Digitizing the Starbucks Experience

New innovations such as Mobile Order & Pay means that now you will always have time for that Starbucks coffee run….

“Perhaps no single competency and capability is enabling us to elevate and amplify the Starbucks brand and to deliver an enhanced Starbucks’ experience for our customers more than our global leadership position and continued investment in mobile, digital and loyalty innovations and technologies”

-Howard Schultz, Starbucks CEO1

~*~*~

How many apps on your phone are for a food or beverage retailer? Do you even have more than one or two?

It’s quite likely that Starbucks is one of those apps on your phone. In the App Store’s rank of free apps, Starbucks is currently the highest ranked app from the food/beverage retailer category, and is the third highest retailer behind Amazon and Wal-Mart.2

Since its launch in 2009, the Starbucks mobile app has grown from a basic mobile payment app into an integral part of the Starbucks digital ecosystem.

After the 2008 recession, as part of the company’s turnaround plan, then CIO Stephen Gillett created an “internal venture capital-style incubator for digital technology”, called Starbucks Digital Ventures, and gave this internal team the autonomy to operate separately and build digital assets.3

Using Technology for Business Challenges

One of the biggest challenges facing Starbucks is declining foot traffic in shopping areas as consumer shift more to e-commerce. Although this doesn’t impact the morning coffee run as much, a lot of Starbucks’ business has historically depended on being an “interceptor” and luring nearby shoppers into the Starbucks store.

In response, Starbucks is trying to adjust its business model to make the store more of a “destination” and is leveraging technology to drive continued traffic to the stores.

Build customer loyalty and drive traffic

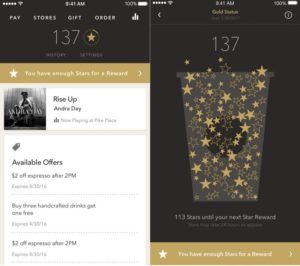

Starbucks is using the mobile app to attract and retain its loyalty members, who are stickier, more frequent customers, and overall higher spenders. Customers must sign up for the loyalty program in order to use the convenient mobile payment function. The loyalty program, My Starbucks Rewards, is integrated into the mobile app so customers can earn and redeem their loyalty points (“Stars) directly on the phone, increasing engagement. Unlike many other retailers, Starbucks customers don’t have to carry the physical membership card or tell the cashier their phone numbers each time to search up their membership information. The program has been a large success, with ~12 million active members in the US today.

Recently, Starbucks has announced partnerships with other companies (e.g., Spotify, Lyft) and pending launch of the Starbucks Rewards Prepaid Card with Chase Bank. These partnerships will allow customers to earn Stars through non-Starbucks purchases and drive return traffic to Starbucks stores to redeem rewards.4

In addition, mobile payment has provided some side financial benefits for Starbucks. The balance on customers’ Starbucks Cards has grown to be an important source of working capital, and the Starbucks Card as a form of tender (during mobile payment) allows Starbucks to pay lower transaction processing fees as the merchant.3

More personalized offers

The company is leveraging the customer data it collects from the app to then provide more personalized and relevant product offers, sent through the app or via email. In the most recent earnings call, COO Kevin Johnson revealed that personalized offers “more than doubled customer response rates over previous segmented email campaigns…. [leading to] more customer engagement and spend”.5

Using Technology for Operational Challenges

Because a significant portion of the business comes during the morning hours, Starbucks’ operating model emphasizes short throughput times to move customers quickly through the line. To continue its fast growth, Starbucks must continue to increase store traffic and essentially serve more people in the same time frame. However, Starbucks observed that when stores become very busy, some customers will balk at the long lines and decide against going in.

Shorter lines and wait times

The ordering and payment process at the cashier is the bottleneck, and the transition to mobile payments, representing 25% of total transactions5, has reduced time at the register. In September 2015, Starbucks launched Mobile Order & Pay (MOP), allowing customers to order ahead on the app, bypass the line entirely, and go directly to the store’s pick-up counter for their drink.7 Barista labor is reallocated from the register and the stores can maximize customer orders with a similar level of labor. Furthermore, Starbucks may attract brand new customers who previously didn’t think they had the time to stop by Starbucks.

Additional Opportunities

Going forward, I believe the company must continue refining the MOP function to replicate more of the in-store selling process, where customers are “upsold” to buy a muffin along with their coffee, or simply make an impulse purchase of the candy bar at the register. In addition, the company can consider digital menu boards connected to the POS system so stores can change prices more quickly or do more impromptu promotions to manage the store inventory. On the E-commerce front, Starbucks needs to leverage technology to lower fulfillment and shipping costs. It still offers high rates for standard shipping, and is losing to retailers such as Wal-Mart and Amazon that have invested in faster shipping that consumers now demand.

(798 words)

Sources

(1) Starbucks Corporation, Q4’2013 earnings call transcript, October 30, 2013.

(2) Apple App Store ranking of free apps. Accessed November 17, 2016.

(3) Welch, Michael, and Buvat, Jerome. “Starbucks: taking the ‘Starbucks experience’ digital.” Capgemini Consulting. Accessed November 16, 2016.

(4) Marte, Jonnelle. “Starbucks expands rewards program by getting into the prepaid card business.” The Washington Post, March 24, 2016. https://www.washingtonpost.com/news/get-there/wp/2016/03/24/starbucks-is-launching-a-prepaid-card-that-will-make-it-easier-to-earn-rewards/ Accessed November 16, 2016.

(5) Starbucks Corporation, Q4’16 earning call transcript, November 3, 2016.

(6) Starbucks Press Release, September 22, 2015. https://news.starbucks.com/news/starbucks-mobile-order-pay-now-available-to-customers-nationwide Accessed November 17, 2016.

Great post highlighting the numerous benefits of the program, from working capital to improved human capital utilization and allocation via mobile app ordering. Another big advantage not highlighted here is the structure of the rewards program itself, which changed within the last year. Previously the program gave you rewards for each visit to the store – regardless of how much you spent, you received one “star” for the visit, culminating in a free item with enough stars/visits. The recent program change altered this from stars per visit to stars per dollar spent, e.g. the more you spend the more stars and subsequent rewards you get, rather than per visit. While this irked some cheap coffee drinkers (myself included), this had a drastic impact on operations. It turns out many customers were splitting orders to maximize stars based on the visit – e.g. a group of three would each individually order, so they each get one star. This would unnecessarily slow down the operations of the store, as three separate orders would have to be handled. This new model disincentivizes such a practice, aggregating demand into single orders in order to maximize dollar value and thus stars and rewards.

Hi Andrew, you’re absolutely right, the order splitting was one of the reasons we wanted to change the rewards program. Under the new program, the company has already seen the number of transactions decrease at the POS (creating addt’l store productivity) but revenues continue to grow.

Great post! Very interesting to consider how organisations whose core product is very low-tech (a cup of coffee always has been and, I would say, always will be simply a cup of coffee…) are trying to leverage tech to boost their business and customer offering. I wonder in years to come if the investment in tech will prove to have been very worthwhile and a driver of success, or is it a “nice to have” that customers value, but ultimately isn’t essential for them to make their buying decsion? Regardless, I think the access to customer data this gives Starbucks and other “low-tech” services makes it a worthwhile investment on its own.