Digitalization and the Death of a (Real Estate) Salesman

Can companies like Opendoor effectively disrupt the real estate broker ecosystem and home-sale supply chain through big data and machine learning?

The home-sale supply chain in America has historically been resistant to change. The hands-on nature of the real estate industry and the fragmented marketplace have supported a time-intensive and expensive broker system.1

Digitalization of Real Estate

Digital innovation over the last decade, however, has challenged the real estate industry and traditional broker model. Companies such as Zillow and Trulia have redefined the home search process by providing on-demand, quality data to the public. As consumers have increasingly shifted toward digital platforms (51% of homebuyers found homes via the internet in 2016), companies have digitized several parts of the home-sale supply chain from pricing (automated valuation models) to transaction management (e-signature platforms) to the open-house experience (virtual tours).2

Opendoor: Data-Driven Speed and Simplicity

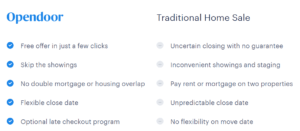

Founded in 2014, Opendoor provides a web-based alternative to the traditional broker model for home sellers. It offers liquidity (3 to 60-day close versus 106-day national average) by purchasing a seller’s home for a fee (6.7% on average versus 6% industry standard broker commission) and then reselling the home in the open market.3,4,5 Opendoor utilizes a proprietary automated valuation algorithm powered through a combination of variables and data to efficiently determine the fair market value of a home.6 The company’s value proposition resides in its belief that big data and machine learning can effectively replace local real estate expertise and that there is a market demand for certainty and simplicity. The digitalization of home pricing differentiates Opendoor by allowing it to operate a supply chain with less labor (eliminating the need for a 1 to 1 in-person broker) and in less time than the traditional model.

However, as the industry continues to be affected by digitalization, Opendoor must consider the risks associated with leveraging technology to determine home prices. These considerations include:

Accuracy and Scalability:

Opendoor’s success relies on the accuracy of its automated pricing model. As a result, the company has taken various measures to protect the efficacy of its technology. First, the company has limited the market in which it operates to focus on a category that is relatively easier to consistently price (single-family homes built after 1960 between $125,000 and $500,000).7 Additionally, Opendoor has leveraged its residential expertise in conjunction with data science to determine the value and interdependence of specific home features to buyers.8 However, as Opendoor looks to expand nationally (currently in 6 major metros), its model will be challenged in markets where it has little to no expertise, and thus may not capture the market nuances or momentum at a local level. In the longer term, the company should consider the ways in which it stress-tests its pricing algorithm across geographies and under a variety of economic conditions and interest rate environments before entering new markets. Because this model has not been tested in an economic downturn, market expansion should occur only after thorough testing over an extended period.

Further Digitalization:

The market has already begun to see the ways in which digitalization is changing the value proposition of a real estate broker. Technology has not only democratized data and pricing estimates, but also allowed the industry to “unbundle” broker services and offer technology-driven alternatives.9 As a result, buyers have more optionality and knowledge throughout the process, which places downward pressure on the fees that a traditional broker can charge. Given that Opendoor currently charges an average of 6.7% to cover the risk, associated fees, holding costs, and profit, if future broker fees drop below 6% will Opendoor be able to match that fee and remain profitable? In looking ahead, Opendoor needs to establish its brand and demonstrate to sellers the multiple benefits that it offers so that it can charge a premium to ever-shrinking fees within the industry. To diversify and increase its customer pipeline, Opendoor has recently expanded its services to become the “one-stop shopping for real estate transactions.”10 The company has begun offering mortgage services and has launched its first “trade-up” partnership with home-builder, Lennar.11 However, although it is good to add ancillary services to a brand, to maintain its competitive advantage, Opendoor should continue to focus on its primary business and demonstrate the unique value that it is offering to sellers.

Future Considerations:

Opendoor is providing a service that once established and recognized should allow it to charge a premium over the traditional real estate home-sale fees. However, it is not clear whether its pricing algorithm is accurate enough to justify investing large amounts of capital with all the risks of homeownership nor to justify the company’s current fee structure. Even if the automated algorithm is accurate enough in its current markets, it is not clear that it is scalable into other markets under a variety of economic scenarios. Given the rapid digitalization of this industry, has Opendoor positioned itself in a scalable and sustainable way?

[798 Words]

1. PWC, “Measuring Industry Digitization: Leaders and laggards in the digital economy,” Strategy&, p. 10, https://www.strategyand.pwc.com/, accessed November 2017.

2. National Association of REALTORS, 2016 Profile of Home Buyers and Sellers.

3. Redfin, “Home Prices, Sales, & Inventory,” https://www.redfin.com/blog/data-center, accessed November 2017.

4. “Closing Times are Speeding up,” Realtor Mag, March 19, 2017, http://realtormag.realtor.org/daily-news/2017/03/20/closing-times-are-speeding-up, accessed November 2017.

5. Opendoor, “Pricing,” https://www.opendoor.com/pricing, accessed November 2017.

6. Amy Feldman, “Silicon Valley Upstart Opendoor Is Changing The Way Americans Buy And Sell Their Homes,” Forbes, December 20, 2016, https://www.forbes.com/sites/amyfeldman/2016/11/30/home-shopping-networkers-opendoor-is-upending-the-way-americans-buy-and-sell-homes/, accessed November 2017.

