East vs. West: Can JPMorgan Chase protect its lunch from the FinTech startups of the world?

Four words say it all about JPMorgan Chase’s assessment of the digital landscape of the banking industry – “Silicon Valley is coming.”

Introduction

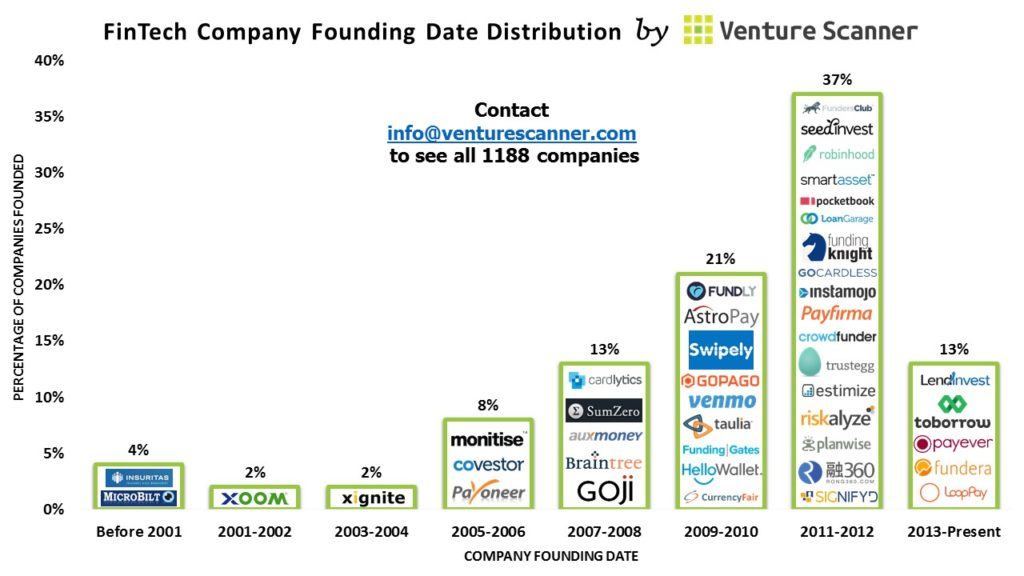

Four words say it all about JPMorgan Chase’s assessment of the digital landscape of the banking industry – “Silicon Valley is coming.” That warning comes from Jamie Dimon, CEO of the NY-headquartered bank, in the 2014 annual report to shareholders. He continues, “There are hundreds of startups with a lot of brains and money working on various alternatives to traditional banking.” [1] Despite critics’ claims that traditional banking has long resisted digital transformation to protect its operating model and fee-based revenue streams [2], JPMC has shown a strong commitment to technological investment. In fact, the company describes itself as a “technology company” with technology being “the lifeblood of our organization.” [3] In 2015, the company spent more than $9 billion on technology with 30% directed towards new investments for the future. More specifically within the digital space, JPMC employed more than 400 professionals in its group focused on product and platform design and innovation, and 1,200 technologists in its digital technology organization focused on delivering digital solutions. [3]

While JPMC is focused on delivering a digital experience in many of its lines of businesses, including Asset Management, Commercial Banking, its work on the Consumer side is particularly interesting. Nearly 50% of U.S. households have a consumer relationship with Chase with a total of 90 million credit, debit, and prepaid accounts. [3] For these households, Chase’s investment in digital means among other things that they are (or in the near future will be) able to transact conveniently through digital channels, including through a reimagined branch experience.

