is facing a existential crisis of having to re-position themselves in this new digital, cord-cutting world. At the same time, it seems like their best strategy for now could be to fight that trend as hard as they could, and try to keep as many viewers in the ESPN TV channel by not investing in other platforms. Nothing else in the ESPN business come even remotely close to being able to fund the business’ needs, namely the mind-blowingly expensive long term sports rights contracts. Digital media, mobile, Tencent, MLBAM are all cool projects that are directionally correct given the business climate, but even if you are successful in building an audience there, will they be able to monetize them enough for ESPN to be a viable business? ESPN, along with most other cable channels, need to see a change in consumer behavior of actually paying for content online before they can commit to a meaningful transformation of truly going digital. In the meantime, maybe investing in those high-priced personalities and keeping them exclusively on air is the only fighting chance they have.