7. Ibid.

8. Ibid.

9. Michele Lerner, “Commissions of 6 percent for home sales once were the norm. That’s changing,” Washington Post, April 15, 2016, https://www.washingtonpost.com/realestate/commissions-of-6-percent-for-home-sales-are-the-norm-but-that-is-changing/2016/04/13/91bb758c-fb55-11e5-886f-a037dba38301_story.html?utm_term=.9dafa2e751b4, accessed November 2017.

10. Feldman, “Silicon Valley Upstart Opendoor Is Changing The Way Americans Buy And Sell Their Homes.”

11. Lennar, “Lennar Las Vegas Creates New Home Trade-Up Program,” http://theopendoor.lennar.com/nevada-las-vegas/lennar-las-vegas-creates-new-home-trade-program/, accessed November 2017.

Thanks for your article, this is really interesting. To respond to your question, I don’t believe that Opendoor’s digital model is fully scalable, but I question whether this is an Opendoor-specific problem, or more of a general industry problem, and I tend to lean towards the latter. As you discussed, the real estate industry is highly complex and nuanced, and not every housing price movement can be determined by data alone. Particularly in economic downturns, I wonder how companies like Opendoor can survive. It seems that while machine learning can be used to accurately predict housing prices under normal economic circumstances, I struggle to see how the timing of the subprime mortgage crisis in 2008 could have been determined by a company like Opendoor. While brokers could weather the housing crisis (albeit, painfully), Opendoor could have easily and quickly become highly unprofitable if it had purchased sellers’ homes for inflated prices preceding the downturn. Unfortunately, while the service that Opendoor offers is highly valuable to consumers, I don’t believe it is scalable due to the current limitations on data to predict and pinpoint the timing of economic cycles.

While this seems like a very cool business model, I’m concerned about the scalability of the company. You reference this as an open question above, but I’m not convinced that the company will be able to scale and improve the algorithm quickly enough to continue to be a market leader in this industry. If the success of the company’s growth relies on adding multiple zip codes quickly and effectively to the platform so that the pricing algorithm can work, what happens if a ton of local businesses pop up, creating a very fragmented market for digitized home buying? Another question I would have is how companies such as Open Door could partner with other real estate technology companies such as Cadre (https://cadre.com/). Both companies are focused on eliminating the “middle man” to reduce fees and it seems logical that a partnership could emerge between websites that allow for buying homes and websites that allow for investing in the companies that build the homes.

Opendoor appears to be offering a valuable application of digitization in its generation of fair market value estimates of home prices. What concerns me, though, is that fair market value is highly subject to assumptions and transactions often occur at prices other than what one might estimate to be the “fair market price”. Does Opendoor have feedback mechanisms to incorporate actual transaction prices so that it may refine its algorithm? I am also concerned about the company’s strategy, particularly as it relates to its basic operating model. Providing the most accurate estimate of fair market value is an inherently valuable service made possible by advances in digital analytics. However, buying homes and adding those assets to Opendoor’s balance sheet make a software-based business unnecessarily capital-intensive. This also assumes that Opendoor is able to sell the homes for a price that doesn’t create a significant loss. Does Opendoor have a large set of willing buyers who won’t negotiate with the “fair market” price that Opendoor determines? What will happen to Opendoor of the housing market craters and the inventory Opendoor carries on its balance sheet suddenly becomes significantly less valuable? While I agree that Opendoor provides a valuable service and has found a useful way to apply the trend of digitization, I worry that the firm’s operating strategy exposes it to significant, uncontrollable macro risk.

Wonderful article about a highly innovative company, and I appear to be much more bullish on OpenDoor’s prospects than the other commentators.

First, I do agree with all of the stated caveats–yours and the commentariat’s–and OpenDoor certainly has its challenges. However, I don’t think those concerns are markedly different from a house sold by a traditional owner or agent. Nobody is very good at assessing the market price of a house, and my own experience buying a home suggests that valuations even among well-respected assessors can vary by as much as 3-6% using the same data. I do agree that scalability is a particular challenge, and that they must be careful to learn the nuances of each individual market. However, housing prices vary on fewer variables than many other products, and housing prices are typically fairly predictable over longer periods of time (recent bust excepted). Given that OpenDoor will try to sell its houses quickly, I am not convinced that their own auto-generated valuations will be too divergent from market realities, and they can quickly adjust prices if they are obviously wrong.

I also see a lot of potential in the business model itself. As much as it pains me to jump to blockchain, I can certainly see the potential to turn sales in a matter of a few days whenever governments adopt the technology. Moreover, I could see OpenDoor using its platform not just for the narrow market of single family homes in a certain age/price range, but also expanding to, eg, the luxury apartment rental market. It will be difficult, but they have only just begun to scratch the surface of this business opportunity, and technologies like blockchain could revolutionize the model by cutting out processing time and rendering agents entirely obsolete.

Great article!

Great article! While I would agree that paying a broker 6% on a large transaction (like buying a home) is expensive and ripe for disruption, I’m not convinced that Opendoor is the right solution to this problem. Opendoor’s economic model is based on the speed in which they are able to flip homes. After the housing collapse, we saw various institutions starting to buy large swaths of residential real estate at large discounts, in order to cash in when the market corrected. Given the recovery in the housing market, Opendoor is no longer able to purchase homes at such a discount, leaving the margin for error very small. While Opendoor does provide value to the consumer (certainty and speed of closure), I don’t think homeowners are typically willing to pay higher fees for this service in most cases.