Chase Branch of the Future

At the center of Chase’s Branch of the Future is the new ATMs, which are not only capable of performing roughly 90% of teller transactions but also go beyond that. [3] One of the biggest innovations (besides choosing your money denominations) is mobile ATM authentication, which allows customers to securely access their accounts by tapping their phones and authenticating via fingerprint or sending themselves one-time ATM access codes. Besides the added customer convenience of never having to use a card, the technology is expected to help reduce fraud stemming from card-skimming devices, which amounted to $1B in bank losses in 2008. [4] Instead of being able to install a device at ATMs to duplicate cards’ magnetic stripe, fraudsters will need to get through multiple layers of security on stolen phones. [4]

Moreover, Chase is carefully crafting its operating model to enable this digital transformation. In these new branches, the teller’s role is shifted to helping and encouraging clients to adopt digital channels. Tellers may also assist customers resistant to digital channels through traditional channels. Though this assistance may prove unsustainable given cost pressures in the industry, in the long term, banks may still maintain some version of this model since federal regulations require banks to provide assistance to protect groups like the elderly and impoverished. [6] In sum, Chase and other banks are shifting their staff makeups at branches to “more financial advisory jobs and fewer transactional jobs” since for example JPMC’s cost per deposit through a teller is 65 cents compared to one-eighth that cost at ATMs and three cents via smartphone. [6]

Furthermore, the bank is going as far as reducing its branch footprint by 5 percent and cutting 300 branches by end of this year. [5] These closures are in response to the nearly 100 million transactions that used to be done in branches which have migrated to digital channels since 2012. [3]

Payments

Another great opportunity area for Chase is digital payments. While being a significant partner in the creation of Apple Pay, the bank took it one step further and announced the development of its own proprietary digital payment solution called Chase Pay, which “connect[s] merchants and consumers through a simple, secure payment experience.” [3] Chase is prime positioned to offer one of the best digital payment platforms primarily due to its scale (36 millions credit and debit card payments every day) and its closed-loop network ChaseNet, which completes the entire payments transaction between cardholder and merchant. [3]

Is this enough?

With the abundance of FinTech competitors like Venmo, Simple, and OnDeck entering the market, the question rises on whether Chase is innovating enough. Chase has taken a number of approaches to dealing with pressure from startups, including partnerships. For example, Chase worked with OnDeck to develop a new working capital product. [3] In other cases, the bank relies on its value proposition of scale and security to compete, including warning customers about the risks of sharing their data with third-party aggregators like Mint. [7] Still Chase must assess its competitive advantage in the face of innovation not only against start-ups but also against traditional banks like Wells Fargo, which has notably been at the forefront of biometric authentication adoption with eye-scanning technology. [8]

Word Count: 799

Footnote

[1] JPMorgan Chase & Co., “2014 Annual Report,” https://www.jpmorganchase.com/corporate/investor-relations/document/JPMC-2014-AnnualReport.pdf, accessed November 2016.

[2] Avery Helen, “US faster payments: Banking’s technological backwater,” Euromoney, Oct 9, 2015, http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1733129151?accountid=11311, accessed November 2016.

[3] JPMorgan Chase & Co., “2015 Annual Report,” https://www.jpmorganchase.com/corporate/investor-relations/document/2015-annualreport.pdf, accessed November 2016.

[4] James Rufus Koren, “Big U.S. banks will roll out ATMs that take smartphones, not cards,” Los Angeles Times, January 31, 2016, http://www.latimes.com/business/la-fi-cutting-edge-cardless-atms-20160130-story.html, accessed November 2016.

[5] Elizabeth Dexheimer, “JPMorgan to Close 300 Branches by End of 2016 to Cut Expenses,” Bloomberg, February 24, 2015, http://www.bloomberg.com/news/articles/2015-02-24/jpmorgan-to-close-300-branches-by-end-of-2016-amid-expense-cuts, accessed November 2016.

[6] Lauren Abdel-Razzaq, “Banks redefine role of teller in move toward technology,” The Detroit News, February 27, 2015, http://www.detroitnews.com/story/business/2015/02/27/technology-changing-bank-teller-role/24156071/, accessed November 2016.

[7] Ron Leiber, “Jamie Dimon Wants to Protect You From Innovative Start-Ups,” NY Times, May 6, 2016, http://www.nytimes.com/2016/05/07/your-money/jamie-dimon-wants-to-protect-you-from-innovative-start-ups.html, accessed November 2016.

[8] James Rufus Koren, “Cutting Edge Wells Fargo looks to eye-scan security,” Los Angeles Times, March 6, 2016, http://www.latimes.com/business/la-fi-cutting-edge-eyescan-20160306-story.htmlm, accessed November 2016.

Thanks for sharing Kamisha – I wasn’t aware of the extent to which Chase actually took smaller, start-up competitors seriously! One competitive advantage that Chase has which jumped out at me was the “global” nature of its products. With international travel and increased need for banking that works no matter where you are in the world, I view Chase as superior not only because it enables you to transact seamlessly abroad but also provides incredibly robust fraud protection and controls that consumers find effective and safe. One issue I have with one-off, smaller scale banking products as a regular commercial Chase consumer is that I don’t feel safe having all of my savings handled by a new technology that doesn’t (yet) have credibility, the same protection and capabilities. I might represent a particularly risk-averse consumer, but I believe Chase has the scale that inherently protects itself from small competition. Also, competitors would have to have a truly unique offering – one that Chase simply doesn’t have – to justify the time it takes to switch and any increased risk of fraud (through the use of technology with less robust infrastructure).

Thanks for the interesting post. It seems Goldman has engaged in various rounds of VC funding in some of the FinTech start-ups such as Kensho, natural language processing based trading software. Citi bank also has its own venture capital arm that is dedicated to FinTech investment and in turn the bank incorporate the new technology into their day to day operations. It will be interesting to see if JP also engage in these types of venture investing, and if yes, what are the companies that are currently backed by JP.

Awesome post Kamisha! Really appreciate the layout of traditional banks and their current challenges. Questions that come to mind are 1) how do they think about in house vs. acquisition? 2) how do they think of human capital in a very traditional company vs. startup talent?

Great post Kamisha. I wrote about one of the Fintech start-ups, Transferwise, who are revolutionising the way we move money around the world… do you think that banks should have in-house venture capital arms that invest in FinTech startups? Do you think that typical banking culture needs to change to facilitate innovation and rapid change – it feels like the culture of banks and the need to keep abreast of modern technology might be at odds with each other.

In a similar vein to Wilson, given the pace of change in the industry, I would question whether in-house innovation should be the number 1 concern for banks. I would prioritise acquisition as a means for banks to protect themselves from becoming obsolete.

Great post, Kamisha! I’m curious how JPMorgan Chase is leveraging digital technology to improve its product on the lending side? Today, the traditional lending process for small businesses is a lengthy and arduous one. Startups like Bond Street have streamlined the process, making the application process take only 1-2 hours and generating a lending decision within days (as opposed to many weeks). While payments and banking are a large part of JPMorgan’s business, lending is just as important. Is it developing this capability in-house? One risk of developing it in-house is that banks are notorious for being large, slow-moving bureaucracies in which change takes a long time to take effect. Given how fast the lending space is changing today, it may behoove them to acquire a player like Bond Street.

Great post. What do think the future value proposition of big banks will be? Do you see banks becoming one stop shopping for all financial needs like insurance, personal banking, wealth management, and mortgages? If consumers aren’t permanently tied to a bank’s ecosystem and don’t feel like they are getting a good deal, then it seems that banks will be likely to lose customers to innovators in the financial industry.

Great post. I think that Fintech companies are going to disrupt the traditional banks. The traditional banks are too big to change the current processes. In my point of view, the comparative advantages that banks have are strong relationship with institutional customers. They should focus on developing B2B business model and adapt technology to improvement efficiency. The B2C market is very fragmented and traditional banks are too slow to react to any disruptive technology.

Thanks for an interesting article! What do you think, if any, is the potential risk of Wall Street giants’ heavy investment in technology? For example, given capital structures of financial institutions have been under strict regulations after the financial crisis, is there any concern that partnership with Fintech companies accumulate invisible risk of overspending?

Great post! I think you presented very interesting perspectives about FinTech and how JP Morgan is fighting back. The benefits of adopting new technologies for large banks are still quite positive and banks have strong incentives to acquire disruptive technologies to remain competitive. Some technologies such as Venmo still rely heavily on banks because, even for FinTech start-ups, it is not easy to get rid of bank intermediation. But this may change going forward so it is in themselves interests to keep investing/acquiring new technologies to remain viable.